skatewash

Advanced Member-

Posts

2,763 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by skatewash

-

The grace period applies to actually doing a 90-Day Report. If you don't do the report the grace period does you no good. It's not leave Thailand during the grace period and you don't have to do a 90 Day Report. The 90-Day Report is required on your 90th day in Thailand (or 90th day since last report), for which you also have a grace period to do the report. There is no option to not do the report if you have been in Thailand for 90 days (or it's been 90 days since your last report). The only circumstance in which you don't need to do the 90-Day Report is if you leave Thailand before 90 days have elapsed since entering Thailand (or it's been less than 90 days since your last report).

-

I had a bad experience opening a SDFCU account using my US address and then using my foreign address. In the meantime I opened a checking account (with brokerage account) at Charles Schwab with my same US address without a problem. In my opinion CS is a much better account to have than SDFCU as they completely reimburse foreign ATM transaction fees. SDFCU does not. SDFCU ultimately decided to reject my application to open an account. The money I paid to join an organization that would allow me to open a SDFCU account was wasted. I highly recommend Charles Schwab, and would recommend people steer clear of SDFCU lest you have a similar experience to mine.

-

How to renew passport? Processing time so high

skatewash replied to Hal65's topic in Thai Visas, Residency, and Work Permits

Passport renewal at US Embassy Bangkok can be done entirely by Thai Post EMS and takes 2 to 3 weeks in my experience. It's hard for me to imagine how it could be any easier or faster. -

Bank Savings Interest Rates 2021

skatewash replied to kiever's topic in Jobs, Economy, Banking, Business, Investments

A Thai Tax ID card is not required in order to open a bank account, but I was trying to get them to recognize that I provided my Thai Tax ID number to them when opening the account so that they could waive (as Bangkok Bank and Krungsri Bank have) 15% automatic tax withholding on interest earned on the account. Some have been successful at doing this but I have not been able to get my particular SCB branch to do this for me. So this year I filed a Thai Tax Return (P.N.D-90) to have the withheld amount refunded. If I could get SCB to not withhold the tax in the first place I would not have to file a Thai Tax Return. -

I filed my FBAR pdf using Chrome, did not encounter the problems with the drop downs you mention. I use my US Mailing Address as my address. I use a VPN set to the US (as I do whenever doing anything US related, particularly financial). It sounds like our tax situations may be substantially different (I'm retired) but all the tax software I've used does allow reporting of foreign taxes paid (Form 1116), albeit all mine are via US ETFs/mutual funds (Regulated Investment Companies - RICs). I do have tax withheld on some Thai bank accounts for which I file a Thai Income Tax Return (PND-90) to have those refunded. Therefore, I do not claim those taxes withheld on my US income tax return. I'm retired so don't have to deal with other expat taxes relating to earned income, and am unfamiliar with those, which may be the ones you are referring to when saying the tax software doesn't handle it.

-

Free Tax USA is a good one. I think whether you need to file a state income tax return depends on your individual circumstances. If you tax residency is in a non state income tax state (Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington, and Wyoming) then probably not. If you have no income generation from your tax residency state then that's probably true as well, but I can imagine that there are circumstances in which an expat still needs to file a state income tax return even though they no longer live in the state (a good reason for making a non-state income tax state your tax residency). Perhaps this might be helpful in exploring the issue of state income taxes: https://www.ustaxhelp.com/determining-residency-for-tax-purposes-expat/#:~:text=If you are a United,have established your residency overseas.

-

I have never experienced that problem. I use my US mailing address (a Commercial Mail Receiving Agency) as my filing address. Elsewhere when questioned by Turbo Tax I say that I am living in Thailand (this used to be significant to avoid Obamacare provisions, but don't think it's all that important anymore). I also use a VPN pointed to the US whenever I am using Turbo Tax.

