(2).jpg.2a397efe2c5444e7eed6daa0be365bec.jpg)

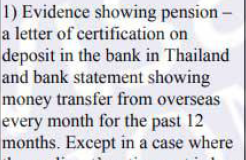

Pumpuynarak

-

Posts

824 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by Pumpuynarak

-

-

7 minutes ago, ubonjoe said:

What about the bank letter confirming transfers came from abroad ?

-

16 hours ago, DepDavid said:

In our village all the Yai say they have never seen the river dry. It has been dry for 7-8 months. Rice is withering brown and crisp. Last year was 50% normal rice yield. This year there may not be any. Maybe no income for a lot of families.

Yep, wifey's village 90Kms north from Korat is really suffering, no rain means no rice = no income for families = no food on the table, i really feel for the people.

-

1 hour ago, poohy said:

You want me to pay my own way?

The school should be paying not the kids parents.

-

2 hours ago, Tanoshi said:

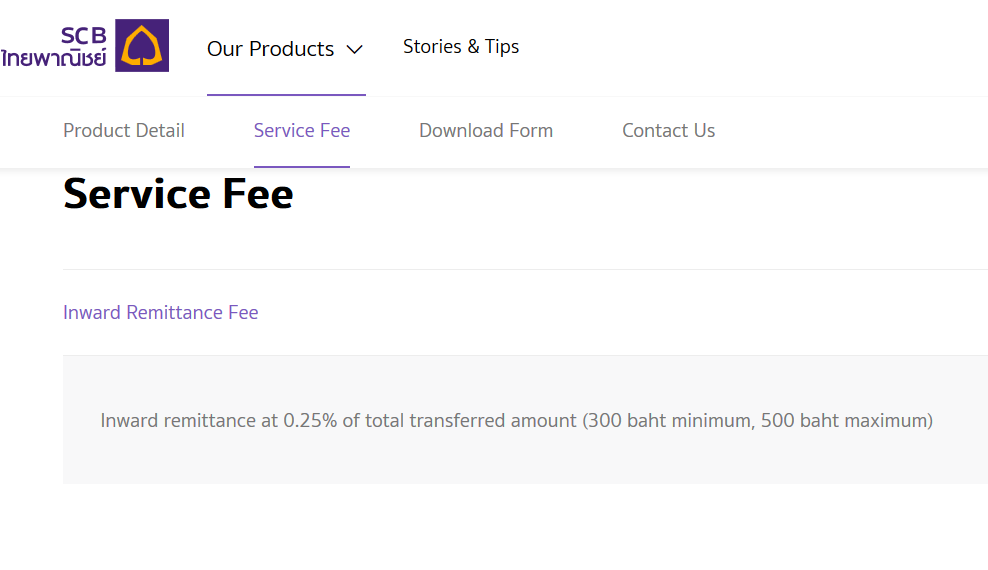

That is the local service fee for SCB converting your currency transfer to Thai baht.

If you look at your HSBC statement, you should find their £4 transfer fee listed.

All foreign bank transactions have to go through an intermediary clearing banks and these charges are usually made to your HSBC account up to two or three weeks after the transfer was made.

HSBC is actually one of the 4 main clearing banks in the UK, but transfer through one of their subsidiary branches in a different Country.

If you ask SCB for a full print out of the foreign transaction, it will provide the details of your HSBC account, plus the Intermediary bank involved, but will not provide charges made.

I suspect HSBC hide the actual transfer fees within the transaction itself.

It's vey easy to make a comparison of your actual charges by HSBC by comparing the amount you sent and received, then use the TW site entering the same sent amount and compare the difference in what you exactly received in THB through HSBC and what you would have received in THB through TW.

You could also calculate the transfer cost using Bangkok Banks London office to make the transfer and Bangkok Banks exchange rate as to what you'd receive as a comparison.

