-

Posts

647 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by cusanus

-

-

8 hours ago, pmarlin said:

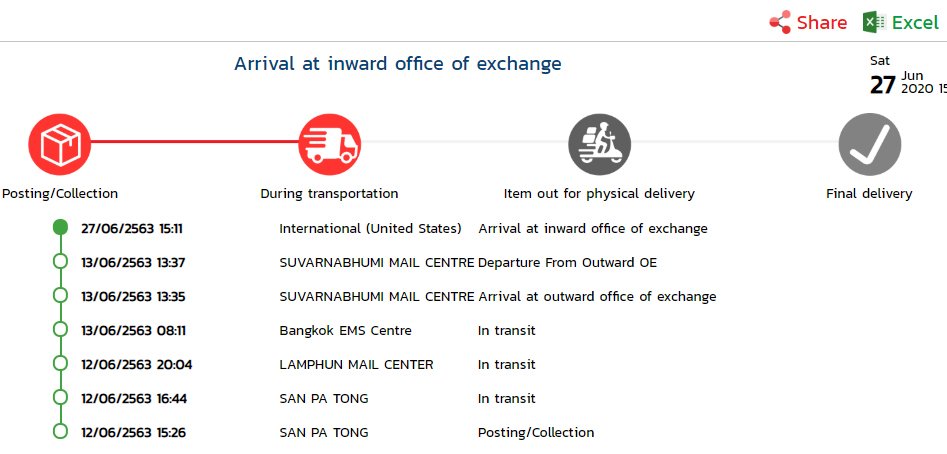

I mailed mine 4 days after you so maybe tomorrow will be in America 1JUl20. But anyway 2 weeks from Thailand to USA seems like it went suffice not air

No, it's always been 14 days for ordinary air. It's not just travel in motion. It's about two months by boat ????.

-

1

1

-

-

4 hours ago, pmarlin said:

Just checked my EMS tracking number on the Form I downloaded. Still sitting at the bangkok BKK airport since 17Jun and hasn;t moved. US postal service shows pre-shippment. This is going to take awhile.

Oh, wait, my mistake, mine has arrived in the US, sorry, but not in transit yet. That's about right, here's my tracking record...

-

2 hours ago, pmarlin said:

Just checked my EMS tracking number on the Form I downloaded. Still sitting at the bangkok BKK airport since 17Jun and hasn;t moved. US postal service shows pre-shippment. This is going to take awhile.

Same here

-

47 minutes ago, Bender Rodriguez said:

thanks for the tip... but I tried b-100 mg , even several a day, for a while

citrate is by definition a bit sour (citric acid)... might be magnesium oxide mixed with citrate...

I tried all kinds of magnesium... even threonate, the best bio available, expensive, did nothing

zinc, tried chelate, the useless gluconate, citrate...as nobody in the world has found something that really works...

the success stories might be from a short deficiency and people who had "tinnitus" for a few weeks...

Oh, goodness, where to start. There are two methods of preparing pure magnesium citrate. One produces a tasteless powder like calcium citrate, the other a very sour, exothermic powder. Magnesium citrate is the most usable form of Mg, and has the added benefit of being a laxative. The amount of B you say? If you aren't taking close to a thousand milligrams a day combined B1 B6 and B12, then you're wasting your time. B deficiencies are particularly common in older people or ones with neurological injury. It took five years to recover from my first TBI episode 39 years ago. I recovered by consuming some ounces of various B vitamins every day, handfuls, but they worked. Since then, I've learned that some people need more B than they get in their diets or they are definitely going to suffer gradual decline. It's also a scientific fact that magnesium is deficient in most modern diets. Has nothing to do with stories. These are realities. But it's up to you and no one else to find out what works, so why ask us?

-

1 hour ago, Bender Rodriguez said:

my tinnitus is getting louder by the month/year. (20+ years)

Now it is like a constant JET engine... many people think about suicide in this endless situation.

Years ago, I could still cover it up with the tv, but now, I hear it from the second I am awake, sometimes at 2 AM... bye bye sleep for that night/day.

I tried about anything in the supplement department.

LDN is supposed to maybe cool down the brain inflammation that does not go away once lit

if anyone has a few tablets left, willing to sell to me and I can see how it goes

Sure wish I could help. I believe I've got something similar, but could get no help, from attempts on my life ages 9-10. Large doses vitamin B have kept me together since 1984. There also seems likely to be an infection. Hits hard early morning about 4am. After many failures I've found an antibiotic that seems to be helping. For the first time in 50 years I may be getting a handle on it. Knock on wood. You can't get very concentrated B vitamins here, also expensive, but I strongly suggest you take up a dose equivalent to Puritans Stress B, also a good organic zinc and several grams Magnesium Citrate (not the sour kind). It won't cure anything but could easily reduce symptoms. Good luck ???? ????.

