-

Posts

12,510 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by khunPer

-

I know, but the problem is not the transformer from high voltage to low voltage, the problem is a broken low voltage cable/line. In my case salty corrosion in a connection on the line by the beachfront.

-

To my knowledge neutral is grounded on every second mast. Both remaining phases worked perfect as 220 volt supply.

-

Thanks for the hint, that might be useful for some on Samui. My three phases on a good day with sunshine and tailwind... On a bad rainy day with headwind the voltage can be as low as around 90 – the lowest I've seen – and up to over 300... Voltage can even shift rapidly... I use a few automatic voltage stabilizers and numerous UPS units to protect sensitive electronic equipment, which so far probably have saved lots of electronic lifes from fatal electrocution...

-

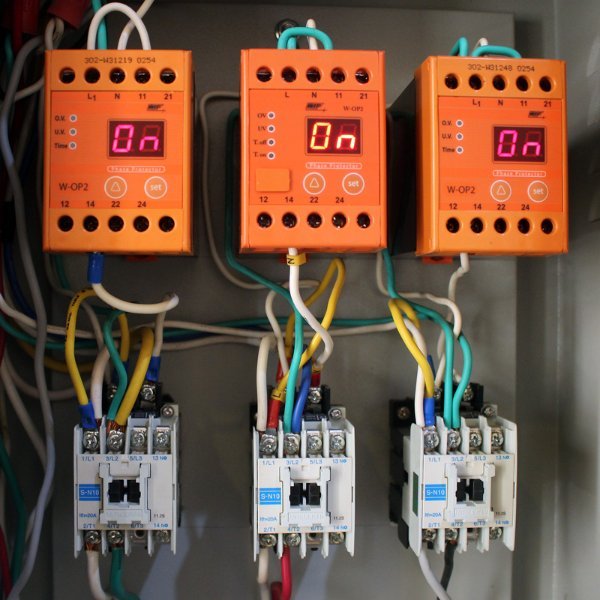

Yes, single phase; i.e., 220 volt. You need one for each circuit or phase with sensitive equipment. Photo is the inside of my protection box for my three aircon circuits, phase-protectors with magnetic switches...

-

Report BMW Maverick Mayhem: Foreign Driver Causes Chaos in Phuket

khunPer replied to webfact's topic in Phuket News

Hopefully the foreign driver will be number 28,809+1... -

Report Cambodia Condemns Thai Temple for Imitating Angkor Wat

khunPer replied to snoop1130's topic in Isaan News

Or just Phanom Rung-inspired – the temple in Buri Ram Province – and don't forget that Siam Reap once was part of Thailand. In fact, the present Cambodians should be very happy that they still have the original Angkor Wat, after Rama IV gave up moving the temple complex and had to settle with a miniature-copy in Wat Phra Kaew next to the royal palace... -

