-

Posts

2,586 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by RSD1

-

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

It seems like the perfect start to a 2025 Season 7 Black Mirror episode imagined by Musk, where everything eventually spirals out of control. Then, five minutes later, the gun inadvertently starts shooting at the pink balloons, and, well, you can guess how it ends… https://www.instagram.com/reel/DE6F1-GNjDi -

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

He was a hero when was a technological innovator like Steve Jobs and by his providing of internet, power, and drinking water to disaster zones. Now he's morphed into a deluded and oversized megalomaniac with madman aspirations, both politically and socially, and an agenda to eventually disrupt the greater well being of humanity.- 184 replies

-

- 16

-

-

-

-

-

-

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

I didn’t intend for this topic to digress into a debate about Twitter, but personally, I’ve never liked it. I don’t see how it serves any real purpose, and most of what gets posted are just anecdotal sound bites. There’s a lot of misinformation and disinformation from people with personal agendas. So, I’ve never had any time for it, but whatever it started out as has only gotten worse since Musk took over and began using it as a tool to shift his political agenda and attack his enemies. It’s pretty disgusting, if you ask me. In the beginning, he claimed he was buying it to clean up misinformation and promote free speech, but all he’s actually done is the opposite and exacerbated the problem, which seems to have been his true agenda all along. And if that’s any indication of what Musk is really all about, promising one thing and then doing another, then watch out. -

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

Yes, fully agree, that’s one potential narrative I had also considered, although I believe he’s less likely to turn his version of Skynet into an outright killing machine and more likely to conspire with China to exploit and undermine Western infrastructure through computer and internet technology. Overall, Elon strikes me as another one of those madmen who has already lost the plot, and I suspect psychedelic drug use plays a role, but his true colors won’t be as clear to everyone else until it’s too late. Another textbook case of "Absolute power corrupts absolutely." Elon also seems like the ultimate troll of humanity, far worse than a maniac like Putin, who at least appears to follow some kind of (more predictable) Soviet era, power-hungry, bloodthirsty agenda. But Elon now seems to do it purely for the “Lolz,” as he already has all the money and success he could ever want and has now transformed into more of a technological and disinformation prankster. That makes him far more unpredictable and possibly even more dangerous and destructive than your typical dictator.- 184 replies

-

- 10

-

-

-

-

-

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

I think that's a stark oversimplification. He said this: These otherwise serious and compassionate people know that when Elon attacks private citizens on Twitter/X—falsely accusing them of crimes or corruption, celebrating their misfortunes—he is often causing tangible harm in their lives. It’s probably still true to say that social media “isn’t real life,” until thousands of lunatics learn your home address. -

Talking to Thais, have you ever had "Pow Wow" moments?

RSD1 replied to Jingthing's topic in ASEAN NOW Community Pub

No problem. Understood you realize your error now. Got it, I think. But what hand gesture did you actually do? I can't really envision the moment. According to YouTube, pow wow is also a native American dance, but I can't imagine you performed anything similar to this: https://youtube.com/shorts/-c1rDAsr9PE I suggest that you take a video of yourself, performing your pow wow hand movements, upload it to YouTube and then share the link with us so that we can all have a better understanding of what actually transpired. -

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

It's not only about his money that will shape the future but, as Sam Harris pointed out, it's all the platforming he does of misinformation, disinformation, conspiracies, hoaxes, and what seems to be his wholesale distorted view of reality. Personally, I think there is a good chance that he could be remembered as a destructor and not a creator. Many people start out on the right course doing some seemingly great things, but then eventually turn to the dark side, which is what they are remembered for in the end. Names like Julius Caesar, Joseph Stalin and Benito Mussolini come to mind. And let's of course not forget Anakin Skywalker.- 184 replies

-

- 10

-

-

-

-

-

Has Elon Musk become an existential threat to humanity?

RSD1 replied to RSD1's topic in ASEAN NOW Community Pub

I also wonder how Elon Musk will be remembered 50 years from now. Innovator or destructor? And will all of his developments with technology, knowing that he never actually invented anything himself, be viewed as substantial or pedestrian?- 184 replies

-

- 11

-

-

-

-

-

Talking to Thais, have you ever had "Pow Wow" moments?

