Expat4life66

Member-

Posts

127 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Expat4life66

-

Stop gaslighting with your racism garbage comment. Hiring inferior employees that are not the most capable to protect the leader of the free world is not racism.. Truth hurts...Will come out later this week after the hearing

-

Dr jill lol was not a president or former president, a decision was made for her Saturday event to keep the A team secret service with her and give president Trump a bunch of temps from TSA and dei hires that were overweight and not trained properly..the F team...what part about that don't you understand

-

She also has her own "hail to the Chief" entrance music 😂 fing joke

-

U.S. Citizen travelling to U.S. with Thai License?

Expat4life66 replied to john 111's topic in Thailand Motor Discussion

Yes you can get the Thai rate, just book online in Thailand, don't use a VPN and if you are a preferred customer, dont use that number. I return to the US annually for a month to visit parents, and I have a valid Thai and US license. When picking up the car, the counter agent may ask how you got the lower rate (happened to me 1 out of 8 times), I showed my Thai ID and license with no issues. Booking at Hertz seems to have the best rates where I fly and the Thai website rate ALSO includes the car coverage (CDW) and liability insurance (LDW or whatever its called now). Using the US site, rates with the two insurance add-ons are double what they are on the Thai site. They used to offfer an even less expensive monthly rate, but I was only able to find weekly rates for my next trip. Another tip, book something then check back every couple weeks, the rates are demand based and change frequently. I was able to save an additional 25% by deleting my original booking then rebooking the same vehicle type when I found a lower rate two months later. Regards, -

Bloomberg Asia was just talking about that. Reagan had an initial bump in the polls that waned over time, but he was shot two months after he took office. JFK on the other hand was, well...

-

-

Your comment has nothing to do with what actually happened. The shooter was outside the perimeter (event) with his father's AR-15 on a rooftop with a direct line of sight to the stage 150m away. The key question is why didn't the Secret service either have that rooftop access blocked (there was a ladder on the side of the building) or agents on that rooftop. Hopefully we get some answers from Mayorkas and his Secret Service DEI minions on Monday in the US. They also need to ask him why Trump was denied additional Secret Service protection.

-

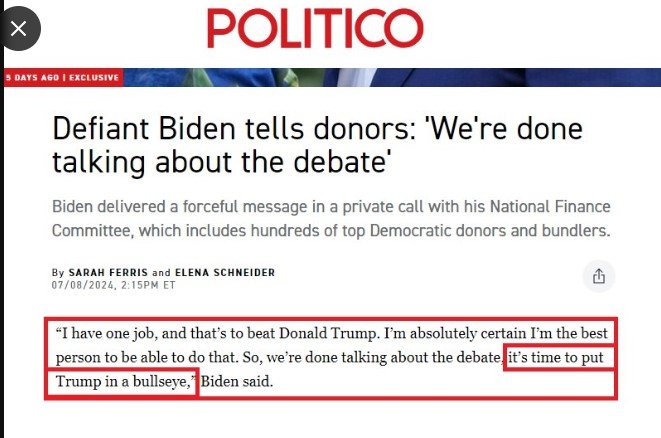

One of his woke interns using the Biden account also posted the bullseye remark on Twitter last week . Somehow it has been removed from Twitter. It was still on Politico the other day, not sure if it has been removed. Jake Sullivan, Obama and the communications team (KJP) need to tone down the language, probably why the Biden campaign pulled all ads yesterday.

-

Nahhhh... This is what the Secret Service has been busy with, the new Director has a background in protecting Lay's and Cheetos. Someone should probably be fired for not securing that roof at 150m with a clear shot. ] Mayorkas also recently denied providing additonal Secret Service detail to Trump and has never provided any to Kennedy despite multiple requests. There are a few threads I've been reading on Twitter with people trying to find the shooter's social media footprint. Everything has been removed.

-

BOI IBC (International Business Center) rate is 15% if your business activities for your BOI entity are costed to multiple tax enties in the Region (APAC). Been that way since before I relocated here with my multi-national in 2015 and is still in place. I always thought the new LTR rate was strange when they announced a 17% rate.

-

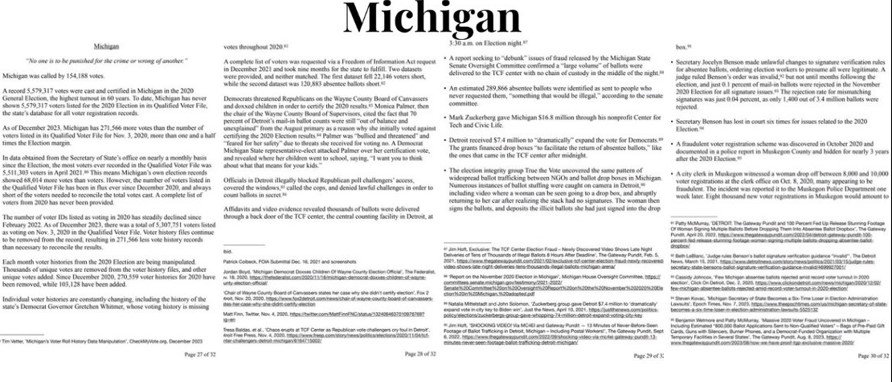

Whitmer is a piece of S*** tooth talker and panders to the muslim base in the Detriotistan metro to vote for her. She just signed a bill on Monday to stop recounts which could potentially uncover widespread cheating in Michigan in future elections in the big cities. Detriotistan is slowly becoming the Philly of the midwest. She will never make it past the first debate in 2028. https://www.democracydocket.com/news-alerts/michigan-passes-laws-restricting-election-recounts-for-fraud-allegations-and-wide-margin-victories/