Thanks for your post, i'm on the case and will do as you suggest with my next transfer on 1st Aug and report back. I did do a small 100gbp transfer using Swift a week ago and only had the 4gbp charge from HSBC and then the hidden charge from SCB, here is the result.....

3473.75bht which equates to 34.73bht to the GBP but of course the SCB service fee has been taken off which i estimate to be 300bht so without the charge i would have received 37.73, that figure stacks up as SCB gives one of the worst rates in Thailand but at least i get the foreign transaction code, no other fees as yet from HSBC on my statement.

-

18 hours ago, Pumpuynarak said:

I did a transfer at 10am Thai time and it was in my SCB account at 2pm same day. The costs are difficult to work out as the fee that SCB charge is hidden in the Baht transfer amount, they just deduct from the amount. I have read somewhere in all the topics it ranges from 300-500bht according to the amount transferred and that would stack up on the amount i received, of course SCB's rate is one of the worst so you also have that to contend with but i have the foreign transaction code guaranteed as its a direct swift transfer.

18 hours ago, Tanoshi said:HSCB charge £4 for an online transfer up to £50,000.

The intermediary clearing bank will typically charge £20-£30.

You should always send in £'s and let the Thai bank convert to baht as the exchange rate is better.

Transfers typically take up to 4 working days.

You mention intermediary clearing bank but to my knowledge there is no use of such as the transfer is Swift direct from HSBC to SCB.

-

7 minutes ago, luckyluke said:

What's the difference in costs and time please?

I did a transfer at 10am Thai time and it was in my SCB account at 2pm same day. The costs are difficult to work out as the fee that SCB charge is hidden in the Baht transfer amount, they just deduct from the amount. I have read somewhere in all the topics it ranges from 300-500bht according to the amount transferred and that would stack up on the amount i received, of course SCB's rate is one of the worst so you also have that to contend with but i have the foreign transaction code guaranteed as its a direct swift transfer.

-

1

1

-

1

1

-

-

39 minutes ago, Tanoshi said:

If you want a guarantee of a coded International transfer, without requesting further proof, make sure you bank with Bangkok Bank and make direct transfers from your US bank account.

Correct Sir, i bank with SCB and because of this issue with TW i now have gone back to doing Swift direct transfers from HSBC in the UK, all coded with FRC (foreign transfers)

-

3 hours ago, Thailand J said:

And the 800k is in the bank under your name still your money.

and when you spend it in Thailand its still only 800K lol

-

18 hours ago, snowballthecat said:

This is turning pathetic! one has to do SWIFT because Immigration do not like Transferwise?

Everyday is a new one!

I believe the problem is that they can't verify the fact that TW PDF's you can supply are in fact genuine whereas a letter signed by your Thai bank poses no problem to them. As you probaly know everything in Thailand is believed to be fake unless you can prove otherwise, a terrible indictment of the country and its people imo.

In fairness to the very pleasant lady boss i saw she was happy to accept mine but i fear that in the future it may be a problem for me say if she got transferred or there was a directive from head office that only bank letters were acceptable proof, hopefully in the passage of time that will change and TW PDF's/bank statements will be accepted by all IO's.

-

I hope she never wins another GS, detestable woman.....

-

I think the way forward is to suggest/insist on a blood test at a local hospital if you are in any doubt as to the accuracy of the machine used, does anyone believe that these machines are calibrated daily before use as they should be ?

-

12 hours ago, marcusarelus said:

You can keep it in or take it out - up to you. It is worth what it is worth. Go back home and get a 2 year O-A visa and take as much as you want out of your Thai bank account and go home in another 2 years and get another O-A visa.

That is the only way its worth anything to you, will TI allow you to do this assuming of course that you have a home to go to in your home country ?

-

1

1

-

-

12 hours ago, Lacessit said:

The appreciation of the baht is only realized when one cashes in and leaves Thailand for good. The 800K for retirement extension is effectively dead money

BINGO, at last we have reality, your money is worthless to you all the time its in a Thai bank covering your retirement extension despite how much it might be worth on repatriation unless of course you're intending to return home.

