- Popular Post

K2938

-

Posts

413 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by K2938

-

-

14 minutes ago, Hiane said:

Maybe I wasn't specific enough, I'm talking about offshore money that hasn't been taxed. As I understand, until the end of this year I can remit it into Thailand tax-free, and starting January 1st 2024 this won't be the case anymore ?

Only if (1) either you are not a Thai tax resident or (2) if the remittance does not contain any income from the current year. Otherwise you will also have to pay taxes on remittances in 2023

-

12 minutes ago, TroubleandGrumpy said:

IMO the best strategy is to wait and see what deveops during 2024. It will be June 2024 before anyone becomes a tax resident of Thailand, and it will probably be later in 2024 that the Thai RD has provided all the details and processes. A tax return is required to be lodged by end March 2025 - so it will be quite some time after that before the Thai RD starts investigating/chasing people (Thais and Expats). There is lots of time to pack the bags and get out of Dodge if this thing goes sideways.

Yes, nothing you can really do at the moment, though if you want to avoid tax you really need to make preparations to leave by June 2024. The worrying thing concerning foreigners however is that they do not really have a lobbying organisation making their voices heard and I doubt that the Thai government reads aseannow.com to find out what they think. So while foreigners are the unintended collateral damage in all this, they might well stay there for lack of voice.

-

- Popular Post

- Popular Post

7 minutes ago, Conno said:Regarding the noose tightening, totally and it's a global phenomena lets not forget that. The reality is we live in a society and financial system that is designed with an architecture that perpetuates poverty for the majority. Taxes and inflation are the primary drivers of that. Let's face it, the current fractional reserve fiat money system is completely broken, overburdened with debt. What we are currently discussing here is just a local symptom of a very global problem.

No, Thailand would be much worse. Truly rich people primarily live on income from investments with capital gains being the key driver of their wealth. Capital gains according to most double taxation agreements are taxed in the country of residence, so no double taxation agreements will help to avoid Thai taxes. And the Thai tax rate of 35% will be much higher than capital gains are taxed in many other countries where there are preferential rates for capital gains or, in some countries, capital gains are even tax free. So unless one has a very strong family reason to be in Thailand, no truly rich foreigner would in the future choose to move to Thailand.

-

3

3

-

1

1

-

2

2

-

- Popular Post

- Popular Post

2 hours ago, Dogmatix said:Not just Thai Privilege/Elite. The million millionaires courted by the previous government with LTR visas now looks even more doubtful. They have an tax exemption via a Royal Decree from the date they get their LTRs but another Royal Decree could easily eliminate that in the interests of “fairness and equality” and the current exemption is not enough for many of them to be able to invest in condos etc without paying 35% remittance tax. They can just blame the Prayut government for any fall out from the LTR visas.

If capriciousness of this government is not scary enough, Move Forward Party is waiting to get into power with real social welfare policies, as opposed to Thaksin’s wasteful one-off vote buying schemes. Appalling economic management and atrocious public education for decades now condemns Thailand to permanently sluggish growth, desperately depending on low end Chinese tourism. It is impossible to generate enough tax revenue for the welfare expectations created by politicians without hugely increasing the tax take by whatever desperate means come to hand including a large increase in VAT m, first to 10% and then to European levels and wealth taxes, capital gains tax etc. The noose is tightening.

So the smart thing would be to exempt foreigners from the taxation of foreign earnings just as the Philippines does ("Resident citizens are taxed on their income from all sources. A person who is not a citizen of the Philippines (that is, someone who is defined as an alien), regardless of whether the person is a resident or a non-resident, is taxed only on the individual's income from Philippines sources."). But who knows what will happen.

-

7

7

-

2

2

-

2

2

-

1 hour ago, Antti said:

The Elite Visa program was rebranded as Thai Privilege Visa and relaunched 1st of October. On the website in the FAQ section it says:

Do I have to pay income taxes in Thailand as a Thai Privilege visa holder?

The Thai Privilege Visa is a privilege visa which falls under the special tourist visa or privilege entry category. The Thai Privilege Visa holder does not need to pay income taxes especially when the income was derived abroad. There are instances where a Thai Privilege Visa holder may voluntarily pay income tax in Thailand.

