K2938

-

Posts

569 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by K2938

-

-

8 hours ago, ballpoint said:

As I said in (one of the many) the tax thread(s), I have the same issue. My fund managers send me an annual statement showing the earnings of each fund for that year (from dividends etc), which I get reinvested, but these rarely surpass USD80k. The true earnings are the combined gain in unit prices, which almost always do exceed that amount. But, until they are actually sold there is no proof of this gain, other than me showing the total value of the funds from year to year - which would be complicated due to the number of them. In any event, this wouldn't be classed as a capital gain, unless I actually sell USD80k worth of them. I suspect that even if I did so, they'd want to know that the amount was sustainable annual income, which would lead me back to the problem of showing the annual total increase in value of my holdings. I can easily see that, by trying to follow the Wealthy Pensioner proof of income method, my loss of investment from annually selling more funds than I need to, or remitting USD250k of my capital to Thailand, would end up greater than any taxes I'd be paying here. Maybe one day, when I'm not so interested in growing my holdings and am more interested in keeping things simple no matter the (affordable) cost, I'll jump through their hoops, but as I'm still under 60, that will be more than a few years from now.

In the back of my mind, there's also the nagging suspicion that one day this, or a future, government will change the tax laws making LTR holders liable for tax, and taxing all overseas income, in line with other countries. Having provided documents proving that one earns at least USD80k per year, it would be very hard to wriggle out of paying taxes on that. No doubt this paragraph will be jumped on by LTR holders, and there's nothing what so ever to say that both those things will happen, and I strongly hope it never does, but it's not as if governments in general, and the Thai government in particular, haven't back tracked and broken promises before. The Australian government is doing it right now with their proposed changes to what constitutes tax residency, and redefining non-taxable Australian property. If I could easily get an LTR here, with no change in my current investment scheme, then I would, but if I'm going to be weighing up gains and losses through complying, then I'd rather stay under the radar until I reach a definite conclusion.

1) The problem with relying on capital gains is also that at least once every few years markets fall. And so your gains might not really exist in a year of relevance.

2) The dividend yield on Western equities is generally in the area of 1.5%-2%, in the U.S. currently even lower. So for 80k USD income without capital gains you would need an equity portfolio value of at least 4-6 MM USD. Not sure if disclosing such big amounts necessarily increases your safety in Thailand.3) Maybe think of the Thai Elite/Privilege visa instead if you feel uncomfortable with the disclosure requirements and have the money.

-

1

1

-

-

3 hours ago, stat said:

Even if translated not sure if they will accept it, as a German tax document is very complicated and even for a native speaker and tax professional like me difficult to understand if you do not know where each line item came from and what it entails.

For example capital profit will be in different line items and charged with losses from previous years etc.

1) So your chance to write an accompanying note explaining everything in a very easy to understand way.

2) Do however not get your hopes up too high about capital gains. If they are significant, the BOI does not very much like them regardless of what is written on their website. But you can try and see what happens.

-

- Popular Post

- Popular Post

4 hours ago, stat said:It would be interesting to know if they accept an abundance of monies i.e. 1-3 Millions Plus USD as enough, even if you can only show 60K USD passive income as this video with a BOI official suggested at 14:05 following. She stressed it should be in an 401K plan but there is no such thing in a lot of countries. Any experiences? Thanks!

The BOI solely looks at income, not assets. So if you were a tech billionaire with stock worth billions, but without any current income, you would not make it. From an economic point of view this is of course not very sensible, but these are the rules. Period.

-

1

1

-

1

1

-

2

2

-

7 hours ago, James105 said:

Do people use agents typically for this or just go straight to BOI and submit the documents etc? Is there any advantage to using an agent to get the aforementioned ducks in a row and get this over the line?

An agent will charge you several times more than the value he or she adds which is generally marginal.

-

1

1

-

-

9 hours ago, Mike Teavee said:

The < 180 days in Thailand will work, but there is an outstanding question around whether income/gains accrued whilst you're Tax Resident in Thailand, will be taxable even if remitted it in a year where you're not Tax Resident?