-

1

1

-

1

1

-

-

4 minutes ago, tgeezer said:

Like pilotman, I get a good feeling when I see that I got the 800,000 fixed account cheaply and have as much right to be joyful in it as pensioners have to be sad at the drop in Baht value of their pensions. Certainly people who preached that the loss of return in locking up fifteen thousand quid must be green when they see that it is now worth twenty one thousand to those of us who did it!

So when are you going to take the profit lol

-

1

1

-

-

15 minutes ago, JohnnyBD said:

A friend of mine bought a house with his wife 2 yrs ago with his money of course and since a foreigner's name cannot be on the title, the house & property it sits on legally belongs to her. I cautioned him about doing that and suggested he buy a condo in his name, but he succumbed to his wife's wishes and bought the house. Well, now they are getting a divorce and the house and property is hers. He lost his money and has to start over. Feel sorry for him, but he knew the risk. Probably a common occurrence here. Just a cautionary story for newbies.

If they were legally married before he bought the house he's legally entitled to 50% from the sale proceeds.

On the subject of the so called investment its totally worthless to the account holder unless he repatriates the money to his home country.

-

15 hours ago, SooKee said:23 hours ago, Pumpuynarak said:My 15gbp charge when swift transferring 2000gbp was clearly stated on my HSBC statement.

If it's a fee HSBC are charging it will. If it's an intermediary fee it won't.

But if its a swift transfer why would they be using an intermediary, i thought swift was direct.

-

13 hours ago, tracy3eyes said:

Just direct from Halifax Uk using swift. And it arrives FTT

5 hours ago, Dene16 said:Transferwise has already stated they cannot guarantee the FTT code

Many posters have recieved both

So on the basis that yourself and a few other people have recieved the FTT code we are supposed to think everything is OK?

Are you prepared to risk your extension when you suddenly realise they haven't been coming through this way for a few months and the ensuing panic to try and sort it out

Just re reading tracy's post Dene and it would appear the transfer was done direct using swift not TW (it was early this morning when i posted lol)

Thats exactly what i did yesterday using swift direct from HSBC UK to SCB and it appeared as a foreign transaction on my SCB statement

-

20 hours ago, Pumpuynarak said:

Me too but i also understand that there maybe a problem with Swift transfers showing as "international" if your bank is using an intermediary. I've just done a small tester of 100gbp from HSBC to SCB to check it out, will report back when i eventually receive the money.

Well would you believe i did my swift transfer at circa 10am Thai time and at 2pm it was in my SCB account !!! the amount was 3473.75 bht, this amount was obviously including their fee and awful exchange rate, no where was the fee shown separatley, clever ehh...

BUT the most important issue was that it showed as a FRC1 (Foreign Remittance/settlement) on my bank statement so it is the way forward for me to go.

Does anyone know the fees charged by SCB for swift transfers before i contact them ? i find their call center rarely has the answer and they have to call me back which sometimes does'nt happen. I reckon i was charged something like 300bht for 100gbp, i would think the more you transfer the charge will reduce.

-

1 hour ago, Dene16 said:

Transferwise has already stated they cannot guarantee the FTT code

Many posters have recieved both

So on the basis that yourself and a few other people have recieved the FTT code we are supposed to think everything is OK?

Are you prepared to risk your extension when you suddenly realise they haven't been coming through this way for a few months and the ensuing panic to try and sort it out

BINGO

-

19 hours ago, SooKee said:

I'm kinda guessing your £50 will result in 700-800 baht less than you'd expect. Be great if it doesn't.

It was 100gbp and i reckon the SCB fee was circa 300bht.

19 hours ago, SooKee said:And no audit trail of these fees either end Statement wise. Even HSBC won't tell you. They say the only way to check will be a transfer enquiry which then cost something ridiculous.

My 15gbp charge when swift transferring 2000gbp was clearly stated on my HSBC statement.

