-

Posts

1,224 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Jenkins9039

-

Interesting as there's usually gold deposits in that from what i learned on the discovery channel.

-

Left overs from the new well was a couple of boulders of this material. When spraying the hose over it disintegrates into smaller chunks. Curious what kind of rock it is.

-

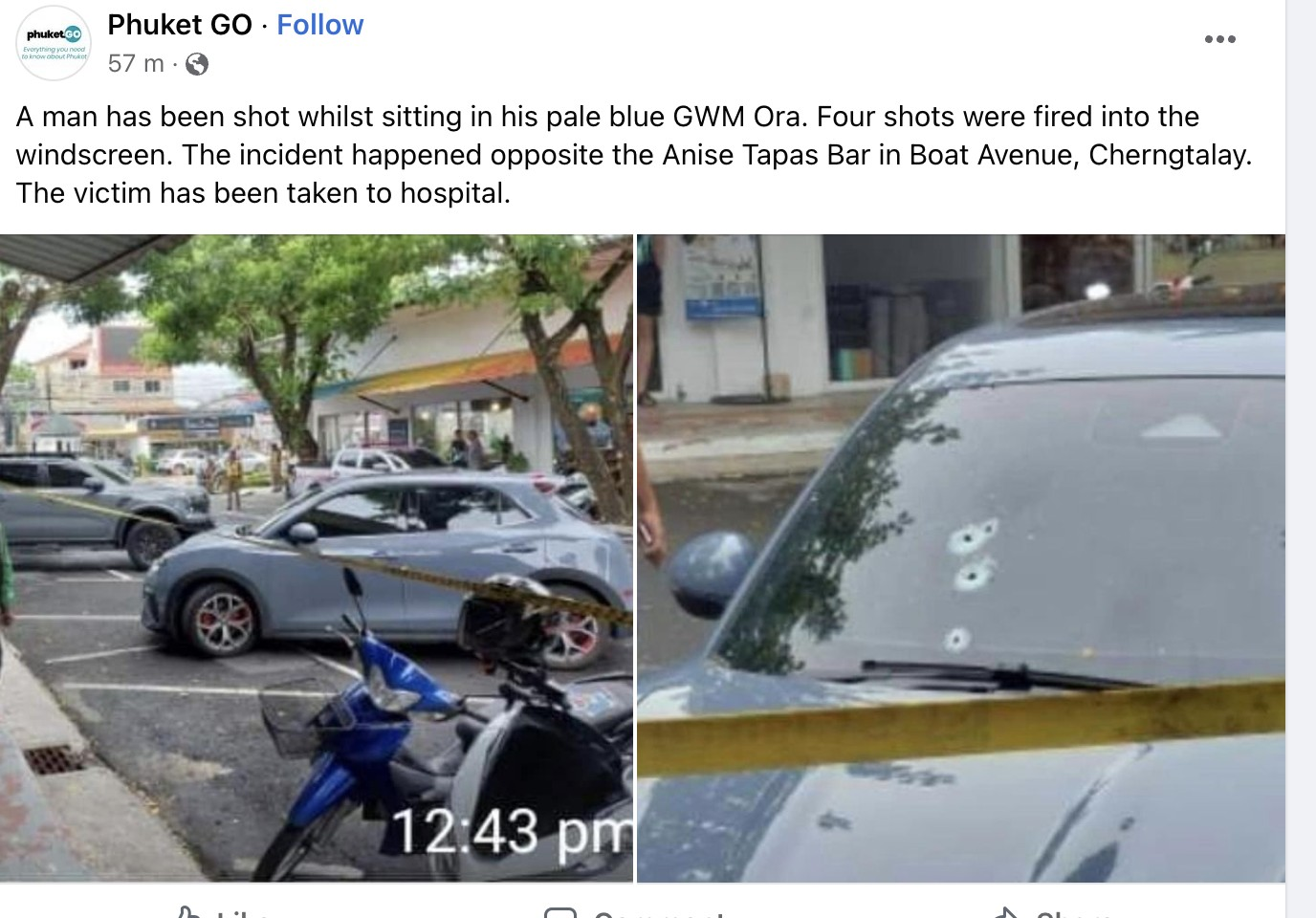

Been here a long time, the past 5 years up until last year most crime was gone. Still had petty crime but criminal organisations or international crime was gone/hidden. Last year you had the Indian/Canadian drug lord killed, and today a shooting in a place i take the family frequently. With all the checks they do (see my post this morning ) not entirely sure how they are failing to capture the bad guys. )

-

Thalang

-

Biggest issue around the crypto markets, is if there is a disruption to Binance Global (Indictment) majority of exchanges (such as satang) are integrated with their AML/Screening, Orderbook/Matching Engine and liquidity. If Binance goes down, it will take at least another 100 exchanges directly with it.

-

Yes

-

One thing i will say is like most other plebs i do the 90 day report, and have a long term visa, immigration came to my home about 5 yrs ago, so they know i live here/there. Seems checking is counter-productive.

-

Been under the weather with food poisoning and in recovery stage, opened the gate this morning to Immigration, who were commencing a street wide sweep for 'tm30', and 'chinese that made thailand look bad'. Seem to have gone door to door (the chinese money launders left a while back). Anyone else having this fruity morning drama?

-

Glad i'm not the only one - started apparently in November, I deposited a small amount into the bank to transfer to someone in the UK and it was 'frozen'. I've since written it off - they were asking too many intrusive questions about me financially as a non resident it's not their business and certainly not the UK Gov's.