RSD1 replied to Jingthing's topic in ASEAN NOW Community Pub

If you did that in front of me, I wouldn't have a clue what you were doing. And what is your actual definition of the term "pow wow"? “Pow wow” traditionally refers to an informal discussion or meeting to share ideas and not Native American Indians per se. I believe pow wow might've also been used in the past to discuss a gathering of American Indians, but that's not a reference that most people would recognize. So how could anyone even know that, whatever the hand gesture was that you made, has anything to do with Native American Indians? Meanwhile, a Thai gives a smile in a confusing moment like that, whereas another Westerner might've just stayed quiet, and raised an eyebrow with a look of bewilderment. -

The following is from a recent post by Sam Harris about the reckless and irresponsible behavior of Elon Musk during the pandemic. With his newly gained political influence and power, has Elon become an existential threat to humanity? https://samharris.substack.com/p/the-trouble-with-elon The Trouble with Elon Sam Harris JAN 16, 2025 I didn’t set out to become an enemy of the world’s richest man, but I seem to have managed it all the same. Until this moment, I’ve resisted describing my falling out with Elon Musk in much detail, but as the man’s cultural influence has metastasized—and he continues to spread lies about me on the social media platform that he owns (Twitter/X)—it seems only appropriate to set the record straight. I know that it annoys many in my audience to see me defend myself against attacks that they recognize to be spurious, but they might, nevertheless, find the details of what happened with Elon interesting. Of all the remarkable people I’ve met, Elon is probably the most likely to remain a world-historical figure—despite his best efforts to become a clown. He is also the most likely to squander his ample opportunities to live a happy life, ruin his reputation and most important relationships, and produce lasting harm across the globe. None of this was obvious to me when we first met, and I have been quite amazed at Elon’s evolution, both as a man and as an avatar of chaos. The friend I remember did not seem to hunger for public attention. But his engagement with Twitter/X transformed him—to a degree seldom seen outside of Marvel movies or Greek mythology. If Elon is still the man I knew, I can only conclude that I never really knew him. When we first met, Elon wasn’t especially rich or famous. In fact, I recall him teetering on the brink of bankruptcy around 2008, while risking the last of his previous fortune to make payroll at Tesla. At the time, he was living off loans from his friends Larry and Sergey. Once Elon became truly famous, and his personal wealth achieved escape velocity, I was among the first friends he called to discuss his growing security concerns. I put him in touch with Gavin de Becker, who provided his first bodyguards, and recommended other changes to his life. We also went shooting on at least two occasions with Scott Reitz, the finest firearms instructor I’ve ever met. It is an ugly irony that Elon’s repeated targeting of me on Twitter/X has increased my own security concerns. He understands this, of course, but does not seem to care. So how did we fall out? Let this be a cautionary tale for any of Elon’s friends who might be tempted to tell the great man something he doesn’t want to hear: 1. When the SARS-CoV-2 virus first invaded our lives in March of 2020, Elon began tweeting in ways that I feared would harm his reputation. I also worried that his tweets might exacerbate the coming public-health emergency. Italy had already fallen off a cliff, and Elon shared the following opinion with his tens of millions of fans : the coronavirus panic is dumb As a concerned friend, I sent him a private text: Hey, brother— I really think you need to walk back your coronavirus tweet. I know there’s a way to parse it that makes sense (“panic” is always dumb), but I fear that’s not the way most people are reading it. You have an enormous platform, and much of the world looks to you as an authority on all things technical. Coronavirus is a very big deal, and if we don’t get our act together, we’re going to look just like Italy very soon. If you want to turn some engineers loose on the problem, now would be a good time for a breakthrough in the production of ventilators... 2. Elon’s response was, I believe, the first discordant note ever struck in our friendship: Sam, you of all people should not be concerned about this. He included a link to a page on the CDC website, indicating that Covid was not even among the top 100 causes of death in the United States. This was a patently silly point to make in the first days of a pandemic. We continued exchanging texts for at least two hours. If I hadn’t known that I was communicating with Elon Musk, I would have thought I was debating someone who lacked any understanding of basic scientific and mathematical concepts, like exponential curves. 3. Elon and I didn’t converge on a common view of epidemiology over the course of those two hours, but we hit upon a fun compromise: A wager. Elon bet me $1 million dollars (to be given to charity) against a bottle of fancy tequila ($1000) that we wouldn’t see as many as 35,000 cases of Covid in the United States (cases, not deaths). The terms of the bet reflected what was, in his estimation, the near certainty (1000 to 1) that he was right. Having already heard credible estimates that there could be 1 million deaths from Covid in the U.S. over the next 12-18 months (these estimates proved fairly accurate), I thought the terms of the bet ridiculous—and quite unfair to Elon. I offered to spot him two orders of magnitude: I was confident that we’d soon have 3.5 million cases of Covid in the U.S. Elon accused me of having lost my mind and insisted that we stick with a ceiling of 35,000. 