-

Posts

10,604 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by sometimewoodworker

-

Proper Size for LED Flood Lights Around House

sometimewoodworker replied to Thailaw's topic in DIY Forum

It’s not the brightness of the lights that are a deterrent, it’s the fact that the property is well lit. As you can see a number of lower powered lights illuminate completely. a single high powered light will provide inky black shadows for miscreants. Also have you considered that if you are running them all night you are going to need blackout curtains to sleep? FWIW if 2w bulbs were easily available I would be using them not the current 3w ones -

From the February highs the S&P is down 15% the Dow is down 19% the NAS100 is down 18% so a small market correction??? Trump is always bragging about his influence on the markets!!! This is showing how true that influence is. By next week he will probably have single handedly turned a long term bull market into a a bear market

-

Well your opinions have been shown to be completely wrong. The biggest crash in the US markets totally fuelled by trump, the previous 2 giant falls were the subprime crash (no single institution or person caused it) and the COVID crash. Trump has turned a booming economy into an almost recession, it has fallen by between 15% and 20%. by next week it maybe a full blown recession. Trade patterns are not changing overnight but in a couple of months or weeks. Canada heavy crude is now going to go to China as well as LNG the US had an almost monopoly on Canadian oil exports. That is just one example. Trump has single-handedly wipe out decades of good will and friendly relationships that probably will not recover for many years if they ever do. He has proved that the USA is not trustworthy and that legacy will tarnish its reputation and influence permanently.

-

Proper Size for LED Flood Lights Around House

sometimewoodworker replied to Thailaw's topic in DIY Forum

We have lights all round our house, the rear wall is 20 metres and has 4 lights the workshop side is 12 metres and also has 4 lights the front of the house has more decorative fittings with 5 up and down lights the bulbs in all of these are 3W at night 4 x 3W is more than enough to not only light the walls but a considerable distance into the garden. we do have a 20W led street lamp at our gate that we run all night along with a few more accent lights in the garden and Waterhouse. My opinion is that 20W LEDs are excessive and vastly more than is needed. CCV images as an example here is the daytime the early evening, so dark but with 3W lights they are enough to allow the CCV to capture colour and lastly we turn them off after midnight so this is the IR illuminated image -

While absolutely true it is possible that you can find the same product from the same supplier on Lazada and you may be able to use cash on delivery. I know that COD is not available for everything on Lazada. AFIK we almost never use COD as it’s much easier to pay first as we often get the driver to leave packages on our gate or garden wall

-

Raise a dispute with AliExpress they have been good

-

I have never had a package go totally missing, I have had hundreds) However I have had a few that were marked as delivered when they hadn’t been, the reason for this is that the local agents (flash drivers) have a number of packages to deliver and if they start to run late the loose money. In each case the actual delivery came a day or so late. The first time this happened I queried the non delivery with AliExpress and the courier (flash express driver) came to talk with SWMBO they were extremely worried as non delivery is regarded a theft and they could loose their contract with Flash The do and often orders are consolidated FWIW the 17Track app is excellent for AliExpress and Lazada

-

New house - a few questions for the electrical system

sometimewoodworker replied to CLW's topic in The Electrical Forum

This is so true. It is also a really good idea to install many more sockets than you can imagine that you will need, you are likely to find that your needs are going to multiple exponentially and the cost when building is trivial, probably less than 200 baht per fitting. -

New house - a few questions for the electrical system

sometimewoodworker replied to CLW's topic in The Electrical Forum

That is absolutely incorrect. it is certainly the case that high demand outlets are directly connected to the main consumer unit, one example would be a cooker. However groups of sockets are connected as a radial and each radial has its own breaker. While partially correct, that groups of outlets can (quite often are) connected as a ring final, this wiring pattern is being superseded by groups of outlets as a radial. broadly speaking a ring final has 2 connections (ends) to the breaker while a radial has one. Very few countries use ring finals, in most it is prohibited. Thailand has nothing stopping you from using ring finals but no Thai electriction or electrical fitter is trained on them. The testing of ring finals is not that difficult but is completely unnecessary to learn for Thailand. -

New house - a few questions for the electrical system

sometimewoodworker replied to CLW's topic in The Electrical Forum

You decide, but if you are sensible you will insist they are. Again you decide, however the standard PEA installation requires at least 1 RCCB it is specified for the whole house. Current U.K. practice is that each circuit has its own RCCB this is good practice. However it is sensible to have the freezer and fridge on an unprotected circuit so you don’t loose the whole lot if 1 circuit trips. @Crossy will probably be persuaded to draw a custom installation wiring diagram but you need to know much more detail as to exactly what you want. a typical Thai double story house may have just 4 circuits, we have an over kill and it maybe 30 😉 we also have double outlets at 50cm intervals in the house and groups of 5 outlets at similar spacing in the workshop, even so I still need a few extension cables Again you have to decide, but twisted wires + wire nuts is not always bad. Wago connectors are good but you will have to insist and watch like a hawk and buy a few hundred of various versions. Few if any installers have them or know where to get them If they refuse get a different installer. There is no reason I know of to exclude AC from RCCB protection. all our AC units are behind an RCCB -

