mudcat

Member-

Posts

295 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by mudcat

-

Never far from our minds as we count the years (going on eight) that a neighbor is still bedbound after a major stroke. His stroke was misdiagnosed by the local hospital as a headache and sent home with (you guessed it) paracetamol. By the time he was transferred to the next level hospital it was too late - they could keep alive but there was no hope for improvement in his condition. His mother (in her 70s) is full time care nurse and regrets not giving any instruction to let him die when under care. He is aware and tries to communicate through vocalizations and nods, but what goes on in his mind is unknown other than he is unhappy. We bought a hospital bed with pump to avoid bed sores, a wheelchair, and diapers for when the 30-baht allowance runs out and whatever else she/he could use to make the long road less arduous but we cannot ease the emotional burden other than being a friend. I have discussed with my wife the U.S. Social Security definition of when she will need to ask to be appointed representative payee (in charge of spending my Social Security benefit for my benefit): WHO NEEDS A REPRESENTATIVE PAYEE (From SSA-787 Medical Opinion of Capability.pdf) “Some individuals … who have mental or physical impairments are not capable of managing their SSA benefits or directing others to manage them to meet their basic needs, so we select a representative payee to receive their benefits on their behalf. …. However, a person’s need for some assistance with financial tasks such as bill paying, etc. does not mean he or she cannot make decisions concerning basic needs and is incapable of managing his or her own benefits. If the individual is able to direct the management of his or her own benefits, then we will consider the individual capable.”

-

Ran into this at work fifteen years ago when the lunch bunch included Bob L. from Hong Kong, Sam A. from Beirut, Hassan from Daka, Garth H. from South Africa, and me from New York. I would make a allusion to cultural touchstones from the 50s and 60s and got blank looks. Coincidentally those were the end of a common culture in the U.S. Comes from working with a group that grew up as the smartest kid in the room (all engineers, some of them even civil) leavened with me, the smart ass.

-

The one thing I am expecting BOI to check is continuous compliance with health insurance/bank balance. When I received my LTR-WP visa they were requiring 12-months of health insurance or some other foolishness. I presented my U.S. Roth IRA with more than $100K in a Pimco bond fund as well as a Pacific Cross health insurance policy expiring a few months. When my five years is up I will be prepared with both cash equivalent and Thai insurance

-

What Would Make You Leave Thailand, Permanently?

mudcat replied to SoCal1990's topic in ASEAN NOW Community Pub

We have been married for fourteen years - spent about half the time for the first ten years in the U.S. so she could get naturalized. Paying for medical care out of pocket or market rate health insurance for my wife at my income level is a deal breaker. As to diet I see the bottles of oil arrive on a regular basis and clean the stove hood trap so I know her diet. She grew up poor in the Isaan and although she does eat the fruit and yoghurt I prepare for breakfast and vegetables and 'spicey' most evenings her upbringing causes her to eat with the seasons - if there are mangos or papaya in season one is never enough and a mid-day mealtime without white or sticky rice diet is unimaginable - all of this puts people at risk of type 2 diabetes - including her older siblings. It is important to compare the older generation of Thai people (at least here in the Northeast) who by and large are trim, fit, and incredibly tough with what I see in the young people around me who frequent 7-11 whenever there is money in the pocket and who have a tolerance for overweight peers as that translates to having money. -

What Would Make You Leave Thailand, Permanently?

mudcat replied to SoCal1990's topic in ASEAN NOW Community Pub

Certainly if my wife dies - she is younger, but not in great health some of which I attribute to the terrible diet most Thai people eat. I keep track of my viability to live in the states (west coast) again - as I qualified for my LTR wealthy pensioner visa income would not be an issue and with Medicare as my re-insurer I could have my choice of medical plans for less then I pay Pacific Cross annually. Even though here I am a 'wealthy' pensioner, in the Bay Area I qualify for a low income 55+ rental - too late to think about purchasing. My income would support us relocating back to the states together but that would require that she be 65-years old to participate in Medicare which would put me at 86-years old which is nothing to plan on. Taxes are not a real issue - my true gross income is approaching $100K but as a married filing jointly effective tax rate is around 6% and even as a single around 13%. All my income (Social Security and local government pension) is exempt from Thai taxes based on the U.S.-Thai DTA. -

