-

Posts

936 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by 007 RED

-

-

My UK passport is due for renewal later this year and I would be grateful for some advice.

I intend to do the renewal through VFS at Trendy Building in Bangkok. Looking at the information on their website they indicate that I need to provide a colour copy of each page of my existing passport and proof of my address here in Thailand (in English).

My questions:

1. Regarding copies of each passport page. Is it acceptable to print 4 pages onto one sheet of A4 paper?

2. Regarding proof of address. Everything that is sent to me from here in Thailand (bills, bank statements etc) has my name and address in Thai (normally copied from yellow book). They want this proof in English. What are the alternatives?

I am aware that I could get an agent to do everything, but happy doing it myself.

Sorry if this has been discussed before but nothing came up on the search facility.

-

OP…. Since your last visit to Thailand back in 2013 (Post# 10) the Thai Immigration system has been upgraded several times.

Firstly

Thailand adopted the Advance Passenger Information System (APIS). This now means all international airlines flying into the kingdom are required to send your biographical details (basically the information contained on the photo page of your passport) to Thailand prior to you being allowed to board the flight. Your biographical information is then automatically distributed to the Immigration, Customs and Security Agencies computer systems which search their databases for you.

If any of the above mentioned agencies have details on their system which precludes you from entering the Kingdom e.g. you have been banned, the airline will receive a “Do Not Board” (DNB) feedback code. The airline is not informed as to the reason why you are not allowed to enter the Kingdom, but because of the DNB code they would incur very heavy financial penalties if they were to allow you to travel, so you will be rejected and your flight ticket cancelled which can be expensive if it's a long haul flight.

As several TV members have previously indicated, you would best travel to one of the neighbouring countries and then attempt to cross into Thailand via a land boarder. If rejected it will just mean a walk back in the direction you came from rather than losing money on a cancelled long-haul flight ticket.

Secondly

During the past few years all Immigration ports of entry have been connected to the central Immigration system in Bangkok by fibre optics, thus now facilitating extremely fast and reliable data transfer.

All Immigration desks at the ports of entry are equipped with Machine Readable Travel Document Scanners. These allow the Immigration Officer to place the photo page of your passport onto the scanner which rapidly unlocks the encrypted information held on the microchip imbedded into your passport.

FYI - The encrypted information on the microchip should be the same as the biographical data shown on the photo page plus an enhanced (cropped) copy of your photo. If it isn’t the same, the system will flag up a potential fake/altered passport.

The information held on the microchip is sent to the Immigration system in Bangkok for checking against their database. These checks include, but not limited to, checking if you are known to the system under another name, second passport (through dual citizenship) or have been banned from entering the Kingdom etc. These checks are completed within a few second. If you have are currently banned a warning flag will be displayed on the Immigration Office’s screen and you will then be subjected to a lot of questions.

Thirdly

The fact that your offence occurred 20 years ago does not mean that the details of your offence and subsequent deportation are not in the Immigration database. FYI - In 1998 Thai immigration installed a new computerised database system and as part of this upgrade, they (Thai Immigration) had a blitz on their old manual records which they had transferred to the new system. Priority at the time was given to the records of individuals who had been deported or were otherwise banned from entering the Kingdom. So, your deportation record from 2000 will almost certainly be in the system.

Fourthly

Immigration has within the past 12 months integrated a biometric scanning facility into their system, e.g. finger printing and facial recognition. If you were fingerprinted and photographed prior to being deported (albeit 20 years ago) that information will be in the Immigration database.

The new fingerprint scanning software is produced by a German company, who according to their publicity blurb can match a fingerprint from within a database containing millions of ‘impressions’ within a fraction of a second. If this is true, the odds will be very much against you entering if your fingerprints are scanned at the port of entry.

Note: Your fingerprints are not stored in the database as an image, but rather a series of numbers indicating significant points within your fingerprint thus making searching that much faster.

FYI – Whilst the fingerprint scanning system is reportedly accurate, a number of serious questions have been raised over facial recognition systems in general as they can produce unreliable matches in particular with people from a several ethnic backgrounds.

General Observations

You indicated in your OP that your passport was stamped when you were deported 20 years ago, but because you cannot read Thai you are unable to determine how long you have been banned for. If you can post a picture of the deportation stamp no doubt one of the TV members will translate it for you.

From what I know of the Immigration here in Thailand they have a tariff system which dictates how long a ban will be based upon the nature and severity of the offence. Bans can range from one year to life. Given what you have indicated about your offence, I would hazard a guess that your ban would most likely be a minimum of 20 years because of the ‘hard’ substance.

How can you find out if you are still banned? Over the years there have been many reports on TV that some lawyers and visa agents who reportedly have connection within Immigration are able to find out such information. Knowing how the ‘brown envelope system’ works this is more than possible, but it is going to cost you. Personally, I would suggest writing to Immigration HQ in Bangkok. Provide them with a copy of your old passport photo page plus the page with deportation stamp and ask them if you are still banned. You may be pleasantly surprised how helpful they can be at just the cost of a stamp.

