ArranP

-

Posts

751 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by ArranP

-

-

Doesn't stop me watching and worrying though.

Yes it does !

If your position is as secure as you suggest then you are serving no use to yourself, or others, by giving the impression that you ARE concerned and adding fuel to the flames of fear.

Enjoy your position and do more meaningful things with your time. In some ways your guilt is worse than others because you can say "Oh look the sky is falling in.....BUT, I am OK"

Actually I don't know if my position is secure. And that is the big worry.

I have money with a number of banks. But as far as I can tell, only the Thai banks are looking solid

I have money in several countries. But they are all massively into deficit budgets and bailouts

:D

:D  Will they default? Will hyperinflation take off, destroying our savings with it?

Will they default? Will hyperinflation take off, destroying our savings with it?Money that was invested in Icelandic banks is now in limbo and probably lost

:jerk:

:jerk: 18 months ago all was very fine. Now the future is uncertain. And I reckon the best way of spending a few hours every day is to read the news, follow up on economics and try to understand how this will all pan out. The crisis is developing INCREDIBLY quickly, and I need to be able to move fast. I probably have much more stress than somebody with property and an income stream from a pension, because in that situation there is not much more to do than sit back, enjoy the moment and pray a bit.

And what guilt am I supposed to have? All my life I have been very cautious with my money, the only debt I had was a mortgage in the UK at 2.5 times my salary, and only then after saving every penny to put up the 10% deposit that the bank required. The guilt lies with all the greedy bankers, politicians and credit junkies, who needed everything today and pay on the never never. I can remember saving up my pocket money for week after week in order to buy an LP to play on my hi-fi system which had taken me some six months to save for.

So, I am very concerned about this whole mess, in which I, personally, have played no part in creating. Indeed I have suffered substantial losses, wiping out several years of savings, money which I will never have again. I feel very angry about this.

The guilt lies with the politicians and bankers of the last eight years, who have issued credit at far too cheap rates and allowed the banks to create the biggest roulette wheel in the universe, using our money as bets and taking huge bonuses because they have made a few lucky rolls.

And am I really adding fuel to the flames of fear? All I am doing is posting a few links and drawing conclusions. Maybe you could try to put a a few links with some optimism, which I will be very happy to read, as I cannot find anything at the moment. And then give us an alternative option to discuss?

12DrinkMore, I've had a significant portion of my capital tied up in "Managed Futures" for 6 months, I don't have to do a thing all is done for me.

There was an article in the Investors Chronical about 4 weeks ago that stated they are one sector to provide good returns.

In 2008 this sector provided returns of 15% and 25%+, one fund performed particaly well and returned 60%.

From my understanding, these are a teams of people trading daily for you, taking long and short positions on fx, commodities, indices, bonds, cash with a horizon of 4 to 5 weeks.

They know a lot more than I do and can enter and exit positions a lot quicker than I could ever hope to.

The fund (www.trend.ky) which I am in follows is computer driven system which looks for pre-defined price patterns.

-

I am a buy-to-let investor with a number of properties and I'm not so sure its as bad as some people are making it out to be, but I suppose it depends on what your time-horizon is. I have all my properties on BOE base rate trackers which are doing very well at the moment from a monthly income perspective as you can imagine with interest rates where they are.

From a capital appreciation perspective, I do not plan to sell any of them for at least 20 years from now, when they probably will be worth more than they are now or a year or so ago.

That said the only concern I have is if interest rates rise sufficiently so that the rents no longer cover the interest payments or tenants loose their job and can no longer pay their rent.

Regards diversifcation I am invested in other areas which provide a significant return and have an income from contracting.

-

With 3,000,000 unemployed there will be little pressure on employers to raise wages to compensate for the higher prices. There is currently no incentive to rebuild the lost manufacturing industry, finance is impossible to raise, UK regulations strangle any startups, and who is going to take the optimistic view that it will get better and invest rather than save?

In my view, as you have observed, things are looking very dire for the UK. There will be a lot of suffering before this depression is over. I cannot see any reason why the GBP will not hit parity with the Euro (one of the real reserve currencies) and then move towards the USD.