Health Rabies Deaths Triple in Thailand: Urgent Alerts Issued

mudcat replied to snoop1130's topic in Thailand News

The travel nurse in the U.S. HMO we were members of recommended and administered vaccines against rabies when we discussed our time spent upcountry in Thailand along with all CDC recommended vaccines. Last year our son/stepson got bitten by a unidentified dog on the ankle while on his motorcycle and needed a full course of injections. Had it happened to us it would have been one and done. -

Ceviche from a stand at Guatemala bus station in 1979. Fortunately inbound so got to the hotel before the storm broke

-

In a secondary city 60 km from the provincial capital we have lost four dealers in the last three years: MG, Ford, Honda, and Nissan. All these brands still have dealers in the capital. Remaining dealers here are three with a strong model line that Includes diesel pickups and SUVs and longtime farmer loyalty: Toyota, Isuzu, and Mitsubishi.

-

Per Politico the rate has been lowered but the exemption for U.S. citizens has been removed: https://www.politico.com/live-updates/2025/06/30/congress/gop-remittance-tax-plan-said-to-raise-a-lot-more-money-despite-lower-rate-00433068 GOP remittance tax in megabill projected to raise a lot more money, despite lower rate Lawmakers dropped a plan to compensate U.S. citizens hit by the tax and forecasters determined a lower rate would actually raise more money. https://www.politico.com/dims4/default/resize/100/quality/90/?url=https%3A%2F%2Fstatic.politico.com%2F35%2F6a%2Fde8815314118b430f99cb5f0633f%2Ffaler-brian-20132.jpg Brian Faler 06/30/2025, 1:13pm ET A revised plan by Senate Republicans to impose a new one percent tax on remittances is now projected to bring in a lot more money to the Treasury even though lawmakers have slashed the rate. One reason: lawmakers are dropping plans to shield U.S. citizens from the tax on money sent overseas, which had been aimed squarely at undocumented immigrants. The provision, included in the domestic policy megabill before the Senate, is now expected to produce nearly $10 billion — nearly ten times as much money as a previous draft that would have charged 3.5 percent, according to the nonpartisan Joint Committee on Taxation. That’s partly because Republicans jettisoned provisions that would have compensated American citizens who also pay the levy. Lawmakers had proposed creating a special credit citizens could claim against the charge, though that’s been deleted from the latest version of the tax, defense, immigration and energy package. It’s also because budget forecasters determined a 3.5 percent rate would be high enough to prompt many people to avoid paying it — by finding other, nontaxable ways of sending money, for example — and that a lower tax rate would actually generate more revenue for the government. The lowered rate appears to have dampened complaints about the tax, a priority for President Donald Trump who pushed it as a way to add a burden to undocumented immigrants sending money to relatives abroad. Some had warned it could hit all sorts of other cross-border payments and lawmakers had faced lobbying from banks and others ratchet it back. Lead Art: President Donald Trump has advocated the tax to deter undocumented immigrants from sending money abroad to family members and others. | Ismael Francisco/AP

-

2025 SSA Form 7162 - "Hello, are you dead yet?" forms.

mudcat replied to connda's topic in US & Canada Topics and Events

Nothing from SSA as of yet - last year my SSA-7162 was dated on June 6, 2024 on the form I received. I completed and mailed it on June 22nd, 2024 - I assume it was received a few days prior to the 22nd. For those who wish to be prepared should their 'personalized' form not show up from either the June or November (last chance) mailing you may wish to download, complete, and mail it. I suggest that you include an earlier form with your bar code and QR Code to make sure that it gets processed in this decade. The SSA site I use for foreigner forms is: https://www.ssa.gov/foreign/ has the current (2023) forms (SSA-7162 for recipients and SSA-7161 for representative payees) and instructions including mailing addresses. I have explained to my wife the importance of completing this form for me and later for herself once I have died or survive to her turning 62-years old. I also explained that she can sign for me (I think it would be best to use a fingerprint rather than a 'X' if I can at least nod my head or blink my eyes in agreement as getting appointed as my representative payee (she is my designated representative payee) should be reserved for really dire situations as SSA-787 (Medical source of opinion of patients capability to manage benefits) makes clear: WHO NEEDS A REPRESENTATIVE PAYEE (From SSA-787 Medical Opinion of Capability.pdf) Some individuals … who have mental or physical impairments are not capable of managing their SSA benefits or directing others to manage them to meet their basic needs, so we select a representative payee to receive their benefits on their behalf. …. However, a person’s need for some assistance with financial tasks such as bill paying, etc. does not mean he or she cannot make decisions concerning basic needs and is incapable of managing his or her own benefits. If the individual is able to direct the management of his or her own benefits, then we will consider the individual capable. -

