mudcat

Member-

Posts

267 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by mudcat

-

I am not looking forward to the day I need to move on from JPMorganChase. As a fallback I think we will open bank and credit card accounts with the State Department Federal Credit Union who explicitly supports expats. Where to park my Roth and brokerage accounts is a bridge I will cross when I need to

-

My Daikan claims to. I point out that selecting Fan Only as mode would eliminate the cost of the compressor running.

-

Sure, after the Navy I in 1968 I bought my father's 1963 Volkswagen Beatle. Bending down to pick up an apple from my lunch that had rolled into the passenger side footwell I crossed the road, through a split-rail wood fence to 'V' in the front and then between two small trees to squish in all four fenders. What would have been called a total if I had insurance to cover new driver stupidity. With my dad's help bought an even earlier Beatle without an engine and performed a engine swap on the street in front of my apartment.

-

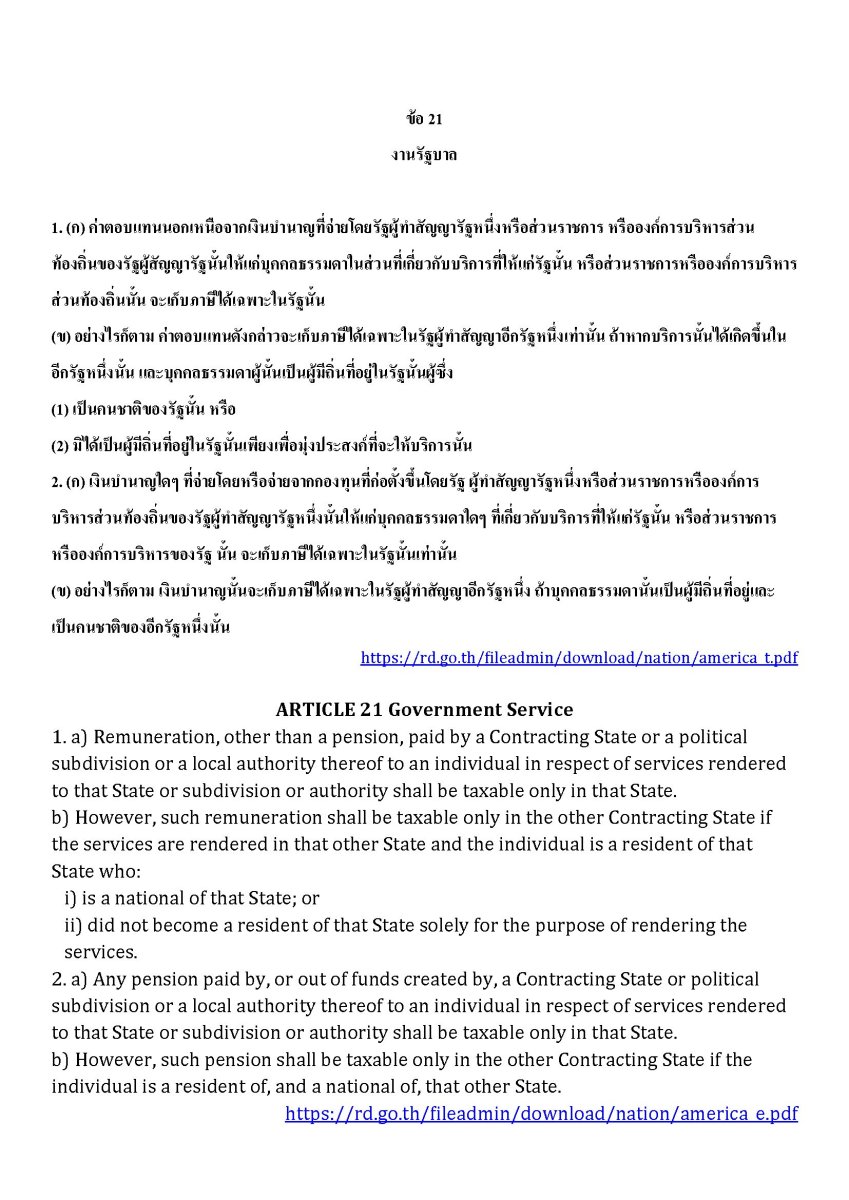

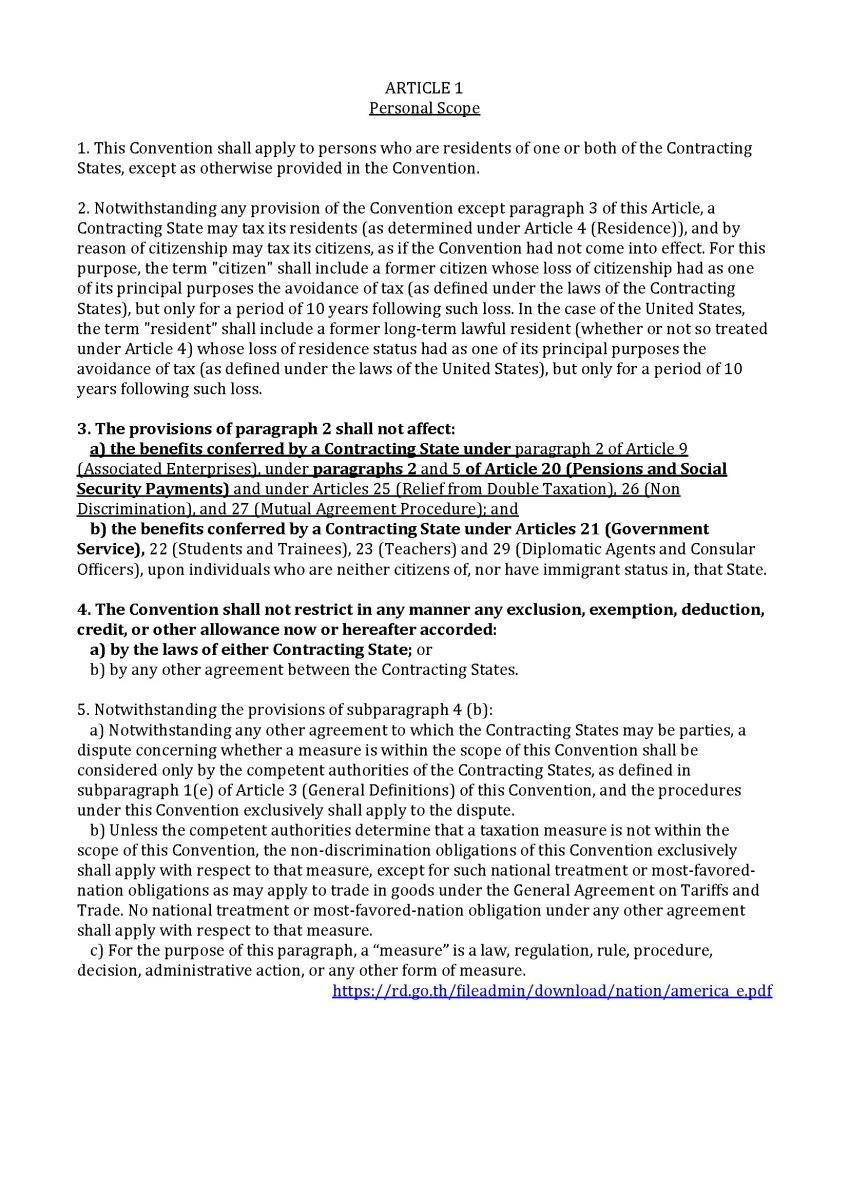

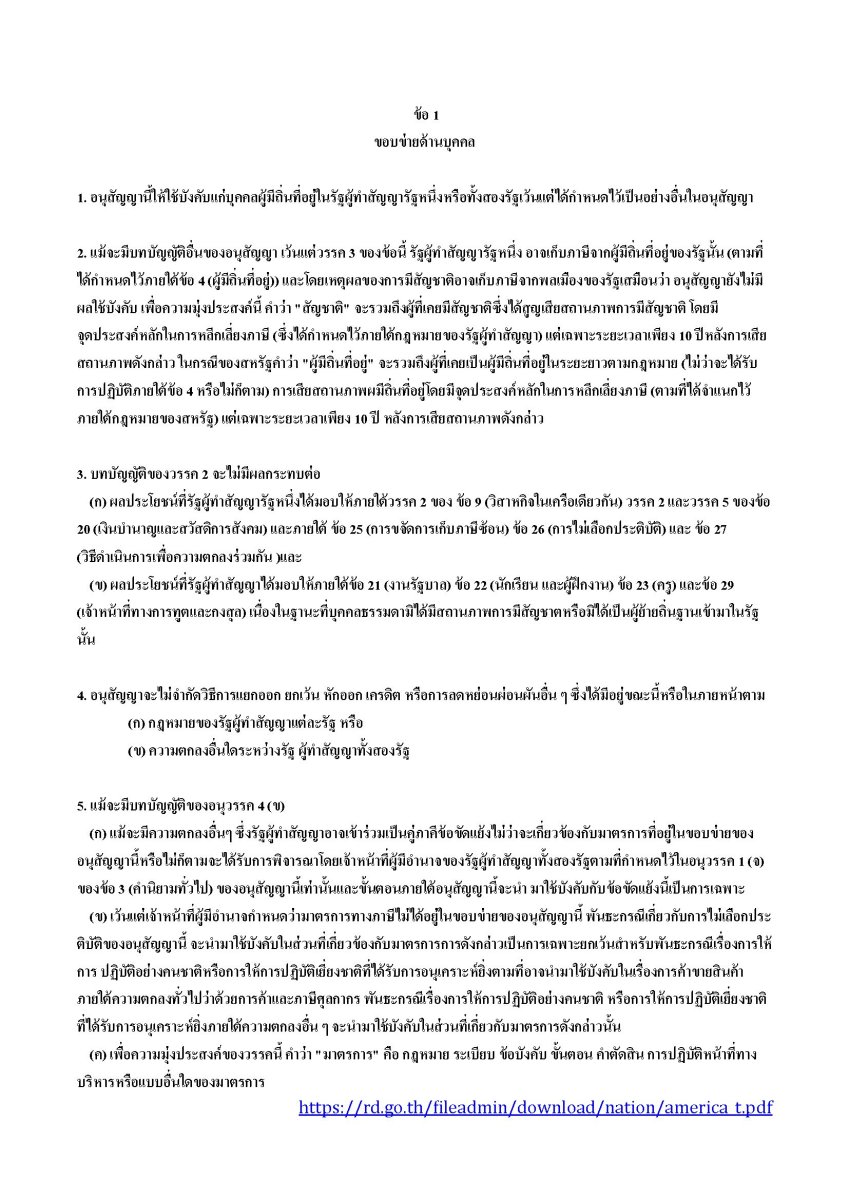

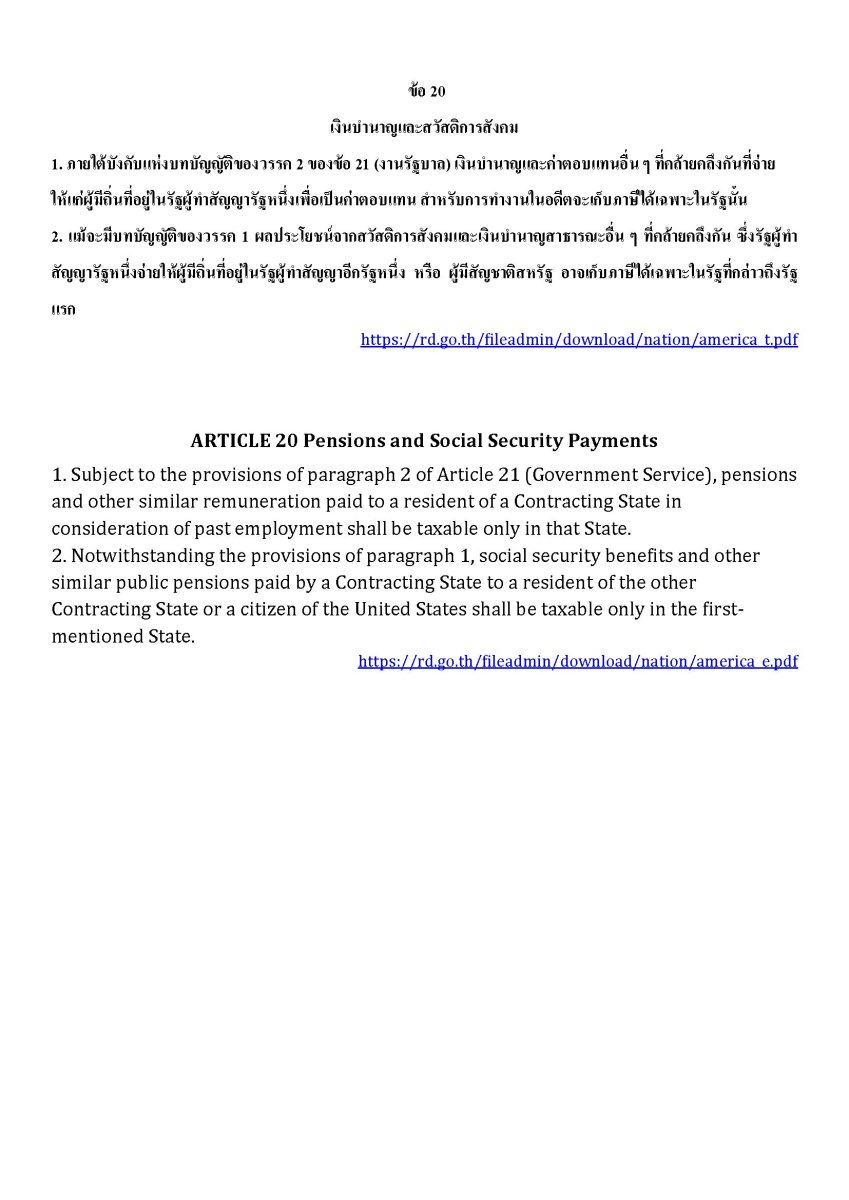

