-

Posts

12,513 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by khunPer

-

Report Israeli Tourist Busted for Selling Magic Mushrooms on Koh Samui

khunPer replied to snoop1130's topic in Koh Samui News

Is this even true anymore? Seemed just like another tourist trap to me but with lots of ganja shops for the druggies and layabouts. Not very impressive with some exceptions. "Idyllic" is depending where you live/stay on Samui – I still find my home being located on "the idyllic island of Koh Samui"...👍 – and you don't need to enter the local ganja shop, just pass it and enter the convenience store instead... -

Report Israeli Tourist Busted for Selling Magic Mushrooms on Koh Samui

khunPer replied to snoop1130's topic in Koh Samui News

Likely, if you have a work permit and is partner in a partnership (co. ltd.) with a Thai. -

Many books are "based on a true story", but not told as facts, as fiction makes the story more exciting. "Eleven Minutes" by Paulo Coelho is an excellent example within the same subject.

-

Fiction might reach more readers than facts. It's most likely helpful to tell these stories, either as fiction or facts. In my view helpful to understand about the ladies in the nightlife, and what they expect. Ans also to understand what you might expect from a relationship with a lady you meet in the nightlife, or who had a past in it. Some of the books I know about are first of all the often referred to "Private Dancer" by Stephen Leather. It got the cover note: "Should be compulsory reading for all first-timers to Thailand". The way the book is written, gives both an exciting fictional story and useable facts about the ladies in the "trade". A fact based book is "My Name Lon, You Like Me?", a true story by Derek Sharron about a young Isaan girl that came to work in both Bangkok and Pattaya. There are several books you might like to check out, like "Last Exit Pattaya" by Saifon Somdaeng, "a 33 year old bargirl from her eearly childhood to her 'Last Exit Pattaya'". "Lady of Isan" and "Lady of Pattaya" are two book by Michael Schemmann. And "Miss Bangkok" by Bua Boonmee with Nicola Pierce. I've heard many true stories from Isaan ladies – and also ladies from other parts of Thailand – one thingthat is common of them all is the kind of "lottery ticket" they "buy" in search for a better life, mainly with a foreign boyfriend or husband. Both through working directly in the nightlife to meet the "Knight on the White Horse", or indirectly by just having some normal work in a tourist area – where the knights assembles – in hope of making one of them interested in a nice lady, not originatiing from the bar-life. The details are different, but the goal seems to be the same: A provider and happy life. Some succed and become happy; some are even extremely lucky; some fails and return to their village; some get stuck to the barlife and or nightlife and cannot escape; and some got a life they didn't expect or whished, even ending up living unhappy if a foreign country.

-

What is the current 2025 Cost of a Cremation in Thailand?

khunPer replied to AngryMan's topic in The Wellness Zone

It's depending on how many days you wish monks to pray for you and how many monks. Cremation only might vary from area to area or temple to remple, depending of creamation method is modern or charcoal. Where I live it was 6,000 baht for the actual creamtion in a mordern diesel fueled oven a few years ago; so, probably around 10,000 baht. Why not ask – or get someone speaking Thai – to ask in the local temple. -

For paying electric bill I simple use the QR-code in the bill – easy peasy to bay via Thai smartphone banking. I use SCB and it works very well. You'll see the amount immediately and can check that it is the same as on your bill. You can chose with account to pay from, if you have more than one bank account in the same bank. You will get a receipt for payment instantly, which is stored in your phone.

-

Taxable income threshold amount.

khunPer replied to notrub's topic in Jobs, Economy, Banking, Business, Investments

100,000 baht, 50% deduction of income, not more than 100k baht 60,000 baht, personal allowance 190,000 baht, retirement deduction if over 65 years 150,000 baht, limit for income taxation ------------ 500,000 baht, before any income taxation. Additionally you can have 60,000 baht deduction for spouse, if she has no income of her own. Income taxationbegind with 5% for the first taxable 150,000 baht. - - - The online E-filling tax return is easy, but it cannot (at present) handle already taxed foreign income. If foreign taxed income exceeds the limit of for example 500,000 baht, and you wish to deduct foreign paid income tax in accordance with a Doubte Taxation Agreement between Thailand and your home country, you will need to fill an P.N.D.90 paper tax return form. -