Bought one with my wife as beneficiary when we were newly married to fund a goodbye gift if that was necessary. I did get asked to provide my passport and U.S. Social Security number a few months ago, so yes life insurance companies are concerned with the U.S. tax man. Of note is that the payout is exempt from the Thai inheritance tax act and income taxes: https://www.rd.go.th/english/37749.html#section42 Section 42 The assessable income of the following categories shall be exempt for the purpose of income tax calculation: 13) Compensation against wrongful acts, amount derived from insurance or from funeral assistance scheme.

-

Tipping does not make much of a difference to me as we don't go to places that are not family owned and staffed. Probably would need to rethink our monetary standards if we lived in a city and had regular haunts. Personal standard is to tip taxi drivers on long trips who don't terrify me - usually ThB 100. Always tip the guy who brings up our bags and turns on the AC - usually ThB 50. (was a caddy in my youth) Always tip the housekeeper - ThB 100 per night (my grandmother and aunt were maids). At restaurants without a service charge leave ThB 50 or 100 on the tray (supposedly gets split among staff unlike tip in the hand). Make special note and tip a bit extra if the grandchild is with us when the waitperson greets and makes her feel welcome, e.g. at our regular restaurant they see us coming and brings the high chair for her and wait for her order (may be a while as she scans the photos).

-

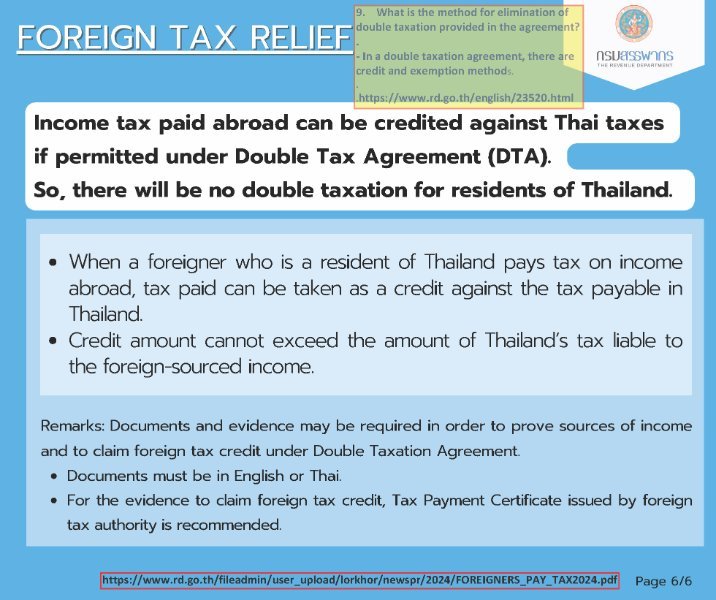

Yet again, another case of TRD PowerPoint slides substituting for actual training - see the last slide in this 'training' presentation: https://www.rd.go.th/fileadmin/user_upload/lorkhor/newspr/2024/FOREIGNERS_PAY_TAX2024.pdf Note that the above presentation ignores DTAs methodology for dealing with foreign income, i.e. by exemption or credit as described in Sections 3.1 and 3.2 of https://www.rd.go.th/english/21973.html