You are misled by an agent website. As you might know agents make a lot of money in commissions from selling Thai Elite visas and therefore have a great incentive to tell you anything to close a deal. You will NOT find these statements on the OFFICIAL website of Thai Elite. They are WRONG.

-

1

1

-

-

4 hours ago, TroubleandGrumpy said:

IMO there are only three viable countries for most Expats - Malaysia, Philippines, Indonesia.

Why is Indonesia attractive from a tax point of view, please?

-

5 hours ago, Dogmatix said:

For a PM and finance minister from Pheua Thai, a party that prides itself on upholding democracy and democratic principles, to support this arbitrary style of imposing illegal changes to long standing laws rather than going through proper parliamentary procedures is nothing short of extraordinary.

Well, they need the money to fund their electoral gifts and would not have the parliamentary majority to do things properly as was pointed out in various commentaries

-

1

1

-

-

3 minutes ago, Dogmatix said:

My point was that ในปีภาษีที่ล่วงมาแล้ว could mean "in the previous tax year" or "in a previous tax year" because Thai has no definite or indefinite articles. However, if parliament had intended it to mean taxation of income in prior years going back to the year dot, they would surely have made that clear by saying something saying similar to the wording used in 161/2566 to clarify that it meant in any previous tax year whatsoever. As you know Thai officialese never uses one word when 10 words would better convey the meaning. In fact, if parliament intended open ended taxation of past earnings, there would have been no need to even mention "previous tax year". They could have just stated that foreign sourced income is taxable. but using the phrase "in the previous tax year" was logical because it was consistent with local income from the previous tax year that has to be declared in annual tax return forms.

I can't find Resolution 2/2528 (1985) but its existence to clarify that the Article 41 only referred to the previous tax doesn't appear to detract from the interpretation that parliament only intended to tax to tax the previous tax year, rather the opposite. At any rate Kittipong makes a good point that principles of taxation dictate that in cases of ambivalence in tax law, tax authorities should make interpretations in favour of tax payers.

-

40 minutes ago, ballpoint said:

I get around the current laws by transferring my money to an offshore holding account prior to the end of the year, then remitting it to Thailand at the start of the next year. I am thus able to show that the money was in the holding account on January 1st, and no further money was deposited into that account prior to my Thailand remittance.

Thank you for sharing the excellent advice you got from your tax advisors. Now separately from this, just in case the current system remains, why for your remittances do you take the intermediate step via the "offshore holding account" and not just transfer directly whatever you want to transfer from abroad on Dec 31, meaning that the money will arrive in the following year then anyway without the "offshore holding account"?

-

45 minutes ago, freeworld said:

Not strange at all. Some countries require worldwide income to be declared if one is tax resident.

But NOT if they only tax REMITTED foreign income as is the case in Thailand

-

21 minutes ago, moogradod said:

It is actually @TroubleandGrumpy who said this, but lets assume that you really did not pay tax for lets say a few years, 4, 5. Do you then think it is better before December 31, 2023 to approach the RD to declare that instead of occasionally get caught in 8 years if this seriously worries you ? It could well be that many are in this situation. I have even heard the story (nothing but rumour of course) of someone who wanted to declare this pension but was sent home by RD. They said at the time it was too complicated for them to verify when what was paid when and did not even provide him with a tax ID. But this may be just a story (which I can hardly really believe I must admit).

Do not do anything like this before there is full clarity on what is going to happen and what the detailed implementation rules will be. Otherwise you might seriously hurt yourself. Also doubt that this information will be available before the new year.

-

1

1

-

1

1

-

-

1 minute ago, TroubleandGrumpy said:

"The new rules state that if you spend more than 180 days in Thailand per year, you will be required to declare all of your foreign income, regardless of when it was earned or whether it was remitted to Thailand. This is a significant change from the previous rules, which only required you to declare foreign income that was remitted to Thailand. The Thai Revenue Department is still working out the details of the new rules, so it is not yet clear what additional paperwork or translations will be required. However, it is important to be aware of the new rules and to start planning for how you will comply with them."

