-

Posts

29,077 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Pib

-

But it's very, very unlikely for the govt to give a No unless the background check identifies the applicant as an International criminal OR, much worse, a past holder of an ED visa a person got in good faith...was stamped into their passport by a govt official. Yea...I know some (probably many) ED visas were issued to unqualified applicants or visa agents slipped a brown envelope to immigration officials but the ED visas were never the less still insured by immigration officials. Now if that ED stamp was a fake stamp entered by a corrupt visa agent then that changes the picture. The follow-on possible impacts of having an ED visa in the past (which I've never had...currently have a LTR visa) like being the reason behind a Elite visa application disapproval just seem over the top by the govt. But maybe I'm just missing the govt's reasoning behind their stance....reasoning I'm sure none of us will ever be made privy to. And hopefully just having a past ED Visa does not result in a "high" chance of or automatic/100% disapproval when the ED visa appears legally issued by govt officials. I guess a lot depends on examination of each ED visa issued....issued legally or illegally.

-

News Release SOCIAL SECURITY Social Security Announces 3.2 Percent Benefit Increase for 2024 Social Security and Supplemental Security Income (SSI) benefits for more than 71 million Americans will increase 3.2 percent in 2024, the Social Security Administration announced today. On average, Social Security retirement benefits will increase by more than $50 per month starting in January. More than 66 million Social Security beneficiaries will see the 3.2 percent cost-of-living adjustment (COLA) beginning in January 2024. Increased payments to approximately 7.5 million people receiving SSI will begin on December 29, 2023. (Note: some people receive both Social Security and SSI benefits). “Social Security and SSI benefits will increase in 2024, and this will help millions of people keep up with expenses,” said Kilolo Kijakazi, Acting Commissioner of Social Security. Some other adjustments that take effect in January of each year are based on the increase in average wages. Based on that increase, the maximum amount of earnings subject to the Social Security tax (taxable maximum) will increase to $168,600 from $160,200. Social Security begins notifying people about their new benefit amount by mail starting in early December. Individuals who have a personal my Social Security account can view their COLA notice online, which is secure, easy, and faster than receiving a letter in the mail. People can set up text or email alerts when there is a new message--such as their COLA notice--waiting for them in my Social Security. People will need to have a my Social Security account by November 14 to see their COLA notice online. To get started, visit www.ssa.gov/myaccount. Information about Medicare changes for 2024 will be available at www.medicare.gov. For Social Security beneficiaries enrolled in Medicare, their new 2024 benefit amount will be available in December through the mailed COLA notice and my Social Security's Message Center. The Social Security Act provides for how the COLA is calculated. The Social Security Act ties the annual COLA to the increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) as determined by the Department of Labor’s Bureau of Labor Statistics. To read more, please visit www.ssa.gov/cola. NOTE TO CORRESPONDENTS: Here is a fact sheet showing the effect of the various automatic adjustments.

- 1 reply

-

- 1

-

-

Hopefully it will come true. About three weeks ago we I booked my red Atto the delivery estimate given by the "manager" of the dealership was about two weeks. As posted earlier after that two weeks had come and gone the Thai wife and I went to talk to the dealership a few days ago regarding "when" is delivery going to occur. Still could not get anything firm...but the dealership promised an updated to us within two days. Those two days end midnight tonight....we haven't been contacted yet....but they still have till midnight. I'll be very surprised if I do get an update today. Time will tell.

-

I think since DTAs must be considered (unless Thailand is going to ignore DTAs they signed) and how that remitted income may be shielded by a DTA (like social security benefits being deposited to Thailand) that all funds remitted will not automatically be considered assessible (taxable) unless the individual self declares it as taxable. We really need clarification from headquarters Thai RD as to how DTAs will play....not only for us farangs but local RD offices. Yeap...typo...meant to say can't...I went back and corrected...thanks for identifying.

-

Until the Thai RD announces DTAs with around 61 other countries are void...not going to be complied with by Thailand...I just can't see what your local RD told you as being correct. Additionally, If I understand you right, you didn't really ask the RD a DTA question; instead, you asked about a UK 12,570 GBP tax threshold for paying taxes in the UK and if that might earn you a Thai tax exemption/reduction.

