- Popular Post

K2938

-

Posts

449 -

Joined

-

Last visited

Content Type

Forums

Downloads

Quizzes

Posts posted by K2938

-

-

- Popular Post

- Popular Post

11 hours ago, stat said:To my understanding all the money I have as principal i.e. cash is covered by DTA as it is existing and all gains have been realized before entering Thailand and so has been taxed in my home country (cash). Different scenario is if I have the money invested in stocks then I am liable to pay income tax on my profit from these holdings. Of course they can demand some nonsense proof which I cannot deliver but in my opinion this should be a safe route.

Just by analogy have a look at these UK rules (shown here even in a simplified way) and you can see that things can get extremely complicated with remittance taxation:

https://pjdtax.co.uk/updates/can-i-transfer-money-to-the-uk/

Of course, nobody knows what the eventual Thai rules will be, but you should expect a bureaucratic nightmare-

3

3

-

1

1

-

1 minute ago, leedm said:

Thanks. On the BOI website it says over 150MM USD in revenue, any idea what that actually means, is it annual turnover or gross or net profit or something else ?

Revenue = annual turnover

-

1

1

-

-

3 hours ago, leedm said:

First question is, will they consider the US companies turnover when determining the criteria.

Initially some people got away with arguing that the ultimate parent company turnover counts. But the BOI then changed this and did not allow it any longer. So unless the BOI has changed its practices again, that would unfortunately mean a no for you.

-

5 hours ago, Ben Zioner said:

Yes, and my gut makes me think that once they've explored all ramifications of their initiative they could come up with a two percent tax on all remittance and cash foreign card cash withdrawals with some tourists queueing at Suvarnabhumi to get their refunds...

Why only 2% if the marginal income tax rates in Thailand for many wealthy people are much higher. 2% would be a gift which will not happen

-

7 hours ago, redwood1 said:

Lets say you have 500,000 dollars you saved in a foreign bank. And you saved a little each year, over lets say 15-20-25 years..

How do you prove that each years deposit was taxed? Well unless your a CPA superman......You will not be able to prove it....

This whole tax plan is like a ship that has sunk before it even got out of dry dock...

That is the whole intention of it???? Technically called contaminated/commingeled/mixed funds. And if you cannot prove what is what which you most likely will not, then all gets taxed. At least that is how it works in some other jurisdictions I am familiar with.

-

1

1

-

-

16 minutes ago, StayinThailand2much said:

Thank you for this. Without wanting to be disrespectful of the article, I would suggest that this is more in the clickbait category. Moreover, the article does not claim that the prime minister said this measure would particularly target foreigners and any potential interpretation of the situation given in this article by the journalist is not what the prime minister said. So rest assured that foreigners are not the target, but the unintended collateral damage. But thank you for posting this.

-

2

2

-

-

1 hour ago, StayinThailand2much said:

The prime minister was quoted as saying that 'foreigners in Thailand are the target due to some "inequalities". (A post on this news forum quoted a related newspaper article a few days ago.)

I do not recall this and it would be silly since taxing the few foreigners will not lead to huge tax revenue. Can you please check the quote you refer to and post it here, if it exists? The only thing which the prime minister said I think is (quoted from Bloomberg):

“Some people may not be happy that I am digging in to this area, but inequality is a big issue,” Srettha said, referring to the growing wealth gap because of tax loopholes. “The principle of tax is that you must pay tax on income your earn no matter how you earn it.”

So nothing about foreigners. They are not the prime target, but the unintended collateral damage.

-

2

2

-

-

- Popular Post

- Popular Post

17 minutes ago, Dogmatix said:The LTR visa came from the previous government and in particular was the brainchild of ML Chayothid who was an advisor to the energy minister who pushed this project at the cabinet level for him. Chayothid was hoping for a ministry or at least a deputy minister role in this government with UTN but unfortunately was left out in the cold completely. So there is no champion for the LTR policy in this government and the BOI, which runs it is under the PM’s office. Of the million LTRs targeted by the Prayut government I think they have only bagged a small fraction of that so far, while the government seems focused on low end tourists from China, Kazakhstan et al for the moment.

