-

Posts

6,750 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by jerrymahoney

-

Without knowing where this all will end-up, to me it was useful to become at least aware of the Thai Revenue Code, (for me) the US-Thailand DTA, and some of the published opinions by the various Bangkok-based tax law and accountancy firms. Final interpretations can wait. I make the 65K+ baht monthly FTT deposits for retirement extension and, for me, nothing on that will change post-2024. Based on the current deductions available as of TODAY for Thai income tax, if I had to pay tax, I wouldn't like it but it would not be any prohibitive amount.

-

According to the Revenue Department, it will seek opinions from the stakeholders affected by the new rule and issue guidelines to provide more clarity. The plan includes an amendment of the personal income tax return form to facilitate the foreign tax credit claim. https://www.mazars.co.th/Home/Insights/Doing-Business-in-Thailand/Tax/Thailand-Tax-Foreign-Income-Taxable-from-2024

-

But according to what some believe on here, it was always possible (at least since FEB 2016) to remit foreign-sourced funds in the current year as long as it was structured as a maintenance gift to a spouse tax-free up to 20 million baht per year. Just no evidence that any high-roller has ever done it.

-

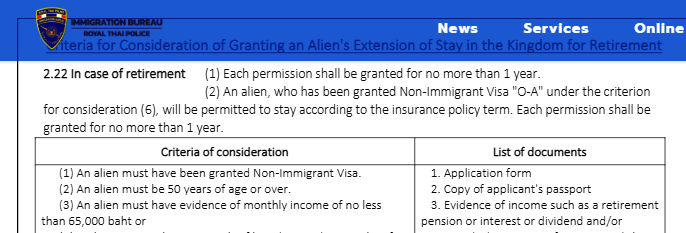

To the above: I have used the 65K per month retirement extension method since the game change 4 years ago -- in 2 different offices. They both want to see a statement from my Thai bank with monthly FTT deposits. No US (in my case) statement required. And they both have requested (demanded?) a Source-of-funds letter which I have provided showing a monthly transfer -- which in my case -- meets the definition of" monthly income retirement pension" AND 'annuity' under Article 20 Par. 3 US-Thailand DTA.

-

To the above: Textualism is a mode of legal interpretation that focuses on the plain meaning of the text of a legal document. ... or from the movie script Seven Days In May: President Jordan Lyman: All right, Colonel. Let's sum it up, shall we? You're suggesting what? Colonel Martin "Jiggs" Casey: I'm not sure, Mr. President: just some possibilities, what we call, uh "capabilities" in military intelligence... President Jordan Lyman: You got something against the English language, Colonel? Colonel Martin "Jiggs" Casey: No, sir. President Jordan Lyman: Then speak it plainly, if you will

-

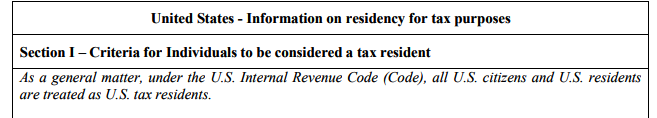

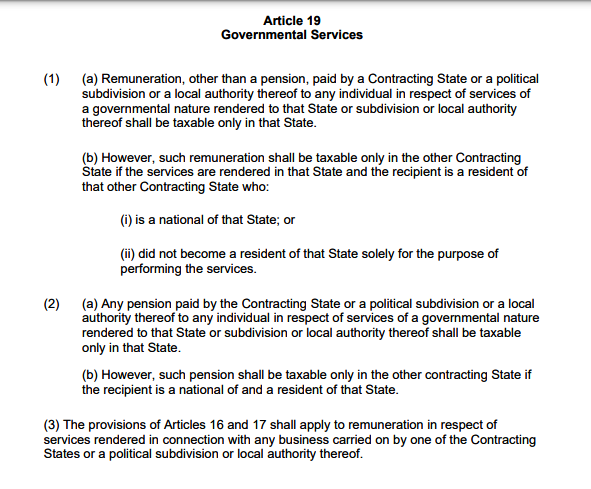

Article 20 Par. 3 : Annuities derived and beneficially owned by a resident of a Contracting State shall be taxable only in that State. What Article 20 Par. 3 means(maybe) is that an annuity derived in Thailand by a tax resident in Thailand can only be taxed in Thailand AND An annuity derived in US by a tax resident in US -- and a US citizen is ALWAYS a tax resident of the US -- can only be taxed in US. And at least for me the 'savings clause' issue is moot because I have no annuity derived in Thailand.

-

Maybe. But as I already give Thai immigration my Thai bank account details for my 65K+ monthly annual extension, a tax filing showing only Social Security and my annuity income -- which is already in the 'source of funds' letter for immigration -- that shouldn't be too difficult. And I have a good translation service that can even get a stamp from Thai MoFA going in from my Thai marriage 2 years ago.

-

T The italics quote was just someone looking to give me my comeuppance. And as far as I am concerned, ALL my remittances to Thailand going back 10 years and more would be covered by US-Thai DTA Article 20. I have now done the 65K+ baht per month retirement extension for the 4 years of the new regime wherein you had to supply banking records of the monthly FTT transactions. So if the revenue folks were looking for me, they would know where to find me.