-

Posts

6,755 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by jerrymahoney

-

T The italics quote was just someone looking to give me my comeuppance. And as far as I am concerned, ALL my remittances to Thailand going back 10 years and more would be covered by US-Thai DTA Article 20. I have now done the 65K+ baht per month retirement extension for the 4 years of the new regime wherein you had to supply banking records of the monthly FTT transactions. So if the revenue folks were looking for me, they would know where to find me.

-

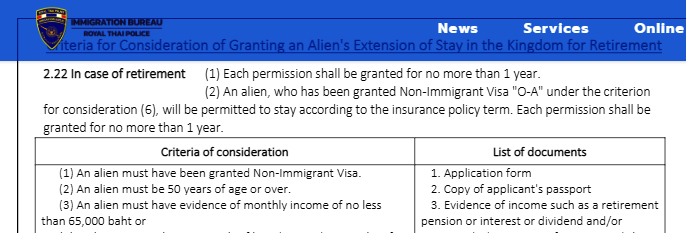

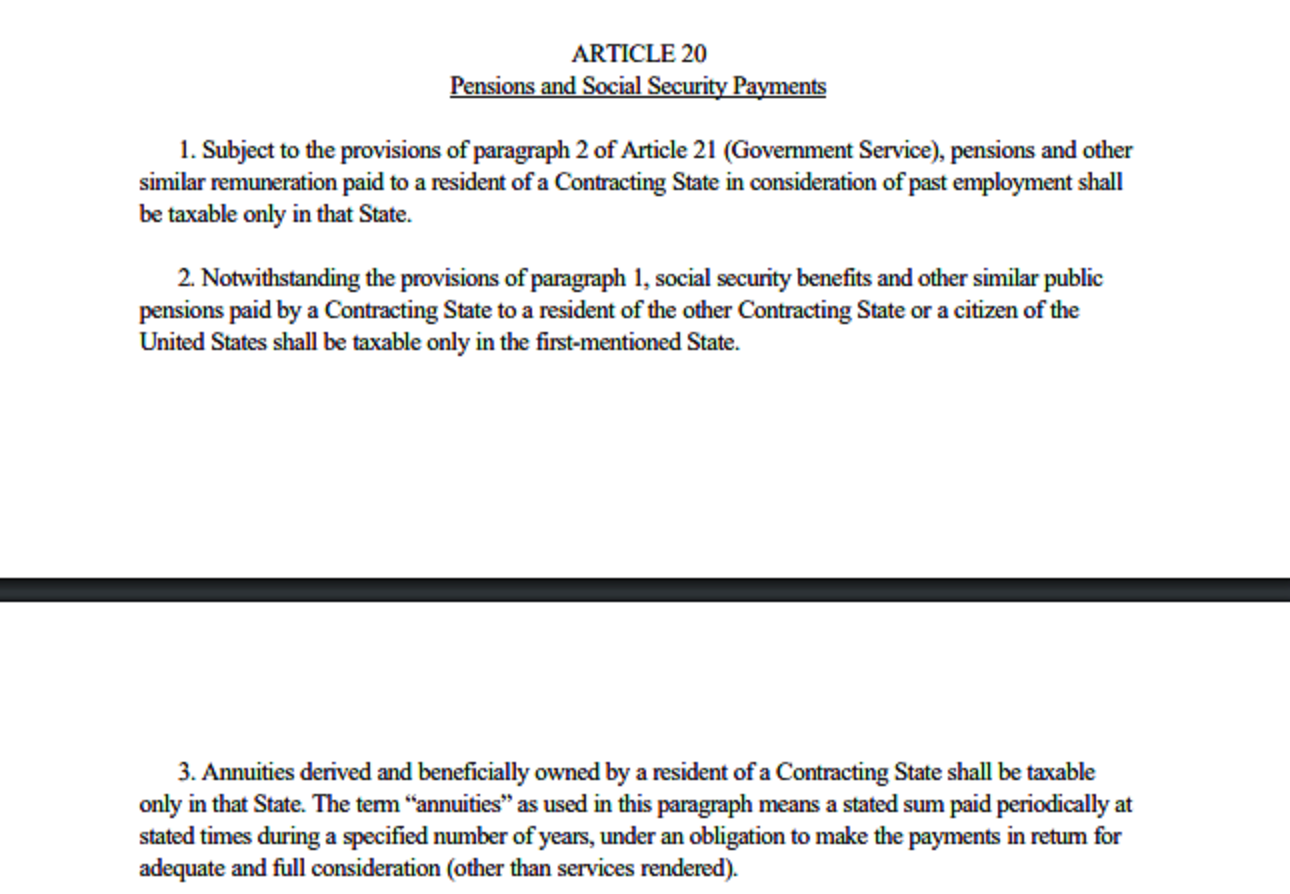

Article 20 Paragraph 3 Under paragraph 3, annuities that are derived and beneficially owned by a resident of a Contracting State are taxable only in that State. An annuity, as the term is used in this paragraph, means a stated sum paid periodically at stated times during a specified number of years, under an obligation to make the payment in return for adequate and full consideration (other than for services rendered). https://www.irs.gov/pub/irs-trty/thaitech.pdf And as per Ms. Sheryl above, my Social Security payments alone are NOT enough for the min. 65K per month transfer.

-

At least according to the report in their seminar as referenced by K. Dogmatix, the (Mazars?) presenter said such foreign gifts 'should' be allowed, which leads me to infer, at least according to that presenter's experience , he does know that such a foreign tax-free gift transfer that has ever happened.

-

I expect the first line of inquiry may be when Immigration says they won't give you an extension of stay without a Thai tax number (TIN) Also from Mazars: According to the Revenue Department, it will seek opinions from the stakeholders affected by the new rule and issue guidelines to provide more clarity. The plan includes an amendment of the personal income tax return form to facilitate the foreign tax credit claim. https://www.mazars.co.th/Home/Insights/Doing-Business-in-Thailand/Tax/Thailand-Tax-Foreign-Income-Taxable-from-2024 When or if that happens, I will comply. I am not on here asking questions as to "How will they find out if ..."

-

This is from the US DTA -Thailand technical report Article 20: 3. Annuities derived and beneficially owned by a resident of a Contracting State shall be taxable only in that State. The term “annuities” as used in this paragraph means a sum paid periodically at stated times during a specified number of years, under an obligation to make the payments in return for adequate and full consideration (other than services rendered). If you think I haven't filed to-date when I should have filed, fine. Turn me in.