All the scenario tables by the various international accountancy firms I have seen solely focus on whether the income was accrued while you are a tax resident in Thailand or not and do not at all focus on if at the time of remittance you are a Thai tax resident or not (see for example https://www.mazars.co.th/insights/doing-business-in-thailand/tax/revenue-department-s-guidance-on-foreign-income, same e.g. EY). So why should the latter be relevant? Do you have any reputable source saying this?

-

9 hours ago, Mike Lister said:

It seems to be so. Just make sure all the funds were earned before 1 January 2024 and that includes interest.

Well, these funds presumably continue to yield income after Jan 1, 2024 and then the interesting - and so far unanswered question - is how to delineate what is old and new if both old and new funds are in the same account/investment/etc.

-

1

1

-

1

1

-

1

1

-

-

3 hours ago, oldcpu said:

Money earned (outside of Thailand) between 1/1/2024 and getting the LTR Visa is not taxable if it is not brought into the country until AFTER one gets the LTR Visa.

There are people who say that is not true IF you were a tax resident of Thailand in the period mentioned (i.e. 1/1/2024 to getting the LTR visa). Who is right I have no idea and probably only the future will show.

-

1

1

-

-

8 hours ago, JackGats said:

My understanding was that it needed to be cash over 12 months, never mind which kind of account (current account, savings account, brokerage account). It then became an issue of showing at least 12 statements of account for at least 12 consecutive months up to the present.

Brokerage account is not acceptable any longer. Only was very eary on.

-

1

1

-

-

3 hours ago, Pib said:

Now if a person ended-up running up a hospital bill say for $50K USD, couldn't pay it due to no health insurance polciy or self-insure capability (i.e., didn't have $100K USD in a bank) and Immigration Police got involved in trying to assist the hospital in getting you to pay your bill, well, Immigration now has justification to cancel your visa since obviously you didn't maintain one of the LTR visa requirements.

So what about if the person could pay the hospital bill and used his $100k USD deposit for this? Depending on how the BOI looks at this in the future, they might well say you failed the requirements as you did not maintain the $100k USD throughout the visa period, throughout the last two years before the 5 year check-up etc. So in the worst case, this $100k USD might well be untouchable.

-

How is the water situation in the apartment buildings in Hua Hin? Water trucks do not really help there.

-

6 hours ago, HerewardtheWake said:

My dilemma is: at over 75, if I discontinue my Pacific Cross policy , and if at some point BoI changes the LTR health insurance rules, I will not be able to get health insurance.

So, is it best to continue carrying the health insurance policy?

If you can at all afford it, it is best NOT to terminate your health insurance. You have absolutely no assurance that the rules for the LTR visa will not be changed tomorrow or that the LTR visa might even be entirely terminated. Health insurance is therefore very important for you.

-

2

2

-

-

2 minutes ago, ArtVandelay said:

If a 50% increase in lung cancer deaths in a decade doesn't inspire a clean up there, then I don't know what will.

Air pollution has got to be worse for children, whose lungs are still developing.

Was also very bad last year. Did anything change then?🤣😱🤣

-

1

1

-

-

On 4/5/2024 at 1:33 AM, stat said:

As for the bigger part I only have shares so I can "generate" income by selling shares whenever I want.

As has been previously discussed in this thread at least in the past the BOI was not very excited about any significant amount of capital gains, especially when these were generated based on your decision vs. the decision of some external trustee. Please therefore kindly update us if you make any progress with this. Thank you.

-

1

1

-

-

EY presentation on tax changes for Thai Privilege:

https://www.facebook.com/watch/live/?ref=watch_permalink&v=1149895986005482

-

1

1

-

-

1 hour ago, Mike Lister said:

I think this may be the difference between investing in an overseas investment fund, overseas, and investing in an overseas fund from within Thailand. It is very clear that any Thai tax resident who invests in a "foreign investment fund or Depositary Receipt", overseas and later remits the income from that profit, to Thailand, is liable to Thai tax. That scenario is the key driver for the new tax rule change, to capture people who have previously avoided tax in that way. I think we can say with great certainty there is no tax exemption associated with that, agreed?