-

20 hours ago, Pumpuynarak said:

I've just done a small 100gbp transfer to my SCB account from HSBC and paid the 4gbp fee, lets see what happens at this end, will it show as a foreign transaction and how much will SCB charge ?

Well would you believe i did my swift transfer at circa 10am Thai time and at 2pm it was in my SCB account !!! the amount was 3473.75 bht, this amount was obviously including their fee and awful exchange rate, no where was the fee shown separatley, clever ehh...

BUT the most important issue was that it showed as a FRC1 (Foreign Remittance/settlement) on my bank statement so it is the way forward for me to go.

Does anyone know the fees charged by SCB for swift transfers before i contact them ? i find their call center rarely has the answer and they have to call me back which sometimes does'nt happen. I reckon i was charged something like 300bht for 100gbp, i would think the more you transfer the charge will reduce.

-

14 minutes ago, gmmarvin said:

I may have to revert to Swift transfers.

Me too but i also understand that there maybe a problem with Swift transfers showing as "international" if your bank is using an intermediary. I've just done a small tester of 100gbp from HSBC to SCB to check it out, will report back when i eventually receive the money.

-

1 hour ago, SooKee said:

I'll be interested to see how the HSBC transfer goes. I use HSBC and stopped using them for transfers to Thailand about two years ago, not because of anything to do with transfer coding (which didn't matter then) but due to the fact they changed (or rather lost) their agent arrangements in Thailand and started using Intermediary banks to send money here. So on a £100 test transfer it was the very attractive sounding £4 flat fee transfer PLUS £14 Intermediary fee (the Intermediary rate you won't be aware of, or even that one has been applied, until the money arrives) then the bank here gets to convert just £86!! That was using HSBC > Kasikorn.

Then because of all this crap with FTT codes I opened a BKK Bank account to get FTT codes from TW which was, and as of a few days ago still is, working. When I opened the account I did a test transfer of funds from HSBC to both Kasikorn and Bangkok Banks, just to see if anything had changed. Both got hit with high Intermediary fees so HSBC is still off my transfer list. Repeated testing gets costly!

Being hit with high SWIFT charges when you know what they will be up front is bad enough. Having some random charge that you won't know about until the money arrives (and even though you'll only know because the funds that arrive are light), and even then won't appear on the statements from banks at either end, is even worse.Thanks for your post, yes i am aware of the fee charged by my Thai bank which was never charged before the middle of last year when i transferred 2000gbp from HSBC and was charged 15gbp by HSBC on top of the 4gbp, i elected to "pay all fees" to HSBC and not pay any fee to SCB, this is when i decided to go over to TW.

I've just done a small 100gbp transfer to my SCB account from HSBC and paid the 4gbp fee, lets see what happens at this end, will it show as a foreign transaction and how much will SCB charge ?

I also could open a BB account and get TW to forward to them but it would appear that there is no guarantee that it would be coded as a foreign transaction despite making phone calls to TW.

What a crock of s...

-

37 minutes ago, jacko45k said:

2). I believe I have read of people here transferring from HSBC and having it suitably marked on arrival in Thailand. Just a matter of knowing which bank(s) HSBC deal with.

3) Transferwise to Bangkok Bank is claimed as reliable but not 100%. I am fortunate that my UK/Offshore bank sends directly to Bangkok Bank via SWIFT and it is labelled as FTT.

4) I am not living in the Korat area but have heard of an agent in KK arranging things, BUT not sure where the extension is from.

Why not do a small txfer to SCB from HSBC, we might be worrying over nothing.

4) I believe KK has their own IO and i would need an agent using Korat IO.

Like you suggest i'll do a small transfer today and see what pans out.

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

have choice of marriage or retirement. Does it matter?

in Thai Visas, Residency, and Work Permits

Posted · Edited by Pumpuynarak

I appreciate that UJ but it looks like everything was supplied by way of bank statements but JL was still declined, i can only think of the bank letter that was missing, i wonder did JL ask why it was declined ?