We're probably a year into this mess already, since the Bear Sterns last March 08, which is therefore one year less to go before things improve.

Whilst we're in this mess, its hard to see if we're going into it, at the middle or coming out of it. But one things for sure we got one year less to go!!

Here goes little bit of humour....

...

How for can one run into a forest? Half way! Cause after half way your running out of the forest.

...

To the man on the ground though, he can't tell cause all he can see is one tree after another, only when it ends can he know where half way was and when he was reaching the end.

However sometimes it can be a stressfull time financially, and not just for the likes of you and me but also for the people who have the power to change things, if you catch my drift....

We don't know exactly when all this will end, but each day is one day less. The USD won't be strong forever.

-

Forget the GBP

http://www.bloomberg.com/apps/news?pid=206...id=ahCfdnOZ3Nfo

Zero rate interest and printing Pounds.

It will be parity with the Euro, then parity with the Dollar and then heading towards PARITY with the BAHT.

If anybody can give me a reason other than BLIND HOPE that the Pound of today should have any value other than sweet FA then state it NOW!

(Yep Zimbabwe here we come, the IMC has already stated that IT DOES NOT HAVE THE FUNDS to rescue more economies)

I am moving my money firstly out of the GBP and then out of the UK as fast as I can cancel bonds, write letters and open accounts abroad. Paranoia? Maybe, but Jesus is this looking bad. And I think that a Euro account in the UK is almost as bad as holding GBPs in the UK. The bstards are bankrupt, insolvent; both morally and financially.

12DrinkMore, when I read your post this morning it made me smile and laugh, as I remember you always have a dismal view on these current events, I mean this in a nice way, as it brightens my day a little to see your consistency.

I recently moved most of my capital from USD into GBP recently.

You keep going on about GBP weakness, I do not think it is about GBP weakness, I think the GBP is just a by stander in all of this getting swept along with the tide. The major player is the USD and its about its current strength due the money flowing back into the USD via hedge funds selling their positions and giving the money back to banks.

With all this cheap money, and money being printed, at some point inflation will re-appear, bank interest rates will go back up, markets will begin to rise as commodities do, when this does the USD will weaken again and likewise GBP strengthen, look at historical charts FTSE/DOW/S&P charts and compare them to USD/GBP fx charts.

-

Reminds me of my relationship with my Thai wife :-)

-

Wednesday 8:30 AM EST

Also can use

-

USD appears to be the main driver to the USD/THB.

With USD (and likewise JPY) its recent strength has mostly been to do with "money flow".

ie money flowing out of equities/commodities and into banks via hedge funds.

One reason for USD to weaken significantly (and therefore for the THB to weaken against GBP) should be a reversal of this.

Deflation - Institutions are able to make money by simply staying in cash at near 0% in a deflationary environment, which is what is happening now, assets are deflating house prices, commodities, cars, electrical goods etc.

Inflation - At some piont all this apparent money printing and cheap money will cause inflation, and thus institutions will have to switch from cash to avoid the value of there money being eroded by inflation, however also at this time central banks will start to raise interest-rates once again.

I think an early indicator of this, would be yields on TS Bonds going up and yields on corporate bonds coming down. As this shows risk appetite returning to the market in the form of money moving out of government guaranteed bonds.

-

USD appears to be the main driver to the USD/THB.

With USD (and likewise JPY) its recent strength has mostly been to do with "money flow".

ie money flowing out of equities/commodities and into banks via hedge funds.

One reason for USD to weaken significantly (and therefore for the THB to weaken against GBP) should be a reversal of this.

Deflation - Institutions are able to make money by simply staying in cash at near 0% in a deflationary environment, which is what is happening now, assets are deflating house prices, commodities, cars, electrical goods etc.

Inflation - At some piont all this apparent money printing and cheap money will cause inflation, and thus institutions will have to switch from cash to avoid the value of there money being eroded by inflation, however also at this time central banks will start to raise interest-rates once again.

