-

Posts

2,127 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by oldcpu

-

-

13 hours ago, MartinBangkok said:

I can't believe the servility and submissiveness of most of the posters on AN. Don't you get it yet? Foreigners, western foreigners, are not welcome in Thailand anymore.

All those of you who stubbornly oppose any critcism of Thais and Thailand, is it because you are too embedded and have no alternative?

No. It's because we don't share your view and we may or may not have family here, and further unlike you, we may like Thailand.

Is everyone in the world compelled to share your view? especially if we believe you wrong?

No one is compelling you to stay. Go in the world where you are most happy, and please allow us to do the same.

-

1 minute ago, jwest10 said:

I had my figures written down but they did not want to see them and that is all and several times too

Yes - i misread your original post. Simply disregard my post that you quoted.

-

-

5 hours ago, Sheryl said:

The Thai tax code states pensions are assessable income. Some types of pensions from some countries are, however, non-assessable in Thailand under the terms of some DTAs. The UK OAP is not one of them, but UK government pensions (for retired military, civil servants etc) are.

Indeed. The Thai-Canada DTA is such a DTA where Thailand is not to tax the pension, making it exempt (for tax calculation) per Royal Decree-18, and thus non-assessable in Thailand. In that DTA it states (where I added the word 'Canada' and 'Thailand'):

Quote1. Pensions and other similar remuneration, whether they consist of periodic or non-periodic payments, for past employment, arising in a Contracting State (Canada) and paid to a resident of the other Contracting State (Thailand) shall be taxable only in the first-mentioned State (Canada).

In the case of Canada, it makes it pretty clear ONLY Canada can tax Canadian sourced pensions or similar remunerations, and hence NOT Thailand.

And from experience I can confirm Canada does tax Canadian sourced 'pensions and similar remunerations' where the Canadian tax rate is not small. Likely it would be better for the person with the Canadian pension if it was only Thailand (and not Canada) taxing such pensions.

-

1

1

-

-

37 minutes ago, deja vu again said:

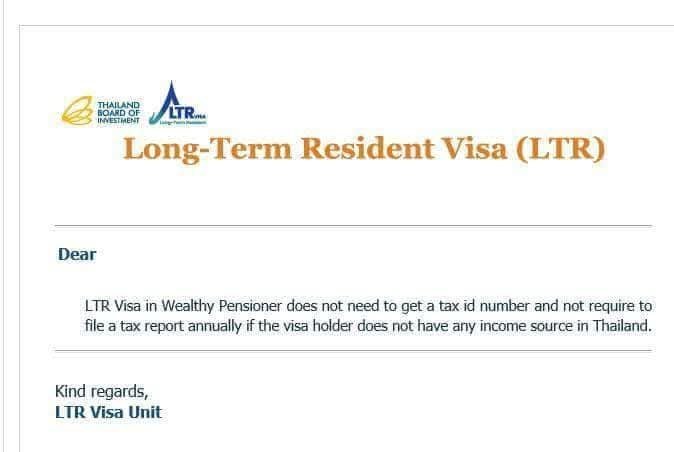

BOI just replied to my question regarding whether I need to file a return with the TRD.

....

The tax exemption benefit applies to income transferred from overseas into Thailand. Other asset types may not qualify. If you have no income source within Thailand and the income was transferred after obtaining the LTR Visa, you are exempt from tax and do not need to report annually to the Thai Revenue Department.

A TIN (Tax Identification Number) is optional and not required if you have no income source in Thailand or if the income was transferred after holding the LTR Visa."

...

"Your income earned outside Thailand and not transferred into the country is not subject to taxation by the Thai Revenue Department. Therefore, you do not need to file a tax return for income sourced outside of Thailand."

Thanks ... i think you are the 3rd person who has posted such or something similar. It is DEFINITELY worth repeating.

BoI are quite firm in their understanding. The Thai RD help line in essence said the same thing to one of our forum users.

It still disappoints me (and gets me suspicious of ulterior motives) that some so called tax advisors on youtube (incorrectly) stay otherwise.

-

1

1

-

-

5 minutes ago, Scouse123 said:

One word about the officials I am dealing with today.

clueless

I think that a bit harsh statement.

In addition to the tax code, there are RD ministerial instructions, and Riyal Decrees also governing taxation ( such as RD-18 which addresses Double Tax Agreements (DTA)) where there are dozens of different Double Tax Agreements. Addressing the tax situation of foreigners tends to more complicated than that of Thai locals.

