-

Posts

1,634 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Longwood50

-

How the Wealthy Save Billions in Taxes by Skirting a Century-Old Law

Longwood50 replied to Scott's topic in World News

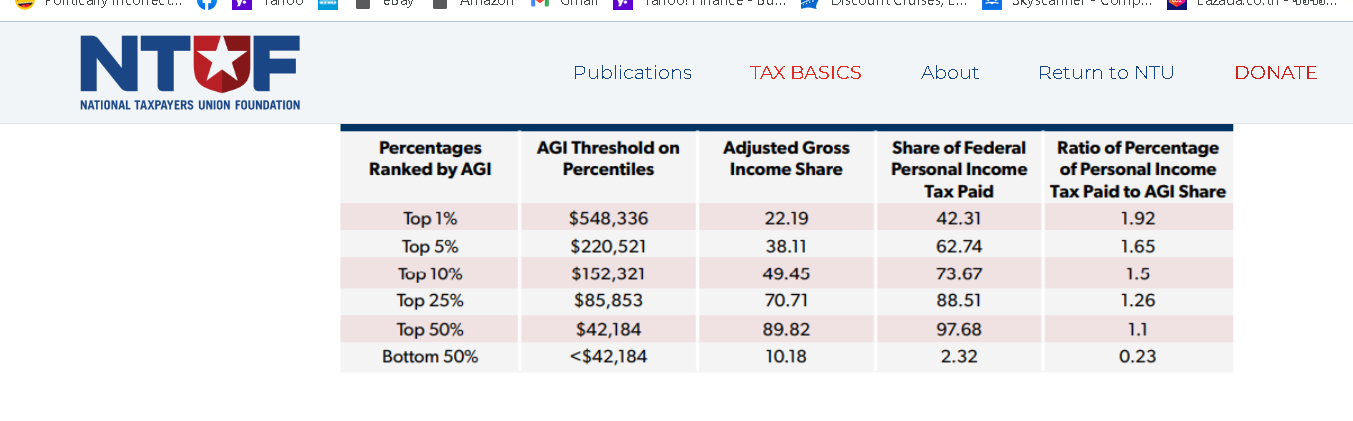

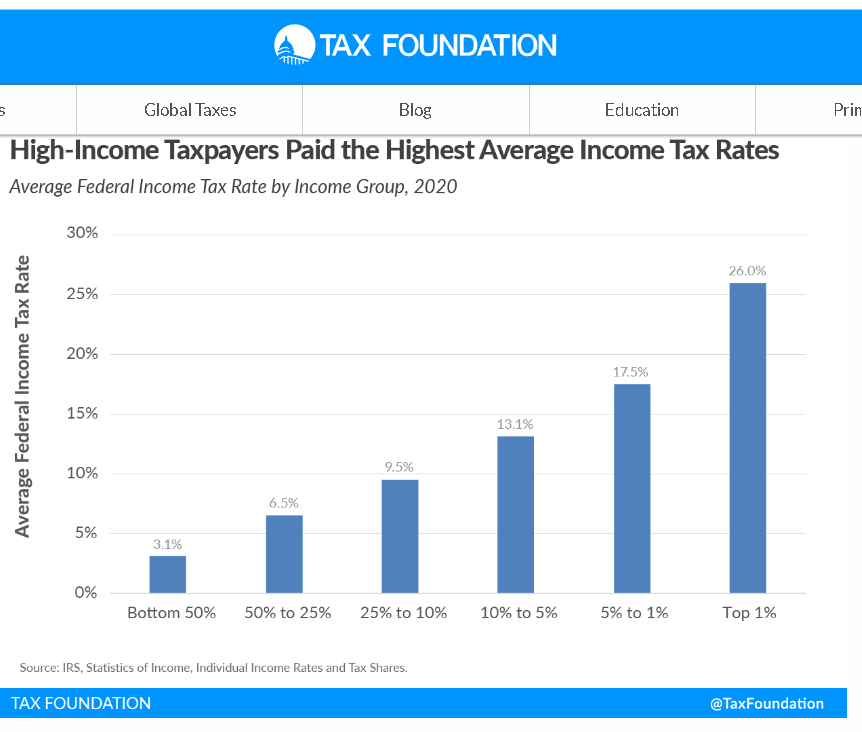

Looks like the buying of politicians i not getting a good return on their investment. Would you care to ever provide any statistic just one to back up your unfounded assertion. https://taxfoundation.org/publications/latest-federal-income-tax-data/#:~:text=High-Income Taxpayers Paid the Majority of Federal Income Taxes,of all federal income taxes. https://www.ntu.org/foundation/tax-page/who-pays-income-taxes -

How the Wealthy Save Billions in Taxes by Skirting a Century-Old Law

Longwood50 replied to Scott's topic in World News

