-

Posts

1,275 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by MartinL

-

Twenty or so years ago, my friend built a huge house in a tiny village in KK province. Pool, a small house for his wife's mother, large grounds, the works. It now lies apparently abandoned after he, his wife and son moved to UK for the lad's education. They are very unlikely to come back to Thailand as a complete family. It seems he's too sick for that now, too skint (even before he left, he had trouble meeting financials for an extension of stay) and the family seem very happy in the new home. In that location, it seems totally unsaleable except very cheaply as a demolition project and a return to the rice paddy that surrounds it. The house was always FAR too big for the 3 of them - I think it was a vanity project in the days when he had plenty of money, built without serious thought to what they really needed. I agree with hotsun's comment - I'd feel really uncomfortable in that situation

-

.thumb.jpg.a649cacedeeccbc218adc073bf668ef2.jpg)

Foreign Driver Crashes Car, Flips onto Its Side in Pattaya

MartinL replied to Georgealbert's topic in Pattaya News

Are the police sure he's a foreigner? If he is, he's learnt Thai driving habits to perfection. -

Deleted by author.

-

On the strength of this post, I got in touch with my deceased mate's widow and asked if she'd received any paperwork from the Scottish Police pension people - she had. The tax code allocated to her on the payment advice slips was 1257 so it looks as though a tax code application mightn't be necessary. The very first payment she received included a back payment and deduction of £500 in tax. Since the widow's pension is FAR below £12,570, I'd expect that to be refunded in the 25/26 tax year and I'll be looking to see whether the 1257 code continues.

-

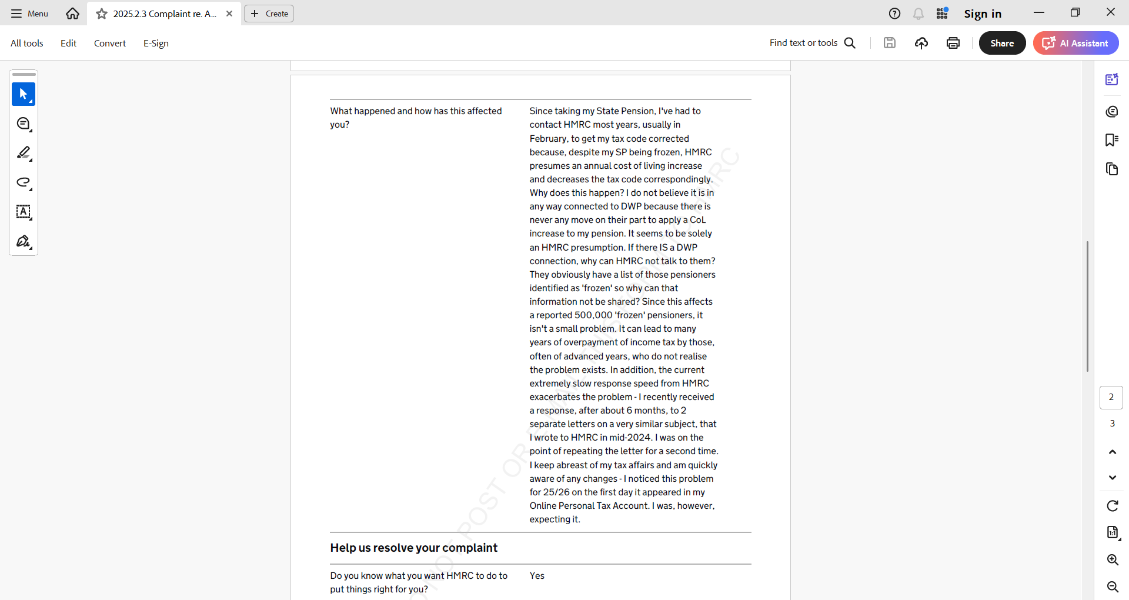

I've just had a response to my complaint - about 3 weeks later which isn't bad. They've apparently put a 'marker' on my tax account so that the automatic assumption of an annual CoL upgrade no longer applies. If you're also fed-up with the annual tax code shenanigans, it looks like you can get a positive result. It's just a pity it took a complaint rather than a simple phone request to achieve this. The text of the response is this:- Thank you for your complaint which we received on 3rd February 2025. Your customer reference is xxxxxxx .Your online submission reference is xxxxxxxxxx. I am sorry you have had to contact us regarding your tax affairs. I have been in contact with a specialist team who have confirmed they have set a specialist indicator to account for the frozen state pension and stop the automatic increase affecting your tax code. Once again please accept my apologies, I do hope your future dealings with us run more smoothly. I look forward to not having this problem in the future - but will have to wait a year to see if they can live up to their words.

