jcmj

Advanced Member-

Posts

1,561 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by jcmj

-

-

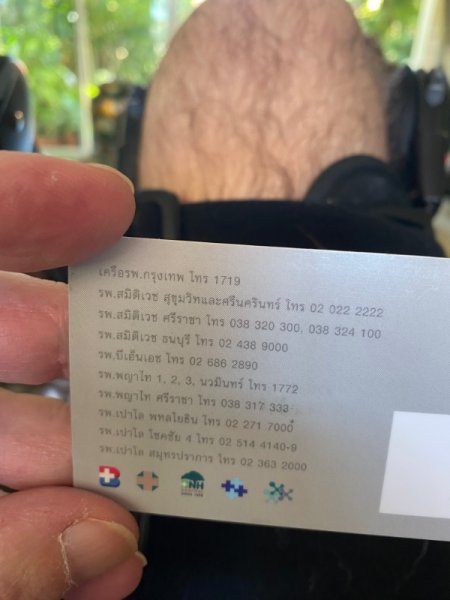

I have one at Bangkok Pattaya Hospital which works for anyone under their group. It’s called the Chivawattana card. I get the platinum card whichasts 2 years and give you 1 large check up and 1 small one plus 15% discount on meds and various services. Also cuts off 40% from your room charge if you have to stay in. It’s on special for 12,900 I believe, so only 6,500 a year. They do have a gold one which lasts a year and a bit less on the discounts for around 6,000 and then they have a Premium one that is about 40 some thousand baht and good for 3 years and bigger discounts. 50% on rooms and other services for doctors fees cheaper. Prime is perfect for me, because I don’t have OPD and I get meds quite often that I can’t get in the pharmacy. Definitely worth a check.

-

Call centric and on my mobile phone I just downloaded a Softphone app, which was either free or a one time small payment. It’s nice to have family and friends call my US number and get ahold of me here and I use it to keep in touch with them. If you are back visiting in the states you have no extra fees at all. I do pay a penny or two for voicemail but that’s optional. Good luck

-

Bank proof of money in the bank

jcmj replied to CPH's topic in Thai Visas, Residency, and Work Permits

Jomtien immigration wouldn’t accept the statement showing the balance throughout the year. He just made copies of each page of my bank book for the past year. Waste of money at the bank. All I needed was the bank certification letter. I’m sure it can change depending on the day and who’s doing it. -

Crime Red Bull Heir at Centre as High-Profile Corruption Verdict Looms

jcmj replied to webfact's topic in Thailand News

It will all be over soon enough and he will be back on the streets, but hopefully keeping out of the public eye. I’m sure there are still some upset people out there that wouldn’t hesitate to kidnap him for some money and then get rid of the scum, or send him to another group to do the same thing. Daddy won’t keep paying, and he’ll finally get his justice. -

Depending on where you call home there are Many VOIP services that can reduce your phone bill by a lot. I have one in the US and it costs $$8.95 a month including 500 minutes of out going calls to anywhere in the USA and unlimited incoming calls from the USA so I have my US phone number and my Thai number. Just an option.

-

Report Thailand Declines US Loan Deal for F-16 Jets Over Tough Terms

jcmj replied to webfact's topic in Thailand News

For a country that never engages in war and only fights off illegal fishing in Thai waters I don’t see the need to spend too much money on their military. -

Crime Red Bull Heir at Centre as High-Profile Corruption Verdict Looms

jcmj replied to webfact's topic in Thailand News

Let’s hope he is gay or just doesn’t want children. I would hate to see him, or his nannies, raise that entitled little child how to buy your way out of any situation and never have to be held accountable for anything you do. It’s going to be hard enough dealing with him upon his return free as Thaksin. -

I’ve seen many Americans try to use their insurance here only to be told they had to pay first then get reimbursed. Many private hospitals stopped taking it for payments immediately because it was too difficult and too long to get paid from the American insurance companies. I’ve had Thai insurance for years and they have changed companies many times, but they have always paid almost all of the bill. Some things they just don’t cover, especially anything mental health related. I’m afraid to see how much it will be this year when I go up an age bracket and just had a long stint in the hospital that cost them well over a million baht. My friend stopped his when he hit 70 and it went up to 550,000 baht. Decided to self pay. If you do decide to self pay make sure you buy a hospital discount card. It will save you a lot, if available, make sure to ask.

