-

Posts

6,764 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by jerrymahoney

-

To the above: Textualism is a mode of legal interpretation that focuses on the plain meaning of the text of a legal document. ... or from the movie script Seven Days In May: President Jordan Lyman: All right, Colonel. Let's sum it up, shall we? You're suggesting what? Colonel Martin "Jiggs" Casey: I'm not sure, Mr. President: just some possibilities, what we call, uh "capabilities" in military intelligence... President Jordan Lyman: You got something against the English language, Colonel? Colonel Martin "Jiggs" Casey: No, sir. President Jordan Lyman: Then speak it plainly, if you will

-

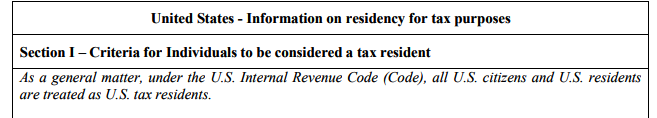

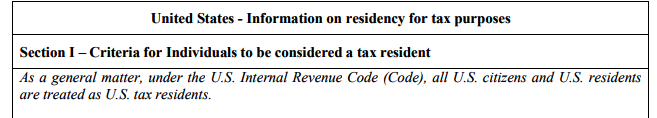

Article 20 Par. 3 : Annuities derived and beneficially owned by a resident of a Contracting State shall be taxable only in that State. What Article 20 Par. 3 means(maybe) is that an annuity derived in Thailand by a tax resident in Thailand can only be taxed in Thailand AND An annuity derived in US by a tax resident in US -- and a US citizen is ALWAYS a tax resident of the US -- can only be taxed in US. And at least for me the 'savings clause' issue is moot because I have no annuity derived in Thailand.

-

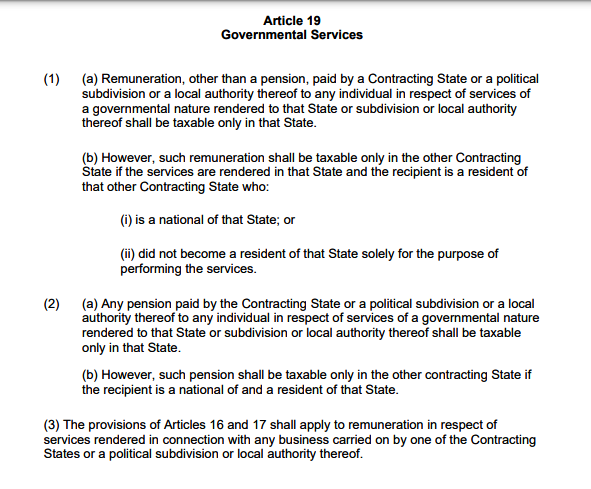

Maybe. But as I already give Thai immigration my Thai bank account details for my 65K+ monthly annual extension, a tax filing showing only Social Security and my annuity income -- which is already in the 'source of funds' letter for immigration -- that shouldn't be too difficult. And I have a good translation service that can even get a stamp from Thai MoFA going in from my Thai marriage 2 years ago.

-

T The italics quote was just someone looking to give me my comeuppance. And as far as I am concerned, ALL my remittances to Thailand going back 10 years and more would be covered by US-Thai DTA Article 20. I have now done the 65K+ baht per month retirement extension for the 4 years of the new regime wherein you had to supply banking records of the monthly FTT transactions. So if the revenue folks were looking for me, they would know where to find me.

-

Article 20 Paragraph 3 Under paragraph 3, annuities that are derived and beneficially owned by a resident of a Contracting State are taxable only in that State. An annuity, as the term is used in this paragraph, means a stated sum paid periodically at stated times during a specified number of years, under an obligation to make the payment in return for adequate and full consideration (other than for services rendered). https://www.irs.gov/pub/irs-trty/thaitech.pdf And as per Ms. Sheryl above, my Social Security payments alone are NOT enough for the min. 65K per month transfer.

-

At least according to the report in their seminar as referenced by K. Dogmatix, the (Mazars?) presenter said such foreign gifts 'should' be allowed, which leads me to infer, at least according to that presenter's experience , he does know that such a foreign tax-free gift transfer that has ever happened.

-

I expect the first line of inquiry may be when Immigration says they won't give you an extension of stay without a Thai tax number (TIN) Also from Mazars: According to the Revenue Department, it will seek opinions from the stakeholders affected by the new rule and issue guidelines to provide more clarity. The plan includes an amendment of the personal income tax return form to facilitate the foreign tax credit claim. https://www.mazars.co.th/Home/Insights/Doing-Business-in-Thailand/Tax/Thailand-Tax-Foreign-Income-Taxable-from-2024 When or if that happens, I will comply. I am not on here asking questions as to "How will they find out if ..."

-

This is from the US DTA -Thailand technical report Article 20: 3. Annuities derived and beneficially owned by a resident of a Contracting State shall be taxable only in that State. The term “annuities” as used in this paragraph means a sum paid periodically at stated times during a specified number of years, under an obligation to make the payments in return for adequate and full consideration (other than services rendered). If you think I haven't filed to-date when I should have filed, fine. Turn me in.

-

I am not clever. I set up my finances 10+ years ago to conform to a monthly income of 65K+ baht even when all that was required was an affidavit from the US Embassy saying you do have it. Not did that only make it easy for me to comply with the change 4 years ago that you actually had to document a monthly 65K+ FTT transaction and have a "Source of Funds" Letter to prove it, it now works that my financial structure totally conforms to the Article 20 US-Thai DTA. So being not clever with the agent-assisted extension and other vapor-ware approaches is looking pretty good heading into 2024.