-

We want to buy a house in or near Nakhon Sawan.

Our children are attending the senior high school so

we need a place with 3 or 4 bedrooms and 2 bathrooms.

Is there a Thai web site with NS Real Estate?

Any leads please?

I found the followin website

-

Hello Nakhon Sawan citizens,

My wife is from Nakhon Sawan, we will be returning with our newborn daughter sometime next year.

I was wondering how does one find property/land in Nakhon Sawan, is there an estate agent or website where property/land for sale is listed?

I've looked a little bit but not found anything so far.

Thanks

Regards

Arran.

I found the following website with some homes for sale and land. The land seems a little pricey to me.

-

I just went through this process in December 2008.

To my knowledge a Thai birth certificate is needed to get a thai passport, when the child has been born in the UK this must be obtained by taking the english birth certificate along to the Thai embassy in London.

Its an easy process, call the embassy to make a check list of things required, print-off and complete the forms, make the photo-copies as required, you'll need some passport photos (preferably with eyes open), make the appointment and turn up the morning. They say you need both parents to attend, but I think I read somewhere if for example one parent is working, then he/she can write a letter to allow the other parent only to attend.

My wife had not seen London so decided to make a weekend of it and drove down saturday morning, stayed in a hotel called the President in Russel Square for £95 per night, has parking, good value for money, went on the london eye, london bus tour, took lots of pictures, etc, etc..

Then drove to attend the Thai embassy on the monday morning, there is a carpark at the university/college just across the way.

-

My wife has a second card on each of my credit cards in her own name and her own pin number, however I keep the cards with me, its usefull for to use when booking tickets, that way she could travel alone if need be.

My wife is quite frugil.

-

Analysts believe alot of the the negative news is already priced in on the GBP, and state it is cheap at the moment.

I switched 31st January at 1.4624

-

I looked at a Qualified Retirement Offshore Pension Scheme. Basically the QROPS itself is just wrapper, the underlying investments may or may not differ from your current pension scheme.

The QROPS may offer significant tax advantages depending on your circumstance, I think basically it allows you to change the tax-duristiction where the withdrawls are submitted ie offshore. Best bet is to contact a financial advisor, many can be found on the internet.

Don't quote me on any of these as I am not an expert and this is from memory, but I remember the following points

5 years after pension has been moved into a QROP, the provider is no longer obligated to report withdrawls to the HMRC.

Withdrawls can commence from age 50 onwards.

I think according to the GAD rules (which are also applied in the UK) upto 9 or 10% can be withdrawn each year for income purposes.

QROPS is a tax efficient wrapper around an investment product(s)

There were some QROPS schemes based out of Singapore closed down by the HMRC in june 2008 as (if I remember correctly) the providers allowed the QROPS holder(s) to withdraw ALL the funds straight away!

Thanks for the feedback, did you actually go ahead and transfer your pension into a Qrops scheme? Regards MT

I did not go-ahead with the QROPS, I am 37 years of age, it turned out If I were to take the growth within the first 5 years of moving it offshore it would also have to be remitted to the UK HMRC.

I decided to pay the monies myself via a different route where I paid tax in the UK before moving offshore.

-

................The Monetary Policy Committee (MPC) are set to meet this week so could well be some further movement on sterling sooner rather than later.

Yes, maybe another 50 to 75 basis piont cut.

-

I'm in Euros at the moment having sold US$ to buy them a couple of weeks ago. I didn't buy sterling straight away as i think it has further to fall against the Euro and i don't trust the dollar.

I'm hoping that (as widely reported) the bank of England will slash rates again later this month therefore widening the interest differential between UK and Euroland. That SHOULD force sterling lower against the Euro.

That's the plan but no one can foretell exactly what will happen for sure. Do some research on the web and make your own mind up which way to play.

Good luck

EUR is forecast to weaken, they are behind in cutting rates, therefore have further to cut. Also they are believed to have a more difficult job in putting policy through to combat recession as it involves the co-ordination and agreement of many countries.