Very strange about declaring ALL income if it is not remitted and not sure what the purpose of that should be. If you do not mind the question, may I ask if this was from a highly reputable tax firm, like one of the Big 4?

-

1

1

-

-

3 minutes ago, mokwit said:

My understanding is if you are here for 180 days+ BUT are not eligible for taxation e.g. because you have been transferring money in the year after it is earned you strictly speaking do not have to register - you are kind of on your honour to register if you have taxable income.

True, but I interpreted your question such that you wanted to ask if by not having a TIN you could avoid violating the new tax rules. And that would not be the case.

-

1

1

-

-

3 minutes ago, mokwit said:

What if under CPR or just anyways Thai banks insist on a TIN to open or MAINTAIN a Thai bank account? Anybody not already registered for tax would have to register for tax in order to maintain the account and be able to present a bank book at extension time.

SCB ALREADY requires a TIN to open a new account for foreigner apparently. There is always the risk that could be extended to existing accounts.

Views?

It does not really matter since not having a TIN does not spare you from taxation. Some people have mentioned this, but this is just an illusion. If you entered Thailand legally which I assume, the Thai authorities know about you and can find you. Having a TIN facilitates things for the Thai authorities, but not having one does not really save you.

-

- Popular Post

- Popular Post

33 minutes ago, Bosm88 said:Hello,

I’m new to the forum and joined primarily because of this topic.

Just recently applied for the Elite Visa prior to the September 15th deadline and now I am unsure how to proceed when I receive the approval letter.

From my prior research, Elite Visa holders were not required to pay foreign income tax as residents (seemingly even for income earned/transferred within the same tax year.)

Curious if anyone expects this to change as it relates to Elite Visa holders?

If so, would it be possible to avoid income tax by paying for bills/purchases directly with foreign credit cards/bank accounts?

Thanks in advance for your insights.

1) There is an email from Thai Elite posted about this a little higher up in this thread which you might want to check.

2) Some Thai Elite agents historically claimed that - allegedly - there would not be any tax whatsoever for Thai Elite visa holders, but this was never correct. Thai Elite visa holders only had the exemption for foreign earnings not remitted in the same year of earning like everybody else.

3) With the proposed tax changes this would be over for Thai Elite visa holders just like for everybody else (with a potential minor exception for LTR visa holders of certain foreign income).

4) So if this change is actually implemented, this will have a devastating effect on Thai Elite visa sales since many justified the huge fees by the tax advantages.

5) Since the Thai government makes a lot of money from the sale of Thai Elite visas it is possible that they will exempt Thai Elite visa holders to avoid this money stream stopping. One would imagine that Thai Elite is aggressively lobbying for this behind the scenes, but what the outcome will be nobody knows.

6) You might want to ask for a deferment of your membership until there is clarity about the new rules. And if you are not granted this deferment and tax is important to you, then you might want to pass on the visa.

7) Using foreign credit cards would most probably be tax evasion. With enough effort from the Thai authorities, it would also be possible to trace this. If they will do this or not, again nobody knows yet.

-

1

1

-

3

3

-

- Popular Post

- Popular Post

11 hours ago, stat said:To my understanding all the money I have as principal i.e. cash is covered by DTA as it is existing and all gains have been realized before entering Thailand and so has been taxed in my home country (cash). Different scenario is if I have the money invested in stocks then I am liable to pay income tax on my profit from these holdings. Of course they can demand some nonsense proof which I cannot deliver but in my opinion this should be a safe route.

Just by analogy have a look at these UK rules (shown here even in a simplified way) and you can see that things can get extremely complicated with remittance taxation:

https://pjdtax.co.uk/updates/can-i-transfer-money-to-the-uk/

Of course, nobody knows what the eventual Thai rules will be, but you should expect a bureaucratic nightmare-

3

3

-

1

1

-

1 minute ago, leedm said:

Thanks. On the BOI website it says over 150MM USD in revenue, any idea what that actually means, is it annual turnover or gross or net profit or something else ?