Thanks for your help - it is difficult navigated Thai bureaucracy when one does not speak Thai. I have created pdfs Thai and English text for each article with the RD source link for the article 1, 20, and 21. I attach jpgs of the pdfs - if you wish me to send the pdfs or word files send me a private message. Hopefully having the documents in front of the officer will spare my arms from excessive gesturing.

-

Alas, that link is the document in English. Trying to avoid the deer in the headlights look from RD staff being presented with an Enlish documebt.

-

Does anyone have a source link or a copy of the 1996 Thailand-U.S. tax convention in Thai?

-

IRS form 8621 is for U.S. citizens who invest in foreign mutual funds that are considered PFICs (Passive Foreign Investment Company) because the companies do not report or withhold earnings to the IRS. Filing Form 8621 has a low $25,000 asset threshold for individuals and a high tax rate that makes investing in any foreign based mutual fund tax unfriendly.

-

I needed to go back and report my wife's bank activity to get her coverage under US Treasury's 'Streamlined' FATCA reporting on FinCEN114. The principal issue were her accounts from before our marriage which I mistakenly belied were not covered. It was a slog but to get current activity compliant I saw no option other than to correct the errors of the past. I am not sure about TRD's enforcement of foreign remittance's, but I had a go around with FinCEN about a transfer to a Cuban friend and it took most of a year to get my $10,000 back and it cost us our relationship with Fidelity.

-

I am not sure of your point. My full SSA benefit is $26,250 and my government pension is $63,750. 15% of my SSA benefit is exempt from taxes, I receive a tax exempt $3,300 health insurance benefit and we earned $2,000 in our small investment accounts. Our standard deduction is $30,750 for a taxable income of $57,850 on which we pay 6,500 in Federal income tax. There is no Thai tax liability as most of my income is taxable in the US and have a LTR-WP visa that exempts any other US remittance's, credit card or ATM use

-

Some DTAs do serve to exempt some income from being taxed by the other country, in our case by Thailand. The U.S. Thailand tax convention reserves for the U.S. taxation of U.S. Social Security and government pensions for U.S. persons who are not also Thai nationals. The result of these two reservations and standard deduction for a married couple results in an effective tax rate of less than 9% on a gross income of around $95,000.

-

Avoid to pay tax

mudcat replied to Jack1988's topic in Jobs, Economy, Banking, Business, Investments

Just to get everyone on the same page the initial TRD change to remittance's tax status for assessable income was in No. 161 from 15 September. It was walked back to exempt pre-2024 savings, income, or assets on November 29 in No. 162. I would attach a pdf with the Thai and unofficial translation to English but pdf are not one of the acceptable file types, so do a Google search -

I have no use for a Thai credit card as I am pleased with the benefits from my U.S. Visa card associated with my JPMorgan Chase banking relationship and United Airlines mileage plus program. But I recently switched from Bangkok Bank's 'Union Pay' ATM Debit card to their Mastercard ATM Debit card because Google would not accept my U.S. Visa card any longer (pricing differences in different countries). Works for that monthly transaction as well as at the ATM machine. We will see if Microsoft accepts my U.S. Visa card for OneDrive in February.