It's difficult for the average RD official to stay on top of all of this.

-

7 minutes ago, driveout said:

Thanks for your answer. Is it true also that banks in thailand now will report to the tax department when you get money/founds in to the bank, like its a automatic system an Ai thing and sends everything to them, specially if you have a foreigner account?

I don't know the precise reporting mechanism nor threshold levels.

But I do believe above certain financial levels, global monetary transactions are recorded and per different existing agreements can be and are in cases reported to various governments.

-

17 minutes ago, JimGant said:

Joe Blow retires in home country in 2025. He has a private pension, which he salts away in a savings account established in 2025. He does the same for his private pensions earned in 2026 thru 2032 -- living off of only his social security. In 2033 Joe Blow moves to Thailand, and is here most of the year and is thus a tax resident.

Joe Blow wires all his 2025-2032 savings to Thailand in 2033. Sanity and common sense would dictate that Thailand has no tax claim against those salted away private pensions, even tho' the DTA says Thailand has primary taxation rights on private pensions.

I share your view ... with the added caveat that Joe Blow better have very good income records for any moneys remitted.

17 minutes ago, JimGant said:The other side of the coin..... Fat cat Thai billionaire, a tax resident of Thailand, earns zillions of dollars abroad, but never remits it to Thailand. Now, this year, 2025, he leaves Thailand for 7 months -- and remits those zillions in foreign income. Would they be taxable when bounced against this: A non-resident is, however, subject to tax only on income from sources in Thailand. Hmmm. If so, certainly give incentive to hop on your yacht and take an extended vacation.

Looks to me that your hypothetical Thai billionaire (zillionaire ? since he transferred zillions) knows how to legally manage his tax exposure.

-

1

1

-

-

2 hours ago, Yumthai said:

You quoted rightly The resident tax payer. In where does this statement mention or concern non tax residents?

You're interpreting, as some others, that statement applies regardless of the tax residence status in the later years. But why? It is always mentioned "tax resident" or "resident (meaning tax resident)" in any official written statement I can find.

And if you had read further, you would also have noticed I typed the following:

QuoteBut I am not certain there ... as (per what you note) one is NOT a resident tax payer when that income was earned.

...

Having typed the above, dependent on the wording of the DTA of one's income source country with Thailand, the income earned may not be assessable in Thailand and hence not taxable in Thailand .... And further if that income earned (when one was not a Thai tax resident) was already taxed by the source country, then one nominally should have a tax credit if there is a DTA with that income source country that one can use to ensure that one is not double taxed by Thailand.

I made it clear that residency and accessibility were factors ... as the income could be considered not in the 'assessible' income category.

i do thou, think it important, one has documentation to prove the income was earned when one was NOT a resident

2 hours ago, Yumthai said:I'm no lawyer but, until amended, the tax law still says:

"Taxpayers are classified into “resident” and “non-resident”. “Resident” means any person residing in Thailand for a period or periods aggregating more than 180 days in any tax (calendar) year. A resident of Thailand is liable to pay tax on income from sources in Thailand as well as on the portion of income from foreign sources that is brought into Thailand. A non-resident is, however, subject to tax only on income from sources in Thailand."

https://www.rd.go.th/english/6045.html

Yep. No argument from me there.

-

1

1

-

-

11 hours ago, driveout said:

If I’m a freelancer in Thailand, offering services like web development, and receiving payments into my Thai bank account. If I stay in Thailand for less than 179 days in a calendar year, do I need to pay taxes?

My understanding is (for your case) only if your income comes from Thailand. If it comes from Thailand you need to file a Thai tax return and report that income.

-

1

1

-

-

19 minutes ago, jesimps said:Quote

You are required to declare and file tax return on all monies transferred into Thailand even if no tax is owed

Only if assessable. You should not file if exempt under a DTA, otherwise you encounter the same problems as the OP. What's the point of a DTA if you're required to file for tax?

I agree only if assessable income AND if above the Thai tax filing assessble income threshold for filing a Thai tax return.

As to the point of there being DTAs? ... it is to avoid double taxation. Not to avoid tax completely.

The DTA is to help determine cases where one county may have exclusive taxation rights (and the other country no taxation rights) and to help in the situation where both countries can tax an income (to avoid double tax).

