Child Tax Credits

-

Recently Browsing 0 members

- No registered users viewing this page.

-

Topics

-

-

Popular Contributors

-

-

Latest posts...

-

44

Was I crazy to buy a Neta V now the company is going bust?

I'd sell it ASAP. If they go out of business you won't be able to get replacement parts for it. At the very least, it's gonna be a massive hassle to score them. -

43

Health Rabies Deaths Triple in Thailand: Urgent Alerts Issued

Your pal is an idiot. Why take the risk? Rabies has a 100% death rate. https://www.bbc.com/news/articles/c98wyllp170o The survivor fallacy which is often wheeled out; rather unintelligently, to justify poor decisions or just dumb behaviour.... “My mate fell off his motorcycle without a helmet and was absolutely fine”.... -

259

Economy Trump Dishes Out 36% Tariffs in Shock Move Against Thailand

This is so easy to solve, Thailand just needs to buy a few submarines then deficit will balance itself. -

43

Health Rabies Deaths Triple in Thailand: Urgent Alerts Issued

Your pal is an idiot. Why take the risk? Rabies has a 100% death rate. https://www.bbc.com/news/articles/c98wyllp170o -

259

Economy Trump Dishes Out 36% Tariffs in Shock Move Against Thailand

I guess the rule is all caputals aren't allowed...might be wrong, though. -

43

Health Rabies Deaths Triple in Thailand: Urgent Alerts Issued

I think the concern is not specifically about the number of rabies-related deaths; seven so far this year, if I’m not mistaken, but in the fact that its a threefold increase, which indicates a surge in cases among cats and dogs. Thus: while the death toll itself remains relatively low, this spike in animal infections should not be dismissed. At a certain point, rising case numbers cross a threshold; what might be called a critical mass, where the spread becomes self-sustaining and increasingly difficult to contain. When that happens, the risk of exponential transmission grows, especially in areas with high stray populations, low vaccination coverage, and poor public awareness. What’s particularly worrying is that rabies, once established in an area, is extraordinarily difficult to eliminate. The virus is almost always fatal once symptoms appear, and by the time it's identified in animals, it's often too late to prevent transmission to humans. Add to that the challenge of monitoring and controlling free-roaming or feral animals, and you have the makings of a public health problem that could easily escalate if left unchecked. Additionally, public complacency plays a role, people often only become concerned when a crisis is already at their doorstep. But the true value of disease control lies in early intervention, not reactive panic. Thus: with rising case numbers as an early warning signal, now is the time to step up surveillance, reinforce vaccination efforts in animals, and ensure that the public knows when and how to seek post-exposure treatment. In short, while the current situation is clearly not a crisis, the trajectory suggests a growing risk that demands proactive management before it becomes a more serious problem. So, while some may casually dismiss the current situation...saying, "It’s only a handful of cases".... that complacency is precisely what allows problems to grow unnoticed. Fast-forward five years, and the very same voices may be asking, "Why wasn’t this addressed earlier?" Public health threats rarely explode overnight; they build quietly, often in the background, while attention is elsewhere. By the time the consequences become visible, the opportunity for simple, preventive action has usually passed. What was once manageable now requires costly and complex intervention. It’s far wiser to recognise the warning signs now and take measured, proactive steps, than to look back in hindsight, asking why no one acted when the risks were still containable. Its exactly the same as the 'stray dog' sitation in the first place !!!

-

-

Popular in The Pub

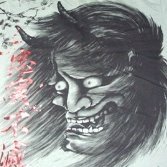

.thumb.jpeg.42eea318e3350459f0aaaa5460326bca.jpeg)

Recommended Posts

Create an account or sign in to comment

You need to be a member in order to leave a comment

Create an account

Sign up for a new account in our community. It's easy!

Register a new accountSign in

Already have an account? Sign in here.

Sign In Now