-

Posts

27,375 -

Joined

-

Last visited

-

Days Won

2

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by connda

-

-

BKK Pushes Forward with ‘Universal Design’ for Public Buildings to Promote Disability Access

AAAAHHH HA HA HA HA HA HA HA.

Typical sidewalk to get to said building.

-

Tuscany perhaps. Married to a big-breasted Italian gal. Le donne italiane sono belle, eleganti e piene di charme. (Italian women are beautiful, elegant, and full of charm).

But reality? (slaps self in face to wake up) - really my only regret living in Thailand is that unlike foreign women who marry Thai guys, I have no path to citizenship via marriage. If I did I'd take it. I like Thailand, the culture, and honestly as a Theravada Buddhist, this is where I belong. Although raised Roman Catholic, but now I'd be a square peg in a round whole in Italy.

Much more my type of gals👇

-

1

1

-

-

- Popular Post

6 minutes ago, BE88 said:All this Trump circus and to make it look like all this predicted big US inflation is being blamed on all these foreign states taking advantage of the big and wonderful US.

Yeah - like adding 5 Trillion USD to the freaking National Debt. Fyi - he's losing a significant portion of those who supported him. Not the true dyed-in-the-wool MAGA types, but the conservatives, independents, and moderate liberals who voted for him based on his campaign platform promises to engage in fiscal responsibility and end wars. What do we get? A Big Beautiful Abomination of a funding bill that removes the debt ceiling and add 5 freaking Trillion USD to the debt.

-

1

1

-

2

2

-

1

1

-

1

1

-

- Popular Post

Given my Thai Tariff Shock Syndrome (T2S2) every time I buy something from the US to be shipped to Thailand - well? I'm none too sympathetic. Not even a little bit.

There is a way out of 37% tariffs for Thailand. Drop their tariffs on US goods imported into Thailand and I 100% guarantee Trump will reciprocate. That's what the tariffs are meant to do - shock & awe high tariff countries into dropping their tariffs on US goods.-

1

1

-

2

2

-

1

1

-

Thai Baht's Rise in Jeopardy Amid Political Uncertainty

And now 37% tariffs on exports to the US. They're gonna need to start exporting quantity - better get that Thai Baht a lot lower to stimulate exports.

-

1

1

-

-

Anutin Denies Eyeing Thai PM Role Amidst Political Rumours

Gotta get rid of the Shin Dynasty first.

-

1 hour ago, CharlieH said:

Good idea ? Or just more control ? Turned on and off easily, where and when you travel? Is this just MORS CONTROL ?

How they gonna put yr annual visa stamp in that ?

So Brits only get digital passports in the near future? Then Brits can't leave the country because no other countries accept digital passports? Interesting that Western countries are now fully embracing authoritarian governance to equal or surpass the types of authoritarianism they claim exists in Russia and China. I can see a day coming on the horizon when Brits and Europeans freedom of movement is limited by social credit scores. Digital passport? That's a start. Easy to turn on, easy to turn off.

UK Government "But it's convenient!"

"But it's convenient!"

Sure it is.

-

1

1

-

-

Make me seriously consider how close to a civil war we may be in the US?

"'Broken arrow' is arguably the most chilling and desperate order that an American military commander can issue. When faced with an enemy about to overrun a surrounded force, a commander uses it to call in an air or artillery strike on his own position.This month, many on the American left are issuing their own “broken arrow” signals, including calling on globalist allies to hit the U.S. with sanctions and other measures. They are seeking to achieve through sanctions what they could not achieve through elections."

Op-Ed by US legal scholar, Johnathn Turley. Also published in The Hill.

https://jonathanturley.org/2025/07/07/hit-us-please-americas-left-issues-a-broken-arrow-signal-to-europe/

https://thehill.com/opinion/civil-rights/5385403-attack-us-please-americas-left-issues-a-broken-arrow-signal-to-europe/ -

3 hours ago, Mavideol said:

Trump erratic behavior, impulsive decisions/reactions, befriends with dictators and somehow admiring them, his relationship with Putin and his love for attention, his big ego making him a dangerous person. Last meeting at Nato questions were risen about the potential of Xi and Putin working together to create diversion and at the same time preparing simultaneously military actions, they know very well Trump's personality disorder, Putin has been plying him for quite some time and all of it being under China's control/advise, it's obvious that Trump would (is) not a credible international leader in such matters, Nato knows that Trump is a TACO and they better prepare themselves to be ready without the USA

World War Three fears as NATO chief warns of joint Xi and Putin attack

https://au.news.yahoo.com/world-war-three-fears-nato-122927606.html

The West wants a war with both Russia and China and have been engaged in provocative rhetoric for year.