There can be cases where legally due to DTAs and Royal Decrees on taxation and due to the source of one's income that:

(1) a person pays taxes in both countries (but not above the maximum that they would pay if only one country involved), or

(2) a person ONLY pays tax in one country on their income, and not in the other country, or

(3) a person pays tax in neither country on their income, or

(4) a combination of the above for different income sources.

It all depends on how the tax law is implemented, together with Royal Decrees on taxation (such as Royal Decree-18 and DTA contents), Royal Decree 743 (LTR visa) and Ministerial instructions por.161/162.

If remitted income to Thailand is exempt in the tax calculation, then it is not to be included in the assessment as to the threshold for submitting a Thai tax return, nor (if threshold reached to file a return due to other income) is the DTA tax exempt income to be included in a Thai tax return.

I am not a tax expert - but sadly, seeing some of the mistakes in some of the youtube blogger purported tax advisors, it appears at present, neither are they experts, as perhaps some time is needed to see how this all plays out.

-

12 hours ago, Yumthai said:

I would add:

- if not tax exempt by being earned in a year you are not Thai tax resident (ex: non tax resident in 2025 can remit 2025 income tax-free in 2025 and at any time in the future).

While that makes sense in terms of what I would like to see, sadly I am not so certain of that being accurate.

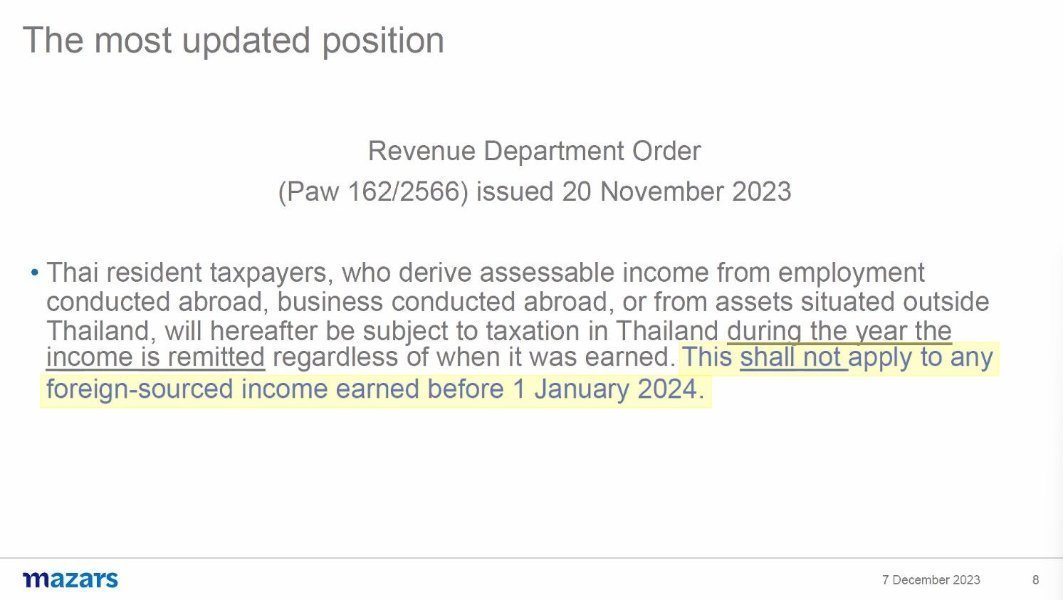

Consider Thai RD Ministerial Instruction Por.162:

The resident tax payer, who derive assessable income from ... assets situated outside of Thailand, will hereafter be subject to taxation in Thailand during the year the income is remitted, regardless of when it was earned. This shall not apply to any foreign-sourced income earned before 1-January-2024.

So that suggests the income you earned (when not a tax resident to Thailand) can still potentially be taxed by Thailand in year 2026 or any later year if you remit that income into Thailand.

But I am not certain there ... as (per what you note) one is NOT a resident tax payer when that income was earned.

Having typed the above, dependent on the wording of the DTA of one's income source country with Thailand, the income earned may not be assessable in Thailand and hence not taxable in Thailand .... And further if that income earned (when one was not a Thai tax resident) was already taxed by the source country, then one nominally should have a tax credit if there is a DTA with that income source country that one can use to ensure that one is not double taxed by Thailand.

So - sad to say ... this could be more complicated.

