-

Posts

6,750 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by jerrymahoney

-

-

REDUX from me: In addition to examples of scenarios in which taxpayers should be exempt from Thai tax on foreign-sourced income, the FAQ also clarifies several points, including: • “Remittance of income into Thailand” is defined as any action in bringing the income sourced abroad into Thailand, including wiring money from a bank account, transferring money via e-banking, or physically carrying cash into Thailand. However, the FAQ did not confirm whether spending money in Thailand from an offshore bank account, credit card, or debit card could be considered a remittance of income into Thailand. (my italics) https://www.mazars.co.th/content/download/1175616/59807824/version//file/Technical-update-November-2023.pdf If ATM withdrawals and credit card purchases/advanced cash from foreign based banks are NOT to be considered as remittance, then, for many, it's all over anyway.

-

So it is reasonably established what is RD Thailand assessable income for PIT. (personal income tax) And it is reasonably established what is RD Thailand non-assessable income for Thai RD PIT. The crux it seems to me is that, if ALL your annual foreign-sourced remittances are self-declared non-assessable income, does that mean you are under no obligation via the 60K current revenue reporting base, to report ones income in any manner to RD even though your Thai bank has full records of those deposits?

-

This topic generally covers persons who are tax residents of 180+ days per year in Thailand. There are only a limited number of ways that one can spend that much time in Thailand and dealing with Immigration is one of them. And other than via the IMM folks, how would RD folks ever even know who is a 180+ day tax resident in Thailand?

-

Well I remember the time roughly 5 years ago when Immigration said, as per the US Embassy: You mean you are not guaranteeing that anyone who claims on an affidavit that they have 65K in monthly income, actually HAS monthly income? And that generated a wholesale reform of the IMMM Police order on extensions of stay via retirement or marriage. Maybe something similar will happen with the Revenue folks on vaporware bank accounts for extensions via retirement. But more germane to what you want to discuss: If ALL my income is non-assessable, will I ever have to file aa PIT form

-

That's OK. Persons who on this and other topics suggest that their agents are pure as the driven snow, probably don't want to talk about it, either. BTW you responded to another post before I edited it to say: Even though I may have 5 million baht deposited annually into a Thai bank account, if i say that it is ALL non-assessable, that is what it is. No need to fill out any silly PIT forms. Trust me. You betcha.

-

Well OK but then there is this from RD link: 2.1 Assessable Income Income chargeable to the PIT is called “assessable income”. The term covers income both in cash and in kind. So what is assessable and what is non-assessable? From some of the posts on here, non-assessable is what I say is non-assessable. Even though I may have 5 million baht deposited annually into a Thai bank account, if i say that it is ALL non-assessable, that is what it is. No need to fill out any silly PIT forms. Trust me. You betcha.

-

You wrote a few days ago: "Should the RD want to have a few rounds on income vs capital, that might prove interesting. But, I really don't think they have, or can afford to have, the resources for such scrutiny." Well if you want to go a few rounds with someone on this stuff, it's going to be with someone other than me. You're beginning to sound like GWBush with his: "Bring 'em on"

-

When I worked in advertising a long time ago, when there were still newspaper grocery store coupons, there was a given norm: The 2 groups of people who most used those coupons were from either the very poor or the very rich. With health insurance, it is possible get out of it a lot more than you put in. And the typical rich person would be kicking themselves silly if they DID get real sick and had to pay the bill far exceeding what even high care insurance would have cost.

-

For 10+ years I received an affidavit from the US Embassy for 65K+ income either at the embassy in Bangkok or on counselor outreach. And for all those years I then received the one-year extension with me physically present in the Immigration office. Neither the US Embassy counselor officials nor any IMM officer in 2 different locations ever suggested there was any Thailand tax obligations related to my stated or proved foreign-sourced income.

-

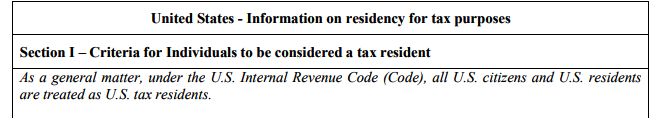

Because the bulk of that will be from US Social Security which is covered by US-Thailand DTA Article 20 Par. 2 and the top-off will be from a source which meets the definition of 'annuity' under the same DTA Article 20 Par. 3 So even is the annuity is not covered for tax purposes, after all the deductions including the age 65 + 190K baht per year and the 150K 0% tax level, the remaining amount will be in the 150K to 300K bracket that will be taxed at 5% or roughly 3000 baht.