lannarebirth

-

Posts

18,698 -

Joined

-

Last visited

Posts posted by lannarebirth

-

-

Which circle of hel_l do those who profit from war end up in? Blood moneym I think, puts you in the 5th circle with the Harpies if I'm not mistaken.

-

I think the idea of talking about the frauds, conspiracies etc. is really to keep the fires burning under the perpetrators. By not letting the issue die the authorities may have to act.

Many questions need answers and hopefully the system will become fairer for all to make a buck or 2.

The Gold sacks of the World will pay one day if the talk is kept up.

Ground swell - class action - fall guys.

I am looking forward to it

Goldman Sachs is a corporation. Corporations have limited liability and vast numbers of shareholders, some of whom are your family, friends and neighbors. If you've been paying attention you'd know financial executives get most of their remuneration on the front end. These people will only suffer when the public ceases to care about markets. Since most everyone has been co-opted into caring about markets, their careers look as bright as ever. Fraud and wars seem a small price to pay for our leisure, chai mai?

-

inflation / deflation

question: where's the beef as far as any inflation/deflation impact on other posters is concerned?

Well I dont have a job to speak of apart from advisory work and Directorships. I look at all my assets principally as investments although a couple of houses which I live in, I dont exactly put in the home theatre hoping to get my money back. I have way too many properties (although mostly distressed asset sales off the banks), quite a lot of equity (principally a minority stake in a listed company I sold out of.) These are my fairly fixed longer term holdings, mostly in Thailand. Deflation will be a disaster, inflation helps up to a point (speeds up real adjustments, rents/eps move with nominal P but yield trend higher as do interest rates (nominal, real likely to fall.) Best case for this lot is a return to decent growth also least likely.

So with my investments the one thing I dont have to hedge is a return to growth. I hedge Thailand at the moment but my liabilities are here, I understand the place and make my best returns, so I dont see it as essential. Both equities and housing is going to get crushed by deflation due to falling nominal income on the assets. Bonds should do well but I hate them and ultimately there must be a credit risk (Japanese bonds look vulnerable with savings turning negative.) I consider my holdings in PMs as a hedge against both deflation and inflation. Their poor performance over the last year doesnt bother me - they did pretty well considering the investment case for them totally evaporated.

I am still looking for a 5/10 year option on deflation. I would like to hold that and far less cash.

Holding cash seems like a problem at present, I'll grant you, but just like your PM, I think one needs to have a certain amount on hand. What percentage of total assets that should be I do not know and which currency it should be I do not know, but perhaps two which are inversely correlated. On the 5-10 year deflation front, maybe 1% of assets could go to LEAP puts on US or Global broad market indexes and another 1% in LEAP puts linked to RE tracking indexes. If those don't pay out it will probably mean your other assets have appreciated far more over that time period.

-

Haven't you been listening Naam? There is no solution. Just sit back and enjoy the ride.

.......

Anyway....is sounding like the Establishment apologist really your style Naam? I think not.

Far from being an 'Establishment apologist' isnt Naam's point more along the lines of 'we should actually be giving the Establishment credit for resolving much of this crisis, rather than bitching and moaning when noone has offered a credible alternative.'

This thread consists of people in various stages of bearishness (myself included) while events are turning out far better than, I think, anyone forecast.

I would agree with these statements.

Further, I would just like to say that the ridiculous 'ATM Withdrawal Fee' thread has almost as many views as this thread.... (well 'almost' being some 47k views vs. some 5xk views)... TV millionaires are really penny wise pound foolish eh? hahaha

As for this thread: I used to enjoy reading ZeroH and Denninger, etc... but now I don't because word has gotten around and conspiracy guys are using it as fodder (without even knowing the meaning of the trading content). Who is the one who first linked to ZeroH in this thread? Lanna? Was it you??!!!

This thread will get fun for me again if we see harmonica or bingobongo return so we can insult each other again, or that one guy with the funny PacMan 'engulfing' charts comes back (or did he do that in the 'Global Correction' thread? - that was a good thread).... Until then, Professor Abrak, you have the floor!

Prior to the March 6th low I had linked to the Denniger site as I think most people don't really know what goes on in markets. He's pretty informative and straight forward but too much of an idealogue in a mileu where being an idealogue will bankrupt you. If past history is any indicator of future market action all this Goldman hate could probably send the market up another 20%. Still, vee bottoms are rare. Accumulate, markup, distribute, markdown, same as it ever was.

-

Attention is living; inattention is dying.

The attentive never stop; the inattentive are dead already.

The Buddha, Dhammapada 21

He not busy being born is busy dying.

Bob Dylan

-

Interesting idea.

The Civil and Commercial Code may not have any provision for trusts.

I think you'll need some very sophisticated advice on this matter.

was told today it was possible , however the agent who quoted the idea , would wouldn't he.

i know it's not possible to buy a house in a childs name, unless the child is 18 and over, but a trust , don't know, i suspect it might be a little to complicated for the current thai lawmakers, or simply they've banned the idea altogether.