-

56 minutes ago, Bender Rodriguez said:

I'm looking for LDN in Thailand, but not via hospital ...

TBI / tinnitus / ...

Would you mind saying more? When did the injury occur? Etc...

-

32 minutes ago, khwaibah said:

If I knew then what I know now I would NOT have signed up through Manila I would have waited and gone back to America and signed up. Just saying

Heck, got SS from Manila just with a phone call. They also provided critical assistsne both to myself and X wife during the last 15 years.

-

1

1

-

-

1 hour ago, Pib said:

If I was Manila I would not accept any 7162 submitted to them until after the normal 7162 annual mailing process has occurred which if you didn't get a 7162 from the May/June mailing then you must wait and see if your receive a 2nd notice in Sep/Oct.

If you were Manila.

-

24 minutes ago, Pib said:

"The SSA Questionnaire (Form SSA-7162 and SSA-7161) this year is delayed."

My tracker shows Manila has read my query with the signed 7162 pdf attached. No reply yet, but assume it will be the same. Seems like the typical disregard for us old ???? folks. We'll just need to check for news from time to time, not panic until October. Could be the next asteroid will solve our problems. Chad Daybell claims July is our last month.

-

2 hours ago, pmarlin said:

Not to take any chances in this not getting the form was starting to bother me. I down loaded the form, filled it out went to the post office paid 883.00 Baht and mailed it EMS. now I'm done with it.

Three of us did the same. Unfortunately, they don't acknowledge receiving or accepting it. I'll call in October to check.

-

22 minutes ago, khwaibah said:

I stand corrected. You got me off my arss and I did some digging. Manila does have a fax but still no confirmation on their site about pdf.

The pdf files I've sent to Manila or other offices have always been accepted, of course after signing and scanning. The same is true for IRS correspondence, but you cannot rely on anything with the IRS. It's a <deleted> shoot every time, so you may have to try try again. You could attach the raw images if you're nervous, but pdf is more tidy and supposed to be universally acceptable. Since you can never be sure, I always follow up by phone. I do use a Magic Jack dongle with a Montana number, so you have to adhere to the right time zone.

-

1

1

-

-

11 hours ago, khwaibah said:

Never involve Manila with anything except for signing up for SS IF you're not in the states. Manila is as useless as they get.. The can not and will not do anything . Do a download of the 7162 form sign it then EMS it to Wilkes Barre no where else. If you envole Manila all you are doing is adding another layer of incompetency. SSA number Baltimore. +1 800 772 1213. I have seen nothing on the SSA website about this subject. Call Baltimore and use EMS.

Ok, maybe this will help. I did call Baltimore just now being awake early, though I'm sure Manila would be just as helpful and prompt as they've always been. The word I was given is that the form 7162 mail out has been cancelled and no suspension of benefits will occur. However, she did say this may be re evaluated in July and, of course, that does leave us in some suspense. Since I got forms without a hitch for 14 years straight, I can probably be a bellwether and will announce if I get one down the road. For 880 baht, I'm still comfortable having sent it in just to be sure. I guess the bar code isn't necessary for that and the PO Box on the return envelope is fine with EMS. Hopefully, we can relax now.

SOCIAL SECURITY ADMINISTRATION

PO BOX 7162

WILKES BARRE PA 18767-7162UNITED STATES OF AMERICA

-

2

2

-

-

45 minutes ago, khwaibah said:

Your friends wasted time as Manila did fork all but forward info to Baltimore. Manila can not do anything but sign you up and act as messenger boy.

Maybe so in some cases, but they have always helped with a variety of issues and have confirmed the results whereas otherwise we wouldn't have known jack ????.

-

1

1

-

1

1

-

-

2 hours ago, khwaibah said:

My 2 satang. Never involve Manila with anything except for signing up for SS IF you're not in the states. Manila is as useless as they get.. The can not and will not do anything . If you send anything to them they only will forward it to Baltimore and the 7162 is sent to Wilkes Barre. If you have an issue call SSA in Baltimore you will get NO help from Manila. s for Baltimore the SSA phone system leaves a lot to be desired but be patent tell you get a live voice. I have had serious issue with Baltimore for the past 4 years but I am still getting my funds DD to my US bank. In the past 4 years and this year is the 5th year. I have had only ONE 7162 sent to me and Zero end of year statements. Do a download of the 7162 form sign it then EMS it to Wilkes Barre no where else. If you envole Manila all you are doing is adding another layer of incompetency. SSA number Baltimore. +1 800 772 1213. The post by another forum member may be correct then it may not be. I have seen nothing on the SSA website about this subject. Call Baltimore and use EMS.