-

I am not clever. I set up my finances 10+ years ago to conform to a monthly income of 65K+ baht even when all that was required was an affidavit from the US Embassy saying you do have it. Not did that only make it easy for me to comply with the change 4 years ago that you actually had to document a monthly 65K+ FTT transaction and have a "Source of Funds" Letter to prove it, it now works that my financial structure totally conforms to the Article 20 US-Thai DTA. So being not clever with the agent-assisted extension and other vapor-ware approaches is looking pretty good heading into 2024.

-

Yes. But as of right now, with the available deductions to me including the age 65+, I figure my tax bill would be about $US 100 per month. But with the US Thai DTA Article 20 Paragraphs 2 and 3, would be zero. But I enjoy reading the posts on this and other topics as to how one can be a 180+ day tax resident in Thailand and have income that is not reported to the Revenue folks as income.

-

Maybe. But at least it seems that the tax lawyers and accountants running the show at AMCHAM and with their high-end clientele aren't familiar with them and have never processed such a tax form as submitted to the Revenue Department. From the Mazars Thailand website: Mazars specialises in audit, accounting, tax and advisory services across a range of markets and sectors. We offer specialist skills beyond the reach of most regional firms. https://www.mazars.co.th/ But if anyone has (ever) since FEB 2016 made a tax-free maintenance gift to a spouse in Thailand up to 20 million baht per annum from an offshore account, we don't know about it.

-

The whole conundrum with Immigration and the agent payoffs is that the people who need to be arrested are the same people that need to do the arresting. All that may change January 1, 2024. Revenue Department may say that such maneuvers are facilitating tax fraud. Maybe. Stay tuned.

-

My father got the tag: 2 woods and a wedge (for par 5) He didn't hit the ball far but he hit it straight. But he had a short game with a wedge that was like watching a pool player. Could go straight up and straight down with backspin if necessary.