Given the current Covid-19 situation I doubt that many people will be able to travel for quite some time so you have plenty of time to explore all avenues.

Best of luck.

-

2

2

-

-

1 hour ago, talahtnut said:

The Visa application is on line.

All your stuff is uploaded on the forms

Its possible they will suss you out at

that time, if not, keep original passport and

go for it. They can only turn you back.

FYI - Thai Embassies/Consulates who are responsible for the issuing of visas do not (currently) have access to the Immigration Database so they will not have any idea if a person is banned.

-

1

1

-

1

1

-

-

9 hours ago, mvdf said:

Changing your name by deed poll won't circumvent the immigration system's querying process. The change of name is recorded in the chip itself under data group 11 (DG11). You would be lucky if the chip is not system-queried but if a diligent officer were to do so and assuming the new biometric system is equipped with chip access privileges which I suspect it is as they use cross-matching to verify a passport's authenticity, then your true name will be revealed. A "hit" would then lead to a chain of further queries and, if blacklisted, possibly unravel your past escapades in Thailand.

Sorry to correct you, but details of a person’s previous name(s) is not held on the so-called biometric chip which is embedded into most passports.

The only information that is currently held on the chip is basically the biographical information that is shown on the photo page of the passport, including an enhanced (cropped) copy of the passport holder’s photo.

That said, as from June 2018 passport issuing authorities have been allowed to include the passport holder’s fingerprints within the second level security facility of the microchip. Inclusion of fingerprints is not mandatory and each passport issuing authority can decide for themselves to include this option when now issuing a new passport. FYI - The second level security facility of the microchip cannot be access by the Immigration standard desktop passport scanner, it requires a high security scanner that will normally only be available to Immigration investigation officers.

Regarding a person’s previous names: This was one of a number of option that was written into the International Civil Aviation Organisation ‘s (ICAO) Doc 9303 Machine Readable Travel Documents, 7th Edition, 2105 guidelines.

However, the option to which you have referred, namely Part 10, Data Group 11 – Additional Personal Details has not been approved by the ICAO Executive Committee. As a result, such information is not held currently held within the so-called biometric chip.

If you had read Doc 9303, you would be aware that it was recommended that the inclusion of the Additional Personal Details (which also included the passport holder’s permanent address; telephone numbers; profession; and custody details etc) was identified as being ‘OPTIONAL’ and not mandatory thus indicating that it would be left up to individual passport issuing authorities to decide if such information would eventually be included on the microchip.

At the time of writing this document (2015) it was appreciated that many countries Data Protection Laws preclude such personal information being shared without the individual’s explicit consent and hence this is one of the main reasons why its inclusion has not been approved by the ICAO Executive Committee.

FYI – Most Immigration systems throughout the world are now very sophisticated and are more than capable of identifying if a person who has previously entered has changed their names or has acquired a second passport e.g. dual citizenship.

-

1

1

-

-

On 6/18/2020 at 1:20 AM, n00dle said:

To the op, there is not a snowballs chance in hell your biometric records from 20 years ago are in the immigration system.

It may then come as a bit of a surprise for you to learn that in 1998 Thai immigration implemented a new computerised database system. As part of this upgrade, they (Thai Immigration) had a blitz on their old manual records which they had transferred to the new system. Priority at the time was given to the records of individuals who had been deported or were otherwise banned from entering the Kingdom. So information relating to the OP's deportation in 2000 will most certainly be in the system.

FYI… I first entered Thailand way back in 1992 and subsequently entered/exited over 100 times. The details of every entry/exit, dating back to 1992, are available to the Immigration Officer if he/she ‘drills down’ into their system. I have seen my Immigration record on several occasions thanks to friendly IO’s.

-

Having the planes which they lease seized because of non-payment of their debts is just one of Thai’s worries.

If they want to fly anywhere outside Thailand they are going to face some serious problems once the bankruptcy order is made because no airport outside Thailand is going to give Thai credit facilities to cover the costs of landing/ground handling fees or for topping up the ‘bird’ for its return flight. Then of course there is the small matter of the cost of hotel accommodation/transport costs for the crew during their stop over.

It will be strictly cash only. So, Thai had better ensure that they provide their pilots with a big suit case full of US$ if they want to fly anywhere outside Thailand.

-

- Popular Post

- Popular Post

OP… Firstly may I say that your dilemma is a total nightmare and I wish you, and your father the very best wishes.

As I read it from your original post you have two problems to overcome to be able to get your father from Phnom Penh to Bangkok for heart surgery.

Originally there is the problem stemming from your father having been banned from entering Thailand, and then there is the problem of his being able to enter the Kingdom given the current Emergency Degree situation.