Thanks for the info, but I must say that Manila has always been of great help for me, maybe not this time, but give them a bit more time. Two friends last year also had their payments restored via Manila. I do expect the EMS form to Wilkes Barr to work, though could not supply the barcode.

-

On 6/14/2020 at 3:03 PM, khwaibah said:

I did this last year and confirm what UJ says.

Dang, thanks for that. So, I hope the exact room number, etc., still works. I sent one to Manilla as I described above by email Sunday, too. The no-reply said there are no phone services or appointments, etc. I asked if they would acknowledge the 7162 and accept it in PDF format w/o the barcode and if suspension of benefits were waived this year because of Covid-19, but so far no answer. Boy, you ever get the feeling that the US government is dying to get rid of us? I know I've been dying to be rid of them the whole of 72 years.

-

1

1

-

1

1

-

-

1 hour ago, Rdrokit said:

I just email them to Social Security Manila.

I did that, too. the sjregion@ssa email address no longer works, so I found this one just today:

Federal Benefits Unit

United States Embassy

1201 Roxas Boulevard

Ermita, Manila 0930

Philippines

Phone: 632-5301-2000

Fax: 632-8708-9714 or 632-8708-9723

Email: [email protected]

None of the offices will give an acknowledgement, but you can play machine gun and check by phone call to Manilla in October to see if you're good. That's what I did last year (for a friend). I find no confirmation that this year is being skipped, but that may be the case. You'd think they'd have mercy on us old folks and at least confirm that you're okay, or not, but that isn't government. Yeah, post it right on the ssa website, too, but nooo..... -

It's taken over two months to receive mail from the US, plus you can NOT use the PO Box on the return form, so you're screwed both ways for getting the original bar code form back in time. So... as I've done for others in prior years, I sent a downloaded form via EMS at the Post Office (no word when regular mail will resume). I did this also on behalf of two others. They've never received one in prior years, but I have, so I could have pasted the bar code from last year, but didn't because I'm not sure what's on it. We split the 880 baht cost of an EMS package three ways. Now, we can also hope that Migz's message is correct, that SS will not enforce suspension of benefits for lack of a 7162 this year, anyway. If you do send one EMS, you can't use the PO Box (I don't think), so I believe this will get there (there are many different addresses out there, many do not work):

Social Security Administration

Wilkes Barre Data Operations Center

ATTN: FEQ Analyst, FEQ Forms 7161-7162

1150 E. Mountain Dr. Room 341

Wilkes Barre, PA 18702-7997There's also an email address which I've used in past years that no longer works, also a fax number. I've not tried that one yet, but it is 506-2291-1032. If it works or not, let us know (oh wait, I don't think it's a valid number, extra digit). Finally, come November you could call Manila to see if you're good and if not ask them how to fix things, send them the form filled out, with or without the bar code if that's what they want. It's a legit concern, there are many whose benefits get suspended, even those who sent in forms with or without bar codes (there's a remark field on the 2nd page where you can address these issues as we did). Good luck, all.

-

2

2

-

-

2 hours ago, silverhawk_usa said:

Thanks for your thoughts. I am by no means what would be considered wealthy. I am not referring to inheritance tax. For a simple IRA or Mutual fund, a percentage will be deducted and paid to the IRS before your beneficiary can receive the funds. She will probably be able to have that tax refunded, but it won't happen without an ITIN. If she is a beneficiary on U.S. bank account, they will require a ITIN also. I suggest, if your other half is to be a beneficiary of any funds from the U.S. (doesn't have to be married) get an ITIN before your death. There are hoops to go through, and I wouldn't want my wife having to hire a lawyer and do it on her own.

As for being unfair or racist, I don't agree. The stimulus checks are intended to help the U.S. economy and get people (in country) back on their feet who need it. I don't live there anymore. That was my choice. If we lived in the U.S. I wouldn't expect Thailand to be sending her checks. Overall, the U.S. is quite accommodating for expats compared to many other countries. I wish all the best to those in the U.S. going through hard times as I do for those in Thailand.My first 10 years I got beaten dozens of times, twice very nearly to death, and this at the bidding of school principals who never had any contact with me or any reason to dislike me. For the next 47 I couldn't get diagnostics on the damages done to my face because the medical brotherhood in the states is nothing but a slut for the pharmaceutical industry. That and purely felonious government fraud made it impossible to pursue a career. You could say I had a choice to stay, if I wanted to get sucked into kiddie porn, tax fraud, or at the end of it a cocaine and meth racket on government property, but to me there was no choice. Now, marrying a Thai woman was my choice. The USA has no moral right to deprive me of the $1200 stimulus just because I married her, and there's no need for her to be a beneficiary since everything I could scrape together in the states came here. She's taken very good care of me and owes the US of A nothing.