-

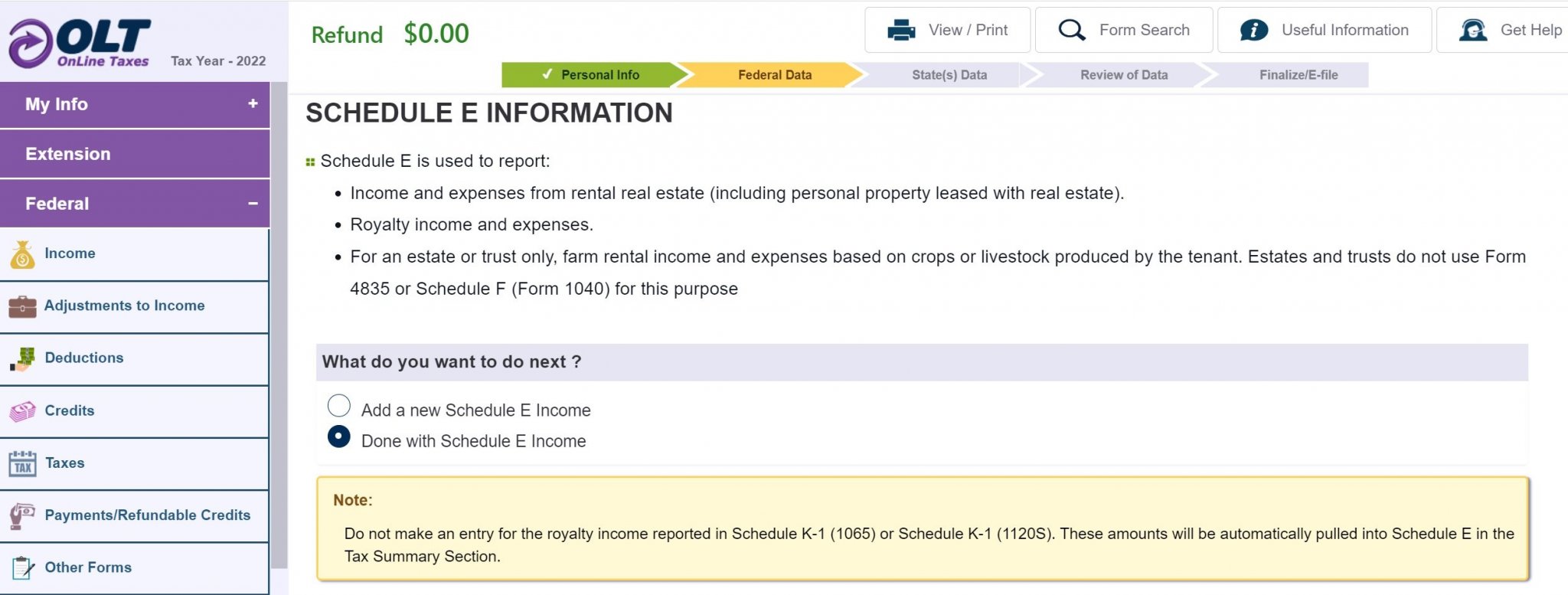

I use Turbo Tax for everything but filing my taxes. It's simply the best I've seen at importing tax forms from financial institutions (1099-INT, 1099-DIV, 1099-B, 1099-R). It's the best tax software out there I'm aware of. But I cling to the notion that filing taxes should be free so every year I first do my taxes on Turbo Tax to arrive at an Adjusted Gross Income figure and taxes due. I then go to the IRS Free to File site: https://www.irs.gov/filing/free-file-do-your-federal-taxes-for-free to see which tax software I can use for free based on answers to the questions asked in the "Use Free Guided Tax Preparation." This year my three free tax software recommendations were TaxAct, File Your Taxes, and Online Taxes. I've looked at all three, but will probably go with TaxAct as I've filed with it before. TurboTax used to participate in this program and I've used them before to file, but they dropped out of the program a few years ago. I'm retired and aside from investor issues (dividends and stock sales) I have a relatively simple tax situation. The free tax preparation software has always worked for me. I have always used tax software to file my taxes, never used a service (which might be more appropriate for more complicated tax situations).