-

On 2/11/2025 at 5:24 PM, Scouse123 said:

... the senior officer took my phone numbers and said ' Leave it with him ' and he will phone me.

I really don't want to sit in their office as though I am impatient.

It's Thailand, they do things in their own sweet time.

Last time an RD official said that to me was over 2 months ago. They never did phone.

-

1

1

-

-

15 hours ago, mudcat said:

Asked and already answered (as I found when reviewed my packet for TRD)

Thai language for Thai-U.S. tax convention:

https://rd.go.th/fileadmin/download/nation/america_t.pdf

English language for Thai-U.S. tax convention:

Thanks. Using that link and a bit of guessing, for those looking for Thai language versions of the Thai-German, and Thai-Canada DTAs:

Canada-Thai DTA in Thai language

https://rd.go.th/fileadmin/download/nation/canada_t.pdfGerman-Thai DTA in Thai language

https://rd.go.th/fileadmin/download/nation/germany_t.pdfThis may come in handy if needing to point out some DTA aspects to a local RD taxation office (in Thai language). Hopefully it never comes to that need.

-

9 hours ago, CharlesHolzhauer said:

Currently, individuals in Thailand are taxed only on remittances.

... and taxed on local assessable income if a certain assessable income threshold level is reached.

-

16 minutes ago, NoDisplayName said:

Filed a joint return online. Received a text message to upload a copy of marriage certificate.

Thanks.

Unless one has been following this forum in detail, it's difficult for others to assess how similar or how different their tax return filing requirements situation is from yours.

-

1 hour ago, Hummin said:

I didn't pay previously tax on transfers from savings, but now I want to have a reserve here.

Next question

I transfer this year, stay 5 months. Next year I'm staying 7 months? I'm off the hook then?

Someone must know for Eu countries, efta, Nordic or Norway.

Sending money to Thailand, when not a Thai tax resident, should not be an issue (i.e. only in Thailand for 5-months).

However when you are a Thai tax resident (ie in Thailand for 180 days or more), any money remitted into Thailand ,

- if not tax exempt by specific words in a DTA (reference Royal-Decree-18), or

- if not tax exempt by an LTR Visa (reference Royal Decree 743), or

- if not tax exempt by being pre-1-Jan-2024 savings (reference ministerial instructions por-161/162),

then as a Thailand tax resident you are subject to Thailand tax on that assessable income if it meets the tax threshold.

If the money you plan to remit is not exempt tax due to what I noted above, then to reduce your Thailand taxation exposure, its best to transfer money to Thailand when you are NOT a Thai Tax resident.

That's my understanding, but note I am not a taxation expert.

Honestly , some of the videos of those who claim to be tax/advisors/experts, are a bit questionable at certain specific locations in the videos, as efforts are being made to better understand the full implications of por-161/162 in relation to tax residency and DTAs. Even some local Thai RD taxation offices are challenged here , given there are many different Double Tax Agreements.

-

1

1

-

-

You can also find the Thai-Swiss Double Tax Agreement (DTA) here:

https://www.rd.go.th/fileadmin/download/nation/switzerland_e.pdf

-

1 hour ago, thesetat said:

Sorry but i may be wrong. But i read today during my google searches that LTR are still required to file tax. I do not have time to find a link but you may want to check to be sure

If LTR visa holders have local Thai income exceeding the tax reporting threshold then they are required to file a tax return reporting the local invome.

I believe only LTR-WP, LTR-WGC, and LTR- WFTP are exempt tax on filing a tax return if no local income and only remitted foreign income.

I have seen BoI statements confirming this, and also a user called the Thai RD tax help line and confirmed this as well.

Only those initially uncertain and/or scaremongers and/or tax consulting firms (trying to drum up business) have been saying other wise.

-

1

1

-

1

1

-

-

17 hours ago, chang50 said:

Because my liability came to very little and to avoid a return trip and the hassle of providing docs. I just paid up.The whole experience was bizaare.

If your income was to be excluded in the Thai tax calculation due to por.161/162, and Royal Decree-18/DTA then you may even be able to file an appeal and get your money back. However if the tax amount paid is small, it likely is not worth the hassle of an appeal.