What that leaves is the possibility that investing in a "foreign investment fund or Depositary Receipt" from within Thailand, say via a Thai bank or investment house, is exempt. If that was the case, it will be the first time in over six months of thousands of posts that anyone in all these tax threads has heard of it and it would also make little sense. What that would mean is that making the investment via a Thai bank was a more cost effective way to make the investing, rather than investing offshore directly, but that the Revenue would relinquish any opportunity at tax, on the income. That would also mean that investors are incentivised not to invest in Thai companies but instead to invest in foreign companies. On the upside, such a measure would benefit the SET trading and Thai banks.

A depository receipt is designed to promote domestic trading of international companies thus avoiding the need to invest overseas.

"A depositary receipt (DR) is a negotiable certificate issued by a bank. It represents shares in a foreign company traded on a local stock exchange and gives investors the opportunity to hold shares in the equity of foreign countries. It gives them an alternative to trading on an international market".

https://www.investopedia.com/terms/d/depositaryreceipt.asp

The following link is from the SET which shows the tax on domestic equities acquired in Thailand. Whilst it is possible to escape capital gains, it is not possible to escape with holding tax on interest or dividends. If it is true that investing in a "foreign investment fund or Depositary Receipt" inside Thailand, escapes all tax, I'm left asking, why?

https://www.set.or.th/en/market/information/tax

There is a final possibility that I can imagine and that is that the article is not complete and isn't adequately specific about what that exemption might involve. I can imagine there might be some classes of DR or investment funds that might be made tax exempt, BOI related companies is one. But the idea that all foreign funds are exempt, doesn't seem credible.

If anyone can see any other likely options, I will be interested to hear them.

I am glad you now agree that it appears to be very strange what Siam Legal is saying.

-

1

1

-

-

2 minutes ago, Mike Lister said:

What that says is that there is an exemption from Thai tax, as long as the funds remain overseas or the taxpayer is not Thai resident. So no, it's not contrary to anything else at all.

No, they are saying there is no taxation as long as one of the three conditions mentioned by them below is met, namely either not tax resident OR not remitted to Thailand OR foreign investment. So according to them a foreign investment on its own would be sufficient to avoid taxes.

-

Siam Legal appears to claim that investing in a foreign (non-Thai) investment fund or depositary receipt is tax-free even for Thai tax residents who bring the income back into Thailand:

“However, there is an exemption from being subject to income tax in Thailand by meeting one of the following conditions:

-

The individual must not reside in Thailand for 180 days or more in a particular tax calendar year.

-

Invest on a foreign investment fund or Depositary Receipt.

-

Does not bring an income from overseas into Thailand.“

(https://www.siam-legal.com/thailand-law/thailand-new-tax-on-foreign-income-an-overview/ )

This seems very strange and contrary to everything else written on this at least as far as I have seen. Any thoughts?

-

1

1

-

The individual must not reside in Thailand for 180 days or more in a particular tax calendar year.

-

18 minutes ago, Northstar1 said:

Great place to retire!😂🤦🤷🏻♂️

still those that defend it. Must have made the mistake of buying there!As you will die much earlier because of the air pollution, you have much more money in each of the years still left. Simple mathematics 🤣

-

- Popular Post

- Popular Post

3 hours ago, hotchilli said:While I agree that a percentage of pollution comes from vehicle emissions I'm positive the bulk of it comes from construction sites, infrastructure projects and crumbling old concrete structures and buildings.

The key driver is not infrastructure projects, but fires. And these could largely be controlled if there were the political will to do this. But nobody cares unfortunately.