Will we have WW3? Yeah probably. Started by the US and NATO.-

3

3

-

1

1

-

-

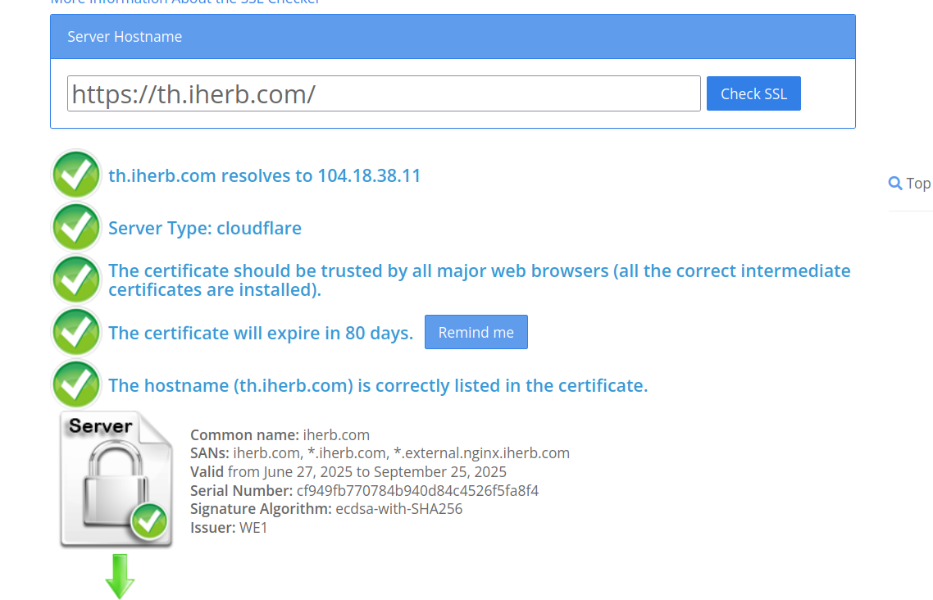

I just connected to https://th.iherb.com/

Works fine. Last week you'd get errors connecting because the certificate was not good but that's been corrected. Clear your cash and cookies for th.iherb.com and try again.

-

2

2

-

-

Where you located?

-

1 hour ago, jimmyjam12 said:

I called Ss international operations today the form 7162 will be mailed next week

relax not a conspiracy not a war against expats smoke a joint drink some Johnny walker not it off

And there you have it. Thanks for checking!

-

On 7/5/2025 at 5:27 PM, MJoe said:

Thanks - I totally agree they are looking to stall benefits to expats.

No they are not. If you're really so worried about it, write your Reps in Congress and the Senate.

Everyone is in the same boat. When the forms come everyone will get theirs. If they don't come by October Plan B is to mail in copies of the form, even better if you have a copy of an old form with a bar-code which I personally have. -

- Popular Post

- Popular Post

4 hours ago, snoop1130 said:The Thai baht's recent four-month rally faces challenges as political turmoil threatens to impact the nation's economy.

I rising THB isn't a good thing as it makes exports more expensive.

-

1

1

-

4

4

-

On 7/5/2025 at 11:32 AM, jwest10 said:

A total idiot it seems, and a teacher at a well-known school?

A total idiot it seems, and a former teacher at a well-known school?

Fixed it!

-

22 hours ago, angryguy said:

Yup the only thing that changed about them after the war is they became super feminine

The Japanese are dying out. Japanese kids don't have kids.