-

Was any of this money you are remitting covered/shielded by a DTA? I know you said your local RD didn't didn't seem to care about the the source of the income (i.e., pension, whatever, etc) of that Bt480K remitted which seems to imply at least with your local RD they could care less about a DTA.....like it taxable by Thailand....up to you to try to get an offsetting tax credit from your home country where the DTA may say it's only taxable by your home country and not taxable by your tax residence (Thailand in this case). I don't believe Thailand is now disregarding DTAs as those are signed/agreed to at the highest levels of each government.

-

Thanks. Since I'm in the processing of buying an EV (Atto 3) I was interested in one of your videos titled "How to make a dumb EV charger a bit smarter" where you said after fully charging your house solar batteries you then use the EV wall charger powered by the house battery to charge your EV because you don't want to use power from the grid...all understandable. However, then you say when you forget to turn off the wall charger it drains your house battery which is understandable but you say it's like a bad thing when you intentionally power the wall charger from the house solar batteries..."or" maybe you meant it can completely drain the house battery "down to zero." Not knowing how big your house solar batteries are (a lot bigger or smaller than the EV battery) and/or when any charger will stop drawing significant power once a battery is full, whether in your EV or smartphone, I'm somewhat confused on what you mean in the video about it can completely drain your house batteries. I guess the size of our house batteries is key....if significantly smaller than the EV battery then I understand. Thanks for your channel....looks like all your videos are meant to pass along good info.

-

Yea...maybe so. Fortunately as a U.S. citizen it appears I'm going to be shielded pretty well from Thai assessable (taxable) income due to the Thai-US DTA and my LTR Visa since the bulk of my income is U.S. govt pensions/social security. But me and my dual US-Thai citizen wife whose social security benefits are also shield by the DTA may end-up having some Thai assessable income on our U.S. private IRAs (the LTR may shield my IRA income)...but if the IRAs do end up being Thailand taxable we will be able to get a full, offsetting foreign tax credit on our joint U.S. tax return...end result no additional overall tax paid (I hope). But time will tell...interesting tax times ahead. Thanks again.

-

Thanks. So, to ensure I'm clear on the remittance part, say income from a private pension not shielded by a DTA was paid-out in the upcoming 2024 year but it was paid into a home country bank account where you just accumulate the pension payouts for some future need then that money would not be taxable by Thailand until you possibly remitted some of it to Thailand? And say you didn't remit any say till 2026 then it would only be taxable by Thailand in the tax year of 2026 (which you file in early 2027)? Thanks again.