-

Ask hotel for screen shot of report they made to immigration via online system showing you stayed overnight in their room. See this for requirements:

-

Here are the requirements for an extension for tourism purposes: http://piv-phuket.com/short-stay-extenions/visa-exemption/ They really should be able to do copies/photos there, but if not, look for a shop with Kodak/Fuji sign. They should be able to do both copies and photos. Agree with avoid Monday and Friday, also any days immediately before or after a holiday during which immigration is closed.

-

https://goo.gl/maps/iXzdFd9f4zkpzanK7 https://www.phuket.net/directory/profile/phuket-immigration-office-patong/ You can have everything (copies/pictures) taken at the Immigration office.

-

I believe that some *agents* have said that they recommend their clients go to Pattaya for "agent-assisted" extensions of stay. Everyone else, including those who do things themselves can get applications processed at Phuket Immigration for extensions of stay as usual. It's an agent problem, not an immigration problem.

-

There's no particular reason to prefer Bangkok Bank for a retirement extension and even a reason to prefer other Thai banks for the 800k money-in-the-bank method. Bangkok Bank's 12-month statement must be done via their headquarters in Bangkok often taking a week to receive, while most other banks are able to provide that statement while you wait or next day.

-

You can check the current price of Pregabalin (better to use the generic name) at Medisafe online (pharmacy located in Bangkok, but can ship throughout Thailand via Thai Post). Use the chat feature to ask for a price quotation: https://www.facebook.com/search/top?q=medisafe pharmacy ร้านยาเมดิเซฟ สาขาพระราม4

-

Good points. You also have the flexibility to go 30 days (up to 45 days in some provinces) early to apply for your extension of stay. There are great benefits in peace of mind with going early. I don't get 12-month retirement extensions, I get 13 1/2-month extensions. This opportunity is available to anyone.

-

The Tourist Visa Online Application Form

skatewash replied to David B 5843's topic in Thai Visas, Residency, and Work Permits

An onward flight booking from one of the online agents is indistinguishable from a booking from any other agent (i.e., comes with a PNR - Passenger Name Record that can be checked in the reservation system used by airlines), but comes with the expectation that you will not pay the full-price of the ticket (only a deposit of about $15-20 which you will lose) and therefore you will not actually fly on that ticket. Consequently the booking will only be valid for a period of time during which you will be checking in with your airline. Thai immigration will not be concerned that you do not have an onward flight leaving Thailand during your initial permission to stay, only some airlines are concerned about this as they are potentially on the hook for flying you back if Thailand were to reject your entry. -

Tax refund from a fixed deposit

skatewash replied to Aforek's topic in Jobs, Economy, Banking, Business, Investments

No, a Residence Certificate may have been needed to obtain your Thai Tax ID, but once that is obtained they will not require one to file your tax return. My experience at the Revenue Department was very positive. They even filled in my tax return (PND-90) the first time and filed it for me. I got a copy and the next year was able to do it myself as you just plug in the new tax withholding numbers. I find doing it online to be pretty easy, but I use Google Chrome on my computer (which is capable of Thai to English machine translation). In some cases that works, in other cases I have to turn the automatic translation off and use the Google Lens app on my phone to translate the screen from Thai to English. -

Tax refund from a fixed deposit

skatewash replied to Aforek's topic in Jobs, Economy, Banking, Business, Investments

Yes, I believe you can get your bank to issue another tax withholding certificate by asking them for another one. It might be best to visit the revenue department in person. Take a look at your notice with Google Lens Translate (from Thai to English) to understand what exactly the issue is. I suppose it could be sent by mail but I would be inclined to visit the revenue department in person. Once you have this year's refund you might want to look at doing it online next year.