I don’t see any likelihood of reneging on LTR visas or the Royal Decree at the moment but I can also see them making a fairly restricted interpretation of the Royal Decree. We have already got the interpretation that only income earned after the visa was issued is exempt which is quite restrictive. Srettha and the RD may well feel that the LTR exemption is irksome in that it is inconsistent with his spur of the moment brainfart policy and clearly the LTR exemption would never even have been considered by this government. So I would guess the chances of erring on the generous side in future interpretations of the exemption may be limited.We just have to see how things will develop. Foreigners are clearly the unintended collateral damage in all this. Probably nobody even thought about foreigners when drafting this and if they did, then they did not really realize that the typical foreigner starts with all his or her money outside Thailand while for the typical Thai it is exactly the other way round. So these requirements are much more onerous for foreigners and moreover foreigners have it much easier to escape from all this by just leaving Thailand which is not really an option to the average Thai. So while it is entirely possible that the doomsday scenario will happen, it is also entirely possible that foreigners will be either entirely carved out from this once the authorities had a chance to think through this or there will be so wide loopholes for foreigners that it will not really be very onerous for them. We just have to wait and see how things will develop.

-

2

2

-

1

1

-

2 hours ago, MistyBlue said:

I inadvertently phrased my response as a question rather than a statement, apologies I wasn't asking a question.

I disagree with your interpretation. Thailand does not have a remittance tax. It has a tax on income that is earned in an assessable year whilst a tax resident, which is then payable when that income is remitted to Thailand (this is not the same as a remittance tax and may not actually end up being payable depending on the tax treaties). This seems consistent to me with the BOI responses being quoted, I just think you're interpreting the responses incorrectly.

Time will tell...

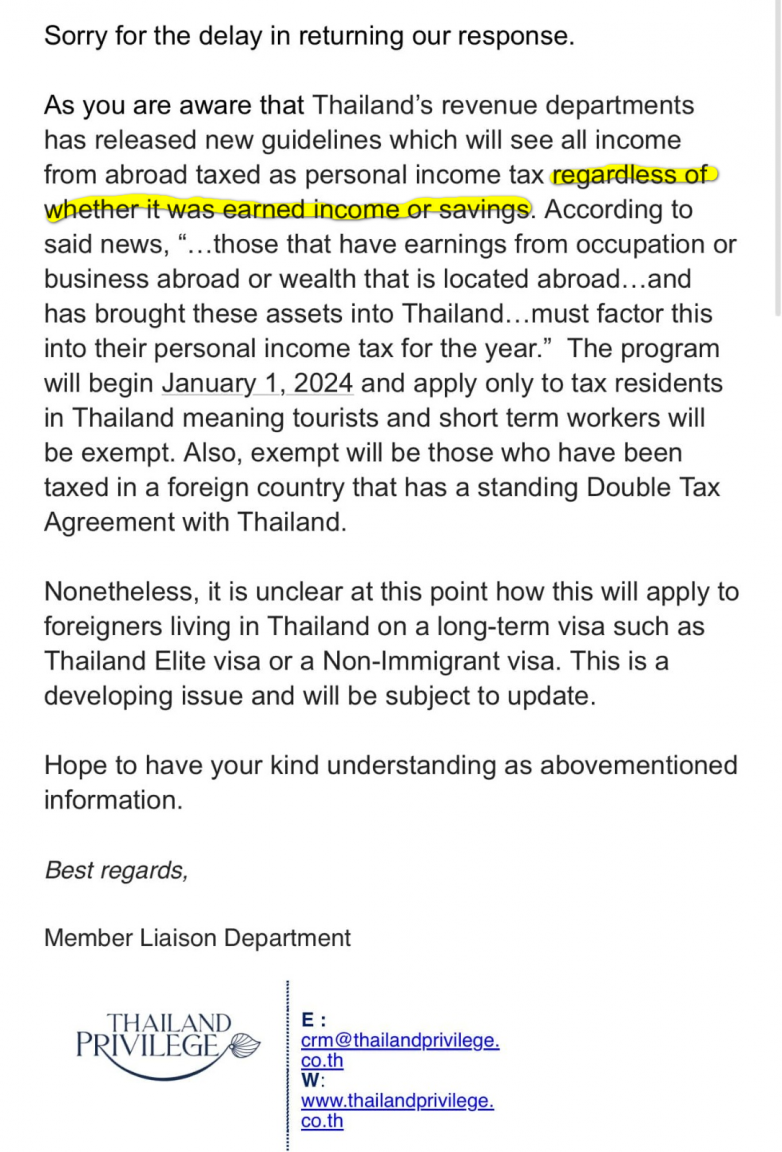

This email from Thai Elite posted by somebody else on the internet by the way also talks about taxation of SAVINGS, but the future will tell...

P.S.: As I am just reposting this, I cannot personally confirm the accuracy of this email, but I do not really suspect that anybody would fake this

-

1

1

-

-

24 minutes ago, MistyBlue said:

But isn't that only if you derive the full 250k (the income/profit etc. that was made excluding initial capital) in the assessable year. You would have to be a tax resident in the assessable year the income was made for it to taxable, it would only be tax on the profit/income made during that assessable year. The tax would then only be paid in the year it is actually remitted.