-

You would be surprised, Thais and Expats working for large multi nationals in Thailand make 30-40% more than the equivalent job in the US. Combine that with 40 days off (vacation and holiday/flex) a year, generous car allowance, a 15% tax rate, 10% match on Provident Fund (like 401K) and the US foreign tax and housing credit its a no brainer for someone that has already paid into US SSO for the full 35 years and wants to work overseas later in their career.

-

Your companies also have a Thailand Tax designation / employer number (the tax ID on your 50 Tawi). That's the ID you use when filing taxes which is why you will file two returns. With my multinational set up as an International Business Center (IBC) (e.g., old RHC), which has over 1000 Tax enties around the world, what determined your tax status was what countries your role actually supported. Say you were in IT and you specifically supported a Thailand company or 3rd party Thailand company, you would be taxed at the progressive rate. It you were supporting multiple companies across the region in APAC you would be taxed at the IBC (15% rate). How Employer 1 was set up with BOI also matters, perhaps not an IBC thus everyone (including Thais) gets equal tax treatment. If you have any doubts that you were taxed incorrectly, you should ask your Employer 1 Payroll / HR department for clarification. If they made a mistake, they would have to reimburse you overpaid taxes and issue a new 50 Tawi Summary for you to file your Employer 1 return. Tax withholding is heavily monitored / regulated by the Thailand BOI so the IBC rate is not applied incorrectly.

-

For Employer 1, if you were working for a Thai only BOI / a Thailand legal entity, you were charged the correct progressive rate. For Employer 2 if you are now working for a BOI / Region Holding Company and supporting legal entities for you company outside of Thailand and possibly also Thai Legal entities you would be eligible for the 15% flat tax on wages, Pfund is post-tax and if applicable, car allowance. There are no deductions allowed with this rate, unlike the progressive rate that is eligible for deductions. Without knowing additional details of your situation and assuming what I wrote above is close to correct, the answer is no you won’t be able to claim a refund, because you were taxed correctly. You will also file two separate tax returns because you will receive two 50 Tawi (like a US W2) from two different employers. For Employer 1 – you complete PND91 like Thais complete, you can use the e-file system to create an account and file using the link below as soon as you receive Employer 1 50 Tawi (you may have to chase this up with former employer) https://www.rd.go.th/272.html For Employer 2 if you are working for a BOI/ROH you most likely will complete a PND95 in Q1 2025 and have to file manually at a revenue office. E-file wasn’t set up for this form when I last filed in the beginning of the year. Good Luck, hope this helps

-

When I worked for a BOI / Region Holding Company, 15% was the tax on expats supporting tax entities outside Thailand (e.g., Malaysia, Phils) and possibly Thailand as well. We had some expat individuals that only worked for one Thai entity, say a market GM or market CFO that were taxed at the same progressive rate all Thais are taxed.

-

BOI extensions are now up to 4 years, the law was updated either in late 2019 or early 2020. When my company's agent partner and my local HR worked to renew my last work permit in 3/2020 I received a four year extension stamp until 3/2024. I believe the size of our BOI registered Thai Trading company (revenue) and HR had a role in deciding how long to renew (e.g., 1,2 or 4 years). Previous to that everyone at my company on a Non-B extension including myself was getting 2 years.

-

Assuming you mailed a paper return to the Austin address since you reside outside the US. The last time I mailed a paper return (pre-covid) to Austin, the processing time was about 18 weeks from when DHL showed it was signed for in Austin. Basically it is probably sitting in a plastic mail tub with all the other returns received that day and will be processed in due course. You can also check to see when it's processed on your account on IRS.gov (using IDme if you don't want to use VPN) or if you are also getting a refund on the mobile app IRS2Go. Hope this helps

-

Any change to TM30 situation?

Expat4life66 replied to steve0101's topic in Thai Visas, Residency, and Work Permits

I got the same error the last week of May (system update notice appeared on the login screen) becuase I couldn't select the radio button (upper left corner) of an address I added last year. System won't process without selecting an address and gives this error. To correct this issue, I added the same address in the TM30 system and reuploaded wifes ID and 2 HB pages. It was accepted immediately. I also deleted the old non-working address. I was now able to click the updated address radio button on the left and on the right enter my PP, Nationality, dates of stay, etc. and the system immediately accepted the updated TM30. After that, I searched for my TM30, located it and printed the PDF that others mention. Hope this helps