4. We communicated sporadically by text over the next couple of weeks, while the number of reported cases grew. Ominously, Elon dismissed the next batch of data reported by the CDC as merely presumptive—while confirmed cases of Covid, on his account, remained elusive. 5. A few weeks later, when the CDC website finally reported 35,000 deaths from Covid in the U.S. and 600,000 cases, I sent Elon the following text: Is (35,000 deaths + 600,000 cases) > 35,000 cases? 6. This text appears to have ended our friendship. Elon never responded, and it was not long before he began maligning me on Twitter for a variety of imaginary offenses. For my part, I eventually started complaining about the startling erosion of his integrity on my podcast, without providing any detail about what had transpired between us. 7. At the end of 2022, I abandoned Twitter/X altogether, having recognized the poisonous effect that it had on my life—but also, in large part, because of what I saw it doing to Elon. I’ve been away from the platform for over two years, and yet Elon still attacks me. Occasionally a friend will tell me that I’m trending there, and the reasons for this are never good. As recently as this week, Elon repeated a defamatory charge about my being a “hypocrite” for writing a book in defense of honesty and then encouraging people to lie to keep Donald Trump out of the White House. Not only have I never advocated lying to defeat Trump (despite what that misleading clip from the Triggernometry podcast might suggest to naive viewers), I’ve taken great pains to defend Trump from the most damaging lie ever told about him. Elon knows this, because we communicated about the offending clip when it first appeared on Twitter/X. However, he simply does not care that he is defaming a former friend to hundreds of millions of people—many of whom are mentally unstable. On this occasion, he even tagged the incoming president of the United States. All of this remains socially and professionally awkward, because Elon and I still have many friends in common. Which suggests the terms of another wager that I would happily make, if such a thing were possible—and I would accept 1000 to 1 odds in Elon’s favor: I bet that anyone who knows us both knows that I am telling the truth. Everyone close to Elon must recognize how unethical he has become, and yet they remain silent. Their complicity is understandable, but it is depressing all the same. These otherwise serious and compassionate people know that when Elon attacks private citizens on Twitter/X—falsely accusing them of crimes or corruption, celebrating their misfortunes—he is often causing tangible harm in their lives. It’s probably still true to say that social media “isn’t real life,” until thousands of lunatics learn your home address. A final absurdity in my case, is that several of the controversial issues that Elon has hurled himself at of late—and even attacked me over—are ones we agree about. We seem to be in near total alignment on immigration and the problems at the southern border of the U.S. We also share the same concerns about what he calls “the woke mind virus.” And we fully agree about the manifest evil of the so-called “grooming-gangs scandal” in the U.K. The problem with Elon, is that he makes no effort to get his facts straight when discussing any of these topics, and he regularly promotes lies and conspiracy theories manufactured by known bad actors, at scale. (And if grooming were really one of his concerns, it’s strange that he couldn’t find anything wrong with Matt Gaetz.) Elon and I even agree about the foundational importance of free speech. It’s just that his approach to safeguarding it—amplifying the influence of psychopaths and psychotics, while deplatforming real journalists and his own critics; or savaging the reputations of democratic leaders, while never saying a harsh word about the Chinese Communist Party—is not something I can support. The man claims to have principles, but he appears to have only moods and impulses. Any dispassionate observer of Elon’s behavior on Twitter/X can see that there is something seriously wrong with his moral compass, if not his perception of reality. There is simply no excuse for a person with his talents, resources, and opportunities to create so much pointless noise. The callousness and narcissism conveyed by his antics should be impossible for his real friends to ignore—but they appear to keep silent, perhaps for fear of losing access to his orbit of influence. Of course, none of this is to deny that the tens of thousands of brilliant engineers Elon employs are accomplishing extraordinary things. He really is the greatest entrepreneur of our generation. And because of the businesses he’s built, he will likely become the world’s first trillionaire—perhaps very soon. Since the election of Donald Trump in November, Elon’s wealth has grown by around $200 billion. That’s nearly $3 billion a day (and over $100 million an hour). Such astonishing access to resources gives Elon the chance—and many would argue the responsibility—to solve enormous problems in our world. So why spend time spreading lies on X?