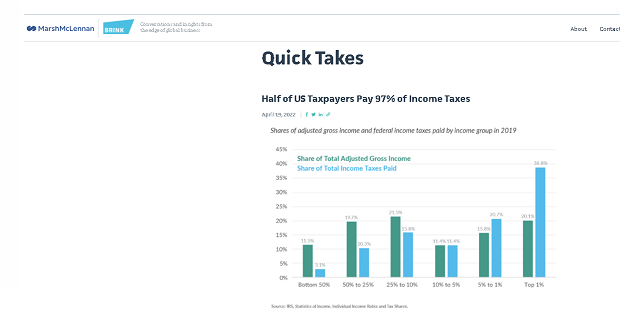

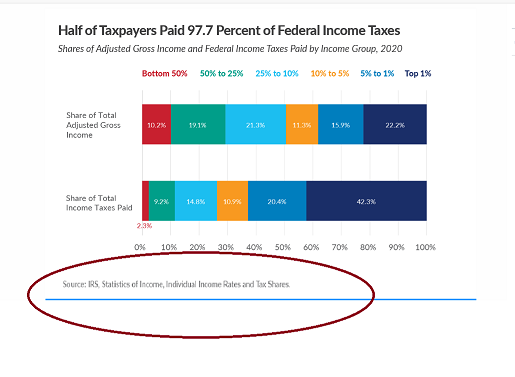

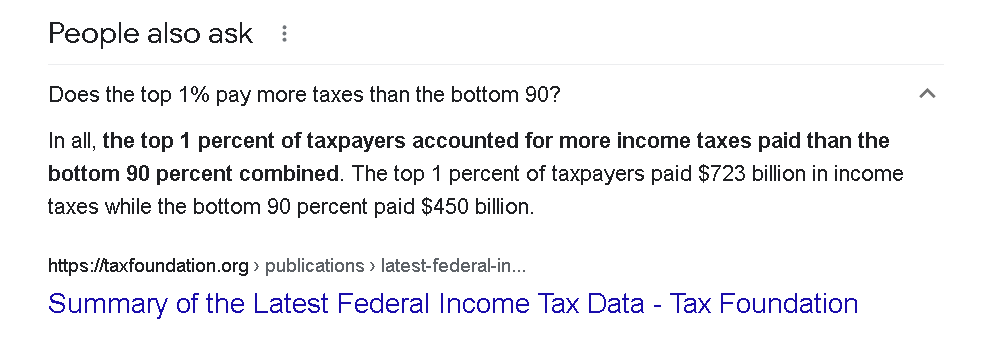

Are another empty platitude backed by of course nothing but the thin air of your mind. If they were so great at creating 'LOOP HOLES' Then tell me why do the top 1% pay more by a great amount then the bottom 90% If they are so great at creating loopholes why is the AVERAGE TAX RATE paid by the top 1% more than 8 TIMES the bottom 50%. You are a product of the refrain, tell a lie, make it a big lie and keep repeating it and eventually people believe it. You believe the wealthy don't pay tax, have loopholes and dont pay their fair share. WHEN ALL THE STATISTICS BY THE IRS SHOW EXACTLY THE OPPOSITE. Google sometime the term, know the truth, see the truth, but continue to believe the lies and see what it says about such a person. -

