Liquorice

Advanced Member-

Posts

4,895 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Liquorice

-

You can apply for the 1 year extension within the last 30 days of the 90 (45 days at certain offices). You'll be given a 30 day under consideration period to process your extension application, which provides the date to return for the extension stamp. Furthermore, you must start and finish the process at the same Immigration office, Non O > 1 year extension application.

-

It's just a different type of visa, like the Smart visa. It's neither a Non Immigrant nor Tourist type visa. You cannot apply for a 1 year extension of stay (retirement or Thai family) from a DTV. You would first have to obtain a Non O visa from a Thai Embassy/Consulate. (Already asked the question). Unfortunately, Gemini AI doesn't handle extension applications.

-

You can enter Thailand visa exempt, then apply for the Non O at Immigration with 400K in a Thai bank account. VE entry = 60 days + Non O = 90 days, total 150 days. The 400K must be seasoned in a Thai bank account for 2 months prior to submitting a 1 year extension application. 1 year extension based on Thai spouse have to be approved at regional level You receive a 30 day under consideration stamp while your application is processed. 5.5 months in the Country, you'd have departed before your extension can be approved. You'd only have time to apply for the 1-year extension if you entered with a Non Imm O visa based on a Thai spouse.

-

Your same question has been answered multiple times with available options. If you don't want to open a Thai bank account and transfer 400K THB funds into a Thai bank account, then apply for and enter Thailand with a Non Imm O visa based on Thai spouse from the Thai Embassy London. On entry, you're given temporary permission of stay for 90 days, which can be extended for a further 60 days at Immigration (1,900 BHT) = 150 days. A border hop and re-entry will then permit you a further 60 day stay = 210 days. Even that can be extended for a further 60 days = 270 days. There are options available, but the key question is whether you want to open a Thai bank account and transfer funds here, or would you prefer to keep your money in your UK bank account? Answer that question, and we can be more specific with your options.

-

Only 9 different types of Non Imm visas listed on the Thai Embassy DC site. I suspect for each type of visa, there will still remain multiple options for the purposes of your visit. https://washingtondc.thaiembassy.org/en/page/visa-fees-validity?menu=64ef5ba41986b07d37326263 Subject to either 180 day extensions, or border bounces for new entries and no doubt for the softer options, proof of booking a class or course. I'll stick with my annual extensions @1,900 BHT per annum, thanks.

-

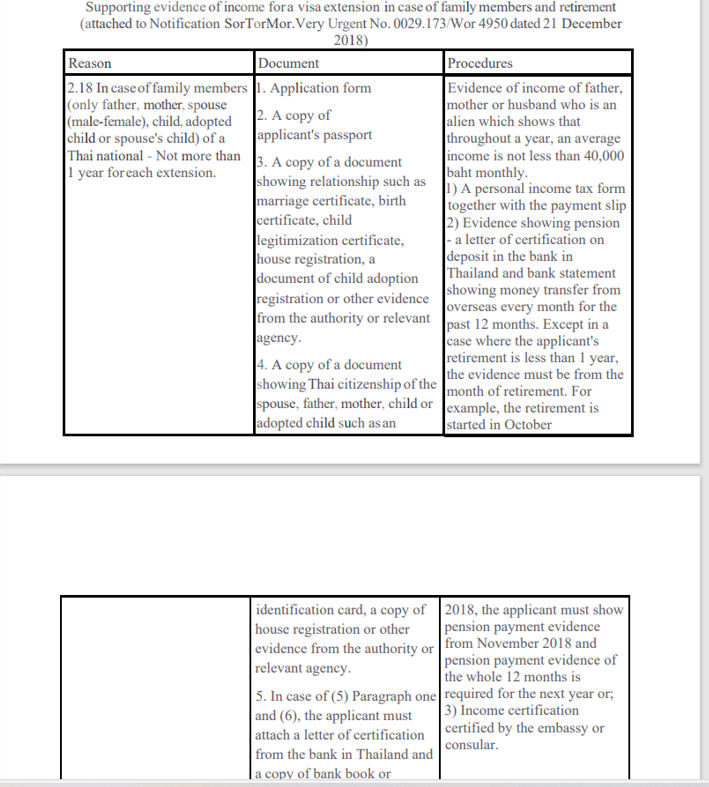

That same exception applies to both section 2.18 "family members" and section 2.22 "retirement", with the same requirements > evidence from Pension! Rightly or wrongly, Immigration make the assumption if you apply for a 1 year extension based on Thai spouse, then you must have retired or be working in Thailand. If you're young enough and not in receipt of a pension, then the assumption appears to be you have sufficient funds to deposit 400K THB in a Thai bank account. At my IO, if using the monthly overseas transfers for an extension based on either retirement or Thai spouse, they regularly request proof of being in receipt of a pension.

-

They announced changes to the Non Imm O-A visa, known as the 'long stay retirement' visa. The change was to reduce the mandatory Health Insurance from the current 3M BHT requirement, to 400K inpatient, 40K outpatient between September - December. If it's not from an official Immigration website, treat it with a pinch of salt.

-

Your Non Imm O visa is 'USED'. You were stamped with a period of stay of 90 days. Permitted to stay until (date) which is a permit, not a visa. It is this permitted period of stay that you extend. You cannot extend the validity of a visa. If your 400K funds haven't seasoned for the required 2 months, you can apply for a 60 day extension. Within the last 30 days of that 60 days (funds now seasoned) you can apply for the 1 year extension of stay. Extensions based on Thai spouse have to be approved by the regional office. When you submit your application for a 1 year extension you will receive a 30 day under consideration stamp, usually from the date your current permission of stay ends. Once approved, your 1 year extension will be backdated to the date your 60-day extension expired. You cannot be on overstay when an extension is waiting for approval.

-

According to the new TM30 regulations, if you're re-entering with a ME visa, or re-entry permit then a new Tm30 is not required. Depends if your IO is complying with the regulation, or not.

-

Firstly, you should always have separate Wills for assets in Thailand and in your home Country and each should reference the other, Your legal spouse will always be regarded as the beneficiary in the event of your demise, and a Will can either confirm or change that. Not in the case of Thai spouse, who under Thai ascension law is the automatic beneficiary, unless a Will states otherwise. This as others have confirmed is why Thai banks advise you to withdraw any funds (if you have access) before advising the bank of the death. There are no repercussions in the case of the Thai spouse making those withdrawals, even without a Will, as she is legally entitled to it. I've helped Thai spouses and a Thai carer through this process 4 times in the last two years.

-

Then they will receive a receipt, which they should give to you to staple in your passport as evidence it was filed.

-

Or failing their reluctance to submit it, request a signed copy of their Tabien Baan and ID card, then file it yourself. You should have covered this with the owner before taking the apartment.