-

.thumb.jpg.a649cacedeeccbc218adc073bf668ef2.jpg)

To be a leftist, is it a prerequisite to hate the west?

MartinL replied to hotsun's topic in Political Soapbox

Excuse my ignorance of the USA political scene but ... I often see this stated; "... registered (party xyz) ... " in US-related reports. Is it REALLY necessary to 'register' as a particular party's voter or is it a choice whether or not to do so? Does it then mean you can't change your mind spontaneously, without re-registering for another party? To officially 'register' seems an odd thing to do, in my view. Please explain. -

All of the cost savings you mention were presented in a 2011 Report:- http://frozenbritishpensions.org/wp-content/uploads/2015/12/Oxford-Economics.pdf but the findings and conclusions were rejected. It would seem that successive UK governments of all colours would prefer to make a political statement rather than save taxpayers' money.

-

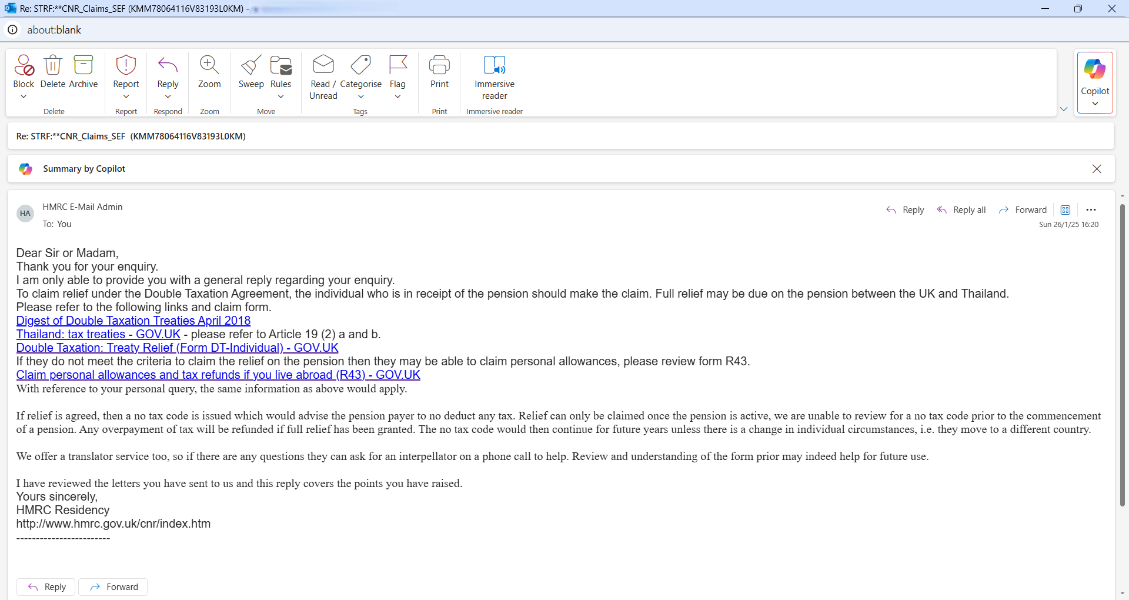

Moderator - if you feel this would be better as a new thread, please do so. "UK Tax Allowance for Thai Widows"? I thought it better to resurrect this thread rather than start a new one. I sent 2 letters and an e-mail to HMRC on this subject in 2024. In the last couple of weeks, I had an e-mail reply - only about 9 months after the original letter! Despite the delay, their reply was a useful one. The e-mail is attached below. Pumpuynarak was told that the Personal Allowance had to be applied for each year. This seems not to be true where Thailand is concerned, because of the UK/Thai Tax Agreement. Using Form DT-Individual, NOT R43, this is a one-off process that, once approved, lasts until circumstances change - death of the Thai widow in receipt of the Tax Allowance being the most relevant for us or failure to return a Life Certificate (?). The form also allows for reclaim of taxes paid in error. https://assets.publishing.service.gov.uk/media/637e192f8fa8f56eabf75e5b/Double_Taxation_Treaty_Relief_Form_DT-Individual.pdf Unfortunately, this application can only be made after a pension starts - after our death - so we can't be there to help our widow but maybe the bulk of the form can be completed while we're still here. I'll be making an application on behalf of my mate's widow soon.