How the Wealthy Save Billions in Taxes by Skirting a Century-Old Law

Longwood50 replied to Scott's topic in World News

I repeat. Two people earning identical amounts of income and both itemize. The Texan is subsidizing the person in California in allowing him to pay less because he gets to deduct his state income tax. -

I will ask her

-

That is the first I have ever heard of that. I know a number of years ago I had a spike in my PSA which was normally very low even now at 74 it is 2.5. The same doctor I referenced did send me in for a needle biopsy which proved to be negative. Though uncomfortable and led to bleeding for an extended number of weeks, it was worth the reassurance and my PSA did drop back. What you suggested is good advise. Get the biopsy and know what you are dealing with.

-

She is Thai however she has has and continues to eat only salt water sea food and never uncooked.

-

On the brink of collapse? Oh in the USA they are showing those government health programs with "healthcare for all" as the panacea. As Margaret Thatcher once said. The trouble with socialism is that eventually you run out of OTHER PEOPLES MONEY.

-

I know this, I am 74. If I was diagnosed with prostate cancer, I would have to have some really strong evidence that it was imperative that I do something about it. Typically it is very slow growing. However prostate removal leads to incontinence, and impotence. Though better outcomes today than years ago, it is still a real possibility. The radioactive seeds are less invasive however once implanted if they don't work, they preclude the option to remove the prostate at a later date because of the radioactivity. Typically in the USA they do nothing but vigilant watching to see if the cancer is progressing. My GF has a cyst on her liver. They say most of those are there from birth. Though Thai doctor wants to send her for MRI, Mayo Clinic the top hospital in the USA says in the majority of instances the cysts are not malignant and also slow growing and reccomends only to have additional ultra sounds to see if the cyst remains the same size or grows.

-

I am certainly not in a position to give you specific advise on your condition however Prostate Cancer is extremely slow growing. Typically in the USA after 65 they do nothing unless there is clear evidence that the cancer has reached the point where it is likely to spread outside of the prostate. My doctor many years ago told me that even young men coming back from Vietnam during autopsies were found to have the very beginnings of prostate cancer. He said for the vast majority of people they will die with the cancer, not from the cancer. He also said that modern medicine had created a dilema. It had allowed physicians to see conditions very early but that presents the dilema. What do you then do. The vast majority of time treatment is worse than the disease. The removal of the prostate, or radiation has significant side effects. He stated in most instances vigilant monitoring was the best course for you were far more likely to die from other causes than the prostate cancer.