Revenue = annual turnover

-

1

1

-

-

3 hours ago, leedm said:

First question is, will they consider the US companies turnover when determining the criteria.

Initially some people got away with arguing that the ultimate parent company turnover counts. But the BOI then changed this and did not allow it any longer. So unless the BOI has changed its practices again, that would unfortunately mean a no for you.

-

5 hours ago, Ben Zioner said:

Yes, and my gut makes me think that once they've explored all ramifications of their initiative they could come up with a two percent tax on all remittance and cash foreign card cash withdrawals with some tourists queueing at Suvarnabhumi to get their refunds...

Why only 2% if the marginal income tax rates in Thailand for many wealthy people are much higher. 2% would be a gift which will not happen

-

7 hours ago, redwood1 said:

Lets say you have 500,000 dollars you saved in a foreign bank. And you saved a little each year, over lets say 15-20-25 years..

How do you prove that each years deposit was taxed? Well unless your a CPA superman......You will not be able to prove it....

This whole tax plan is like a ship that has sunk before it even got out of dry dock...

That is the whole intention of it???? Technically called contaminated/commingeled/mixed funds. And if you cannot prove what is what which you most likely will not, then all gets taxed. At least that is how it works in some other jurisdictions I am familiar with.

-

1

1

-

-

16 minutes ago, StayinThailand2much said:

Thank you for this. Without wanting to be disrespectful of the article, I would suggest that this is more in the clickbait category. Moreover, the article does not claim that the prime minister said this measure would particularly target foreigners and any potential interpretation of the situation given in this article by the journalist is not what the prime minister said. So rest assured that foreigners are not the target, but the unintended collateral damage. But thank you for posting this.

-

2

2

-

-

1 hour ago, StayinThailand2much said:

The prime minister was quoted as saying that 'foreigners in Thailand are the target due to some "inequalities". (A post on this news forum quoted a related newspaper article a few days ago.)

I do not recall this and it would be silly since taxing the few foreigners will not lead to huge tax revenue. Can you please check the quote you refer to and post it here, if it exists? The only thing which the prime minister said I think is (quoted from Bloomberg):

“Some people may not be happy that I am digging in to this area, but inequality is a big issue,” Srettha said, referring to the growing wealth gap because of tax loopholes. “The principle of tax is that you must pay tax on income your earn no matter how you earn it.”

So nothing about foreigners. They are not the prime target, but the unintended collateral damage.

-

2

2

-

-

- Popular Post

- Popular Post

17 minutes ago, Dogmatix said:The LTR visa came from the previous government and in particular was the brainchild of ML Chayothid who was an advisor to the energy minister who pushed this project at the cabinet level for him. Chayothid was hoping for a ministry or at least a deputy minister role in this government with UTN but unfortunately was left out in the cold completely. So there is no champion for the LTR policy in this government and the BOI, which runs it is under the PM’s office. Of the million LTRs targeted by the Prayut government I think they have only bagged a small fraction of that so far, while the government seems focused on low end tourists from China, Kazakhstan et al for the moment.

I don’t see any likelihood of reneging on LTR visas or the Royal Decree at the moment but I can also see them making a fairly restricted interpretation of the Royal Decree. We have already got the interpretation that only income earned after the visa was issued is exempt which is quite restrictive. Srettha and the RD may well feel that the LTR exemption is irksome in that it is inconsistent with his spur of the moment brainfart policy and clearly the LTR exemption would never even have been considered by this government. So I would guess the chances of erring on the generous side in future interpretations of the exemption may be limited.We just have to see how things will develop. Foreigners are clearly the unintended collateral damage in all this. Probably nobody even thought about foreigners when drafting this and if they did, then they did not really realize that the typical foreigner starts with all his or her money outside Thailand while for the typical Thai it is exactly the other way round. So these requirements are much more onerous for foreigners and moreover foreigners have it much easier to escape from all this by just leaving Thailand which is not really an option to the average Thai. So while it is entirely possible that the doomsday scenario will happen, it is also entirely possible that foreigners will be either entirely carved out from this once the authorities had a chance to think through this or there will be so wide loopholes for foreigners that it will not really be very onerous for them. We just have to wait and see how things will develop.