-

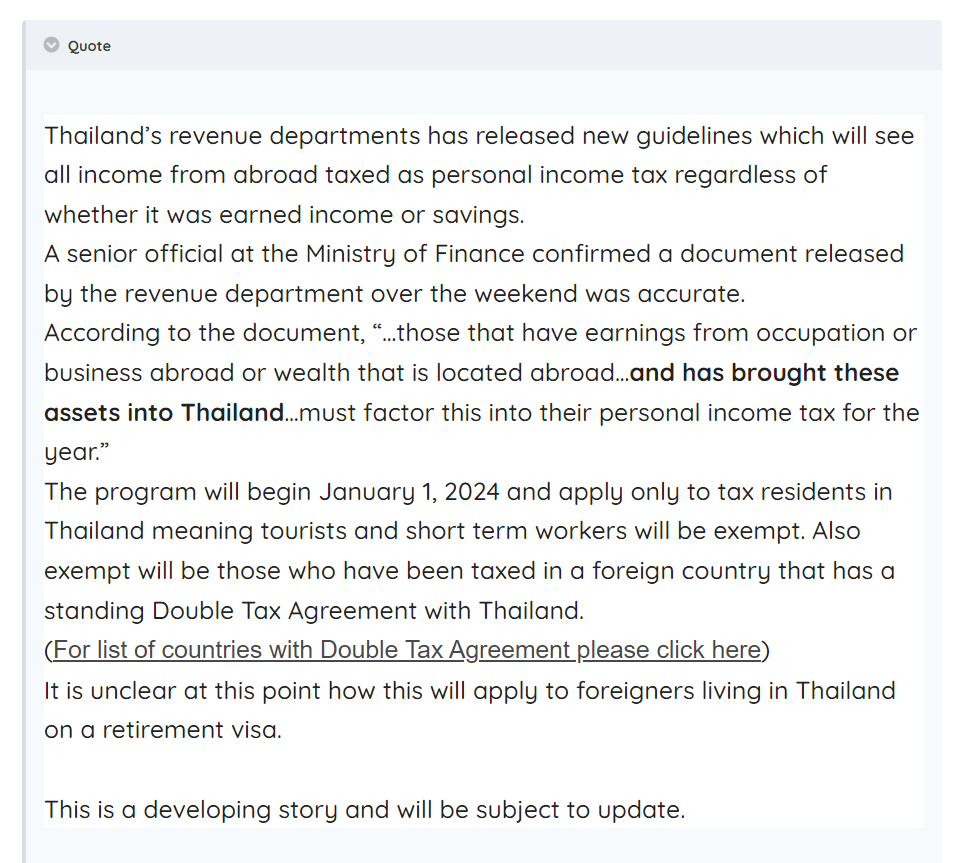

Below is the beginning news article from this mega thread talking the new RD directive where I bolded one phrase of it. Go take a quick read below. The article basically says if you are a Thailand tax resident and have foreign income assessable (taxable) by Thailand lets say like income from a private retirement acct, investment, private pension, etc., which is "not" shielded by a DTA do I have the correct understanding from the article such assessable (taxable) income would only be Thailand taxable "when/if" you remitted that income to Thailand; thereby meaning if you never remitted that specific income...say just left it in your home country (and could prove it) then that specific income stream would remain untaxable by Thailand? Like say a person expended all that specific income on bills, stuff bought in the home country like upkeep of home/family member in the home country....or just flatout left it setting in a home country acct untouched....maybe saving it to be inherited/given to someone upon your death.....or just untouched as you might plan to repatriate to the home country in the future. Or is the article wrong/making an assumption and Thailand expects to tax that specific Thailand assessable (taxable) income--assuming you declare it to them--whether you remit it to Thailand or not? Seems the more I read crossfeed/articles/posts on this subject the more I get wrapped around the axle on "remittance" part of the subject. Thanks.

-

Thanks. The new Elite visas sure have got expensive...not only the new and improved prices but now even a healthy application fee. I expect they hope this new $50K application fee will stop people from applying who really just want to see if they can get approved...not really sure they can come up with the full visa cost...just not sure they can follow thru for some reason as it is a big sum of money. Heck, Bt50K is the entire fee/cost for an 10 year LTR Visa and that fee is not paid upfront. Fee only paid if the person's application is endorsed (BOI's terminology for a preapproval after application review) and then the applicant follows thru with the very final step of paying the $50K fee for actual issue of the visa...that is, having the visa actually issued/inked into your passport. Preaching to the choir I know...LTR fee info just for others listening in.

-

Many youtubers are only into creating videos due to money earned from the number of subscribers/views/likes they can get. I have nothing against that. Many of the videos are good and many are just bad, click bait videos. But many of such youtubers who must continually make new and very frequent videos to keep the money following in (and maintain an influencer/celebrity status) end-up making videos that are nothing more than "their opinion editorials." Really just entertainment videos mastcaraiding as fact. Take many youtuber videos with a big grain of salt.

-

Did the FB poster provide a reference as I wonder if the poster might just be talking a B50K visa agent fee if he's not applying directly with govt Thai Elite company. Thai Elite pays a 10 to 15% commission to its approved GSSA agents for each approved Elite visa, but that don't prevent any agent from also charging a fee to handwalk the applicant thru the application process. Maybe some agents don't want to take the chance now of hand walking the applicant only to end up with no money made if the applicant is not approved/doesn't follow thru in paying the govt the when approved which prevents the agent from recieving the 10 to 15% commission. Or maybe the "govt" has indeed decided to now charge a refundable-if-approved application fee....kinda like a deposit that is only credited back to the applicant/towards the main Elite visa if approved "and" when the applicant follows thru in payment for actual issue of the visa

-

No need to do anything now. If you don't get a 2nd mailing chances are very high you are good to go. If you do get a 2nd mailing be sure to mail it back ASAP by "regular airmail" not registered airmail as regular airmail will arrive Wilkes Barre significantly faster than registered mail. Yes there is no tracking on regular airmail but as you've found out registered airmail is not providing tracking all the way to Wilkes Barre/not confirming delivery. Don't worry about it until mid Jan when you would be able to see any suspension of payments in your online SSA acct. If seeing a suspension then contact SSA.

-

Rate Charging Suppliers based on ease of use?