-

A further point - you may need to show your end of 2023 statement - to establish the balance pre-2024 was savings in your Roth. To show that 'taxes' were paid on contributions or conversions be ready with your f5498 (1099 for source taxable IRA) and f8606 (non-deductible IRAs with highlighted section 2 showing that taxes were due on the conversion) - I keep these documents with each year's tax return

-

Your description describes Roth IRA qualified distributions. Roth IRAs were established contemporaneously with the Thailand-U.S. tax convention so their special character was not addressed in the convention or the the technical explanation. In the model convention from 2006 (https://home.treasury.gov/system/files/131/Treaty-US-Model-TE-2006.pdf) Roth IRA (Section 408A) plans were noted on page 11 and treatment of them was discussed under the technical explanation of Article 17 paragraph 1 on pages 54-55: " However, the State of residence, under subparagraph (b), must exempt from tax any amount of such pensions or other similar remuneration that would be exempt from tax in the Contracting State in which the pension fund is established if the recipient were a resident of that State. Thus, for example, a distribution from a U.S. "Roth IRA" to a resident of the other Contracting State would be exempt from tax in the other Contracting State to the same extent the distribution would be exempt from tax in the United States if it were distributed to a U.S. resident. The same is true with respect to distributions from a traditional IRA to the extent that the distribution represents a return of non-deductible contributions. Similarly, if the distribution were not subject to tax when it was “rolled over” into another U.S. IRA (but not, for example, to a pension fund in the other Contracting State), then the distribution would be exempt from tax in the other Contracting State." I recognize that this treatment of a Roth IRA is not binding, but it would provide support for argument that Roth distributions are not assessible income but rather savings to the extent of their valuation as of December 31, 2023.

-

Since I received my LTR-WP visa my solution is to leave almost nothing in my single Thai bank account and rely on my direct deposit of Social Security benefit for living expenses. I do make sure that I maintain my balance a bit over my ordinary benefit amount so Social Security can claw back their ounce of flesh (see https://www.usa.gov/social-security-report-a-death). Real assets stay in the U.S. where they are in our joint checking account and my TOD brokerage account with my wife as named as beneficiary (inheritances pass tax free to my dual U.S. Thai national wife - see below). My Roth IRA (or any IRA) requires a spouse to sign paperwork designating how she wishes to inherit - in our case it will be lump sum distribution. Note that a non-U.S. national beneficiary will have a more difficult process including 30% U.S. tax withholding. I direct my pension income into my U.S. checking account where it gets used to pay Visa bills and regular monthly contributions to my brokerage account of which I am sole owner so it can pass to her without taxes. Any inheritance is documented by the brokerage account's beneficiary statement (controlling) and U.S. will (supporting). Transfers to my wife after my death to my wire go by wire and include a 'succinct' memo such as ours Inheritance from Spouse, ***. Tax Exempt under Inheritance Tax Act Section 3.2 and Thai Revenue Code Section 42.10. Inheritances from a spouse are exempt from taxes under the INHERITANCE TAX ACT, B.E. 2558 (2015): Section 3: This Act shall not apply to: (2) an inheritance received from a deceased person by the spouse of the deceased person. Transfer of your inheritances to a Thai bank account. The Roth IRA and Brokerage account you inherit from me and transfer to either of your Bangkok Bank account(s) is also exempt from income tax: Thai Revenue Code Chapter 3, Section 42: The assessable income of the following categories shall be exempt for the purpose of income tax calculation: (10) Income derived from an inheritance

-

When I do my FBAR reporting, I report the highest balance in each account during the year. I use the US Treasury exchange rates which are published in January to convert to USD. When I report my Thai bank interest on my tax return, I use the spot exchange rates on the day the interest posts. Report of Foreign Bank and Financial Accounts (FBAR) | Internal Revenue Service For each account you must report on an FBAR, you must keep records with this information: Name on the account, Account number, Name and address of the foreign bank, Type of account, and Maximum value during the year. It is easy to get crossways with the different U.S. government reporting of foreign assets. FATCA dates back to 2014 - FBAR is reported on FinCEN 114 which is filed with the Treasury and not with your taxes (blank atta. As JohnnyBD posted, the threshold is pretty low aggregate balance >$10,000 at any point during the year, so many if not most of us will need to file at some point during our stay here. I have filled out templates for my wife and myself that we complete and file at the same time as we file our taxes. There is a program to 'get right with the IRS' called streamlined filing which requires filing back FinCEN 114 forms and amended f1040s. I went through that process and it was not fun, but doable on your own if you have good records. The other requirement is to disclose on overseas assets anywhere on f8938 which is filed along with your taxes. The thresholds are complicated but most of us will not be required to file. https://www.irs.gov/businesses/corporations/do-i-need-to-file-form-8938-statement-of-specified-foreign-financial-assets If your overseas financial assets are getting up into the 100s of thousand USD I suggest that you also take a look at the instructions https://www.irs.gov/pub/irs-pdf/i8938.pdf. NOTE "If you do not have to file an income tax return for the tax year, you do not need to file Form 8938, even if the value of your specified foreign assets is more than the appropriate reporting threshold." We will not need to file a f8938 as most of our assets remain in the U.S., and my U.S. citizen wife will not need to file after I die when she is living on SSA survivor benefits and Thai bank account interest, but the transition year after she inherits will included in the final tax return.