-

How the Wealthy Save Billions in Taxes by Skirting a Century-Old Law

Longwood50 replied to Scott's topic in World News

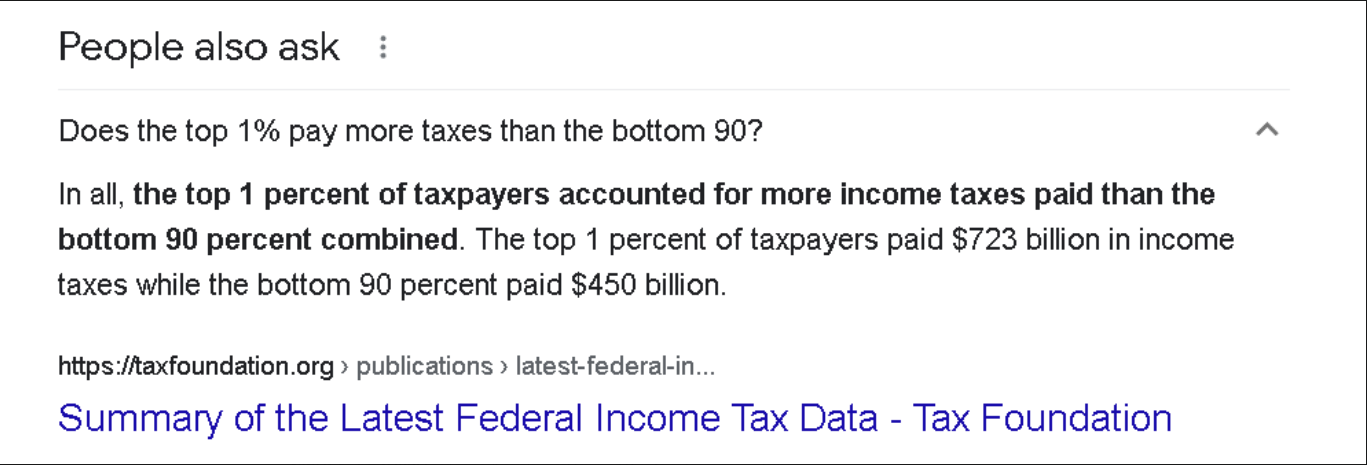

I am not defending them. What I am saying is there is no such thing as a loophole. It is obvious you have no idea how tax loss selling works. IT IS NOT A LOOPHOLE. Example Balmer owns two stocks. He paid $5 million for each. The first one increases in value to $7.5 million and he sells it for a $2.5 million gain. The second one decreases to $2.5 million for a $2.5 million dollar loss. So net HE EARNED ZERO However the law states that unless Balmer sells the stock he has a loss in, he can not declare it on his tax return. So Balmer sells his stock at a loss to offset his "gain" otherwise he would pay tax on his $2.5 million dollar gain when in fact overall he really earned zero from the total of his investments. There are "no loopholes" there are only tax laws. There are no tax havens, off shore accounts, that save people money. The IRS says you must declare any and all income from any and all sources irrespective of how you earn it. Technically a bank robber, drug dealer or a prostitute could be prosecuted for tax eveasion if they did not declare their earnings. This idea that the wealthy don't pay their fair share of taxes is a myth that is peddled to garner votes from those who are not in the 1% and there are more of them. The top 1% of earners in the USA pay more than the bottom 90% combined. Use google it can be your friend. So in terms of jobs and tax revenues you want More Billionaires not fewer. You are showing your class envy despising those who are successful. https://taxfoundation.org/publications/latest-federal-income-tax-data/#:~:text=In all%2C the top 1,90 percent paid %24450 billion. -

How the Wealthy Save Billions in Taxes by Skirting a Century-Old Law

Longwood50 replied to Scott's topic in World News

I said those who get to deduct their California and New York income taxes are being subsidized. Two people with identical income one in California and one in Texas, both itemize. The Texas tax payer will pay more. The majority of tax payers don't itemize. -