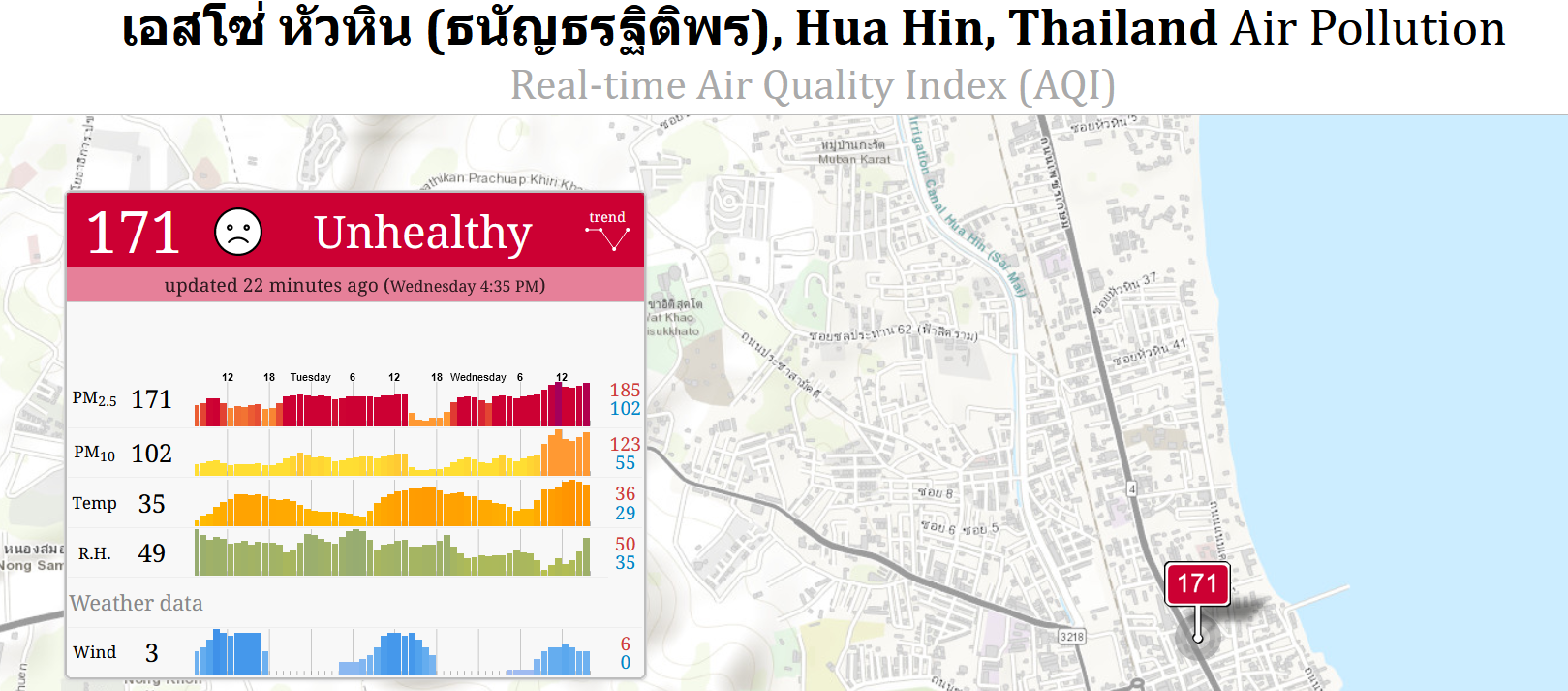

The picture shows real-time data

-

1

1

-

2

2

-

5 hours ago, jvs said:

Not only in Bangkok,i have never seen it this bad in Cha-am.

Went out shopping this morning and the hills we can normally see very clearly are not visible at all today.

Sore eyes yesterday already and even worse today.

