Jeffrey346

-

Posts

1,624 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Jeffrey346

-

-

10 hours ago, paddyfield7 said:

I asked my lawyer about paying taxes in Thailand. She said that the Thai Tax Authorities wouldn't care about it, they would rather expect Farangs to bring a lot of money to here AND SPEND IT!

Your Lawyer is a jerk. Thailand has a Tax Agreement with the US. If you earned money in the US then it is not taxable here as long as it was declared in the US.

Think about getting another Lawyer.

-

10 minutes ago, yankee99 said:

you can open online but you most likely will need a vpn and possibly genuine ss card and usa drivers license

i opened etrade from here

also secured usa citi card, chase card and discover from Thailand

be prepared to have to call and sometimes they want to call you. This was ok with google voice

I did not use a vpn. But do have a US phone number from Ooma. They did not call me.

I told them I do not have a US drivers license. They accepted my passport.

-

Just did this 6-8 months ago with Chime Bank. The are an online bank owned by Bancorp. I needed a US address but did not have to supply any proof.

They will issue you a no fee international debit card. You can have your retirement DD with no issues. There cell/mobile app is awesome.. Check it out.

BTW, if you want me to recommend you, they will pay both of us $50. But you must setup DD.

-

1

1

-

-

I use uHosting $15.00/mo.. 5000 channels all the sports and live TV you want. Excellent service and live chat via Telegram. Free trial as well..

-

1

1

-

-

In the US.. All told, a radiologist completes about 13 years of training after high school. In addition to this training, there are two exams to successfully take to become certified by the American Board of Radiology. Some subspecialties of radiology must be chosen during the residency period.

-

1

1

-

-

My friend just went through this procedure last week. here in KK. He had all his translated docs but never went to the MFA and needed his Passport translated.

The lady at the Amphor said you need to go to BKK or use the service to have all your docs certified which cost 2900B.

-

I use my Banks Apps and just touch scan. Both BKK Bank and SCB works great. Just scan the shops QR Code.

-

- Popular Post

- Popular Post

26 minutes ago, tonray said:While I waited mt turn at the DLT in Chatuchak , I watched an Italian guy become quite agitated after being told his yellow book was not a satisfactory proof of residence anymore and he needed a Cert of Residence from Immigration.......yeah...the yellow book is losing its sheen. I tried to get one in Bang Yai, Nonthaburi and the lady told us in no uncertain terms...pretty much forget about it...some Amphurs just do not want to think of foreigners as residents in any official sense

Once again, just the DLT person's opinion. My Yellow Book has never been turned down.

-

5

5

-

13 hours ago, Chris.B said:

It is not a problem the money coming from you. However you will have to go to the Amphur's office and sign a disclaimer to the land. Don't forget your passport and may be your marriage certificate.

Why sign a disclaimer? For what purpose?

-

This is Thailand and it Depends on the Ampur. My wife got mine with my Passport and Thai ID.

-

2

2

-

-

4 minutes ago, pineapple01 said:

She must be the only one then, or keeps U in the Dark.

Perhaps your wife is telling you she is getting a great deal. But in reality, the rate is not much better than the banks. If fact, bank auto loans today are 0 to .002 % where Gov loans are 7%

My wife is a Lawyer and a very well paid Gov employee. She has never, and never will keep me in the dark. Gov employees can borrow from the Gov if they get 2 co-workers to guarantee the loan. Once they guarantee you they expect you to guarantee them. I situation I would not want to be in.

-

On 8/16/2020 at 5:32 PM, uncleP said:

Government workers get cheap finance in Thailand

Really?? My wife is a Gov employee and gets no special deals

-

1

1

-

-

4 hours ago, JoePai said:

As long as they are quarantined properly I can see no problem

Do you really believe that a Tourist will agree to 14 days of quarantine yet afford it??

-

1

1

-

1

1

-

-

23 hours ago, clarky cat said:

I’m in khon kaen city so plenty of options I’d assume..

I'm in KK. Across from the KK museum there is a huge AC shop that all the little shops send customers to who need to have the dash pulled to do AC cleaning or repair.

I too my Vigo there 2 years ago as the evaporator needed to be cleaned. They charged me B1500. it took about 90 min.

You may want to go there as all they do is AC repair.

-

1

1

-

1

1

-

-

What about those who entered the Kingdom using an APEC Card. Do they need to leave by the 26th as well?

-

On 8/7/2020 at 11:39 PM, Brightly said:

RichCor,

I have tried using an internet based calling system. However, the voice quality isn’t quite as good, and my friend is slightly hard of hearing. She says it’s hard to hear me online. Hence, the phone plan query.

Download the LINE APP. I use it worldwide and the voice quality is perfect.

-

1

1

-

-

- Popular Post

OH!! he can host it as a private Hotelier as he won't be President...