-

British-Thai Dual National First Passport

Jenkins9039 replied to Jenkins9039's topic in Family and Children

If you read, clearly I am concerned of the potential for the UK to realise the debt is so high that they come after overseas assets in death duties, currently they do not - kids being given passports now would make the government (*uk) aware they exist as such with CRS (common reporting standards) when i die, my assets would be at risk for potential overseas taxation as they would be net parties to those distrib. Rather simple really. Gov in debt -> needs cash -> raids overseas assets (death duties, income tax) -> kids reg will be linked up to me -> CRS informs of assets -> death certifc reg for me -> Gov comes for tax. Currently there is no tax overseas -> this is changing. -

British-Thai Dual National First Passport

Jenkins9039 replied to Jenkins9039's topic in Family and Children

Actually that's not true. It costs 125,000 $ approx to acquire tax free citizenship, which can provide such, pocket change in the grand scheme of things. At the moment they are not registered with the UK but are registered in Thailand, the moment they become known to the UK there's the potential for some form of taxation [on my wealth] at my demise. As it stands it's 0 in the UK bar localised tax for local asset(s). If they decide to relocate to the UK, and if the UK changes the current inheritance tax system to include overseas - then they are looking at 40-60% tax on any assets, the UK has 2.x trillion of debt and will likely have 3 trillion by 2025. - you think they won't change the current tax system? seriously? In Thailand it's 10%+ -

Wife absolutely doing my head in - doesn't seem to get it into her head that British Children are British by Birth not by passport, keeps pushing for the kids to get their first British passport even though that will bring them to the attention as future HMRC tax payers (CRS + Death Taxes/Inheritance) instead of just allowing them to apply for a British Passport as and when they need it in a few years and travelling on a Thai passport for the interim period - ideally 10 yrs. Anyway rant over. Where do they apply - Thailand or remote to the UK? What docs are needed? Seem to get conflicting and transferred to EIRE when ringing the hotline.

-

Homeless Farang with no help from the Mayor's office

Jenkins9039 replied to Ironmike's topic in Phuket

I heard you were looking for a well to be dug (Original Poster)? If so 092-499-7275 - about 2,400 THB a ring. (they are based in Mai Khao) Just done ours and another on the road. -

- Referencing Certificate of Residence.

-

Got a link, this is the residential address doc? Bluetree are MEANT to do it, but always send you to either PHUKET or PATONG (apparently Patong do). Having said that, i recently heard it's now being handled in Samui by the transport office... i guess immigration there are fed up with farang not wanting to pay the 500 thb tea money so offloaded, personally, i am happy paying the 500 THB even though its meant to be free simply to just have the blasted thing (need for yacht license).

-

Solar Water Heater Hurdle

Jenkins9039 replied to Jenkins9039's topic in Alternative/Renewable Energy Forum

Was considering installing one off these on the pipe off from the solar water heater, so it sends the right temp to the rooms (showers). I'm not entirely sure how useful they are and whether they actually work, and then have a issue if the water temp is too low (cloudy days) will they function? -

Solar Water Heater Hurdle

Jenkins9039 replied to Jenkins9039's topic in Alternative/Renewable Energy Forum

-

Solar Water Heater Hurdle

Jenkins9039 replied to Jenkins9039's topic in Alternative/Renewable Energy Forum

As mentioned - impossible to get now. -

Solar Water Heater Hurdle

Jenkins9039 replied to Jenkins9039's topic in Alternative/Renewable Energy Forum

Our tiles that are in place are not cheap. -

Hi, had a comment before (can't find). Our home only has one pipe coming to the shower(s) with hot water from heaters above the ceiling (each shower x 3). I want to install solar water heating - but hitting a hurdle, the company sais that a new green pipe needs to be run. and you manage the mix of hot/cold at point - this is not something we want to do, as each wall would have to be retiled (100k per wall before we even start - and struggle to find the same tiles as discontinued - been there). So my idea, is there must be a way that the solar heater heats the water, its then gravity fed/pumped to a mixing tank of sorts before flowing to the house shower (heads) - we are only interested in the showers - we have 5kw system and 3kw system for the pool, each shower heater when used uses 3.5kw so we have a power issue at times (too much being consumed). So as you can see - cutting out the heating of water will take some pressure of the house grid, but doing so will create extreme costs making it not worth while/viable. Has anyone come across a tank of sorts that can mix the hot water coming from the solar hot tank with cold water that we can then send onto the house? Thanks - did see this but looking for a off the shelf solution i can just give to somchai

-

Man Held For Killing British-Thai Youth Over Drug Deal

Jenkins9039 replied to webfact's topic in Chiang Mai News

-

Has anyone had success with these? We currently have three shower water heaters in the house, soon to be 5+ [excluding taps]. Not entirely sure if you actually save money on them, aside from that our household is quite big, not sure if heated water would be lost travelling the network of pipes we have going on - how did others resolve? with redundancy for backup water heaters? https://www.lazada.co.th/products/solar-hot-water-heater-150-litre-stainless-steel-tank-can-save-30000-baht-per-year-in-electricity-cost-warranty-10-years-i1415434939-s12416000771.html?

-

Homeless Farang with no help from the Mayor's office

Jenkins9039 replied to Ironmike's topic in Phuket

When they lay the concrete that will raise the road slightly, then dig out the beginning part of your drive and have a slope. FYI it cost the local gov here 800k just to raise a slither of road where it always flooded every year... Further when they design the road, you'd be surprised just how many people need to sign off on it - so they'd have to go back to the drawing board... only way you could get around that is have the locals make a <deleted> load of noise... but let us be honest, they will look at you and say som - nom - na, he can afford it, tight elite farang. -

Ubonjoe has passed away - Funeral tomorrow May 8 at 2pm

Jenkins9039 replied to george's topic in Isaan

RIP UJ. -

Gold is dug in Thailand..