-

1 hour ago, lopburi3 said:

Have Thai wife with ITIN.

Have filed jointly with DD refund on February 5.

Have not received any government payment 12 years ago or now.

I have to keep reminding myself that the statisticians say I'll be dead in six years and thank God I've got enough in the bank to eat. I'll have to remember not to get the next wife an ITIN. They're definitely right when they call me stupid.

-

16 minutes ago, silverhawk_usa said:

What some are missing here, is not the fact that you are legally married to a foreigner, but whether or not she applied for a Individual Tax Identification Number (ITIN) with the IRS. If so, she can then be claimed on your taxes. If no ITIN, married or not, you cannot claim her. Be aware; this number also makes her liable for U.S. taxes. For instance if she would inherit any U.S. funds she would need that ITIN and be liable for taxes due. Hope this helps.

It certainly explains it if you make enough money for the ITIN to shave your tax, not much sense for those of us who get no tax break for getting a spouse an ITIN just because they thought it might be useful and who have no taxable income. Nor is there any applicable inheritance tax unless it amounts to many times more money than most of us have ever dreamed of. For blokes like you, it still seems outright unfair and racist. You are being punished for having a non citizen wife, but why? What the hell.

-

1

1

-

-

7 minutes ago, Berkshire said:

Yeah, I honestly do not understand their rationale for doing this. It's not that your wife is/isn't an immigrant, it's that she's not a US citizen. There are millions of Americans in your predicament, both in the USA and abroad.

Crazy. Yeah, I got her a TIN about nine years ago and have usually filed joint even though I have no taxable income. So, changing to filing separate with an amended 1040X probably won't impress them, even though thousands with Thai wives who have never filed joint will get their checks. Meaw has never been to the US and neither of us ever hope to go there. It certainly does look like punishment of foreigners or those who might love them by Mr. Trump. As if I hadn't been punished enough by turning my back on crack cocaine and kiddie porn. Ok, ok...

-

Did several comments disappear? Is it just me, or does it not compute that a Thai wife who has never been to the USA is NOT an immigrant? To get a jump on it, I filed a 1040X (amended return) as filing separately without my Thai wife's info. Then I took it to the Post Office and found that Thai Post does NOT ship to the USA anymore. That could be a serious problem in five weeks when we're supposed to mail in our Proof of Life forms or face termination of SS payments. So, it's looking like those of us with Thai wives may not get our $1200 payment, even if they're in no way immigrants.

-

1 hour ago, cusanus said:

Well, now, SOB, Thai postal would not mail my 1040X to the USA, Covid-19, no mail to US of A

This could be a serious problem since five weeks from now we will be receiving Proof of Life forms (SSA 7162) which if are not returned will mean that our Social Security payments will stop Feb 2021.

-

1

1

-

-

38 minutes ago, gamb00ler said:

You can definitely try that approach. The final determination of your eligibility will be based on your tax filing for 2020 because this payment is actually an advance on the refundable tax credit created for 2020 in the CARES Act. If filing as married separately doesn't cause you to pay more tax you can make the change on your 2020 tax filing and receive the benefit later.

I always ask myself why I put her on the form, anyway. So, the amended 1040-X goes out today...

Part III (explanation) goes like this. Why wait?According to news reports, US citizens with immigrant spouses do not qualify for the $1200 stimulus check. In a few cases, it is stated that spouses with TIN numbers instead of SSAN numbers will disqualify a taxpayer. My spouse is a Thai national, NOT an immigrant to the USA. She has never been to the USA. I had to leave the USA to avoid pervasive crime interring with employment, including 100s of millions in tax fraud and drug racketeering on government property (which the IRS ignored). I included my Thai wife as a spouse on the 1040 out of respect, but since neither of us has any taxable income in either country, there is no need to include her in anything. There are many ex pats here in Thailand with Thai wives who are getting stimulus checks because they do not file a joint return. Please do not deny me a stimulus check simply because I'm married to a Thai national. Thank you.

Well, now, SOB, Thai postal would not mail my 1040X to the USA, Covid-19, no mail to US of A

-

1

1

-

US SS form 7162

in Home Country Forum

Posted

I've been her 15 years and sent or received dozens of items regular air. Every one took exactly 14 days give a day or two. Suit yourself. EMS is regular air, you know.