- 184 replies

-

- 19

-

-

-

-

-

-

-

The whole bankrupt photo collage concept is laden with goofiness to begin with because one can just as easily collect headshots of a number of good looking Democratic women, transpose them with headshots of ugly Republican women, and presto. Like anything else, it all comes down to an agenda and the way that one spins it. But then again, you'd have to be a Tramptard to even find the concept entertaining.

-

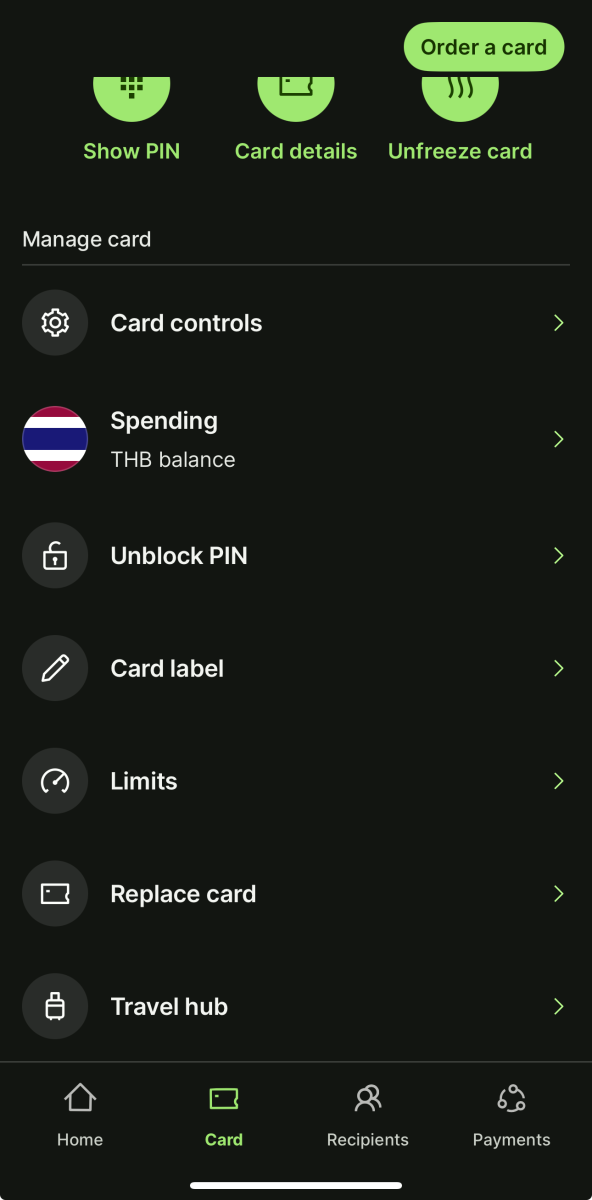

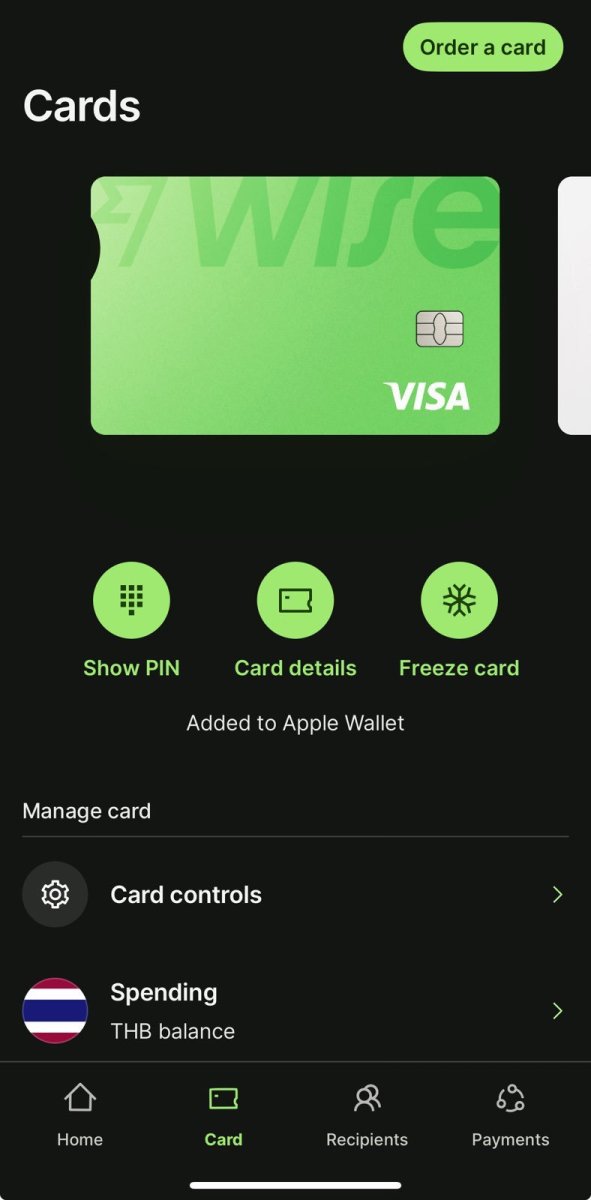

That seems unusual. I would contact them to see what they say. In my opinion, it’s one of the most important security features of the card because it allows you to limit which spending accounts and jars it can access. By the way, the "Card controls" function is another great feature. It lets you disable payment methods you don’t want the card to use, adding an extra layer of security. For example, you can disable contactless payments on your physical cards and enable only chip transactions. This would require you to insert your card into the machine and usually enter your PIN to complete a debit purchase, preventing anyone else from making a purchase with your card (using only tap and go and no PIN) if you lost it. On my digital cards, I restrict them to only allow online purchases or digital wallets. I see no reason to enable any other functions on those.

-

Also, is your account a business account or a personal account? If you can't get it working then you can send them a support ticket and hopefully they can explain why. Click on Home, then click on your avatar in the upper left corner of the screen. Then click on Help and scroll down to the bottom and there is a "Contact us" option where you can eventually send them a support message or request a call back.

-

