MangoKorat

Advanced Member-

Posts

3,072 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by MangoKorat

-

A Night in the Thai Police Station

MangoKorat replied to Hellfire's topic in ASEAN NOW Community Pub

How the hell did we get on to Gazans? I thought this was about drink driving? -

A Night in the Thai Police Station

MangoKorat replied to Hellfire's topic in ASEAN NOW Community Pub

Well that's not a provisional licence in the way that we know it - which is for learners. To be able to drive on your own in Thailand, you need to have passed a test. Learners don't actually get a licence. In addition, if I remember correctly, Thailand used to operate a licence exchange scheme - people from certain countries were allowed to have a Thai licence without taking a test provided they held a full licence in their home country subject to passing colour blindness and reaction tests. That was how I obtained my Thai licence. My 5 year Thai licence expired during the Covid period and I haven't bothered renewing it yet because not being resident, I can use my UK licence and I don't want to go though all the palava of getting a residence certificate etc. I am told that when I do renew it, I'll only get a 2 year one at first - so if provisional means learning, will I be considered as being a learner again for the ensuing 2 years? -

A Night in the Thai Police Station

MangoKorat replied to Hellfire's topic in ASEAN NOW Community Pub

Yes, that was also my conclusion Richard. I am not making small of drink driving, not in any way, shape or form. However, this has to be put into context. We are talking about a country where under the new points system (if they ever ger around to introducing it), a drink driver would not lose their licence until they got caught for the third time. If someone gets caught, for any crime, it is not the police's job to issue punishments, the courts do that. Being made to stay in such a place is a form of punishment. Remember that the disgusting ratholes that the police keep prisoners in contain both the guilty and the innocent. -

A Night in the Thai Police Station

MangoKorat replied to Hellfire's topic in ASEAN NOW Community Pub

There is no provisional licence in Thailand. -

Up until now, I've sourced my bike tyres in the UK and brought them with me when I visit - I found decent tyres were cheaper in the UK than from stockists in Thailand. However, I'm likely to need 4 or 5 sets of tyres this year so had a look around and jeez, some brands are less than half the UK price on sites like Lazada etc. However, are they real of counterfeit? In other circumstances it should be a 'no brainer' - tyres are normally your only contact with the road and a bad choice might give you a different type of 'contact' with it - slam dunk right? Possibly but......... in the UK (and Europe I believe) bikers get totally ripped off by just about everyone connected with the motorbike trade on just about anything we want to buy. Far from being the 'poor' young man's transport it used to be, biking is very much part of the 'leisure industry' now and many bikers are in their 50's and 60's. with cash to spend. Bikes are our 'toys', can sometimes costs as much as cars and the manufacturers and parts stockists know it so they push us to the limits. Have the crazy prices we pay just become the norm? So much so that much cheaper prices just ring alarm bells? Quick example, a couple of years ago I needed a lockset for my bike and due to potential language difficulties, I decided to source one at home in the UK. That was until a Kawasaki dealer in the UK quoted me over £400 (17500 baht). No way, its not a complicated lockset - no chips or ECU codes, just 2 lock barrels and an ignition switch. A member here took a look at the Kawasaki online parts catalogue and suggested I persevere with my potential language problems as the exact same parts in Thailand, from a Kawasaki dealer were £140. Since then I've bought many other genuine parts for both bikes and cars in Thailand and saved literally 0000's. I got a genuine Honda (car) brake master cylinder for less than half the UK trade price. People have suggested only buying from reputable bike shops and main dealers but does that guarantee no fakes? 2 years ago I bought some Amber Leaf tobacco from Doha Duty free that turned out to be fake - confirmed by a spelling mistake on the packaging, the makers JTI in London and me coughing my guts up. There have been several cases of major High Street stores in the UK unkowingly selling counterfeit products in the news recently. Retailers often don't buy directly from manufacturers - they buy from wholesalers and distributors so they may be just as succeptible to fakes as the end user is. So, are these tyres on Lazada and other similar websites genuine or not? Has anyone actually bought some and tried them?