-

2

2

-

-

- Popular Post

- Popular Post

-

- Popular Post

- Popular Post

1 hour ago, Moonlover said:On the 18th Sept 2023 an article in the Thai Enquirer was amongst the first to announce these amendments (not rules) to the Thai tax code. That article included following paragraph:

'The program will begin January 1, 2024 and apply only to tax residents in Thailand meaning tourists and short term workers will be exempt. Also exempt will be those who have been taxed in a foreign country that has a standing Double Tax Agreement with Thailand'.

I repeated this paragraph many times on this forum but it was consistently brushed aside. Maybe now folks will start to take note.

A quick look suggests that article references POR.161, which was later clarified more with POR.162.

Further, note that articles massive qualification statement:

QuoteIt is unclear at this point how this will apply to foreigners living in Thailand on a retirement visa.

With regards to the Thai Enquirer article stating "exempt will be those who have been taxed in a foreign country that has a standing Double Tax Agreement with Thailand" that is IMHO a simplification to which most agree it is a simplification.

Its more complex that that I believe.

In the case of some DTAs, both Thailand and the source-country of the pension (for example), can tax the pension. In that case, one is into tax returns and tax credits (unless one has an LTR-WP, LTR-WGC, or LTR-WFTP visa).

In the case of some other DTAs, only the source country of the pension can tax the pension (or similar remuneration) - where in this case countries such as Canada (with its DTA with Thailand) and other country's civil service/military pensions only being taxable in the source-country. In that case, if no other income, there is no need for TIN nor tax returns.

And in other cases (Germany springs to mind) only Thailand can tax a German state pension (by state pension I mean NOT civil servant/NOT military) and not Germany tax the state pension. In that case such state pensions if received after 31-Dec-2023 and if remitted to Thailand are to be taxed in Thailand (also only if Thailand taxation threshold exceed). Further complications are tax return filing thresholds ... and of course presence of an LTR-WP, LTR-WGC and LTR-WFTP visa plays a factor.

So its very DTA specific here as well as there being some other factors.

... and add to that a paranoid view by some who (IMHO) incorrectly claim that a TIN and Tax Return is needed still, despite the Thai law making it clear in some cases that DTAs (as called up by Royal Decree-18) can make it clear some pensions are exempt Thai tax and hence in some cases legal that no Thai tax return need be filed.

Ergo lots of confusion, not per se due strictly to Thai RD, but rather due to the paranoia (although the paranoid may call it ultra conservatism) on this forum.

-

1

1

-

2

2

-

2 hours ago, TallGuyJohninBKK said:

One of the interesting things they were very clear about, which was one of the important points I wanted to seek advice on, was whether pre-2024 savings would only be counted as CASH holdings, or also include the value of stock holdings, in other words, total account balances as of the end of 2023. And they were very clear without any waffling that any pre-2024 savings calculation would be based on TOTAL account balances, stock and cash balances inclusive.

That's an interesting interpretation. Not one I expected, but one I would be happy to see.

I suspect most of use with trading accounts that are a mix of cash and equities, have a 31-Dec-2023 record as the total value (cash + share price at close business 31-Dec-2023) of our savings. I believe this and all subsequent trading / cash records then need to be kept, if desired to show subsequent remittances to Thailand came from the pre-1-Jan-2024 amount..

-

1

1

-

-

41 minutes ago, TallGuyJohninBKK said:

But FWIW, Carden's office is claiming they have confirmed with the TRD legal staff the interpretation that for an expat to claim Thai tax exemptions for foreign remittances like U.S. Social Security & government pensions under the DTA or pre-2024 savings under the TRD policy, that the expat supposedly needs to file a zero income Thai tax return and then attach a statement specifically claiming the pertinent exemptions and the related amounts brought in.

That Carden assessment begs the question ... why would the Thai RD NOT put a location on the Thai tax form if it was necessary to provide such information.

No where in the Thai tax guide , that I could see, requires that. ...

I am very suspicious that an unnecessary requirement is being pushed forward to try and raise money for a tax advisor office (to get expats to obtain TINs and file tax returns through such offices, when such is not a requirement for some (as confirmed by local Thai RD Tax offices - and the Thai RD helpline)).

Warning about TTB bank

in Jobs, Economy, Banking, Business, Investments

Posted

I would very very surprised.

Thai banks want and need the foreign money to retain solvency.

If foreign money left ( due to foreigners having no Thai tax ID ), banks would be at more risk of not being solvent.

The top level bank managers have massive influence over politicians. They will ensure this doesn’t happen.

Money to the banks talks here.