Dealing with the ban…. According to your original post you indicated that your father was banned for 5 years, some 8 years ago. If this is correct, then the ban has well and truly expired and, therefore, he should under normal circumstances have no problem in returning to Thailand.

FYI…. When details relating to a person’s ban are entered into the Immigration database the system requires an end date to be entered. This should be in the format DD/MM/YY. The date should be entered in the Gregorian calendar format e.g. with the current year = 2020. A problem arises when the person entering the end date enters it in the Thai Buddhist calendar form e.g. with the current year = 2563. Unfortunately, the Immigration system cannot differentiate between the two calendar forms and will accept both, hence it is possible for the ban to be current for another (63-20) 43 years.

This date error does occur occasionally and can be easily rectified without recourse to a lawyer who will no doubt try to ‘milk’ you for every Baht that they can screw out of you.

I note from your posts that you are based in Chiang Mai, and that you also have a brother in Bangkok. I would strongly recommend that you (or your brother) contact Immigration HQ in Bangkok (address given below) to establish that your father’s ban has expired. Personally, I would not bother with your local Immigration office as unless you have a very good relationship with the Officers there, you may not get a helpful response.

You will need a copy of your father’s photo page of his passport (preferably the one he used when he was banned). If he no longer has that, a copy of the photo page of his current passport. I would also suggest taking a copy of your birth certificate (which should have your father’s full name on it) as proof that you are related.

If you explain to the HQ Officers your dilemma I think that you will find them extremely helpful. If the end date of his ban has been entered incorrectly, they will get it changed and confirm it almost immediately.

Thai Immigration HQ address:

Royal Thai Police – Immigration Branch, 507 Thanon Suan Phlu, Thung Maha Mek, Sathon, Bangkok 10120

Tel: +66 2287 3101 Fax: +66 2287 1310 (sorry no email Facebook address available).

FYI….. The details of your father’s ban will not be expunged from his Immigration record, it will always be lurking somewhere in the background. That said, his ban will not show up when he checks in for a flight to Thailand through the Advance Passenger Information System (APIS), or when an Immigration Officer scans his passport at the port of entry.

Dealing with the second problem of getting your father into Thailand at the moment is far more difficult to resolve. As you are no doubt aware the current Emergency Decree has effectively closed all boarders/points of entry and has prohibited non-Thais from entering the Kingdom.

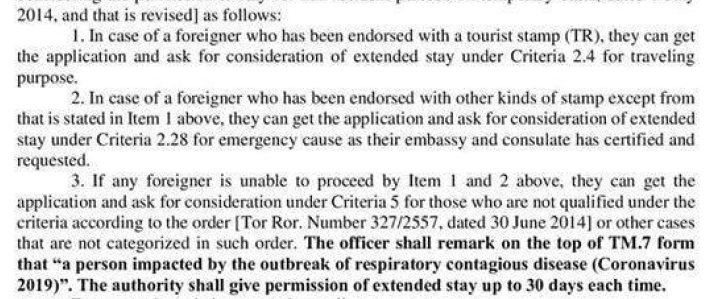

There are a few exceptions, and 3.(4) of the of the Civil Aviation Authority Thailand (CAAT) Temporary Order, dated 3 April 2020 (which has been extended until the end of May 2020), indicates that the ban does not apply to: “Humanitarian aid, medical and relief flights.”

The question is, does your father’s case/situation fall under the category of medical and relief flight? My personal opinion is that it probably does not as I suspect this exemption is to deal with a flight carrying medical aid/personnel to a disaster zone e.g. earthquake.

I suspect that this is where the lawyer you referred to said that you needed a “person of influence”, because someone with influence is going to need to persuade the powers that be to permit your father to be flown into Thailand for medical treatment which he cannot receive in Cambodia. All I can suggest is that you contact your father’s Embassy here in Bangkok, with letters from the medical staff in Phnom Penh indicating the need for his transfer to a hospital in Thailand. Hopefully they may know the right people and be able to offer assistance in the matter.

As I said at the beginning, you are facing a horrible dilemma, one that I would not like to have to face. I wish you all the very best of luck and hope that your father gets the treatment which he appears to desperately need.

-

7

7

-

- Popular Post

- Popular Post

OP…. Like @ChiButty said above, it was quite unusual 10 years ago for someone to be banned from entering the Kingdom for working without a work permit.

As far as the ‘blacklist’ facility within the Immigration system is concerned it functions on the end date of the imposed ban and if that was 5 years ago it should not show up when the basic interrogation of your record is done e.g. by the Advance Passenger Information System (APIS) when you check in to fly to Thailand, or when the Immigration Officer scans your passport at the point of entry.