-

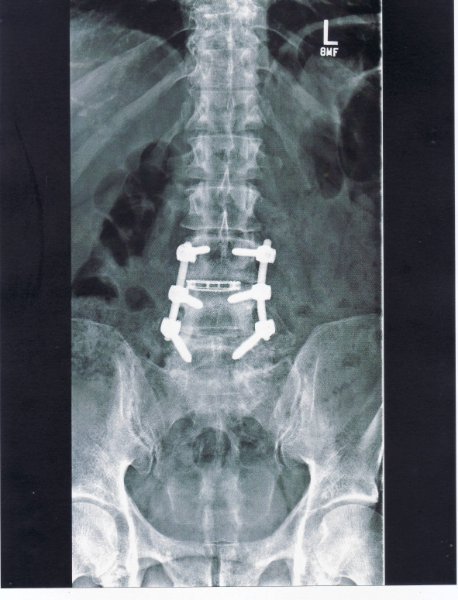

As a veteran of two spinal fusion surgeries (same surgeon, fifteen years apart) I can attest that a successful operation will give you your life back. The procedure is long (but you are asleep) but I was walking the next day and on a plane back here in a few weeks. Go for the most experienced surgeon you can find and avoid any miracle cures if the MRI indicates surgery.

-

I am not sure about your PEA, but I believe that here the bank transfer has to happen from the PEA account holder's account. I simply transfer ThB2k per month to cover utilities (water, garbage, internet (NT), and PEA. Over the year it is more than enough and leaves her money to top up her DTAC account - I cover an annual data sim card (about ThB 1,800). My wife maintains an adequate balance for the two direct pays (PEA and NT) so this only works if the account holder can be trusted to maintain their balance, The other two (water and garbage) are chump change.

-

Always keep in mind that Thailand is a low trust country where "people say" all sorts of things that reinforce their suspicion of anything other than cash. We have PEA and NT (TOT) on autopay and make a monthly transfer to my wife's for food and household expenses. The only issue with individual transfers is they are limited to one year and need to be renewed each December.

-

Ocean Freight Shipping for relocation to the USA

mudcat replied to Serge22's topic in General Topics

Not authoritative, but from a firm that does household removals to the U.S. Your shipment of personal effects and household items can be imported duty-free if: You are a returning US citizen: a. All personal effects or household items must be owned and used for at least 12 months prior to you importing them. https://www.sevenseasworldwide.com/customs-advice/us Refer to Customs Form 3299 and associated instructions: https://www.cbp.gov/document/forms/form-3299-declaration-free-entry-unaccompanied-articles -

Ocean Freight Shipping for relocation to the USA

mudcat replied to Serge22's topic in General Topics

The contact page for Thailand directs one to Malaysia. I seem to remember speaking with them. Best if you copy your inquiry so you can direct them to it or forward it to them. As my original post mentioned you will do better if you can ask for a depot to depot quote and take advantage of their expertise in ocean shipping and paperwork and take care of local transport yourself. https://www.sevenseasworldwide.com/contact -

Ocean Freight Shipping for relocation to the USA

mudcat replied to Serge22's topic in General Topics

When we moved our stuff from San Francisco to the Isan in 2020 we used Seven Seas' move cube service. https://www.sevenseasworldwide.com/en-th/ They were fussy about documentation coming this way (boxes labeled and inventoried), but lo and behold the box arrived at our home without any need to travel to Bangkok to clear customs. Everything arrived without any damage and we were very happy. Their moving cubes: https://www.sevenseasworldwide.com/en-th/moving/movecube/#big We purchased a full set of moving boxes from U-Haul to effectively pack and then stow into the cube - with planning the move cube can be fully packed: Believe that their West Coast depots are in Richmond (near SF) and Los Angeles. Probable best to plan on unloading into a U-Haul truck at one of those sites, and try to get a quote from your Thai home to their Bangkok depot. -