Probably the Zircon is similar to the black CyberPower units. FWIW you want the CPS unit in a place you don’t hear as when recharging the batteries the fans are LOUD. The battery expansion is given as unlimited BUT the unit will not charge an unlimited number of batteries. It is billed as noiseless BUT there is a warning beeping when in it’s not on mains (I think you can disable that) and when recharging the battery’s it’s far from quiet

-

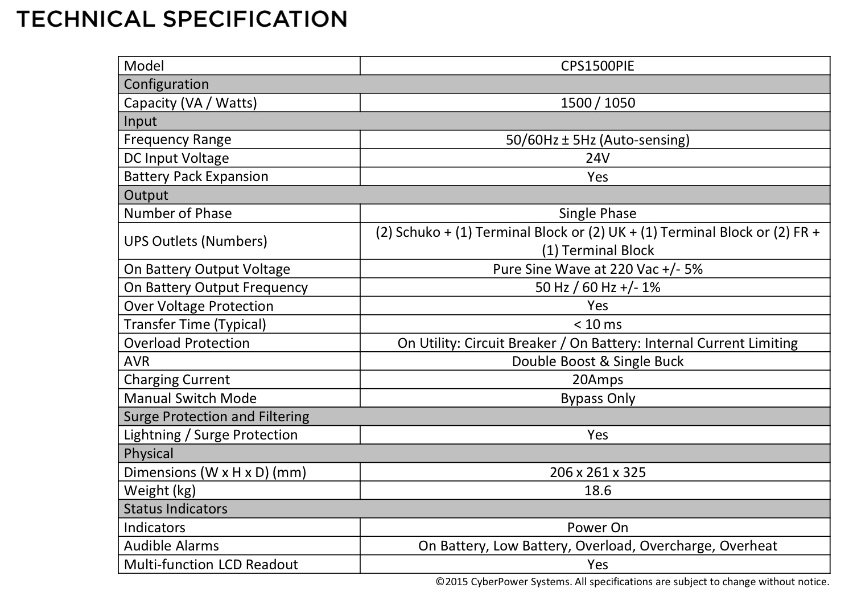

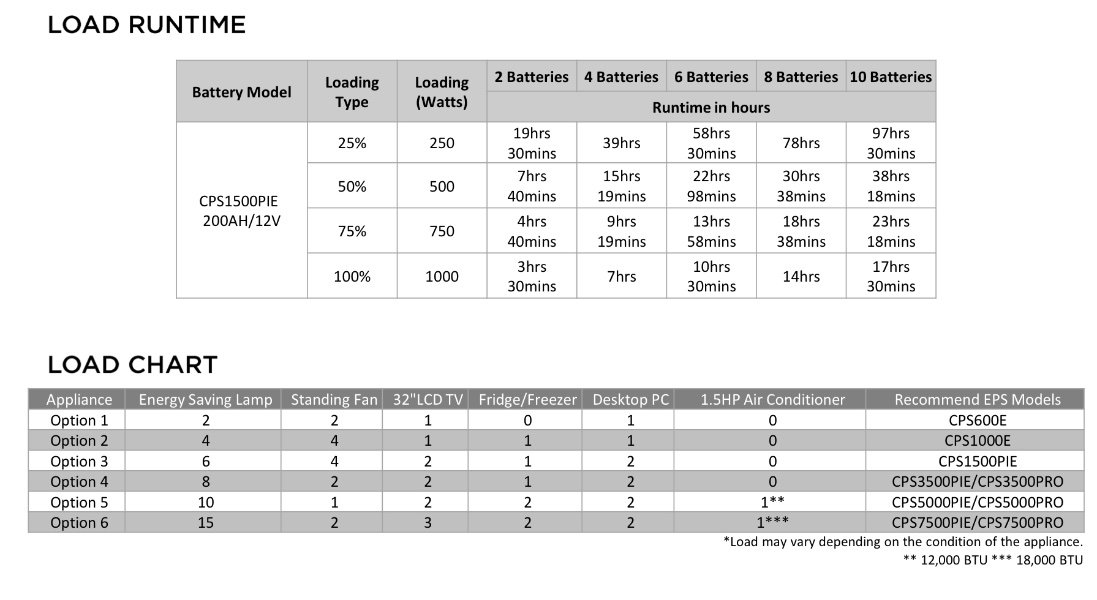

As posted the UPS name is CyberPower, I didn’t bother to search for more than 1 supplier, you will need to search for more https://s.lazada.co.th/s.vKOrh the model I have is the CPS 1500 PIE. it is unlikely that you will find that model online, you will have to go to a specialist shop AFIR it was ฿16,000 plus 2 deep cycle batteries, you need 2 as it runs on 24v NB IT IS THE CyberPower yellow not the black I suspect it is rated for data centre usage and that the claimed output is genuine it incorporates a pure sign wave AVR as you can see if you want a longer runtime you just add more batteries or higher powered ones