-

That link leads to the latest form on the DWP website BUT it's different to the one I received a few days ago. That might be because the one we get is specific to us as individuals - i.e. it has the NINo so they know a lot of detail from that.

-

Or this .... https://assets.publishing.service.gov.uk/media/67160776e94bb9726918ee90/Life_Certificate.pdf

-

I looked at my online Personal Tax Account yesterday and, as expected, HMRC had reduced my tax code for 25/26 based on their assumption that I got the CoL increase of 4%, which I don't. I phoned them as soon as the phone lines opened, asked them to correct it and the change appeared in my PTA about 15 minutes later. No difficulty at all - unless you call listening to endless 'helpful information', "your call is important to us" and %#@&*!& awful music a 'difficulty'. I also fired off a complaint, via the online complaints page, to HMRC re. the constant need to correct them.

-

Some years ago my tax code suddenly changed in just this way - no additional income, no changes at all. It turned out that my main pension provider had changed the scheme name and HMRC weren't aware of the change. In effect, I was being taxed on one income under the OLD name and a distinct, but same amount, income under the NEW name. It was corrected once I pointed this out to them (and, I suppose, they made their own enquiries), Check that something similar hasn't happened here.

-

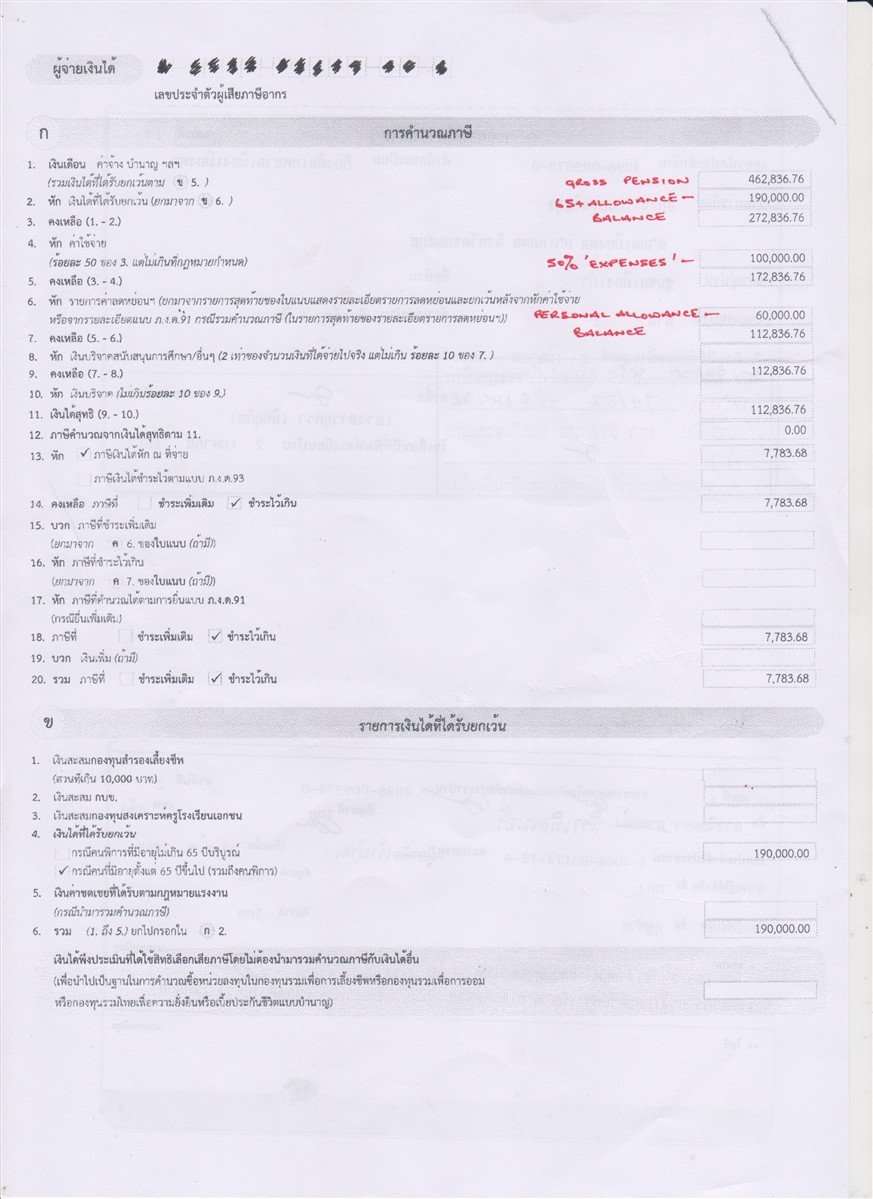

I can't provide a link but I can show an actual example of it being applied. The attached is a page from my wife's tax return from last week. She only has pension income so uses Form 91. She's 69 so qualifies for the 65+ allowance. The 100k 50% 'expenses' is deducted at Line 4 - even though she has no 'expenses' as I'd understand the term. Those two and the personal allowance of 60k puts her in the 0% tax band. The figure of about 7,700 baht is the withholding tax taken during 2024, to be refunded.

-

That's the way I've arranged things too. I remitted a total of 620k฿ in '24; 282k from verifiable pre-24 savings which is non-assessable, 338k from pension receipts in '24. Above the 120k filing limit but, with TEDAs of 60/100/150/190 k, below the level at which tax is due. My plan is to repeat something similar for '25 and beyond - pension income to just below the TEDA limit and topped-up with pre-24 savings BUT in the back of my mind is the concept of First In First Out which might mean someone says that savings must be exhausted before newer income is remitted. That'd change things a bit but not disastrously. I haven't read much on that subject but I haven't been scrupulous in reading everything in these threads.

-

Try 'long tabien' instead of EMS - same tracking but maybe a little slower - I don't know; I haven't used EMS for years. Yes, cost is around the 200-300 baht figure for a normal-size letter. My last 'long tabien' letter took 10 days to UK.

-