-

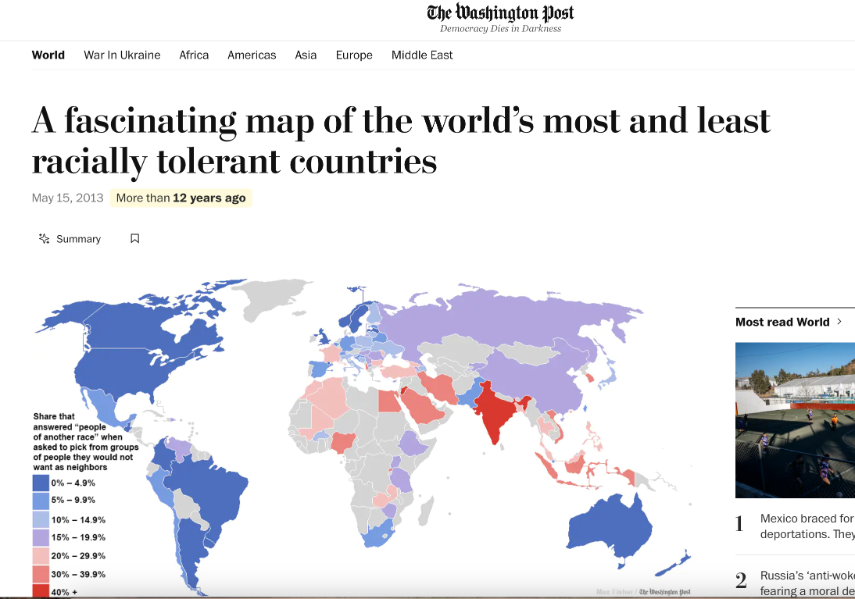

22 hours ago, NorthernRyland said:

These maps printed by Western media are worthless. In every one of these statistical graphic, the West is the "shiny city on the hill" and everyone else are s***.

-

- Popular Post

- Popular Post

How To Turn Yourself Into A Walking Freakshow

-

2

2

-

2

2

-

- Popular Post

- Popular Post

Trump 'Madman Theory' How Unpredictability Is Shaping Global Power Dynamics

Most countries consider the US to be agreement and treaty incapable. Which is a direct consequence of the "Madman Theory."

Trump's idiocy is going to bankrupt the US and I fully expect the Republicans to lose Congress in 2026 and the Presidency in 2028.-

1

1

-

1

1

-

3

3

-

Roll out the extrajudicial summary executions ala Shinawatra. Yeah the country has a meth probably but it will never be solved because too many people are making money.

-

1

1

-

-

21 minutes ago, KhunLA said:

Foreigners aren't wealthy in TH. If they truly were wealthy, they wouldn't be in TH.

Exactly. A typical middle-class American comes to Thailand and buys a home with a price tag of a fixer-upper in the US and that person would be considered "Wealthy" here. Average home price in the US is about 1/2 million bucks so if a farang drops 16.5 million THB, in the US he's barely keeping up with the Jone's.

-

2

2

-

1

1

-

1

1

-

-

1 hour ago, SoCal1990 said:

Some of the financially successful foreigners living in Thailand display their wealth by buying luxury condos or building large houses, driving expensive cars, wearing flashy designer clothing, and openly spending big in restaurants and nightlife spots.

So do "financially successful" Thais. It's the norm. Thais are raised and indoctrinated with a need to display status and wealth. Most of them. Foreigners are already considered to be rich by benefit of being a farangs. The concept of farangs living in big houses in gated communities and driving fancy cars is an exception that is probably the norm. It's probably a bigger surprise when farangs don't display their wealth.

-

2

2

-

-

17 hours ago, KhunLA said:

You really need to know your usage, Feb, Mar, Apr & May.

Here we go:

Jan: 372

Feb: 385

Mar: 512

Apr: 585

May: 704

Jun: 621

Interesting. I wonder why we are drawing so much in the last two months? I let the wife take care of the bill so I've never noticed that? Hummm? -

18 hours ago, KhunLA said:

Our house is well built, insulated block, insulated roof & ceiling, minimal wall exposure to sun.

Ours is too. We rewired the house about 6 years ago. Put insulation into the roofs, we have external sunscreen blocking the sun from hitting the south facing walls. I renovated an existing home so the insulated block would have been a grand idea had I built new. Replaced all the windows with high quality double glass sliding windows and we keep the two kitchens (Yep! we have two kitchens, main kitchen and dining areas with another sink. Wife likes to cook, so do I for that matter) separated from the main house using sliding glass doors which traps any kitchen heat. The house much cooler during the Hot Season and warmer during the Cool Season (it gets downright cold here in January at which time I'll run a free standing heater in the bedroom/study).

Thai Police Dismiss British Teen’s Drug Smuggling Claims

in Thailand News

Posted

Enjoy your prison term. Conditions in a Georgian prison might actually be better than a Thai prison. Should be glad you didn't get busted during a stopover in the UAE or Saudi Arabia. Don't do the crime if you can't do the time.