The end date of the ‘blacklisting’ facility within the Immigration system should be entered in Gregorian calendar format, that it to say the current year should be 2020. The problem arises when an IO enters the end date in the Thai calendar format with the current year 2563. Unfortunately, when the Immigration system checks the date format when the details are entered it cannot distinguish between the two calendar formats. This problem has occurred quite a few times.

It has been suggested that you contact a lawyer, but as you have already discovered they will give you mixed answers. Remember, they are trying to make money out of you.

If as you said you were banned for 5 years, some 10 years ago, then your ban has well and truly expired. I would suggest before purchasing any ticket to travel to Thailand that you contact Thai Immigration Headquarters (address given below), and explain in simple terms that you were banned for 5 years, 10 years ago, and wish to return to Thailand (no need to explain why you want to return) - keep it short and simple. Provide them with a copy of the photo page, exit stamp and banned stamp from the passport you had at the time of your ban.

Contrary to what many people will tell you they (Immigration) can be quite helpful at times.

Thai Immigration HQ address:

Royal Thai Police – Immigration Branch, 507 Thanon Suan Phlu, Thung Maha Mek, Sathon, Bangkok 10120 (Mark your correspondence: For the Attention Of The Immigration Commissioner).

Tel: +66 2287 3101 Fax: +66 2287 1310 (sorry no email Facebook address available).

If they reply and confirm that your ban has been completed and that you are free to enter Thailand make sure that you bring a copy of that with you just in case.

FYI…… The details of your 5 year ban will not be expunged from the Immigration database, it will always be lurking there somewhere in the background.

Best of luck.

-

3

3

-

1

1

-

1

1

-

Where I live we are on main's supply if you can call it that and like many people here in Thailand we also suffer from low, and sometimes non-existent, water pressure. This is basically because the water company use mainly plastic supply pipes to get the water to the house and they cannot put to much pressure behind the water for fear of pipe joints bursting.

I have 2 x 1,000 litre tanks each with an outlet pump. One tank is used for the house the other for our smallish fruit garden mainly during the hot season. The joy is that with mains supply water pressure low during the day, when most people and local factories want water, the tanks fill up at nigh when demand is low.

I have attached a few photos of the garden setup.

Photo #1 shows the inlet pipe, with shut-off valve just before the pipe enters the tank near the top. The screw removable lid on top of the tank is also shown..

Photo #2 was taken above the tank with the lid removed to show the inlet ball valve which is just like the ball valve in the loo).

Photo #3 shows the bottom of the tank and the outlet pipe feeding the pump - again there is a shut-off valve between tank outlet and the pump inlet.

FYI... there is a second outlet hole at the bottom of the tank. This is for draining the tank if necessary and is also fitted with a shut-off valve.

A really simple DIY job. In my case the ball valve was included with the tank, but they are available from Homepro if that is were you will purchase your setup.

Good luck.

-

2

2

-

-

- Popular Post

- Popular Post

The Rolling Stones; The Beatles; The Kinks; The Who; The Bee Gees; The Hollies; Pink Floyd; The Animals; Led Zeppelin; The Cream; The Moody Blues; David Bowie; The Zombies; The Yardbirds; Eric Clapton; Manfred Man; Petula Clark; Jethro Tull; The Troggs; The Searchers; Gerry & the Pacemakers; Deep Purple; Herman’s Hermits; The Dave Clerk Five; Tom Jones; Joe Cocker; King Crimson; Cliff Richards & the Shadows; The Tremeloes; Chad & Jeremy; Lulu; Cilla Black; The Tornados; Freddie & the Dreamers; Marianne Faithfull; Engelbert Humperdink; The Mindbenders; The Merseybeats; The Swinging Blue Jeans; Helen Shapiro; The Creation; UB40 to name but a few.

If your wondering how I came to see all the above artists/groups, the answer is simple. From the mid 60s onwards I was a member of St. John Ambulance Brigade in Coventry (UK). The unit that I was a member of was assigned a regular first aid duty at the Coventry Theatre (AKA The Coventry Hippodrome) which hosted pop concerts most Sunday evenings.

The perks of the ‘job’ included free entry, a free programme, located in front of the stage (now I know why I’m almost stone deaf) and often backstage access to meet the artists after the show. Oh I nearly forgot, also providing TLC to the young ladies who fainted at the sight of their favourite pop star.

From the programmes which I still have I complied the list of artists/groups who performed at the Coventry Theatre between 1964 and 1980. It should be noted that some were the lead performers whilst others were support artists at the time.

-

3

3

-

9 minutes ago, Susco said:

Sorry, but did you read the threads where TV members posted their personal experience with importing household goods?

No you didn't, otherwise you would know that what is written in the law and what happen in reality in Thailand, never is the same thing

No need to bit my head off!!!

FYI... Yes I did read those threads, several years ago. The one thing that was missing from all of them was any indication as to when they were able to bring their possessions into the Kingdom duty free. Yes it may have been a few weeks before they posted, but more likely prior to the exemption being cancelled.