-

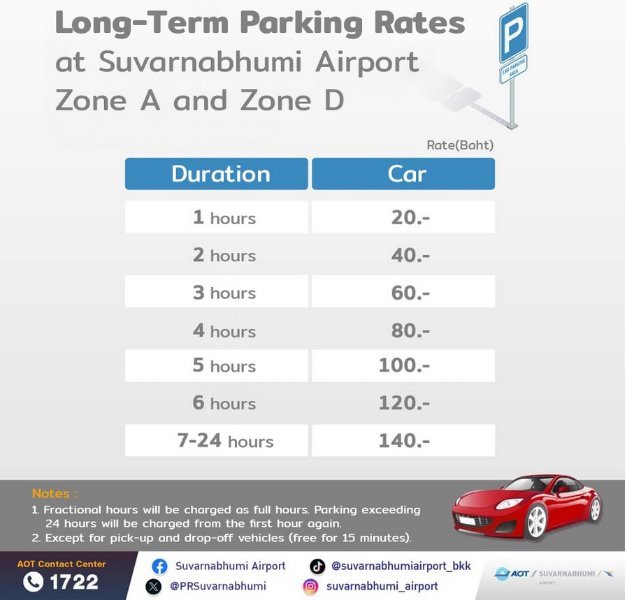

I realise that different people/institutions interpret things differently but I don't consider 24 hours as 'Long Term'. Anyone know if there's any actual long term parking AT the airport?

-

Gutters?

-

Tourist Brawl on Phuket’s Bangla Road Sparks Online Outrage - video

MangoKorat replied to snoop1130's topic in Phuket News

So what do they propose? Later in the post they refer to Free Visas in a context that lays the blame at them. The fighters, most likely entered visa exempt. Yes that currently gives some nations 60 days but most have enjoyed 30 days for many years. Do these young guys suddenly become more violent on day 31? Charge for visas? The problem is, young men, testosterone and alcohol - do they seriously think that charging for visas would reduce this behaviour - it might but the fee would have to be so high that it would put off the vast majority of tourists. Best way is to catch such people, punish them severely and make sure that's well publicised. That won't stop it but it will reduce it. Other than that, it goes with the territory, bars, beer, girls, parties - take any one of those ingredients away and many tourists will go elsewhere. I'd be happy to go back to how it was when there weren't so many young people visiting - would the Thai gov and the tourist industry? This will no doubt, give fuel to the fires of those that think Thailand can become a select destination - aimed at the rich, those people live in cloud cuckoo land. As do those that think the country can be a quality, family destination - without the infrastructure. -

Everyone's different. I still repair my own vehicles/carry out a lot of DIY and never intend to stop. a). Because finding competent people can be difficult in Thailand. b). Because I don't like being ripped off. c). I enjoy it.

-

No but we have been talking about/the OP is about blow torches , the gasses for which are very different/subject to less restrictions than gasses used commercially such as in the motor trade. By the way, Mapp gas was reformulated a few years ago, it is not the same gas you were using 40+ years ago.

-

Odd, I was in the motor trade for over 30 years and never used any form of Propane/Butane gas. We used Oxy/Acetylene for both welding and cutting - no other gases in the shop.

-

-

I wouldn't want/don't need that torch - is the gas available on Shoppee?

-

Yes but the newer types run hotter, they will also run upside down and are self igniting. Unlike regular butane/propane blowtorches, they turn off as soon as you release the trigger. In any case, I didn't say Mapp gas was new, I said the new generation of torches. Where were you buying gas 40 years ago? I don't remember ever seeing it where I see it now.

-

We are the worst to be honest - done it thousands of times but know damn well that I shouldn't. A parallel - don't think that buying a used car that has been owned by a mechanic is necessarily a good choice. Retired mechanic - yes. Active mechanic - possibly not. We get so sick of working on motors that we often neglect our own.

-

Just updating this for anyone interested. I will be bringing my blowtorch with me in June to do some work on my heat pump. Mine is one of the new generation of blow torches that use Mapp gas capable of reaching 3600f. Obvioulsy I can't bring gas on the flight so I checked online and found this company. https://gggroupthai.com/product/bluefire-mapp-gas-premium-quality-wholesale-factory/ They are wholesalers but if they can't sell me a cannister, they should be able to point me in the direction of a stockist. Clearly if they can do that, they can do the same for a torch.