Crime Russian Tourist Busted for Smuggling Hashish into Thailand

khunPer replied to webfact's topic in Koh Samui News

Taking cannabis to Thailand is same-same like bringing red wine to France... -

Cannabis Dispensaries in Koh Samui - Top 10

khunPer replied to CharlieH's topic in Koh Samui, Koh Phangan, Koh Tao

There are more cannabis outlets than convenience stores. The latter I have 3 of within 200 meters healthy walk from my home, but within same distance there are 6 cannabis outlets... In Chaweng Beach a restaurant seems to attract customers for dinner by offering a "free joint"... -

Report American Tourist Held in Phuket for ADHD Drug Possession

khunPer replied to webfact's topic in Phuket News

Simple resolution: Make sure to bring an official prescription with you, if you need to take medicine during your holiday trip. Your embassy or your home country's foreign ministry often have advices about this matter... -

Opinion Casinos in Thailand Unlikely to Boost Tourism

khunPer replied to webfact's topic in Thailand News

Ultra rich casino-fans might already have multiple more interesting offers than Thailand to choose from... -

3rd May: Samui Bike Week by Chaweng Lake... Organizer's description: On May 2–3, 2025, thousands of riders from across Thailand, Malaysia, Singapore, and Indonesia will descend on Koh Samui for the 13th Annual Samui Bike Week — two days packed with roaring engines, live music, and serious island party vibes. What to Expect Over 10,000 motorcycles expected Up to 60,000 visitors per day Concerts, shows, and events every night at Pru Chaweng Huge street gatherings, vendors, beach parties, and lots of chrome on display! Fun fact Past events drew around 3,000 bikes — this year’s goal is triple that! Why You Shouldn’t Miss It Even if you’re not a biker, Bike Week is one of Samui’s best people-watching events: Stunning custom rides, beach parties, loud engines, live music, and an unbeatable festival atmosphere. Whether you’re cruising on two wheels or just joining the party, Bike Week 2025 promises to be one wild, unforgettable ride. Source: Adapted from Bangkok Post + Samui Social field notes Some of my photos from last, unfortunately little rainy night...

-

Normally it says: Gift tax of 5% is payable when the donor is a living person and the recipient is an ascendant (parents, etc.), descendant (children, etc.), spouse or others. However, the following gifts can be given without tax: Real estate received by a legitimate child if the value of the property is less than 20 million baht. Maintenance income or gifts received by an ascendant (parents, etc.), descendant (children, etc.) or a spouse when the amount is less than 20 million baht. Maintenance income or gifts to a person who is not an ascendant, descendant or spouse due to tradition or custom when the amount is less than 10 million baht. Gifts received by a person who intends to use the gift for educational, religious or public purposes according to the donor's intention.