-

14 hours ago, Susco said:

@masterpasser Google is your friend.

There are a few posts/threads on this forum about people on retirement visa, who have imported full container of personal belongings, and paid no or minimal import duties .

Sorry, but unfortunately the duty free exemption for second-hand personal possessions imported by Non-O (Retirement) visa holders moving to Thailand was withdrawn from the Customs Regulations some 10 plus years ago and is no longer available. FYI.... when it was available the possessions had to be imported within 6 months of the person's arrival into the Kingdom.

-

OP…. I appreciate that we can become very much attached to certain items that have brought us pleasure over the years, and we can be reluctant to give them up. In your case I would take the advice already given by several TV members namely, sell the items and purchase a similar setup here in Thailand.

Why? The simple answer is that it's going to cost you an arm and a leg to get your beloved audio system into Thailand.

The current Thai Customs import duty on audio equipment is 60% of CFI. If you are not familiar with the term CFI it stands for Cost of item + Freight cost + Insurance cost.

As I am almost deaf I have never considered purchasing a high-end audio system as I would never get the benefit of the quality, hence I have no realistic idea how much your system costs. But, for example purposes only to illustrate how much Customs duty you may need to pay let us say your system new price is 100,000THB, the cost of shipping is 30,000THB and insurance is 10,000THB.

Note: Customs tend to work on the price as new.

CFI would be 100,000 + 30,000 + 10,000 = 140,000THB

Import duty payable @ 60% of 140,000 = 84,000THB

Note: The 60% import duty figure is taken from the current Thai Customs data fact sheets.

Then on top of the import duty, you will also need to pay VAT @ 7% of CFI + import duty.

140,000 + 84,000 = 224,000THB

VAT @ 7% of 224,000 = 15,680THB

Total Duty payable (84,000 + 15,680) = 99,680THB

Although my estimated cost of your system may well be way off the mark, you will see from my illustration that the cost of the duty which you will need to pay will almost be equal what the system is worth.

You will no doubt read from other threads (and it has been mentioned by one member in this thread) that you can easily reduce your import and VAT duty liability by declaring a lower cost on the shipping documents. Two things spring to mind when I hear this advice.

Firstly, if your system is worth 100,000THB and you declare it as only being worth say 20,000THB, that is the value the shipping agent will put on the insurance declaration. If the system goes missing, or gets damaged, in transit you are going to be way out of pocket because the insurance company is only going to compensate you to the declared value, not the true value.

Secondly, Customs Officers throughout the world have seen it all before and they are wise to all the tricks of the trade. If the items are declared on the shipping advice as being audio equipment they may well decide to take a closer look at the contents because of the potential high import duty payable. Customs Officers have access to big databases which they can search for details (make/model/serial numbers/costs etc) of items going back many, many, years. If they find that you have grossly under declared the value of the goods they (the Customs Officers) can confiscate the goods and fine you three times the true value of the goods.

The only way to get the duty payable reduced is by providing the original system purchase invoices to the shipping agents and allow them to negotiate a reduced value based upon age of the items with Customs, e.g. brown envelope passed under the table.

You may also read from other threads that TV members have indicated that they have not paid any import or VAT duty on good sent to them from overseas. I do not doubt their claims but nowadays Customs declarations of items shipped by agents are all done electronically and their (Customs) systems automatically highlights items of high potential value that may need closer inspection e.g. audio equipment. As well as their system identifying potential items for inspection Officers also do random checks as well.

FYI… Customs Officer receive a basic monthly salary (about 25,000THB per month). However, they can receive a bonus which is based upon the value of duty which they recover. Hence it is in their interest to screw you for as much as they can.

Hope this info is of use and very best of luck.

-

On 4/22/2020 at 1:37 PM, Kwasaki said:

And your Thailand experience evidence is 007. ????

Please don't take my name in vain.... The RED = Retired, Extremely Dangerous. ????

-

OP…. To be honest, I think the plastic bottle in the septic tank is the least of your problem.

You mentioned in you post that you opened the lid of the tank which is in the kitchen. A septic tank under your kitchen. That's not good!!!

I am mindful that someone constructed the kitchen conversion prior to you purchasing the property, so please don’t feel that I’m having a go at you. I just want you to be aware that you may have a real problem.

Normally septic tanks need to be able to freely vent to atmosphere as they produce several nasty gasses. In particular, methane and hydrogen sulphide, both of which will cause serious problems if allowed to build up in a confined space such as a kitchen.

Methane is a colourless and odourless gas which is relatively non-toxic. However, it is highly flammable and when mixed with the right proportion of oxygen (there is 21% in normal air) will readily cause an explosion if triggered by a spark/flame (gas burner or light switch in the kitchen).