-

U.S. taxation of American Expats

mudcat replied to ericbj's topic in Jobs, Economy, Banking, Business, Investments

U.S. citizens still have representation should they choose to vote. I continue to vote from my last U.S. voter roll district and will continue to do so. I do understand that U.S. permanent residents also are subject to U.S. taxation without any voting rights, so they are in the same position as most expats here. -

Thai wife, US brokerage

mudcat replied to NoDisplayName's topic in Jobs, Economy, Banking, Business, Investments

This can be an issue if the 'brokerage' account is actually a retirement account (401K, IRA 403B), and maybe even Roth IRA. https://www.irs.gov/retirement-plans/plan-distributions-to-foreign-persons-require-withholding -

Two years with our Veloz next month. The jump seats (6th and 7th passengers get used once a month or so). Appreciate the isofix latching for up to two child car seats and the side airbags for rear seat passengers. Dislike the aerodynamics that collect dust on the rear window up here in the northeast, may not be an issue where you live. The Veloz replaced a Chevrolet Spin which was orphaned by Chevrolet leaving the SE Asia markets. When I received my LTR visa my ThB 800k retirement visa account We looked at other alternatives and settled on the Veloz. Did not consider any Chinese EVs, but if we were looking today we would consider a Yaris Cross HEV.

-

Both my wife and myself needed to close out our JPMorgan 'AutoInvest' accounts at the end of 2023 as JPMorgan was not continuing the product. Everything went into our joint checking accounts at Chase and on to our individual brokerage accounts so we have a clear pre-2024 savings trail. We will be each wiring the exact pre-2024 balances (>$25,000) to Thailand once our T-Bills matures in early December. On the wire form's 'Message to Recipient Line' we will add: "Pre-2024 Savings Remittance Exempt per TRD No. P.162/2023" Once the wires are in and dealt with we will visit our local TRD provincial office with all of our documentation to close the loop we started when we visited them late last summer. This will clear up some remittance and inheritance complications for my wife as we will consolidate the balances in the two brokerage accounts into a single account under my name where she is the primary beneficiary.

-

As far as I know Thailand does not recognize trusts but there is a provision called "controller of property" in our wills my wife have used to protect what we would leave to our grand daughter. As we do not trust her parents or our in-laws with a chunk of money we named a cousin who successfully got his child through university and launched

-

I have not had any contact with BOI about accepting a Roth IRA balance for the $100,000 substitute for a "Bank" balance in lieu of a foreign or Thai health insurance policy and do not plan on raising the issue with them until my recertification in three-years. I continue to maintain a Thai health insurance policy as fallback, but given the nature of Thai insurance companies, the 25% discount for a 40K ThB deductible and a 3-year no claim discount keep the policy affordable (to me) so it can serve as a major medical policy. As mentioned before, my Roth statements have a three-year look back chart on the first page and every December statement shows there have been no distributions or contributions in that calendar year under "Retirement Contribution and Distribution Summary" or something similar demonstrating that increases and decreases in the balance are the result of market movement and not me drawing down my balance, and as a retiree, I cannot contribute to it, so it is a lump of money that earns returns (or absorbs losses) under my brokerages 'private client' advisor scheme. I am fortunate in that between my Social Security benefit (direct deposited here) and my government pension paid into my U.S. checking account, I have not needed to withdraw from my Roth IRA The Roth serves as the principal asset I will be leaving to my wife if I pre-decease her or split between two educational institutions (a daycare center I taught at in the 1970s and the graduate school I attended in the 1990s) should she pre-decease me.

-

Incredible US banking ineptness

mudcat replied to jaywalker2's topic in Jobs, Economy, Banking, Business, Investments

My plan if things go south with my too big to fail bank because I live here is move everything over to the State Department Federal Credit Union https://www.sdfcu.org/. One needs to become a member of an affiliate organization but it seems a better option than cashing out retirement accounts.