I've had this problem every year since taking my SP in 2019. I've written a snail-mail letter to HMRC every year and, at the same time, phoned them as a 'belt and braces' measure - not DWP since I see it as a tax problem not a pension problem since the pension doesn't change at all - and it was corrected but the problem recurred the following year. Last January/February, I kept an eye on my Personal Tax Account and, as soon as I noticed the SP rate for 2024/25 mentioned - it was wrong, of course - I called the HMRC and spoke to a real live person!!! Anyway, after talking about it, the agent asked if the pension was frozen at the same rate as the previous year (Of course it it, it's FROZEN!) which I confirmed. Result was that the correction was made in my PTA within 10 minutes of making that call and showed my SP figure had reverted to the correct, frozen amount. I'm hoping the if a correction's necessary this year, it'll be as easily corrected as last. Of course, it'd be ideal if we didn't have this crap to contend with every year. I've tried 'nice' letters with limited success. I'm considering a Complaint letter if there's a problem this year - that has got good results for other problems in the past.

-

Pretty much exactly my experience at my local district tax office last week. I take it you were refused a TIN. All these reports of TIN refusal because of already-taxed pensions means I'm leaning towards the belief that the RD has told local tax offices that such pensions are not to be taxed further but that bit of info. hasn't been publicly announced for some reason. If my belief is wrong, never mind - it's not the end of the world. I decided at the start of all this that my financial affairs were very simple - pensions and some pre-24 savings - and I knew what was assessable and taxable and calculated how much tax I might have to pay in the worst scenario, taking TEDAs into account. Not much at all and, if tax credits can be applied, then nothing. Not worth worrying yourself senseless over.

-

Agree. In another thread, I said "I was refused a TIN because I have no earnings in Thailand ... maybe the TO people are waiting for proper instructions from their senior people". From all the reports of denials of TINs, it increasingly feels like they've already had instructions not to provide TINs for those living on pensions - and my TO specifically asked about pension income - we've just not heard about it and it'll never be confirmed one way or he other.

-

Yes, I know all that but a TIN is needed to file a tax return and, in so many reports, TRD local offices have refused to issue a TIN, including in my own case just yesterday. The manager of my local tax office was acting in what he clearly believed was the correct manner to my enquiry in denying me a TIN. He certainly didn't appear to be acting out of malice or indifference as he took time to explain his stance. I won't change his belief that his action was correct so I didn't try too much. How can we even get on the first rung of the ladder in an attempt to comply with the law if we're denied the tools to do so?

.jpg.5042d9ebe809318b12a02a9d9758888b.jpg)