-

Incorrect answer. The time you are permitted to stay in the U.K. for each entry maybe, for example 90 days. However the date you can first enter is often/usually specified. But most importantly the date by which you must exit is always specified. Thus if your visa expires on July 1st and you enter on June 28th your permitted stay is 4 days. If you enter on March 1st your stay is 90 days (all of this is assuming the above is true)

-

That is what we do. The main router and security CCV cameras are powered by our UPS. We have 24v 50Ah batteries powering it, it is trivial to add more capacity (though not cheap), we have had power cuts lasting more than 4 hours, I did not check the level of charge but suspect 8 hours with the current system will be no problem. We had baby UPS’s before but this small industrial one is likely bulletproof. NB the guarantee is 24 month’s on site. I have used this once at about 20 months on a previous CyberPower UPS

-

With regards to the insulation under the roof, we have use 3 versions, the first is sprayed on PU, in the house it has yellowed but there is no breakdown it is expensive. On the outside kitchen we used cheap steel with a stuck on foam with an aluminium foil on the underside, this rusted through in spots and the foam came off after a couple of years. the last roof over the outside kitchen is a sandwich of steel, foam, and steel. So far it has only shown signs of quite rapid fading of the top surface but the sandwich shows no sines of breaking down, though it’s only been about 2 years. With large windows, they can be reasonably energy efficient, the majority of ours are, but that requires them to be shaded from the sun. We have a minimum 2.5 metres overhang of the roof so some of them only get early morning and late afternoon sun, the others no direct sun. However they are also double glazed with low-E glass so are also sound attenuating, the give about a 24db drop.

-

The LED’s are fine, it’s the driver that gets munged. Depending on the bulb a 1 microfarad capacitor will decrease the light but increase the life by a factor of 10. This works with some units but not all. The way you discover if your units are the ones is to try it and see. The capacitors aren’t expensive.

-

What Would I Look For To Find This?

sometimewoodworker replied to carlyai's topic in The Electrical Forum

As has been mentioned WD 40 is not correct, in fact it is almost the absolute worst thing to use. first a contact cleaner, this is an example break clean may also be OK then if actually required a dry PTFE maybe needed, but clean dry contacts are what was designed to me used. -

In over 60 years of doing electrical stuff I have never used a torque screwdriver, I have never had one of my connections come loose. The only connection that has ever needed to be tightened was one done by a non electrician in our house. Just try tightening connections on a test socket using gorilla strength. There will be some possible outcomes with a slot headed screw you will break half of the head off with a Philips screw you will round off the recess in the head with any screw you will break off the screw under the head with any screw you will strip the screw thread with any screw you will strip the threads it’s going into. I have experienced all the above, most over 60 years ago the outcomes are partly dependent on the quality of the screws and threaded section as well as your strength. However once you have experienced some or all the above you will develop a feel as to when tight is tight enough. NEVER use an impact driver or any power driver.

-

More Serious About Coffee

sometimewoodworker replied to fredwiggy's topic in ASEAN NOW Community Pub

I got all mine from Lazada and keep them in the car for when I don’t want to stop -

More Serious About Coffee

sometimewoodworker replied to fredwiggy's topic in ASEAN NOW Community Pub

I have 2 of them that I used in Watford where there was a superb coffee roster and I could get many different coffee beans. When I was in Japan and now here where good fresh roasted isn’t easily (or ever) available I switched to cold brewing. I am now less able to be a coffee connoisseur but the benefits to me of cold infused (I won’t say brewed because that requires heat) coffee are great. The caffeine is still there, the acidity is virtually gone, the oils have not been heated so do not go rancid (this is why if you hot brew after half an hour or so of keeping hot it becomes unpleasant). Now I can have a thermos of hot coffee and the flavour is the same however long it’s been kept. The only downside is that smell is almost nonexistent PS if you grind your own beans, freeze them and the grind will be better. Also freeze your fresh ground coffee, it will be better for longer. -

More Serious About Coffee

sometimewoodworker replied to fredwiggy's topic in ASEAN NOW Community Pub

If you look carefully there are about 4 different zero sugar/sweetener types available, the 2 Birdy, a Robusta & an Arabica both in tins, the Suntory Boss and the Cafe Amazon both in plastic bottles