Hydrogen sulphide is a colourless gas which smells like rotten eggs. It is highly poisonous. The trouble with this gas is that you may smell it initially, but it quickly deactivates the smell receptors in your nasal passage, so you lose your sense of smell and be unaware of the potential danger. High concentrations of the gas within a confined space can result in a person rapidly losing consciousness, asphyxiation and death.

Sorry, but I don’t have any easy answers to your potentially serious problem. You need the advice of an waste management expert. Unfortunately I doubt you will find one in LOS.

Best of luck.

-

1

1

-

-

The Notification of the Civil Aviation Authority of Thailand on Temporary Ban on All International Flights to Thailand (No. 2)

6 April 2020

In reference to the Notification of the Civil Aviation Authority of Thailand Re: Temporary Ban on All International Flights to Thailand issued on 3 April 2020 for the prevention and control of the Coronavirus Disease (COVID – 19) Outbreak.

In order to maintain the continuity of the prevention and control measures, by virtue of Section 27 and 28 of the Air Navigation Act B.E. 2497, the Civil Aviation Authority of Thailand hereby issue the following orders:

1. All international passenger flights to Thailand will be banned from 6 April 2020 at 17.00 UTC to 18 April 2020 at 17.00 UTC.

2. All flight permits granted to international passenger flights for such period will be cancelled.

3. The ban on 1. does not apply to the following:

(1) State or military aircraft

(2) Emergency landing

(3) Technical landing without disembarkation

(4) Humanitarian aid, medical and relief flights

(5) Repatriation flights

(6) Cargo flights

4. The passengers on board the aircraft leaving the airport of departure before the entry into force of the Notification will subject to 14-day quarantine under the contiguous disease law and the regulation under the Emergency Decree on State of Emergency B.E. 2548.

With immediate effects until further notice.

Issued on 6 April B.E. 2563 (2020)

Source: https://www.caat.or.th/en/archives/49329

____________________________________________________________________________________________________

Effectively this temporary order stops all passengers (Thai & foreigners) on international flights from entering Thailand by air. As will be seen in 3. above, there are a number of exemptions, one being Repatriation flights. This is to allow people who are currently stuck in Thailand to return home - not Thais to return home.

Although BKK website arrivals/departure info shows lots of international arrivals expected they have not updated their site to show the flights cancelled. If you look at Flightradar24.com you will see 95% of the scheduled international arrivals/departures are shown as cancelled.

It should also be noted that a large number of flights coming into, and departing, BKK are in fact cargo flights.

-

2 hours ago, expat_4_life said:

Pretty bold now that arrivals are effectively down to zero.

Statistics of international arrivals at Suvarnabhumi:

28 March: 1,834

29 March: 1,795

30 March: 995

31 March: 1,126

The figures that you have provided above for international arrivals at BKK , with a few exceptions, will be Thais nationals returning home.

If you can recall, on the 25th March the Prime Minister announced on TV the first stage Emergency Decree, namely:

"All foreigners will be banned from entering the Kingdom in order to combat the import of Covid-19. This decree will come into affect from midnight tonight (25th) and remain in force until the 30 April 2020.

The decree bans all foreigners from entering Thailand at all entry points, the exception being shippers, diplomats, drivers, pilots and others permitted by the Prime Minister".

-

36 minutes ago, Orton Rd said:

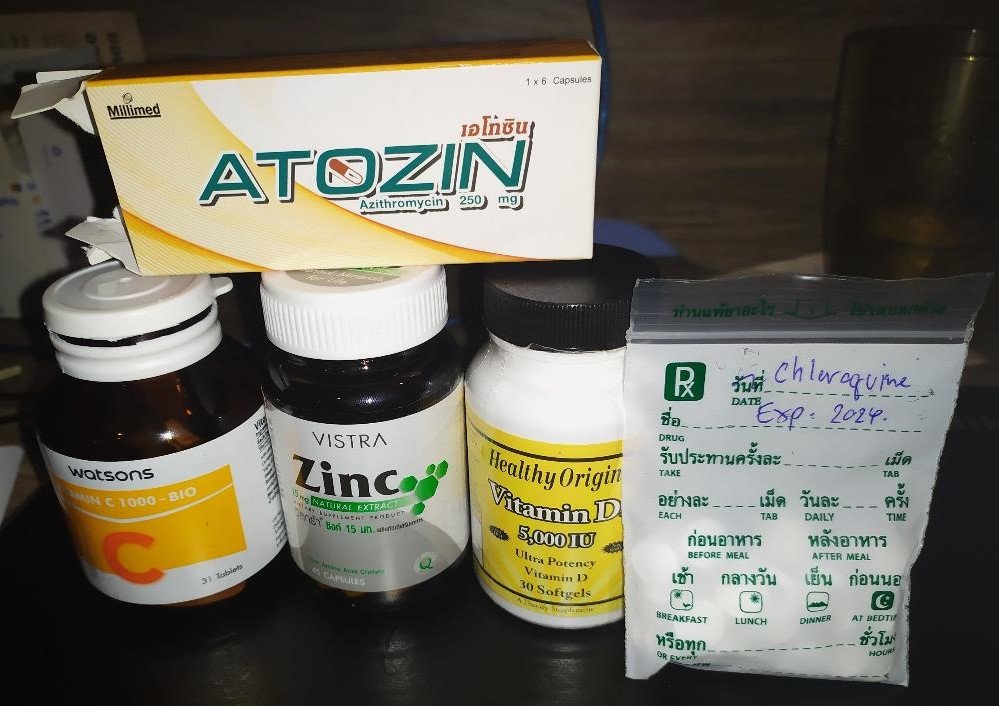

You might get desperate if you can't breath and the Hospital has no ventilators, or even any of these drugs. I will be taking it if desperate. Why let other people take responsibility for your health especially in a third world country, I'll look after myself rather than some dubiously knowledgeable Thai in a white coat.

Personally, I will stick with the time tested and trusted cure all Thai Seng Oil. Guaranteed to fix all ailments as indicated on the bottle.

-

1

1

-

1

1

-

-

Re: Chargeback

In an earlier post I mentioned that Chargeback was also an option when, as appears to be currently happening, that an airline cancels a flight and then only offers a refund less a cancellation fee (which can be substantial) or flatly refuses a refund on the basis that the ticket was non-refundable. I would like to clarify a few things concerning Chargeback.

Firstly: If you are under the impression that raising a Chargeback claim with your credit card provider will instantly get your money back, then I'm sorry to disappoint you. The Chargeback scheme is effectively a dispute scheme which involves the card holder informing the card provider that he/she disputes the payment made for any one of a number of reasons - in the case of an airline cancelling the flight the claim would be that the card holder did not receive the service as contracted when they purchased the ticket.

Upon raising the Chargeback claim, the credit card company will contact the provider's bank with details of the Chargeback claim and request that the finds be returned to them. The service provider can, and in many cases will dispute the Chargeback claim. If the service provider disputes the chargeback, the claim will go for adjudication which may take some time. If it is decided that the Chargeback claim is valid the service provider's bank will deduct the value of the chargeback from the service provider's account.

Secondly: If you are considering a Chargeback claim most credit card companies require the claim to be submitted within a specific time from the date the purchase was made. Each CC company has different time limits so its best to check what that is with your CC provider. Visa for example requires a Chargeback claim to be made in less that 120 days from the date of purchase.

Thirdly: As mentioned above, the Chargeback scheme is basically a dispute scheme. Therefore, when submitting a claim you will need to provide evidence to your CC provider that you have initially tried to claim a refund from the service provider. In the case of the airline having cancelled your flight(s) you should keep a copy of any emails or other correspondence that you have had with the airline and send that as supporting evidence with your Chargeback claim. In cases where you call the airline make a note of the date and time of your call and a brief summary of the conversation with the airline call centre agent and supply these details with your chargeback claim - FYI... almost all call centres record telephone conversation so it will be difficult for the airline to dispute you contacted them.

Fourthly: If the airline has either cancelled the return segment (or part of the return segment) of your flight, it is unlikely that Chargeback will be successful. This is because unless you are unlikely to be able to quantify actual cost of the return segment(s) of the return flight. If you give a figure plucked out of thin air the service provider will instantly dispute your claim and possible counter claim that your claim is a fraud. Hence this type of Chargeback is fraught with danger and could affect your credit rating or the CC provider withdrawing your card.

For all those affected by flight cancellations, I wish you best of luck.

-

1

1

-

-

Re: EU261

A number of members have mentioned claiming against EU261 because the airline has cancelled their flight, so I have clarified the situation below.

EU Regulation 261/2004 is a law which provides compensation to passengers whose flights have been delayed or cancelled.

EU Regulation 261/2004 is an EU law so it applies to countries in the European Union (EU) and was created by the European Commission (EC) so it’s sometimes called EC261 or EC Regulation 261.

All countries that are part of the EU fall under the regulation 261 rules – there is no option to opt out. Some European countries that are not part of the European Union, such as Switzerland and Norway, have opted in to EU Regulation 261 as a benefit to their citizens and travellers in and out of the their airports. At present these Regulation still apply to the UK although it has withdrawn from the EU.

Flight Delay/cancellation Regulations apply to anybody (regardless of age or nationality) whose flight departs from an airport based in an EU country or whose flight arrives into an EU country and is operated by an EU airline.

Example 1: You have a return flight booked London to Bangkok. If the initial outbound flight is delayed/cancelled you will be entitled to EU261 compensation. EU261 will also apply if there was an intermediate stop on route e.g. Emirates via Dubai. If the return flight is delayed/cancelled (Bangkok to London) you will only be entitled to EU261 compensation if the airline is an EU based carrier e.g. BA,LH,AF etc.