It seems you have been misinformed all around. No trusts in Thailand. I am not sure if it is possible to buy in a childs name but it is certainly possible to transfer ownership to a child once bought. The child will require a guardian of the court and cannot sell before 20 years of age except with court approval. That's what a search of prior threads on this topic would have got you.

-

Surely by now with such things as the revelation about the nature of the Goldman Sachs

trading programme, the artificial environment as to how banks can determine

the way their assets are valued and how markets seem so utterely divorced from economic

fundamentals......at the end of the day markets can now be engineered to

behave any way people want them to ?

Lets start to call it what it is and not beat around the bush - (no pun intended George as you let it happen)

con·spired, con·spir·ing, con·spires

v.intr.

1. To plan together secretly to commit an illegal or wrongful act or accomplish a legal purpose through illegal action.

THIS IS precisely what GS has done - read the website they tried to shut down - www.goldmansachs666.com

As each day passes more and more FACTS are revealed about GS and so when we look back we can see that it is in fact a conspiracy.

con·spir·a·cy (kn-spîr-s)

n. pl. con·spir·a·cies

1. An agreement to perform together an illegal, wrongful, or subversive act.

2. A group of conspirators. FED, GS, US government, banks etc.

3. Law An agreement between two or more persons to commit a crime or accomplish a legal purpose through illegal action.

4. A joining or acting together, as if by sinister design:

So Klingons aside this is a conspiracy we are watching unfold. Its not the black helicopters and people switching briefcases but higher up very sophisticated stuff. Like wizz bang computer programs that can do 60% of Wall Street trades in nano seconds!!

When you have a wall street bank that is not accountable in any shape or form, that can use a computer program to manipulate the markets, with gold and money it does not have, and the government allows it to happen with no investigation then folks I think you can bet your last dollar that its a conspiracy in the TRUE SENSE.

Wake up!!!

Good luck

You wake up . All Wall Street companies are like that and for the most part always have been. What has changed is the HUGE participation in markets by largely ignorant "investors".

Banks are scum and that never wasn't the case. What's changed is that the government no longer protects you from said scum. Even that, the apathetic populace doesn't seem to care about except when the trade isn't going their way.

From here on out it's a three card monty scheme. If the market goes up your currency goes down and your taxes go up. Every combination will have the "stakeholders" losing. They're gonna keep moving that ball.

-

What's relevant is that it is the abdication by the government, and by extention the citizenry of discharging its responsibilities that has led to this crisis. Blame Goldman Sachs? What for? Do you blame a snake if you let it out of its cage and it bites you? You knew it was a snake, right?

People don't like to fix blame when doing so requires a hard look in the mirror. In the most democratic nation on earth (and other similar nations) it is the peoples willingness to cannibalize themselves for short term gains that has led to this crisis. If banks have profitted unduly in this scheme, it is the fault of regulators. If regulators have failed it is the fault of government. If government has failed it is the fault of the citizenry.

.........................

Surely it is established that the cause goes back to the effort to socialize housing for political reasons, add in some easy money..............

Then people get greedy. But we do that, like the snake.

It goes back to this:

http://en.wikipedia.org/wiki/Employee_Reti...me_Security_Act

and similar schemes, which created this:

which created a distortion of valuations for income flows and a vast misallocation of capital. The most elegant scam in history. "send us 10% of your income every month and check back with us in 30 years", "stay the course" "blah, blah". Deregulation and shoddy oversight not even an issue for "stakeholders"

. "Do whatever you please, just make my stocks go up".

. "Do whatever you please, just make my stocks go up". -

-

"I think his anger is misdirected. "Goldman Sachs 'co-opted' this that or the other"? Goldman Sachs can only co-opt the government if the politicians are willing to sell their power to the highest bidder. He has this backwards. The government conferred upon Goldman Sachs the power to steal. The only power Goldman Sachs has comes from the government, not the other way around. Goldman also didn't steal anything from from taxpayers - the government is the only one that has that power."[/b]

Well lanna personally I don't think there was much that wasn't relevant.........

So by now is it possible you are prepared to concede that Alex Lah wasn't entirely off the planet with his conspiracy warnings ?

There is something strange or immoral ( possibly even sinister) about the Obama administration and they are changing America beyond all recognition

while the Americans sit back and don't seem at bothered probably because as Flying said they are all too busy making a living and the politicians are

using this for their " scheme ".

What about the story involving small business lender CIT Group who are being allowed to fail ?

" small business lobbyists were warning that the lender's demise could ripple through the economy. The

pain could be most acute in the retail sector, where CIT is a big player in "factoring"---the business of giving

credit to apparel makers and their suppliers, and then collecting on the payments due them from retailers "

http://www.businessweek.com/bwdaily/dnflas...0715_942426.htm

This seems crazy because we know that :-

" small business is the engine of U.S. economic growth, responsible for 75 percent of all net new jobs, we are frequently told."

So how can this possibly help to improve the unemployment situation?

. nothing seems to make any sense anymore....