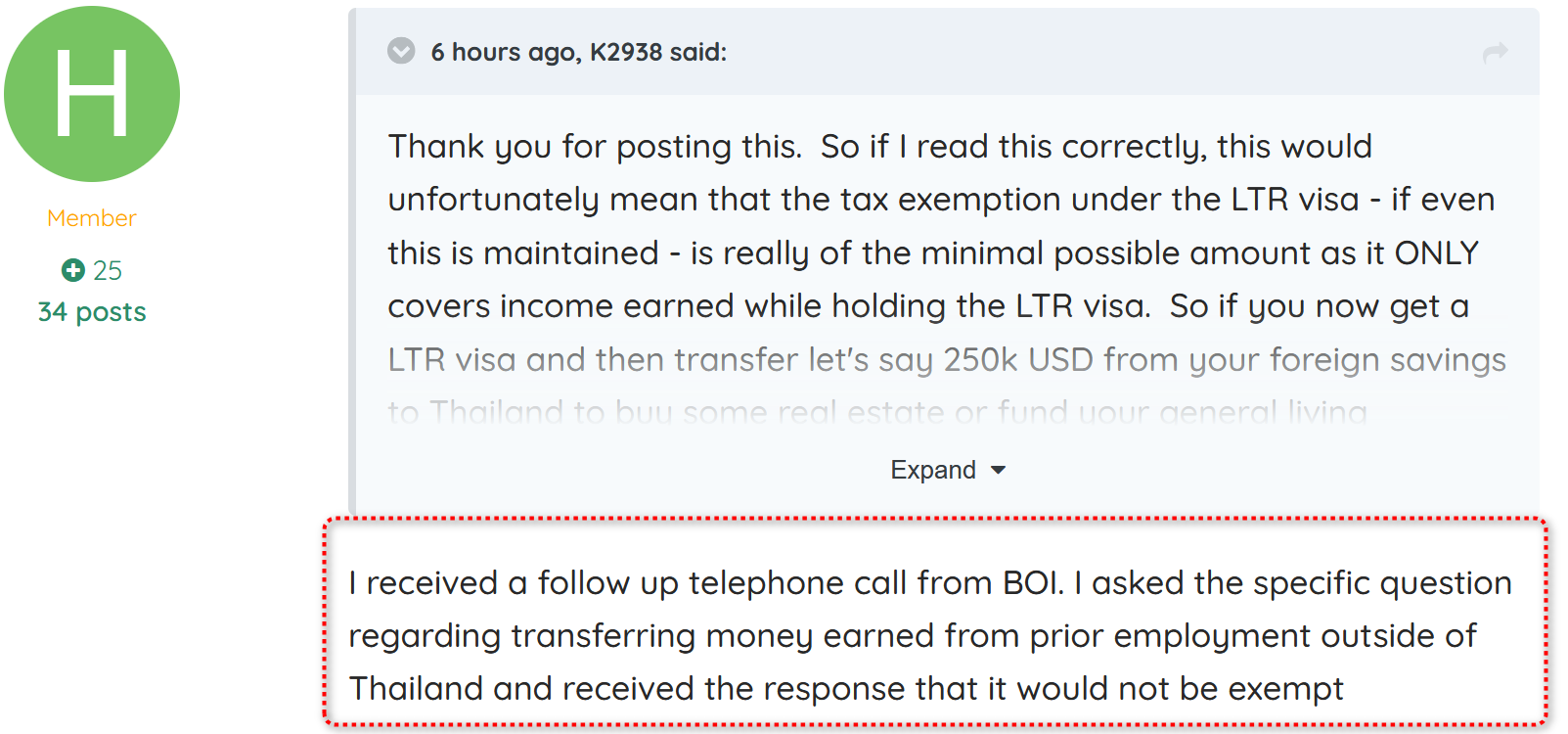

@MistyBlue, I happily admit that I cannot guarantee you the validity of my answer at this point of time where many things are still in flux. I can only say how I would interpret what the BOI has said. And this is now moreover not only my evil suspicion, but has also been confirmed by @hwas post above about his conversation with the BOI:

So based on what we know today I would answer your question with a clear no.

As it would appear that the authorities have not really thought through all this and as this would greatly decimate the number of wealthy foreigners living in Thailand and bringing in money which is something the authorities should be interested in (read: LTR and Elite visa holders), things might change again in the future. But right now my best guess to the answer to your question unfortunately would be a very clear no.-

1

1

-

-

6 hours ago, Pib said:

If the new rule does go into affect 1 Jan 2024 then they would only be looking from that date forward...and as said earlier on income, interest, dividends earned since 1 Jan 2024 (not before that) if not already shielded by a DTA.