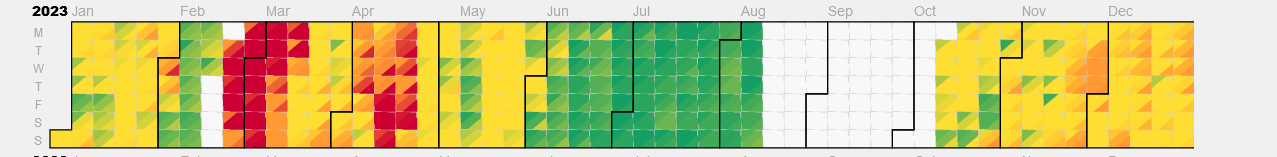

Sadly, if you value your health, things have deteriorated so far in recent years that you now better also decamp to somewhere else Feb-Apr even if you live in Hua Hin / Cha-am

-

1

1

-

-

20 minutes ago, Polar Bear said:

DENV 1 used to be the most common in Thailand, followed by DENV 2, then it switched, and DENV 2 became dominant. DENV 4 is usually the least common everywhere, but it is also potentially the most serious and the one most likely to cause hemorrhagic fever in a subsequent infection. Also, for unknown reasons, people seem to be more susceptible to DENV 4 after having had a previous infection of another strain. DENV 4 is still the least common strain in Thailand, but it's rising and fast, and Bangkok is considered to be one of the highest-risk locations for it globally. There are at least 3 different genotypes of DENV 4 circulating in Bangkok.

What is the source of your statement on DENV 4? I am not at all saying that it is not correct, but I have for example seen a Thai study from 2010 which says the opposite:

"DENV-2 appears to be marginally associated with more severe dengue disease as evidenced by a significant association with DHF grade I when compared to DENV-1. In addition, we found non-significant trends with other grades of DHF. Restricting the analysis to secondary disease we found DENV-2 and -3 to be twice as likely to result in DHF as DEN-4."

(https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2830471/ )

See also this from Brazil: https://bmcinfectdis.biomedcentral.com/articles/10.1186/s12879-016-1668-y ("The present study found that cases of DENV-2 had a higher proportion of severe dengue than among those of DENV-1 and DENV-4") -

3 hours ago, oldcpu said:

With perhaps, the exception of the LTR allowing one to self insure for Health insurance. Being able to show the equivalent of $100K US$ in cash, in a bank account anywhere in the world,

True, but even there the BOI appears to be kind of immune to economic logic. If you show them a brokerage account worth a zillion dollars, they will say this does not meet the self-health insurance criteria since it needs to be in cash even if you could easily sell the shares at any time or take out a margin loan against them hugely exceeding $100k USD. Also, they even reject if the $100k USD in cash is in a brokerage account in cash, insisting it needs to be a bank account as far as I know. So they just love to tick boxes and if the situation does not fully meet this they will reject things even if they are economically vastly superior.

-

1

1

-

-

1 hour ago, MistyBlue said:

"Greeting from LTR Visa Unit.

If your income does show in your tax report such as SA100, then it is possible to accept it as part of your passive income."As only the interest part of a purchased annuity shows up on a UK SA100 tax return (a tiny % of the overall income amount of a purchased annuity) then it would seem to rule it out.If there are any reports in the field of anyone applying and attempting to use a purchased annuity would be interested hear of experiences.I would recommend you to talk to them again about this. They should accept an annuity. Regarding their answer whoever wrote this just did not get that since this is already your money, you of course will not pay tax on the capital part being returned to you. Point this out to the BOI - politely - and see what they say. Best to visit in person if that is possible for you.

If you need an additional argument, tell them that they also accept Roth IRAs in the U.S. as far as I know and they are also tax-free.

P.S.: The only problem with annuities is that they tend to be awful investments. But that is a different topic.

-

Try Malaysia. The problem in Thailand is that government hospitals probably will have a long waiting list and private hospitals might well charge you more than in many Western countries outside the U.S. So just search on Google and you will find a lot of good offers in Malaysia.

LTR Visa is Now available for Long Term Residency

in Thai Visas, Residency, and Work Permits

Posted

Correct