What's relevant is that it is the abdication by the government, and by extention the citizenry of discharging its responsibilities that has led to this crisis. Blame Goldman Sachs? What for? Do you blame a snake if you let it out of its cage and it bites you? You knew it was a snake, right?

People don't like to fix blame when doing so requires a hard look in the mirror. In the most democratic nation on earth (and other similar nations) it is the peoples willingness to cannibalize themselves for short term gains that has led to this crisis. If banks have profitted unduly in this scheme, it is the fault of regulators. If regulators have failed it is the fault of government. If government has failed it is the fault of the citizenry.

I like part 2 of the video where the guy says that if GS was selling shares in Auschwitz people would buy them if they thought they could profit. I believe he's right.

-

Here's a Goldman fan.

Notice how the Professor warms up when auditing the Fed comes up.

http://www.zerohedge.com/article/max-keise...-sachs-are-scum

Regards.

WOW -I loved every second of that eight minutes

I just wish the rest of America would wake up.to what Max is saying

I particularly loved the part where he accuses GS of being financial terrorists

and no different than Bin Laden

By the way does anyone know the up-to-date status of -H.R.1207

Federal Reserve Transparency Act of 2009?

I see it ended up with 270 co-sponsors in Congress

so why hasn't it passed the Senate yet?

I think this was the most relevant comment made about the clip, which I may view tomoorow at my present download speed.

"I think his anger is misdirected. "Goldman Sachs 'co-opted' this that or the other"? Goldman Sachs can only co-opt the government if the politicians are willing to sell their power to the highest bidder. He has this backwards. The government conferred upon Goldman Sachs the power to steal. The only power Goldman Sachs has comes from the government, not the other way around. Goldman also didn't steal anything from from taxpayers - the government is the only one that has that power."

-

OK, so pick a name and stop by the pet shop for some food tomorrow. That's how I got my cat too.

-

It's called a "dump" or a "skip loader" in American English.

Anyway sorry he went into the drink. Hope all are OK..

Or maybe even a "dumpster loader". That's the ticket.

-

bojo.

this was the skip truck and the crane at about 11 ish this morning ..... back on dry land : )

enjoy pic

dave2

Ah, I see one could call it a garbage truck or refuse transporter even.

-

Just a couple of questions if I might. What is a "skip" and a truck with an "open bin" means what exactly?

'Skip' is the word for an 'open bin' only Brits use skip as far as I know, I don't know who uses 'open bin'. It's a heavy duty metal container which can hold refuse/rubbish usually, that is placed usually at the side of a road/on building sites and will then be lifted onto the back of a lorry that will take it away and dump the rubbish or recycle/whatever.

Regards Bojo

Thanks for that. I one suffered under the limitations of American "English", could one call it a garbage truck?

-

Just a couple of questions if I might. What is a "skip" and a truck with an "open bin" means what exactly?

-

Red faction flags being planted along roadsides in Mae Rim.

-

Thanks for the responses. I finally got through on the phone. I was told they don't look at emails anymore as they have decided to stop the visa run service to Vientiane and Mae Sai too, presumably. Ads still up in classifieds.

-

Nothing?

-

Anyone have a phone number for this place? They do not respond to emails apparently. TIA

-

Well, none of those things are revelations to me. My general view is that when markets are being manipulated get on the side of the manipulators.

" Manipulation " to me implies something which maybe occurs occasionally such as insider trading for example.

but nowhere near as insidious as what has happened over the past few months - a mentality that trading conditions and even laws

are changed - anything to make money.( e.g. GM and Chrysler bondholders being ruled against ) I can't see how so much corruption

in the markets can lead to long term economic stability. Its like watching a like a group of junkies desperate for their next fix

and to hel_l with the long term consequences..........

Manipulation covers a whole lot more area than that. Say margin requirements being raised and lowered. Talks from bully pulpits. Trashing all other havens for cash. Lots of things can be done.

Anyhow, if the short term consequences are dire enough one needn't dwell on the long term for too long.

-

If you want to go along with the manipulators you need to know how it is being done.

You cannot beat those super computers and the army of mathematicians they have.

You need to know what goes in, and how they calculate.

You know that Lana?

Who said anything about beating them?

-

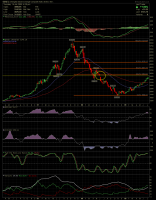

That IS my view, which is soon to be an Intermediate term negative view, though it may turn out to be wrong as the LT chart is showing signs it may have turned up.

Surely by now with such things as the revelation about the nature of the Goldman Sachs

trading programme, the artificial environment as to how banks can determine

the way their assets are valued and how markets seem so utterely divorced from economic

fundamentals......at the end of the day markets can now be engineered to

behave any way people want them to ?

Well, none of those things are revelations to me. My general view is that when markets are being manipulated get on the side of the manipulators.

-

That IS my view, which is soon to be an Intermediate term negative view, though it may turn out to be wrong as the LT chart is showing signs it may have turned up.

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Where Is Gold Going In This Market

in Jobs, Economy, Banking, Business, Investments

Posted

I think it might better be explained by deleveraging and the tightening of futures margin requirements. Froth.