Unfortunately my suspicion mentioned above with the caveat "if I read this correctly" now also appears to have been confirmed by the BOI as just posted by @hwas on the main tax change thread in this forum. So I am just cross-linking this in case there are people not following both threads:

-

1 hour ago, ukrules said:

I think the point is - the previous year/years tax benefit which has often erroneously been referred to as 'the loophole' was never ay any point anything to do with the Thailand Elite visa.

The Thailand Elite visa is just a way to stay here permanently and take advantage of those tax rules.

Well the tax rules are apparently changing due to this proposal (we shall see on that) by a new previously non politician PM who's been in office for several weeks but it's certainly nothing to do with TE and I'll bet the folks over at TE were just as surprised and annoyed by this new proposal as the rest of us.

Lets face it - it will destroy their entire business model.

Oh yeah, my point - there's nothing to grandfather for TE as the tax thing was unrelated. It's like saying get a TE visa and take advantage of cheap 'insert cheap thing here' in Thailand - then the prices increase - nothing to do with TE.

Indeed. But there is a strong incentive for the authorities to work out some sort of special exemption for the TE visa because otherwise the number of further TE visas sold will most likely totally collapse as many people justified the high TE visa fees by the tax advantages. And since the Thai government makes big money from selling TE visas, they have an incentive to work out some sort of special exemption to keep this money flowing. But strong incentive does not mean it will necessarily happen, so we will see what the future brings.

-

8 minutes ago, Pib said:

Money you simply transfer is not taxable now or possibly under this new tax rule beginning 1 Jan 2024..it's interest and dividends you earn from assets like say 5% interest on a 250K savings acct.

I wish you were right, but that is unfortunately not at all clear at the moment as the 250k savings are surely income of some prior year. And if by comparison you look at other countries taxing remitted funds, then in some of them this would be a taxable event, in some it would not. So how things will eventually be construed in Thailand nobody unfortunately knows at the moment. The fact that the LTR exemption does not appear to cover this is therefore a real potential problem.

-

1

1

-

-

26 minutes ago, hwas said:

Received this from BOI today, tax exempt only for prior year:

Greetings from the LTR Visa Unit.We want to clarify that the tax exemption for overseas income will commence from the month you receive the LTR Visa onward, which typically falls within the next tax year.Any income earned in the period prior to holding the LTR Visa will not be considered for tax exemption.Thank you for posting this. So if I read this correctly, this would unfortunately mean that the tax exemption under the LTR visa - if even this is maintained - is really of the minimal possible amount as it ONLY covers income earned while holding the LTR visa. So if you now get a LTR visa and then transfer let's say 250k USD from your foreign savings to Thailand to buy some real estate or fund your general living expenses, then this will NOT be exempted as these 250k USD are NOT income only received AFTER holding a LTR visa.

-

1

1

-

1

1

-

-

1 hour ago, hwas said:We want to clarify that the tax exemption for overseas income will commence from the month you receive the LTR Visa onward, which typically falls within the next tax year.Any income earned in the period prior to holding the LTR Visa will not be considered for tax exemption.

Thank you for posting this. So if I read this correctly, this would unfortunately mean that the tax exemption under the LTR visa - if even this is maintained - is really of the minimal possible amount as it ONLY covers income earned while holding the LTR visa. So if you now get a LTR visa and then transfer let's say 250k USD from your foreign savings to Thailand to buy some real estate or fund your general living expenses, then this will NOT be exempted as these 250k USD are NOT income only received AFTER holding a LTR visa.

-

33 minutes ago, jonny on the spot said:

Im pretty much sold on Malaysia for my 6 months a year if this tax thing happens. I suppose its just a case of being careful, it can happen in London if you unlucky just as easy.

The problem with Malaysia is that the conditions of their Second Home Visa are very onerous and expensive and if you go there for 6 months without a visa you will probably get into trouble even if you leave some time between the different stays. Or what visa are you thinking about using for Malaysia?

-

1 hour ago, Misty said:

"Please be informed that normally, your overseas income will be subject to Thai personal income tax only when you are a tax resident (staying in Thailand 180 days or more in a tax year) and have brought such overseas income into Thailand in the same tax year that you are a tax resident and have received such overseas income.

Thank you for posting this very useful email from the BOI. May I ask if you received this email before or after the announcement of the new taxation of foreign remittances from Jan 1, 2024 onwards? If it was after, then it seems rather weird that the BOI continues to claim that "normally, your overseas income will be subject to Thai personal income tax only when you... have brought such overseas income into Thailand in the same tax year that you... have received such overseas income" which obviously will not be the case any longer from Jan 1, 2024 onwards.

