-

Posts

6,755 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by jerrymahoney

-

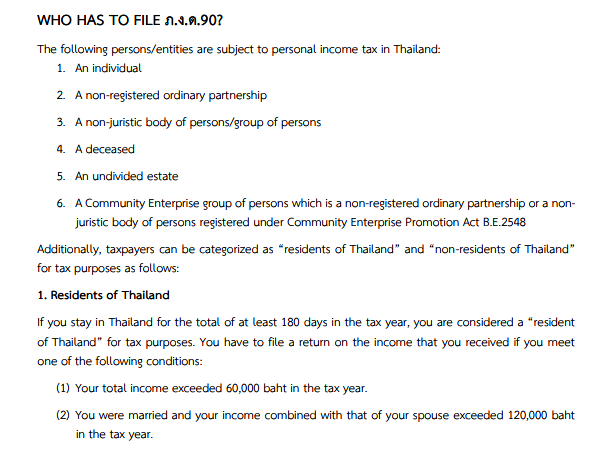

What is oft posted on here is that the agent set-up with Immigration allowing expats to bypass IMM 's own Police Orders -- that specifically require a Thai bank account -- involves just too much money to ever go the wayside. Except for one thing: The Revenue Department may soon have a dog in this hunt, as the Texans say, and right now, Revenue is not getting any of the money that could be taxed against those bank accounts, tangible or otherwise.

-

If the revenue folks really wanted a tax filing every year for the past 10 years they could have stationed an RD investigator at every decent size immigration office to buttonhole farangs as to whether they have submitted their annual tax form. And then they could have modified their system to identify those with extensions of stay but are 'excused' from ever showing up at immigration offices.

-

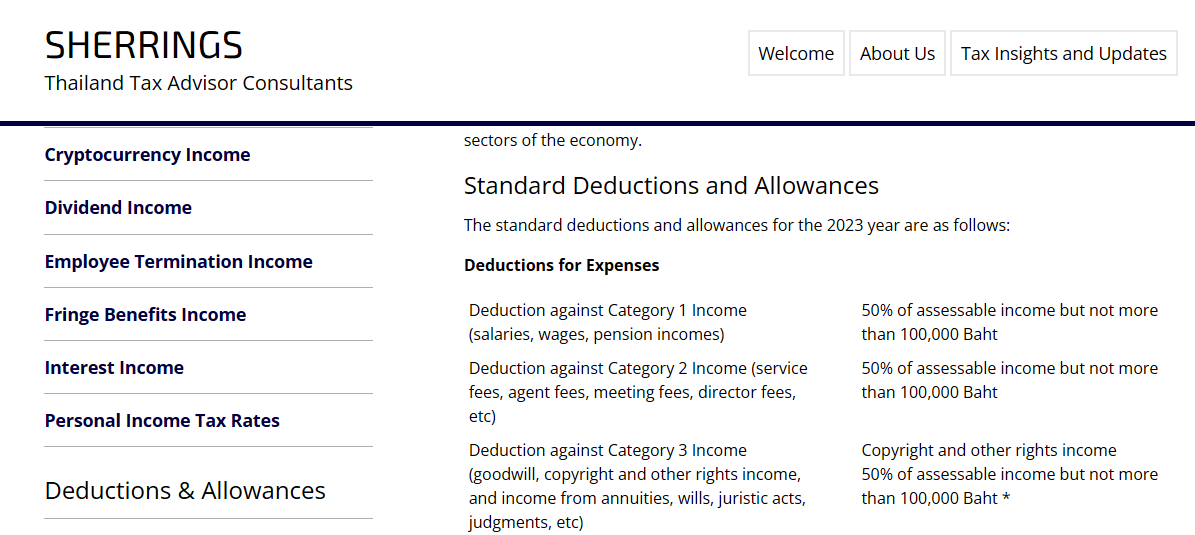

I have done that for 4 years now with the FTT 65K+ baht monthly transfer and source-of-funds letter for the retirement extension of stay. Maybe have to get the thing(s) translated. If there might still be taxes to be paid, might only be about $US 100 per year after all the available deductions for this age 65+ guy.

-

Because there would be 2 types of expats not filing: Those who would not be filing because they are below the minimum assessible income filing level and those who just do not file regardless because they consider themselves below the Revenue radar. i.e. the earlier topic: Living in Thailand using only ATM money for more than 6-months - tax consequences

-

I will guess this may be what happens in Thailand especially if the Form is modified to show 'Credits' (as per Mazars report) including non-assessible foreign-sourced income and some explanation why it is non-assessible. Else one could have 2 million baht foreign-sourced annual income deposited in a Thai bank account and claim no report required as it is non-assessible income. Scouts honor. Trust me.