-

Fire Fire Breaks Out on Classic Yacht Off Sattahip Coast

khunPer replied to Georgealbert's topic in Pattaya News

Well done reaction by jet ski and speedboat, trying to extinguish the fire...👍 -

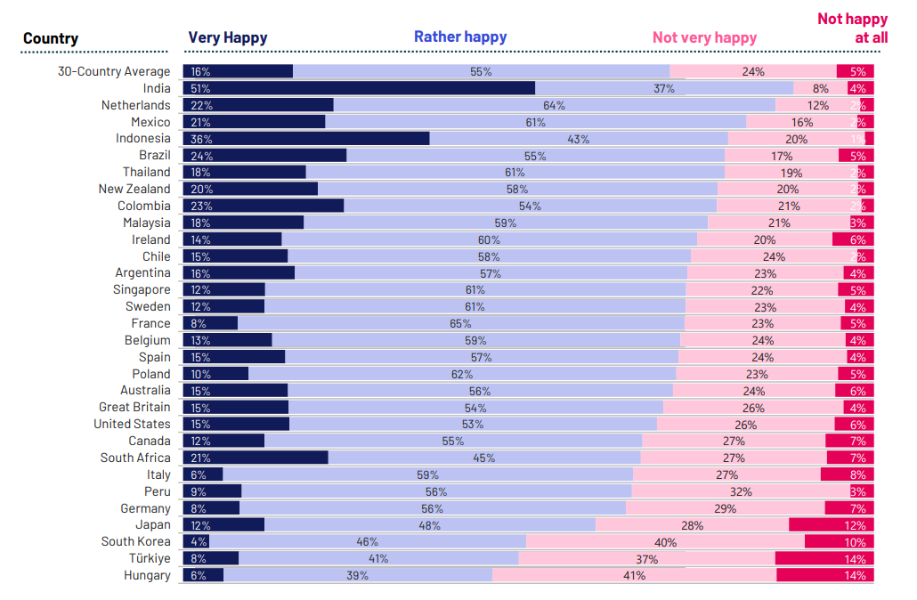

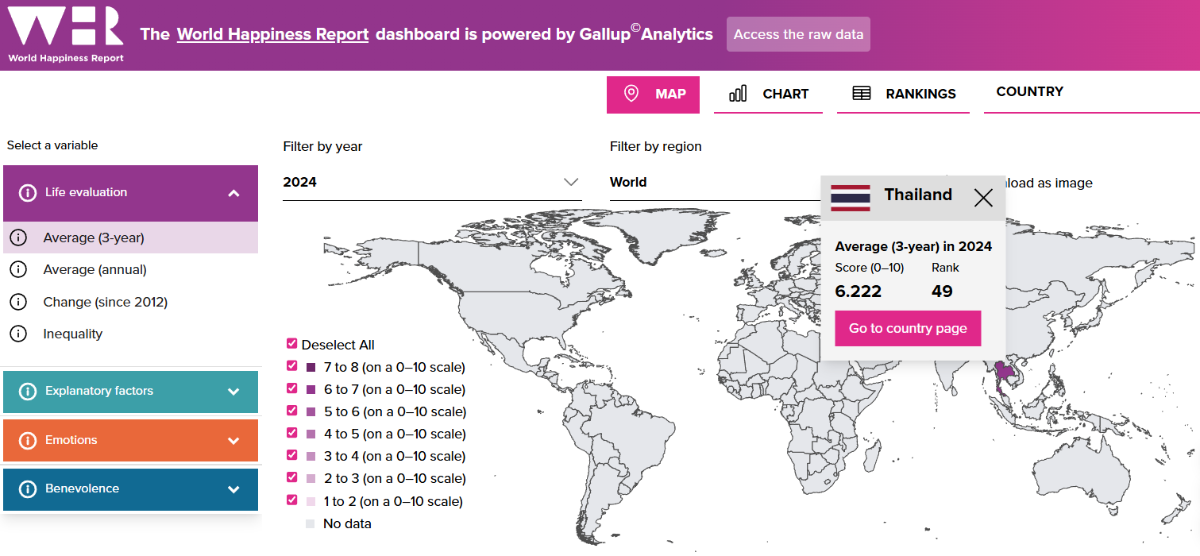

Report Thailand Ranked 7th Happiest Country in New Global Survey

khunPer replied to snoop1130's topic in Thailand News

There are only 30 countries in the "Global" survey instead of the normally around 170 countries in Global surveys... Link to the Ipsos Happiness Index 2025: https://www.ipsos.com/sites/default/files/ct/news/documents/2025-03/Ipsos-Global-Happiness-Index-2025_1.pdf In Gallup's World Happiness Report Thailand ranks #49... Findland is #1, Denmark is #2, and Iceland is #3... ...and #6 here is Costa Rica. Link to Gallup World Happiness Report: https://data.worldhappiness.report/table -

Clarification on Retirement Visa

khunPer replied to Slinky1958's topic in Thai Visas, Residency, and Work Permits

First year with monthly bank transfer of not less than 65k baht, you need to show proof of two months transfers, all following years full 12 months transfers when extending your stay. -

Clarification on Retirement Visa

khunPer replied to Slinky1958's topic in Thai Visas, Residency, and Work Permits

I haven't heard about that possibility, sounds interesting. Normally the rule is that if a joint account is used – two names – it need to be 1.6 million baht instead of 800,000 baht. -