-

2

2

-

1

1

-

2 hours ago, MistyBlue said:

I inadvertently phrased my response as a question rather than a statement, apologies I wasn't asking a question.

I disagree with your interpretation. Thailand does not have a remittance tax. It has a tax on income that is earned in an assessable year whilst a tax resident, which is then payable when that income is remitted to Thailand (this is not the same as a remittance tax and may not actually end up being payable depending on the tax treaties). This seems consistent to me with the BOI responses being quoted, I just think you're interpreting the responses incorrectly.

Time will tell...

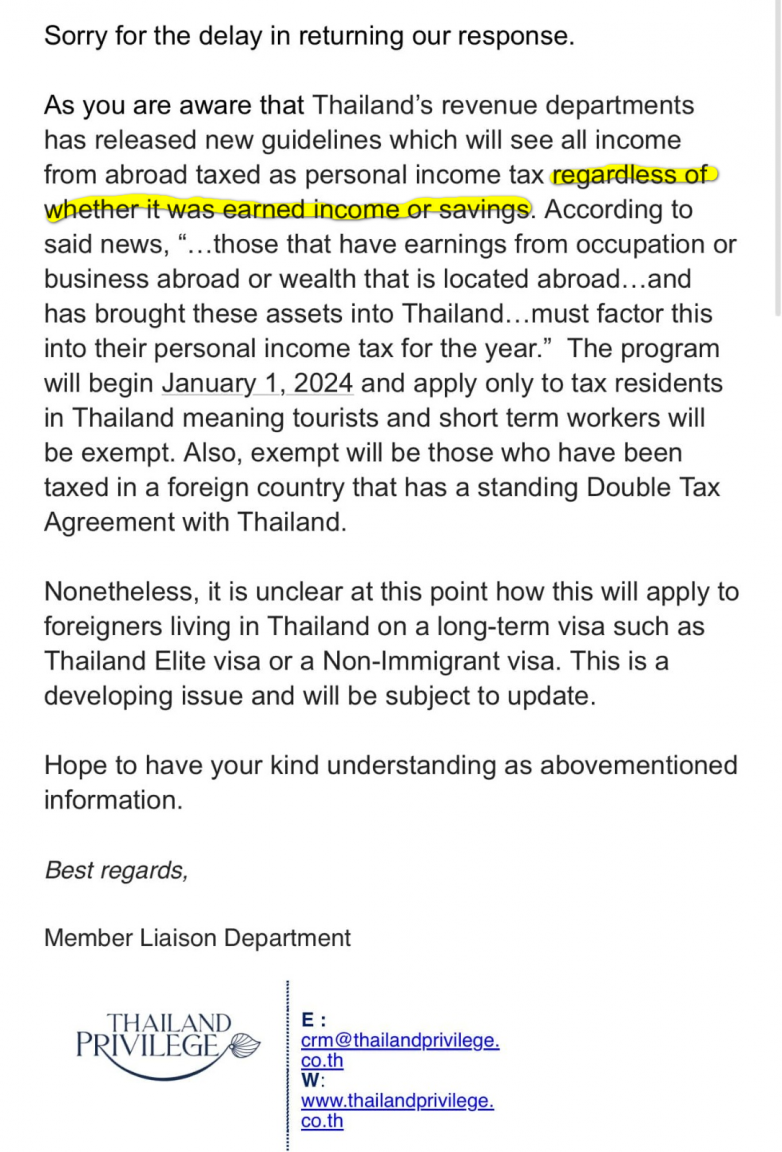

This email from Thai Elite posted by somebody else on the internet by the way also talks about taxation of SAVINGS, but the future will tell...

P.S.: As I am just reposting this, I cannot personally confirm the accuracy of this email, but I do not really suspect that anybody would fake this

-

1

1

-

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Thai gov. to tax (remitted) income from abroad for tax residents starting 2024 - Part I

in Jobs, Economy, Banking, Business, Investments

Posted

Not true according to the extremely narrow interpretation of the law put forward by the BOI themselves which you can read about higher up either in this thread or the LTR thread