-

1 hour ago, Dogmatix said:

The Royal Decree potentially exposes LTRs to random visits from RD officials with outstretched hands examining bank remittances and making the owner prove it was income earned only in the prior tax year and not in years earlier than that which are assessable under the Royal Decree combined with the reinterpretation.

I wonder if "prior year" in the English version of the Royal Decree for LTR visa holders really means "prior years" and the whole thing is just a translation mistake. This is just a guess, not something I verified myself. But somebody should.

-

2

2

-

-

- Popular Post

- Popular Post

56 minutes ago, Misty said:And neither is the BoI. Before you post again here, perhaps you can write and ask them as so many of us LTR visa holders already have?

While the statements of the BOI provide some comfort to LTR visa holders, the honest truth is probably that currently nobody - including the BOI - really knows what the final outcome will be and all this is kind of a giant negotiation between all interested parties. Having said that however the chances of LTR visa holders to escape the tax are probably better than those of any other group of foreigners since they do have the Royal Decree which no other group has. Quite well positioned are probably also Thai Elite visa holders since the program would show a devastating decline of applicants if the tax benefits do not remain and these people pay big money for their visa which directly goes into the Thai budget so there is a strong incentive for the government to protect them. But what the final outcome will be really only the future will show.

-

1

1

-

3

3

-

- Popular Post

- Popular Post

5 hours ago, stat said:No LTR does not change anyting as it "only" exempts income earned abroad NOT income transfered into TH.

According to the BOI managing the LTR program this is incorrect. According to them LTR visa holders are exempt from tax on income remitted to Thailand as you can also read in the LTR thread on this forum.

-

1

1

-

1

1

-

1

1

-

12 hours ago, Hummin said:

For most my best guess, it will continue as it have done, but for those who already have tax number, it will be easier to squise a few more baht from.

The very same who claimed a tax number on long stay visa, have done it to save paying tax to their orign country.

It is a very good reminder, that what we have today, might not continue the same way in future.

Currently having or not having a Thai tax number should not make any difference whatsoever. If you are legally staying in Thailand which I assume applies to most on this forum, then the Thai authorities know about you regardless of if you have or do not have a Thai tax number.

-

1 hour ago, Dogmatix said:

Inheritance tax in Thailand is exempted between spouses and otherwise only payable over l million baht.

If you allow me to correct your typo: The inheritance tax threshold in Thailand is actually not 1, but 100 million baht. And if the assets are not in Thailand and you are not a Thai national and you are only on a non-immigration visa such as Elite, retirement etc., there is no inheritance tax regardless of value.

-

1

1

-

1

1

-

-

1 hour ago, Happy happy said:

So sorry if this has been asked already above.

It is:

1.Can someone with a retirement O visa (800,000 in bank method) change it to a Elite 5 year Visa?

2. And if so, is the holder of such Elite Visa exempt from income brought in from overseas?

1 - yes, if you apply, get approved (which most people do) and pay the sizeable Elite visa fee

2 - depends on the as yet unpublished details of the new regulations from Jan 1, 2024; based on what has so far been published no

-

.png.3b3332cc2256ad0edbc2fe9404feeef0.png)

Thai gov. to tax (remitted) income from abroad for tax residents starting 2024 - Part I

in Jobs, Economy, Banking, Business, Investments

Posted

1) There is an email from Thai Elite posted about this a little higher up in this thread which you might want to check.

2) Some Thai Elite agents historically claimed that - allegedly - there would not be any tax whatsoever for Thai Elite visa holders, but this was never correct. Thai Elite visa holders only had the exemption for foreign earnings not remitted in the same year of earning like everybody else.

3) With the proposed tax changes this would be over for Thai Elite visa holders just like for everybody else (with a potential minor exception for LTR visa holders of certain foreign income).

4) So if this change is actually implemented, this will have a devastating effect on Thai Elite visa sales since many justified the huge fees by the tax advantages.

5) Since the Thai government makes a lot of money from the sale of Thai Elite visas it is possible that they will exempt Thai Elite visa holders to avoid this money stream stopping. One would imagine that Thai Elite is aggressively lobbying for this behind the scenes, but what the outcome will be nobody knows.

6) You might want to ask for a deferment of your membership until there is clarity about the new rules. And if you are not granted this deferment and tax is important to you, then you might want to pass on the visa.

7) Using foreign credit cards would most probably be tax evasion. With enough effort from the Thai authorities, it would also be possible to trace this. If they will do this or not, again nobody knows yet.