How the Wealthy Save Billions in Taxes by Skirting a Century-Old Law

Longwood50 replied to Scott's topic in World News

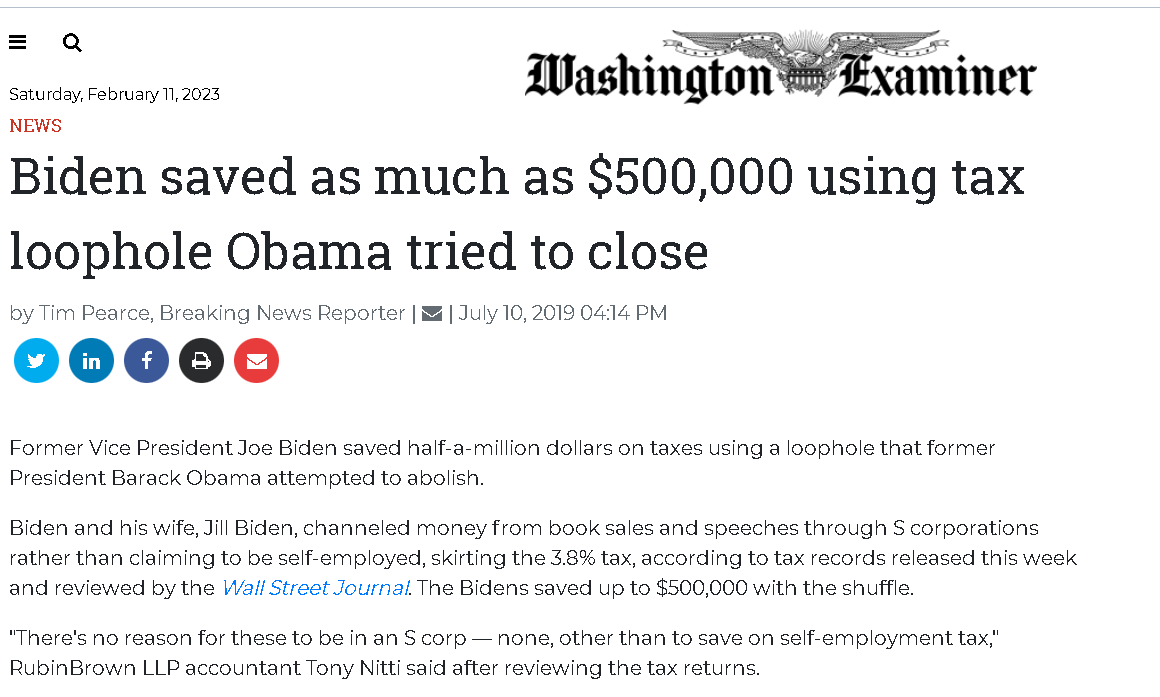

The fact is that unless someone is lying on their tax return, they all are using not "tax loopholes" but rather the legitimate regulations to lower their taxes. A tax loophole could be applied to a 401(k) because it reduces the tax owed by someone saving for retirement. It could be a mortgage interest deduction that is not enjoyed by someone who rents versus owns their home. It could be someone from a high tax state like California, or New York being able to deduct their state income taxes but the person with the identical income living in Florida or Texas pays no income tax so in effect they pay more to subsidize the deduction given to the person living in California and New York. Now with Balmer it is highly unusual to have two virtually identical securities. He sold the security and took the loss. That loss only can be used to offset a gain. He really only delayed not avoided the tax. The loss meant he paid more for the stock he sold than it was worth. The stock he replaced it with was with a lower cost basis. So assuming the stock rises in value, he will then owe the taxes on the gain. He avoided nothing. He only deferred when it would be paid. This only works if Balmer had sold stock that had "gains" So what he did by selling the stock he was able to write off his losses but only to the extent that he had gains in other securities that he make a profit on. So he paid his taxes on his gains minus the losses in the securities he sold. Nothing unfair at all about that. Would you have him pay taxes on his gains but not write off losses. This wash is nothing just for the "rich" Each December millions of investors sell securities that they have a loss in to offset gains. Again, all that does is change the timing of when future taxes would be paid. It is called tax loss harvesting and the majority of it occurs in December each year as investors sell their losers to avoid paying the capital gains tax on their winners. They still pay taxes on their net gain, and net losses are limited to a $3,000 limit against ordinary income. Even Biden funneled his book revenue into a Sub Chapter S corporation thereby saving $500,000 in taxes. In a Sub Chapter S the payroll taxes are based on your "salary" not the income of the corporation. The earnings of the Sub Chapter S would still flow to his personal tax return and he would pay income taxes on them, however his payroll taxes were reduced by upwards of $500,000 because he only paid those on what he stated was his salary not the earnings of the corp. Now is that a loophole? No, it is a legal method that is part of current U.S. tax law. Don't like the practice whether that is tax loss of securities or Sub Chapter S treatment. CHANGE THE LAW Don't crab about people who use the regulations to lower their taxes. https://www.washingtonexaminer.com/news/joe-biden-saved-as-much-as-500-000-using-tax-loophole-obama-tried-to-close -

Your experience is identical to mine. Of course being a former banker I know a bit where to push and show them that Bangkok Bank has done it for me previously or as in the most recent case, that immigration supplied a copy of a letter on Bangkok Bank letterhead detailing how to complete the required letter. However it is much too time consuming and annoying to have to do battle each time I go in. What amazes me, is yes if what was being asked was out of the ordinary, I can understand why the bank personnel might not have encountered it previously. However with non-o visas the bank must run into requests from foreigners each and every day. Yet when you ask, you get this look on the bank personnel as if they have just had a lobotomy.