Example 2: You have a return flight booked from Bangkok to Paris. Your initial flight from Bangkok to Paris is delayed/cancelled. You will only be entitled to EU261 compensation if the airline is an EU based carrier e.g. BA,LH,AF etc.

I hope this helps.

-

1

1

-

-

56 minutes ago, ubonjoe said:

I suspect that it is required for the wording of the Embassy letter to the Commissioner of Immigration for the consideration of extending a visa. I've not seen a the Embassy letter, but I would assume it will go along the following lines:

Mr Bloggs a UK citizen holding passport number 12345678 currently holds a Thai tourist visa which is due to expire on the 28 March 2020. Mr Bloggs was due to leave the Kingdom on 27 March 202 on Emirates flight EK123 which has now been cancelled due to the current virus situation. The airline has been unable to offer an alternative flight which will allow Mr Bloggs to exit the Kingdom before his visa expires.

I should be grateful if you would consider extending Mr Bloggs visa.

Yours faithfully etc. etc.

-

2

2

-

-

32 minutes ago, Peter Denis said:

Wow, if Emirates would refuse a refund (or challenge the credit-card charge-back) I would classify them as a 'rogue' airline.

Even if I have a non-refundable ticket, the fact remains that they are not honoring the contract by providing the service they sold me.

But we live in strange times, so it is well possible they would try to weasle out of it (I read on their web-site that if you paid using your Emirates-miles, they would NOT refund these - which is also a questionable practice).

I totally agree with you.

That said, hypothetically put yourself in their position. You have massive overheads (aircraft leasing cost, staff salaries, aircraft landing/parking fees etc) and lots of bills to pay during the shutdown which is not fault. What would you do? No doubt the same as them and try and hang on to every last penny for as long as possible.

Don't get me wrong, I totally disagree with the way that they are handling this situation and no doubt when things eventually return to normal many of their loyal customers will remember the way that they have been treated and migrate to another airline.

FYI.... The comment about having paid with Skyward miles and not being refunded only applies were someone has booked a flight with miles that were about to expire e.g. they have booked a flight in April with miles that are about to expire at the end of March. If the miles were still valid at the time of the flight then those miles will be credited to the members account.

-

1

1

-

-

2 hours ago, stouricks said:

Booked 'non-refundable' tickets with Emirates on a Debit Card. BKK to DXB to MAD and back. The DXB - MAD - DXB have been cancelled but the Emirates website says that only the Fare will be refunded and not the taxes/fees. Anyone any ideas please.

Also booked NOK Air to get me from Phitsanulok to DMK to connect to the Emirates flights, also with Debit Card (Bkk Bank).

Took out insurance with Frank in Bkk which only covers cancellation due to sickness for me, wife or close family.

Sorry stouricks but the information which I have underlined in your post above is incorrect, it is in fact the complete opposite.

According to the Emirates, the amount of refund you will be entitled to will be accordance with the fare condition of your ticket. Unfortunately, as you have a non-refundable ticket, that is what you will get. Nought! You may, however, get the passenger tax element refunded but that is only going to be a small amount.

To make matters worse, if you have paid by a debit card it is unlikely that the card provider operates a 'claw back' scheme.

Sorry mate, but it looks like you have been 'shafted'.

That said, one glimmer of hope may be if you have travel insurance you may be able to make a claim on that for flight cancellation.

Best of luck.

-

1

1

-

-

4 hours ago, stouricks said:

Or it could be possible that the VOUCHER is for a flight on the same route, regardless of price. Then that would be better than the refund.

No. In many cases the voucher will be at a value set by the airline, which may not necessarily be the price that you paid for the ticket e.g. less any admin or penalty fee. The voucher will be for a value in whatever currency you paid, it does not specify that it must be used against the same route as you originally intended.

What you need to bear in mind is that if you decide to use the voucher to purchase a new ticket on the same route within the validity of the voucher (e.g. 12 months from date of issue) you will most likely be faced with having to pay extra for the new flight because no doubt the fare will have increased.

Best of luck.

-

1

1

-

Renewing UK Passport

in Thai Visas, Residency, and Work Permits

Posted

Many thanks for the replies so far. They are much appreciated.

For clarity, regarding my question of printing 4 pages of my passport onto one side of A4 paper, I have provided an example below of what I was considering. It will provide the information that they require but just means less paper involved. If I was really cheeky I could print double sided (8 pages on one sheet of A4), but that may be pushing my luck.

Regarding the requirement for providing proof of address: As mentioned in my original post, all my bills have my address in Thai and the Passport Agency require it in English. Good suggestion regarding my Thai driving licence (shown on reverse in Thai and English). Only problem with that is only part of the address is given.

UJ.... you suggested getting the yellow book translated. Will the translation need to be certified (MFA)/