Plenty. I'll tell slightly detailed, as others might be also be interested in how it worked well for me and her. 1) For the language gap I invested in en English language school to improve her already modest English. Doing that is a benefit for both me – if the relationship lasts – and her, as good English skills improve job possibilities and salary. The same school also had en IT-course, so Word and Office got included in the tuition. We are back in 2004, where IT and computers were uncommon in Thai school-system, even rare in many government offices. I had her to quit her work as receptionist in a small hotel or guesthouse, se she could learn full time. I paid her living costs and we had long-time rented a bungalow bungalow in a different part of the country, to where she had been working; i.e. she moved from Hua Hun to Samui, if you wish the details. The rest is a matter of mutual trust in each other – thais are also sceptical about farangs... 2) Culture gap is depending of both parts, if both are ready to learn and accept other culture. Part was leaning my future girlfriend about my Western culture. So the following European summer I "invited" her the visa-possible periode three month to Denmark, and furthermore started with more impressions of European culture by a holiday to Paris in France. Visiting neighbouring Sweden was self-understood, also some of the Danish cultural stuff like castles, museum and other events. Living in my country was a compromise of two cultures, where we had Thai food when she cooked, and I made farang-food when I cooked; and when we were dining out it was foreign food for her. She also learned how to make farang food and was an excellent host for summer garden parties taking care of BBQ-steaks and accessories. The following two years we repeated the same in the summer, having holiday trips to Italy – Rome, Neapels and Venice – the next year, and Britain the third year. Each year new culture events to visit in Denmark. We mingled with my Danish friends – only one of them had a Thai wife – so there was not what often happens when a Thai girlfriend visit a farang in his home country, where the circle of friends change to be Thai-oriented – the whole idea was to teach about my home country's farang-culture. The plan had all time been that I would change four seasons with pleasant all-year-summer – she was not interested in moving to mu country, she told me right from the beginning – so, the remaining 9 month of each European cold period I commuted between Denmark and Thailand, 6-7 times a year ("Always look at the bright side of life": THAI punished me with a gold card and always upgraded me to business class, my lovely girlfriend never tried a monkey class trip to Europe...😀). After I moved to Thailand we still travelled to Europe as tourists, and also visited Singapore and Cambodia. In Thailand I would buy her any books she wanted – she loved to read, and there was no soap-opera TV in the bungalow – to improve her interest. She chose mainly Thai-translations of Western book, among these the Harry Potter-series and Dan Browns book beginning with "The Da Vinci Code". This was great, as we could enjoy the films together when they appeared, and furthermore first years European trip to Paris included Louvre, which was part of the da Vinci Code – the reason for my choice of destiantion, because it had meaning for her – next year Rome and the Vatican, as that was the following year's Dan Brown-book. 3) Our age gap is almost 32 years – me from 1949, her from 1981 – but I works well. She considers me to teach her due to my longer life-experience. I need her to teach me about Thai culture – many of the several books about Thai culture and relationships came later – it was especially important when visiting the Isaan-area, where she originated from; she comes from the Khmer-area. Also, I'm more into contemporary music than nostalgic 60s and 70s stuff. And then I like partying in the nightlife – that one of the reasons to chose Samui – and enjoy the funky newer music; I'm actually a fair, if not cool, dancer and prefers house music. Age gap becomes small in time. I was more than double her age when we met – 22 vs. 54 – now we heading for only one third, 44 vs almost 76. We still head out in the night life together, enjoys concerts together, both dine out or candlelight dinner for two at home, some times shopping together – some times better to be alone, when I look for things a man is interested in, and she wish to try an endless row of clothes or similar check of makeup – seeing new films or taking a trip up to Bangkok for some event like a concert, etc. Furthermore we daily talk about what happens in the news, both Thailand and the World; She would normally by little more up to date with the Thai news as I have to wait until ASEAN NOW and other English sources gets it translated next day, while I might be a bit on the forefront with World news. But we also – and that might be equal important – give each other time. So, she is better of alone with her friends than taking a farang to sit alone in a corner not interested in what girls chats about and hardly understand it, if he was interested. The same when some of my Danish friends visits me. Subject might not be of interest for a Thai – some talks much about the happy old nostalgic time – and often change of language to Danish is preferred, as not all are that good in speaking English, which is needed to be polite to the Thai, sitting by the table. In that way we avoid boring situations, when we do not share interests. - - - A young lady with no children might be interested in having family, and since I never had found money and time for it at home, I was also interested in having an heir. Therefore the single moms in their 40s in my home country, who was interested in me, had no interest at all from my side. So, a young girlfriend would be a perfect match – and we got a daughter together, she is soon leaving the teen-era. In conclusion: "Nobody is perfect", but "some like it hot", a young or younger partner og spouse – we are not married, just boyfriend/girlfriend, it's more easy. So far we have been able to share a fair level of culture and interest for 22 years; and as I'm planning for at least 22 more years, she might at one point need to accept to take care of a grumphy old man...

-

She can walk out, if she so wish. But, she might have obligations to the mama san – if what she say about money and getting started is true – and she might (also) get a split on the final bar-fine. It's not umcommon that there is a (kind of voluntary) sum to be paid, and prices might have increased to 50k baht... Also worth to remember that a 58 year old man might not find love only from 26 year old stunning lade – even she is a single mom – she might first of all need for a stady provider for her and her 8 year old daughter, and also the lottery ticket for an upgraded better future. However, it can be win-win and work well – and love can grow in a benefitial relationship...

-

Why do most people NOT smoke weed even though it's legal?

khunPer replied to JoseThailand's topic in Thailand Cannabis Forum

Not everybody smokes, including weed and e-cigarettes... -

According to the Thai tax-rules both foreign card withdrawals and foreign card-payments in Thailand, and money transfers, are in principle income taxable when staying in the Kingdom 180 days or more within a calendar year. However, it has been officially suggested that foreign income earned in 2025 and 2026, transferred into Thailand in same year as earned, will be tax exempt.