Stratigists on Bloomberg are expecting an increase in bad news from europe shortly.

USD is forecast to weaken as the cause of its strength, re-patriation of money to USD from de-leveraging ie forced selling of assets, nears an end. (same for JPY).

Next; at some point inventories will drop sufficiently so it will cause manufacturing to re-start and purchase commodities. Speculaters will have little excuse to remain in almost 0% cash, instead can use almost 0% currencies USD and JPY to re-open equity/commodity positions. Thus rising commodities and equities....

Historically as equity indices (DJI S&P FTSE) and commodities have risen, the USD has weakened. With THB paired with the USD, more baht for the pound.

-

The British government doesn't notify the Thai government, it is up to you to do that or not. You can notify the Thai embassy in London and inform them, or do this in Thailand when you move to here.

Look at the following webiste of the THai embassy in London (in Thai, so I hope it is the right information):

Contacted the Thai Embassy in London, they informed me my marraige has already been registered in Thailand, it would have been done when we registered at the Thai Embassy in London for our daughters Thai Birth Certificate and Thai Passport, apparently they do it the same time.

They told me the local district office of my wifes home town would have been updated with details of our marraige.

-

well, so far the only two comments that are supportive about the UK economy/GBP are:

1. Hold on to sterling because its, er, too late.

"Sometimes, it really is best to do nothing" and "I think that if you haven't done anything with your Sterling by now, then to do something, just anything, at this late stage is to risk missing the upside and will only further compound losses"

I don't think anybody knows whether this is the early, middle or late stage. all I can see are the projections for a recovery continually being pushed out quicker than the elapsed time between the projections, if you get my drift. Late 2007 the projections were early 2009, then, for most of 2008 Brown was on about 3Q 2009, now in the space of just a month I have seen projections heading out to 2010, 2011 and 2012....

2. "Manufacturing in Britain has charted its own decline but to dismiss it as an engine for growth is to ignore facts. It still contributes 20% of the economy and 60 % of that is trade with our Eurozone partners who have their own woes yet to filter down. The £'s devaluation can only increase competitiveness to the detriment of the EU which has a currency locked into basket cases of economies exampled by Italy, Spain and Portugal.The Euro is flattered to deceive and the £ will soon recover"

Don't know where you got the figures, but basically your optimism is based on a declining manufacturing industrial output, of which the 60% of 20%, ie 12% contribution to the economy is exported goods sold to the Eurozone who, by your own admission, will be struggling to afford them....

And further blows to the GBP are already in the pipeline

http://www.telegraph.co.uk/finance/persona...o-interest.html

As the strength of the GBP has, to a large part been because it was a high yield currency, this is being unwound and the cash disappearing into the USD and JPY.

http://business.timesonline.co.uk/tol/busi...icle5434660.ece

Here we go again. Brown about to issue a few more billions so the banks can afford to pay the bonuses.

...

So come on, give me some reason to be optimistic. The UK economy over the last decade has been based on a consumer debt driven boom due to house prices and vapour wealth "created" and now "destroyed" by the Casino of London. What is going to replace them?

Most of the USD strength has been caused by forced selling of assets and equities, as a consequence the GBP amongst others have weakened.

When commodities and equities rise again, which at some point they will, not much return can be gained from almost 0% cash, the USD will weaken, and the GBP (amongst others) will strengthen. The THB is paired with the USD more baht for your pound!

Its not much to do about GBP, its macro or its interest rates. The macro and interest rates are dire everywhere, ie more or less it balances out, we are in a global economy, and its ALL in recession...

When equities/commodities go up the USD goes down, when equities/comodities go down the USD goes up, look at the historical charts they show it, this time its largley due to do with money-flow.

-

I just don't geddit, or rather where on earth should a recovery in the GBP come from?

Rather than ask where GBP strength will come from, I think it better to look at where the USD strength has come from?

The answer, according to most of what I've heard on Bloomberg, is because of the forced selling (ie the credit crunch) and re-patriation of this money to the USD and JPY.