-

I live in Pattay and use the Bangkok Bank Pattay Klang office. This is a typical example of going to a differnet branch and getting different answers and more importantly going to Chonburi Immigration versus immigration in other provinces. The Chonburi Office was adamant that they require for those using monthly 65,000 baht method a 12 month bank statement, and a letter from the bank detailing by date the transfers for the same 12 month period. I showed the officer various confirmations such as from Wise, and even those supplied as a sample confirm from Kasikorn and he said no. Only a single piece of paper, and it must contain all the transfers from the 12 month period. No mulitple papers from the bank or Wise.

-

I am told that is true for transfers going to Kasikorn and Bangkok Bank but not true for SCB because they go through some bank intermediary who gets the transfer from Wise and then transfers it to SCB. I don't know for certain this is true, but the person who told me sure seem to be very knowledgeable on the subject.

-

Again that is due in part to different levels of expertise and different managers not different ownership. You can go to multiple immigration offices and likewise the rules are different. That does not establish that each is an independent entity and not part of the Thai government. I have Googled Thai Bank branches and franchises. Nothing suggests they are independent entities

-

I think you are talking about overseas organizations starting a "branch" here in Thailand. Not a branch bank. All of the branch banks in Thailand have reporting structures that lead to the parent bank. That would not be true if it was a franchise. Also, any of the income from the branch would go to the franchisee who would only pay a franchise fee. Those results would not show up in the financial reporting of the parent corporation. Each of the franchisees would be required to establish a separate corporate identify with capital. They are their own company and they operate independently. If I have a McDonalds franchise, I pay McDonalds but I have my own company that owns the location. That would mean each branch bank in Thailand if not owned by the parent would have to file a separate business with the DBD. Each office would have to have its own corporate board, and file annual reports. Nope, I think you have an apples to oranges comparison. You saw the name branch and assumed it was a branch bank. I can have a company in the USA that sells farm implements and offer franchises to others to start a branch in Thailand that sells them. Totally different animal.

-

Perhaps, I have to do a bit more checking. The one Kasikorn Bank said only a specific branch bank could do the letter. I doubt that. I have found when someone doesn't know here in Thailand they just try to pass the Old Maid card by saying no they don't do it but yes another office can. If I find it is only a specific Kasikorn office that is no different than what I have now with Bangkok Bank. If Kasikorn says they can do it same day that means only one trip instead of three.

-

Not really difficult and the difference is typically more than 1%. I set a rate on Wise to make an automatic conversion which is something you can not do if you transfer directly to the bank. You get whatever rate is the banks "buy" rate on that day and that time. With Wise the rates move throughout the day. You can either manually process the conversion when the rate goes up or as I do set it to do automatically. The foreign exchange conversion is a money maker for the banks. They want obviously to pay as little as possible to buy your currency and charge you as much to sell it back to you. Nothing wrong with that it is a business but Wise gives you more for your currency as a mid market rate on any given day than the rates quoted by the banks.

-

I don't believe the two 6 month statements would work. As I understand it, they can only get the past 6 months worth of transactions. If I went to the bank after 6 months and got a statement and then waited for another 6 months the first statement would be stale dated. The statements are good for only 7 days. Also that still does not eliminate the letter that must look exactly like this. Even if done perfectly, I have to travel 30 minutes to my branch wait in line and order the statement. I then have the same return trip. The following week I get the pleasure of another 1 hour round trip to pick up the statement and then order the letter. If they are willing to type it up for me same day, I have the delight of spending my afternoon in the Bangkok Bank branch. If not, like this year, I get to pick it up the following day making it another 1 hour roundtrip not including the wait time in the branch.