-

What happens with money in the bank when the farang dies?

khunPer replied to Equatorial's topic in Marriage and Divorce

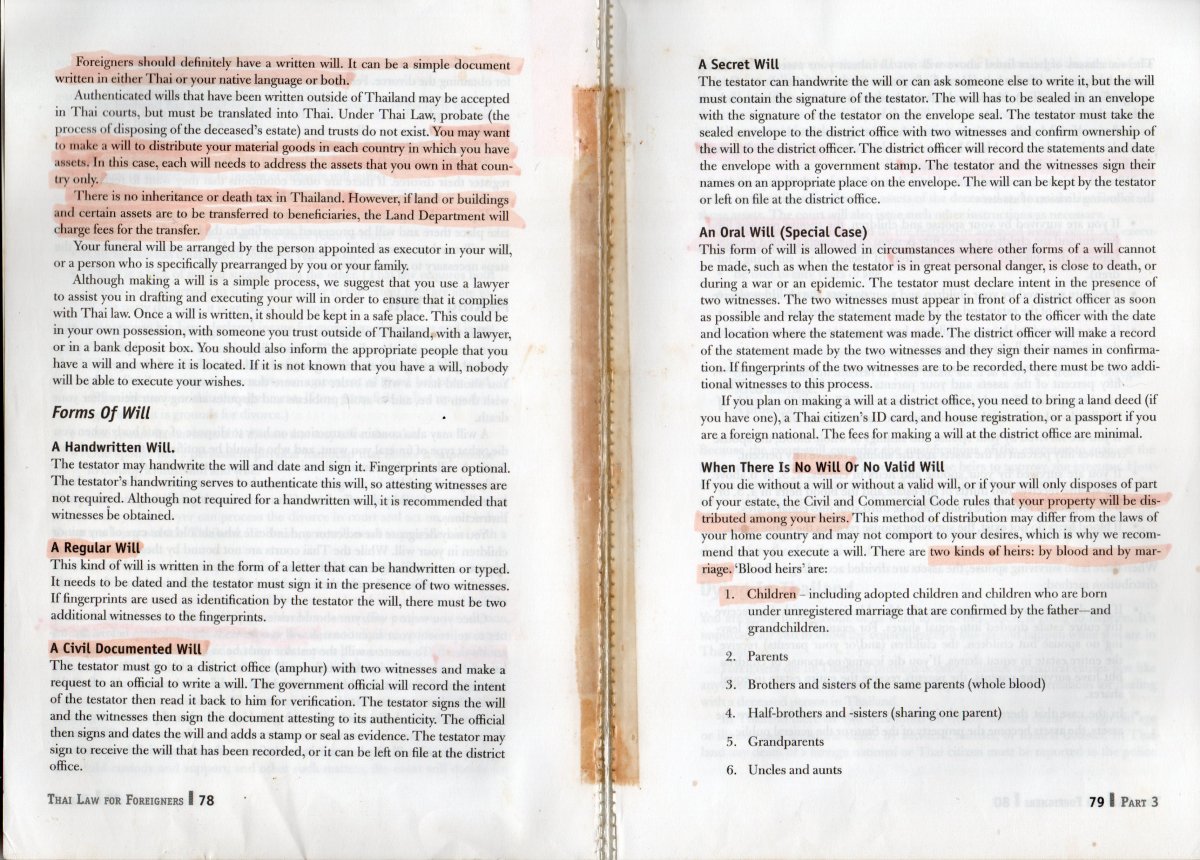

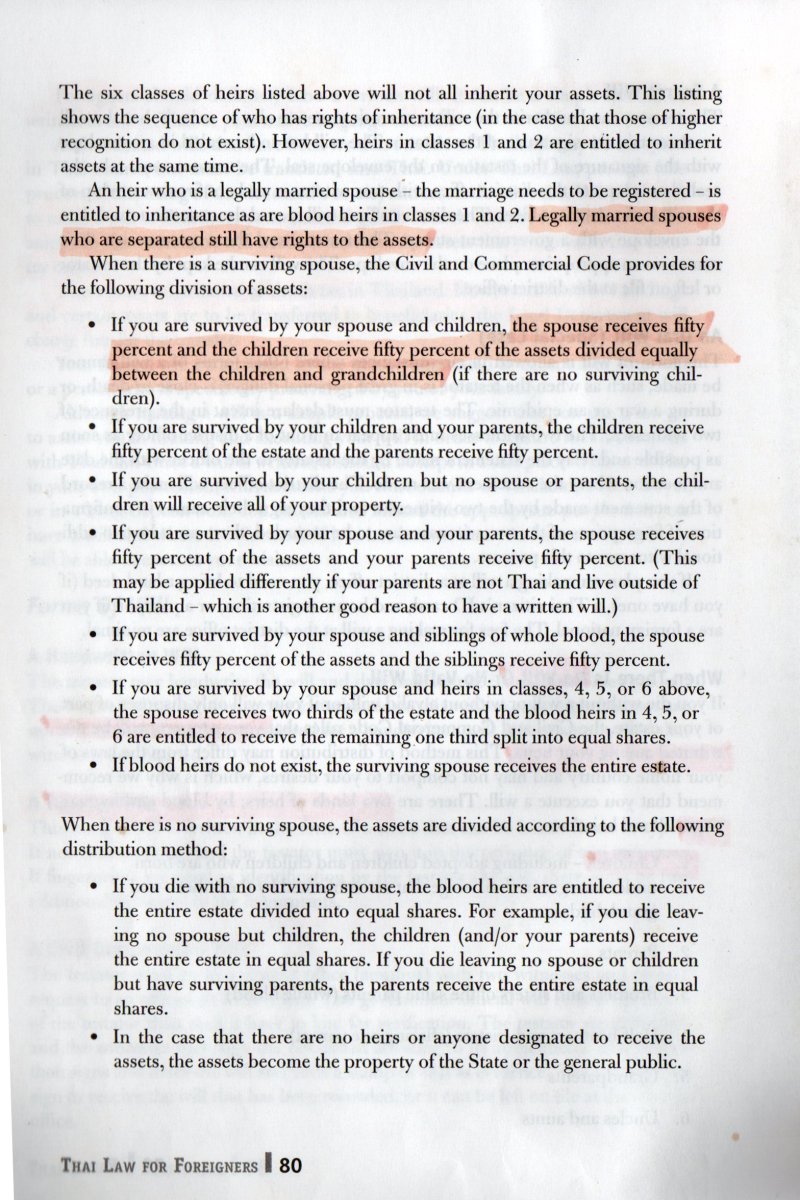

The bank deposits will be part of the estate. Distribution of the estae depends of a last will and which country the primary home was – probably Thailand in this case – as the estate will be handled in country of primary home. If there is no last will, the Thai rules distribute with 50% to the spouse (wife) and 50% to other family. If there are no blood heirs, the spouse will get it all. If you wish to be in control of where belongings and after you move on to next level, make a last will. Even one writing one yourself can be legal and make a difference. Image-texts below are from the book "Thai Law for Foreigners"... -

Seems like you understand "Thai way of thinking" very well...

-

Foreigner Tax Requirements

khunPer replied to PatThaiM's topic in Jobs, Economy, Banking, Business, Investments

Nothing has changed so far, but it has been suggested to omit the foreign income tax for two years for foreign income transferred same year as earned. -

That is correct, the women handles the finances...

-

Analysis Thailand in Trouble: Expats Exit as Vietnam Steals the Show

khunPer replied to webfact's topic in Thailand News

"Bureaucracy" and "welcoming spirit" are the main key words to considering other places like Vietnam, while dual pricing in some cases might also be a subject... -

If you look the same it's probably no problem. I use the same photo for 4 years when doing my extension of stay – I get 4 copies when a phboto is taken, even when I use immigration's own photo service. Since I don't change my life-style and how I look often, I get away with this photo-budget planning...

-

Report Thaksin Faces Possible Resentencing Over Hospital Stay

khunPer replied to webfact's topic in Thailand News

You seems to forget that "some are more equal than others"... -

I presume that they could find my house "without any prior assistance", since they showed up without any prior contact. However, the immigration office where I live has always insisted on a hand drawn map in return for an extension of stay – at least during the 18 last years where I got such a service – and the latter about 10 years also a Google-map with co-ordinates of the address. So, it's easy peasy to find my home with a GPS...

-

Probably there are more info for the police than share here, including bank account number, name and branch for the person that received the money...