-

3

3

-

16 hours ago, phetphet said:

No. It's a Samsung. New 2020 model. My old one never did it even though plugged into the same socket as the new one is. woke up the other night wondering what the bright light was in the living room. Got up to check and the TV was on. happened a few times now. I am just switching off at the socket now.

Go into setting and locate CEC and turn it off. My TV CEC is in the Sound and Display section.My TV is LG and it fixed the issue.

-

Poured the last 3 nights in KK

-

1

1

-

-

4 minutes ago, Pib said:

Contrary to popular belief, a person can not amend a return just for any reason---and one of them is changing filing status except under specific situations and unless doing it before the annual filing deadline which is 15 July 2020 for the 2019 tax year but 15 Apr for normal tax years...extended tax deadline when filing for an extension does not apply. Additionally, if you could change from married jointly to say married filing separately the impact on the other person comes into play as in possibly requiring them to file a return also.

Below Efile webpage gives a layman's overview of changing filing status....basically a no-can-do if after the normal filing deadline each year and unless a specific reason applies like maybe a deceased spouse.

https://www.efile.com/married-filing-jointly-tax-filing-status/

But using the IRS Interactive Tax Assistant (ITA) is best. Go to below ITA webpage below dealing with "Should I File An Amended Return" and walk through the half dozen of so questions to determine if you can change from a joint return to any other filing status. For the "has the tax deadline passed" question which is 15 July for tax year 2019 or 15 Apr for other years you select Yes since we've passed the normal tax filing deadline (remember, extended deadlines do not apply). I walked thru that ITA webpage to see if a joint return could be changed to any of the other filing statuses like Single, MFS, Head of Household, etc., and the answer was NO!!! It will gives reason why you can't as you go thru the questions.

https://www.irs.gov/help/ita/should-i-file-an-amended-return

Thanks for the info @Pib When I spoke to the IRS, they did say I could file for the payment on my 2020 return. Not sure how but time will tell...

-

1 minute ago, DerekJ said:

I’m a non filer I don’t know but my wife and I received ours last time. It is ridiculous how it’s getting held up by the likes of the FBI who doesn’t deserve a new building right now. If it wasn’t for things like that the people who really need it the most in the states would have it by now.

Does your wife have a US SSN?

-

15 hours ago, Pib said:

You are not eligible per the CARES Act which your Congressman probably voted for. I agree that it's not right.

In the HEROS Act that the House passed several months but the Senate never moved on it would have allowed you to get a payment...and your ITIN spouse also. The Republican HEALS Act that the Senate unveiled a few days ago basically maintains the same eligibility requirement as the CARES Act that was passed into law.

As our Democrats and Republicans come to some compromised act over the coming weeks I hope the Democrat proposed eligibility requirements win out. Time will tell.

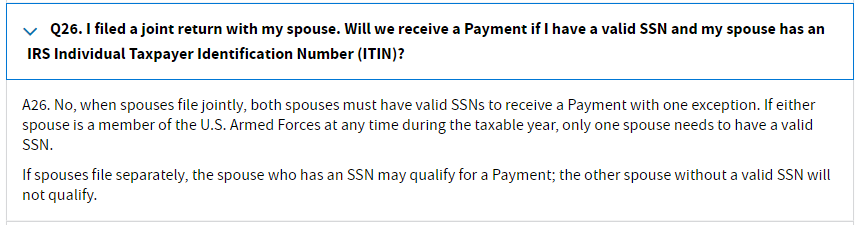

CARES Act Eligibility

https://www.irs.gov/coronavirus/economic-impact-payment-information-center#eligibility

15 hours ago, utalkin2me said:I think she was telling you to file an amended return and not file jointly. I am not a tax whiz but i did not see a reason on green earth why someone would file joint with a non us spouse.

I will have to do the math, but... If I file an amended return, would I have to file 2018 and 2019?

-

14 hours ago, Pib said:

More info on ITIN eligibility under the House HEROS Act that went no where in the Senate.

Thanks for the info.. I wasn't aware of the CARES Act

-

I never got the first check so I called the IRS and was told that I am not eligible. I told the agent I meet all the rules and should get the payment.

The agent put me on hold for 20 minutes and when she returned, said that there is a Congressional rule that states "if you are married to a non US citizen and filed a tax return you are not eligible".

I said that is ridiculous and discriminatory. She said if I had not files a joint tax return I would have been paid.

I sent a letter to my Congressmen it's been 6 weeks with no reply.

-

1

1

-

Will I Pay Tax in Thailand?

in Jobs, Economy, Banking, Business, Investments

Posted

If you earn money in Thailand it's taxable. The bank by law deducts 15% of earned income which you can get back by filing for it at the Revenue Dept as long as the earned income is less than B150,000.