Clarification on Retirement Visa

khunPer replied to Slinky1958's topic in Thai Visas, Residency, and Work Permits

1. Maturing period of deposit. The 800k baht need to be in deposit 2 month before application of extension of stay and 3 month after extension is granted. Then the deposit can be reduced to not less than 400k during the following almost 7 month until 2 month before next application for a one year extension of stay. 2. Fixed deposit. The normal 12-month fixed deposit – same rule for 3-month and 6-month – in Thai banks allows you to withdraw funds during the fixed period, but you lose the earned interest. The immigration states that you shall be able to withdraw fund, id needed. I – and others – have used a 12-months fixed deposit for several years. 3. Income letter from embassy. The letter is valid for 6 month. Some embassies do not issue an income-letter anymore. -

Clarification on Retirement Visa

khunPer replied to Slinky1958's topic in Thai Visas, Residency, and Work Permits

The easiest way to sleep well without thinking about next extension of stay is to leave the 800k baht in a 12-month fixed deposit and cash the interest once a year, so the balance of 800k baht is kept. Using monthly transfer method might require little more statement from the bank as proof of monthly transfers. If you a any point transfer less funds than stated in your opening post, exchange rate deviations might be an issue, so you never get below the 65k baht each month. Even the cash interest rate for fixed bank deposit is 1.5% p.a. – around that level at present – or little lower, it might be worth the interest difference from other investment, to stay free from financial worries for next extension of stay. With a budget in the area of 100k baht a month, the interest difference in money – between for example 4% p.a. and 1.5% p.a. of 800k Baht – is relative small. -

You can read the official rules and details here: https://www.customs.go.th/cont_strc_simple.php?ini_content=individual_F01_160426_01&ini_menu=menu_individual_submenu_02&lang=en&left_menu=menu_individual_submenu_02_160421_01 I've imported household from Europe some years back. It's worth to carefully consider what is needed – like non easily replaceable items and items of affective value – compared to buying new stuff locally. Be carefull with electronic items if not prepared for 220 volt/50Hz. You are eligible for one air consignment and one surface consignment for tacfree import of personal household items. A (very) detailed packing list is expected and a reasonable value of the items. Be prepared that you might pay a small amount of import tax and v.a.t. upon custom clearence. If it's a smaller consignment it worth checked with an international door-to-door transporter that will handle custom clearence and might give you a quote in advance for the total cost. You need to be in Thailand when to shipment arrives, as your passport – with non-immigrant visa – is normally needed for custom clearence.

-

So many food item prices continue to increase every few weeks

khunPer replied to steven100's topic in ASEAN NOW Community Pub

International market sets price for coffee, and coffee is increasing a lot... -

Tourism Thailand Vows to End Dual Pricing Amid Growing Tourist Backlash

khunPer replied to webfact's topic in Thailand News

Entrance to Grand Palace in Bangkok is free for Thais, while foreigners pay. In a way fair enough, it's the Thais' culture, while foreigners are tourists – and most of us foreigners can afford to pay for the ticket. Generally I'm okay with dual pricing. -

Politics Supreme Court Dismisses Lawsuit Against Thaksin Shinawatra

khunPer replied to snoop1130's topic in Thailand News

Reminds me of my kind Thai neighbour of Chinese origin, who invited me on green tea. He gave me a small piece of paper with his phone number and said: "Khun Per, if you ever get into troubles in Thailand, call me; one phone call from me can clear everything." I presume Thaksin either also knows someone importnat that can make a phone call, or perhaps he is himself such an important person... -

1) You need to go to the revenue department – the branch hyou need will be in the customs house, where you register for vat and TIN – and apply for a TIN. You will get a little matrix-written slip with proof of your TIN. It should be fairly easy to apply now, when all foreigners staying 180 days and more need to pay income tax of transferred fund. 2) A Yellow House Book includes a Thai ID-number for aliens, which is same number used for TIN and on a pink ID-card. I'm not sure if you still need to visit the revenue office to activate the Yellow House Book ID-number as TIN, or you just do it online when register for the tax return form. 3) Where I live it's easy and kind service in the revenue office. The online tax return dorm also works well, if you don't have any foreign paid income tax to deduct.