From the 1996 Technical Explanation: Paragraph 3 Some provisions of the Convention are intended to provide benefits by a Contracting State to its citizens and residents that do not exist under its internal law. Paragraph 3 sets forth certain exceptions to the saving clause that preserve these benefits for citizens and residents of the Contracting States. Subparagraph (a) lists certain provisions of the Convention that are applicable to all citizens and residents of a Contracting State, despite the general saving clause rule of paragraph 2: (1) Paragraph 2 of Article 9 (Associated Enterprises) grants the right to a correlative adjustment with respect to income tax due on profits reallocated under Article 9. (2) Paragraphs 2 and 5 of Article 20 (Pensions and Social Security Payments) deal with social security benefits and child support payments, respectively. The inclusion of paragraph 2 in the exceptions to the saving clause means that the grant of exclusive taxing right of social security benefits to the paying country applies to deny, for example, to the United States the right to tax its citizens and residents on social security benefits paid by Thailand. The inclusion of paragraph 5, which exempts child support payments from taxation by the State of residence of the recipient, means that if a resident of Thailand pays child support to a citizen or resident of the United States, the United States may not tax the recipient. (3) Article 25 (Relief from Double Taxation) confirms the benefit of a credit to citizens and residents of one Contracting State for income taxes paid to the other. (4) Article 26 (Non-Discrimination) requires one Contracting State to grant national treatment to residents and citizens of the other Contracting State in certain circumstances. Excepting this Article from the saving clause requires, for example, that the United States give such benefits to a resident or citizen of Thailand even if that person is a citizen of the United States. (5) Article 27 (Mutual Agreement Procedure) may confer benefits by a Contracting State on its citizens and residents. For example, the statute of limitations may be waived for refunds and the competent authorities are permitted to use a definition of a term that differs from the internal law definition. These benefits are intended to be granted by a Contracting State to its citizens and residents. Subparagraph (b) of paragraph 3 provides a different set of exceptions to the saving clause. The benefits referred to are all intended to be granted to temporary residents of a Contracting State (for example, in the case of the United States, holders of non-immigrant visas), but not to citizens or to persons who have acquired permanent residence in that State. If beneficiaries of these provisions travel from one of the Contracting States to the other, and remain in the other long enough to become residents under its internal law, but do not acquire permanent residence status (i.e., in the U.S. context, they do not become "green card" holders) and are not citizens of that State, the host State will continue to grant these benefits even if they conflict with the statutory rules. The benefits preserved by this paragraph are the host country exemptions for the following items of income: government service salaries and pensions under Article 21 (Government Service); certain income of visiting students and trainees under Article 22 (Students and Trainees); certain income of visiting teachers or researchers under Article 23 (Teachers); and the income of diplomatic agents and consular officers under Article 29 (Diplomatic Agents and Consular Officers).

-

The savings clause in Article 1 (Personal Scope) of the 1996 DTA: ARTICLE 1 Personal Scope 1. This Convention shall apply to persons who are residents of one or both of the Contracting States, except as otherwise provided in the Convention. 2. Notwithstanding any provision of the Convention except paragraph 3 of this Article, a Contracting State may tax its residents (as determined under Article 4 (Residence)), and by reason of citizenship may tax its citizens, as if the Convention had not come into effect. For this purpose, the term "citizen" shall include a former citizen whose loss of citizenship had as one of its principal purposes the avoidance of tax (as defined under the laws of the Contracting States), but only for a period of 10 years following such loss. In the case of the United States, the term "resident" shall include a former long-term lawful resident (whether or not so treated under Article 4) whose loss of residence status had as one of its principal purposes the avoidance of tax (as defined under the laws of the United States), but only for a period of 10 years following such loss. 3. The provisions of paragraph 2 shall not affect: a) the benefits conferred by a Contracting State under paragraph 2 of Article 9 (Associated Enterprises), under paragraphs 2 and 5 of Article 20 (Pensions and Social Security Payments) and under Articles 25 (Relief from Double Taxation), 26 (Non Discrimination), and 27 (Mutual Agreement Procedure); and b) the benefits conferred by a Contracting State under Articles 21 (Government Service), 22 (Students and Trainees), 23 (Teachers) and 29 (Diplomatic Agents and Consular Officers), upon individuals who are neither citizens of, nor have immigrant status in, that State. https://rd.go.th/fileadmin/download/nation/america_e.pd

.jpg.5d6b3a4d49b399d3ef927d822f2dd041.jpg)