-

Illegal Foreign Tour Guides Bypass Thai Law with Bribes

MangoKorat replied to webfact's topic in Thailand News

I'm not referring to the ones selling 'packages' whilst they are in Thailand but the law on tour guides is stupid. People from other countries feel much more comfortable with someone who speaks their language as a native. Don't they realise that foreign companies actually bring tourists to Thailand - if having a foreign guide encourages that, what's the problem? Tourists actually create jobs! I'd also like to hear what the Professional Tourist Guide Association has to say about the thousands of unlicenced Thai tour guides and companies. Guides are required to undertake formal training and sit an exam in order to obtain a licence which needs renewing after 5 years. Tour companies also need to be licenced and lodge a security deposit with the TAT. I wonder how many Thai guides and companies comply with these requirements - I know of several that don't. -

I'm pretty sure I asked for help on this issue previously but didn't get a reply that helped. I have now found the cause - completely by accident - hopefully this might help anyone else who has the same problem. The issue: My laptop would go slower and slower when I was on Facebook Marketplace - eventually going so slow I had to exit and re-enter. I was often impossible to be able to see all the items I was searching for. The fix: I had another issue that required me to turn off my adblocker. I couldn't find out how to disable it so deleted it with the intention of re-installing it. Since then 'Marketplace' has run perfectly and I can view as many items as I like without any slowing.

-

A popular and common opinion - but not one I agree with. I can't say what else happened but in the video, it was the bouncer that started the violence. Thai bouncers need to learn that their job is not to attack people, its to stop disturbances. There is no doubt that this man was an idiot but it goes with the territory. Venues that sell alcohol should expect drunken idiots and deal with them appropriately. Any one of those kicks and punches could have killed the idiot - would you be saying he deserved it if he died? I don't know about Thailand but people have been killed and seriously injured by bouncers in the UK - which is why the trade is now regulated and bouncers have to be licenced.

-

Then you don't know people very well. For example, when you know you're way around, its pretty easy to find a decent hotel for 1500 per night in central Bangkok. If you don't know - you might spend 2500 - 3500 on a room and think that's what you need to spend. However, some people think others are impressed by where they stay. They will often tell you where they are staying when you haven't asked. Many years ago, I stayed at the Amari Watergate, from memory I think it cost me 3500 (at least 10 years back). Yes, the room was nice but I tend not to spend so much time in my room when I go away. The TV was much the same - 99% Thai and the water still ran out across the bathroom floor instead of down the waste. The bedside lights didn't work and I didn't find the staff very helpful. The food was ridiculously expensive and there were very few alternatives close by. The security staff asked my wife for her ID card as we were entering the room and told me I should register 'guests' with reception - you can imagine my response to that - one of the words was 'off'. Fast forward to last month when I had occasion to stay in Bangkok, I stayed on Soi 33, nice room, good size, clean, friendly staff and plenty of food available nearby - especially at the Irish pub, just around the corner at 199 for a 7 piece English breakfast. You really do not need to pay a fortune for a good room. As for flights, I know plenty of people that travel business class but couldn't afford to if the travelled often and I also know people who like to say they travel business class who I know actually travel economy. As I say, if you think people don't massage their ego's by attempting to show off or appear affluent - then you don't know people very well. I am not saying all by the way and I am, in the main, referring to people who post on here, not necessarily in real life. But versions of the same also happen in real life - people often project an image, other than their real one because they want to impress. I know people in both the UK and Thailand who live in a hovel but drive a BM or Merc. Why? Because in the main, people don't see their house - but they see their car. I have a relative who rents his home (not through choice) but drives a Ferrari 488. Fools may be impressed, I just laugh. As for flights, I can only repeat - business class is very nice but for me, no way is it 3x (+) as nice.

-

British Fugitive Arrested in Phuket After Violent Brawl in Bangkok

MangoKorat replied to webfact's topic in Phuket News

Probably another sad one for you.