Pib replied to Greenside's topic in Thailand Motor Discussion

When I read this I thought to myself after the update a few hours ago I was still logged in as I don't signout of the app. So, I wondered if I logged out could I then log back in after the update? I logged out and was able to log back in no problem. So, the updated app didn't affect my ability to log in (yet). -

Are any of you BEV owners using a OBD2 adapter to periodically check your vehicle's condition/any trouble codes, etc.? Seems a lot of Youtube videos use OBD2 data during their videos but don't identify what adapter they are using or the few that do list a pricey adapter costing several thousands baht. Since there are so, so many different OBD2 adaptors sold ranging from Bt50 (like the Elm 327 Mini sold on Lazada/Shopee) to thousands of baht AND since all OBD2 adapters are not created equal do any of you have recommendations for a low cost OBD2 adapter that works well on a BEV? And maybe available on Lazada/Shopee?

-

Yes....folks with their Thailand address on-file go thru this every year. Thailand is one of the countries on an annual schedule. There is also a list of countries that are on a biennial schedule. But as mentioned Thailand is one of the many countries on the annual list. Now I know you were only talking about the 7162 for yourself but if say you had a spouse also drawing SS benefits who also has a a Thailand address on-file with SSA "and" earned those benefits solely on your SS earning record (i.e., receiving what is called a spousal pension) then that spouse would only receive a 7162 every two years. Both the Thailand address and spousal pension criteria must be met; not just one or the other). My wife receive a spousal pension since she didn't quite work 10 years while in the U.S.; so her social security benefit is based on my earnings record....she only get a 7162 every two years while I get mine annually.

-

At the bottom is what the Manila FBU SSA office says on their website. You can also download a blank copy of a 7162 for completion and mailing to Wilkes Barre if you never got the barcoded 7162 mailed to you and Wilkes Barre never received it back from you. And of course you would need to talk with/send an enquiry to Manila for regarding the problem. Usually what happens is after you contact your local SSA office (which is Manila for us folks in this part of the world) they would initiate action to unsuspend your payment and have you mail a 7162 to Wilkes Barre and/or Manila. It usually takes a few weeks for suspended payments to be unsuspended and resent. Yes, you can find some horror stories on social media sites where it took a l.....o.....n......g time to get the payments unsuspended but typically those stories leave out some critical details as to why the benefits were "really" suspended. Also easy to find on social media sites where people got benefits suspended for non-receipt of 7162, but after contacting their local/servicing SSA office they were unsuspended promptly and withheld payments arrived within a few weeks....even before the next regularly scheduled payment. Up until several years ago it use to be not-so-hard to contact Manila via phone any work day of the work week or via email. But now their phone hours are limited to Tue and Thu from 8am to 11am (and good luck in getting a human to answer).....and an email direct to Manila SSA may never be answered as they want you to use their online Inquiry Form which is easy enough which effectively completes/sends an email to Manila and then they respond by email....typically "weeks" later. The Manila SSA Office is a lot slower and harder to contact now than a few years ago....I don't know why....maybe undermanned, etc. https://ph.usembassy.gov/services/social-security/ https://ph.usembassy.gov/services/social-security/faq/

-

What should appear in your online acct is you will see your "next month/not paid yet" payment (that's not the exact wording but you know what I mean) showing as zero, suspended, etc. That would be the upcoming early Feb payment (which is really the payment earned for Jan but being paid in Feb) since the suspension would go in affect sometime in Jan which is after your early Jan payday. Now whether you might also get a formal notice showing-up in your online acct correspondence box I couldn't say as it depends on the nature of the correspondence as to whether it will show-up there also and/or just be snail mailed to you. But you will get a written notice in snail mail that will probably take around 3 to 4 weeks to arrive. That notice would be generated in Jan notifying you of the suspended payment effect for the Feb payday and onwards. Yea, you will be able to tell from looking at your online acct....but it will be sometime after the Jan payday before it becomes noticeable. After the Jan payday is completed that when the SSA would take action to block further payments and notify the pensioner. Some people refer to that as the 3rd notice since SSA didn't get a reply to the 1st (May/Jun) or 2nd (Sep/Oct) 7162 mailing.

-

Rate Charging Suppliers based on ease of use?

Pib replied to Greenside's topic in Thailand Motor Discussion

Hey, I just thought since multiple bookings can now be done but you are not sure what time you will be able the charging station just book a bunch of consecutive time slots. But I expect there is a catch that would make that costly like maybe multiple booking fees being applied for each 30 minute booked slot--I don't know since I haven't actually tried it yet as I'm still waiting to get my new EV delivered. But at least I'm registered on the app with payment option setup also.