Good points. I agree that not having an ATM or debit card can be a good security measure. I do the same with the account where I keep the majority of my funds. However, for my daily spending account, I do have one. There have been times when I couldn't make a cardless withdrawal or needed to pay for something in a pinch that required a local debit card. I don’t use it often, mainly as a backup. There are also times when I go out at night and leave my phone and app behind, so having the card is convenient if I need to withdraw cash in those instances. Everyone’s situation is different, so what works best for you is what matters most. But in my case, having a card with a daily withdrawal limit of 3,000-4,000 Baht isn’t too risky, especially when the account doesn't hold a large balance.

-

Yes, in the mobile app. Attached is a screenshot from the green cardvsettings. You can see the Spending function below the card in the app. There are also more settings below it if you scroll down in the app, but unfortunately you can't see them all in this limited screen shot. All the settings fall under "Manage Card" undereath the card as you can see.

-

Village People to Perform at Trump’s Inauguration Celebration

RSD1 replied to Social Media's topic in World News

Trump is the cause! -

Village People to Perform at Trump’s Inauguration Celebration

RSD1 replied to Social Media's topic in World News

I love it. Perfect label for any Trump supporter. I will make use of that for sure. Thank you. -

If it ain't broke don't fix it right? Actually his second term gaggle of broke-dicks do at least share one thing in common, they are all loyalists to a fascist, which is the only qualification for their jobs they actually need. You've got a convicted felon and sex offender at the helm and you could have had 2 more sex offenders in other top positions, but they had to let Geotz go. What a pity. Otherwise you would have had three p**sy grabbing musketeers in the White House all at once! Covfefe!

-

Village People to Perform at Trump’s Inauguration Celebration

RSD1 replied to Social Media's topic in World News

But I was laughing my arse off when I wrote that. That's a tantrum? I can see that delusion is strong with this Trump minion.