What do you think will happen when this rush of money flowing back to the USD calms down ?

-

The Economist - Guide To Economic Indicators (sixth edition)

Cyclical or leading indicators (page 54)

Overview

In developed economies at least, GDP progresses erratically around its long-term growth trend. There are periods when growth spurts ahead, followed by periods of recession. This variation is known as the economic, business or trade cycle. It repeats every five years or so, although no two cycles are ever of the same magnitude or duration.

The cycle has four phases: expansion, peak, recession and trough.

Trough

Output will not fall indefinitely. It will stop at some minimum level (a trough or depression) because employees retain jobs and spending power where they work in government or in industries supplying food, basic essentials and perhaps export goods. Unemployment and welfare payments, past saving and new borrowing enable other consumers to buy essentials.

Slack demand for investment funds may pull back interest rates making new or replacement investment attractive, at least for the industries providing basic essentials. And with consumer demand steady, investment demand begins to lift the economy again.

Expansion

When demand first increases, for whatever reason, it gathers mementum automatically. The first sign is often a rundown in inventories. Output then rises faster than demand while these are rebuilt. Companies take on unemployed workers, who spend their new income on postponed purchases of consumer goods. This creates more demand and so companies employ more people, and so the process continues (the mutliplier). Before long producers come up against capacity constraints. If they are confident that demand will remain bouyant (expectations), they invest more in new plant and machinery, which generates even more demand (the accelerator).

-

Yes, no problem.

Thinking about it, we were married in the UK, but I do not recall notifying the Thai authorities yet about the marraige. Do the UK authority contact the Thai authorities? How are Thai authorities notified of our marraige ?

-

EUR is forecast to weaken, ECB are behind the curve on cutting interest rates, bad marco from germany, multi-country agreements make it more difficult on policy to combat recession moving forward.

Nobody's denying the world isn't in a mess...

Every day a new Polaroid is taken from the world (btw: Polaroid has filed for bankruptcy); the next day the Polaroid is old news.

LaoPo

Pound is about as low as it can go, which is a good sign that it will lose another 10% because markets have just gone crazy. Soon I'll buy sterling and ditch my bt. I don't see a major swing for some time, but 55 within 6 months. Significantly more 1 - 2 years.

I've stopped selling in pounds and now deal in dollars. Hit me bad.

Jim O'Niel of Goldman Sachs is in agreement with you, he mentioned the pound has weakened a long way already and he found it interesting there is alot of bad press on the pound in the UK papers, which he thinks is indicative of a an end to its current trend.

Whilst many stratigists believe the pound may weaken further in the near term, they tend to believe the pound will strengthen against the dollar through 2009, they attribute most of the current dollar strength to mass de-leveraging.

This is why I am moving my capital from USD into GBP. I entered into the dollar @ 1.97 to the £ in june 2007, I am moving from the dollar to the £ january 2009 at 1.4# to the pound. It £ may weaken a little further in the short term, but I'm locking in those profits.

As for investment, I am invested in the Tulip Trend fund, www.trend.ky and the Brandeaux fund, although the brandeaux fund has suspended trading for now due to a single broker issuing an extraordinay amount of redemptions, Brandeaux do not want a fire-sale of its assets so they suspended trading for now. I'm not sure how this will play out in 2009, they say they want to resume subscriptions in january 09 but so far make not mention to resuming redemptions ?? They continue to publish consistent positive returns to the funds of approx .8% per month.

-

Yes, no problem.

Thanks Mario

-

Belated Merry Christmas also Vic; saw this message too late.

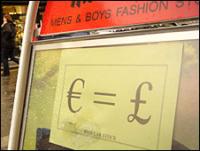

Yes, the GBP is almost on par with the Euro 1.024 for 1 GBP

LaoPo

EUR is forecast to weaken, ECB are behind the curve on cutting interest rates, bad marco from germany, multi-country agreements make it more difficult on policy to combat recession moving forward.

£ Nudging 52 Bht

in Jobs, Economy, Banking, Business, Investments

Posted

Thanks Chiang Mai!