-

Economy Rising Egg Prices in Thailand Strain Consumers and Businesses

jcmj replied to snoop1130's topic in Thailand News

Supply and demand. Just stop buying eggs. We ear too many as it is. -

Well apparently she must have had some success if she’s going to build a weed holistic hotel on Samui. She must have a nice nest egg. Unfortunately she needs to stay here longer than 2 weeks to see if she actually likes it and can deal wall of the Thai Laws, envelopes and bs to even get it started. Thailand does not make it easy for any foreigners to do business. Don’t let their bs fool you.

-

Report Thailand Bans Corporal Punishment in Landmark Child Rights Move

jcmj replied to snoop1130's topic in Thailand News

A teacher smacked my son’s fingers with a ruler Once for not having his haircut short enough. I went into that principals office and told them to get that teacher down here along with my son. I let them all know in no certain terms that if my son ever came home again like that, they would all get the same from me. Son was a bit embarrassed, but no one lands a hand on my children in school, especially for something so trivial. I did spank my children and give him the belt until he was about 6 and if he dared slam his bedroom door because I said no to something he wanted I would follow him up there and open the door and explain to him that he can’t have everything he wants. I don’t care what your friends have. If you want something do some extra chores around the house, but never slam that door again or there will be consequences. He never did it again and he has been well behaved and respectful to his peers and adults since he was 7. So I believe in early discipline, just don’t overdo it and make them do chores to learn some responsibility and also ways to negotiate to do more to get paid for so that he can save up for something he wants. Nothing is free in this world. He learned how to wash, dry and iron his school clothes by 10. He had to sweep, mop and clean up his room every Sunday as well as clean his bathroom and shower. He is now so much further ahead in life than many other coddled children. -

Young Man to Sue Thai Police After Six-Day Detention Drama

jcmj replied to webfact's topic in Southern Thailand News

Even if he wins he would probably only get compensated for lost wages. They don’t really do pain and suffering here. Good luck -

Naked Man Stirs Phuket Market, Raises Mental Health Concerns

jcmj replied to snoop1130's topic in Phuket News

Sure glad they are willing to help him If they find out who his employer is. -

Drunken Assault Shocks Pattaya as Tourist Attacked Unprovoked

jcmj replied to snoop1130's topic in Pattaya News

Why is everyone blaming the victim. The Thai guy has a long history of causing chaos and trouble and he should have been in jail, not just let go with a 100 baht fine and a Wai. They definitely need to work on their judicial system here. -

Road Rage Scandal: Politician's Son in BMW Causes Devastating Crash - video

jcmj replied to snoop1130's topic in Bangkok News

Well considering he’s Thai they can’t black list him, but he should definitely be paying for all of the damages to the vehicle and the medical bills, then thrown in Jail before he escapes for attempted murder and then taken off of the list to run for any official election permanently. But I’m not holding my breath as Daddy may have a lot of money and connections. TIT -

Thailand's AI Robocop Debuts at Songkran Water Festival

jcmj replied to snoop1130's topic in Thailand News

I hope that it would at least make sure that the offender listed, then found by the cops, if they are willing to get off their butts instead of just watching the AI cop. Hopefully they would actually have to have a paper fine, Not a usual bribe from the cop who finds them, would be a good idea. But TIT. Hard to see this actually working here. -

Drunk Tourist Turns Pattaya Street into Vehicular Mayhem

jcmj replied to snoop1130's topic in Pattaya News

Patient for the damage. Pay a large fine and lock him up for at least a month, then deport him and blacklist him for 10 years. They need to be tougher on drinking and driving laws here and should really put more patrol cops on the streets instead of a dozen under a tent road stop. -

PM Paetongtarn Named Young Global Leader 2025 by World Economic Forum

jcmj replied to webfact's topic in Thailand News

I just wonder how much they paid for this prestigious award. -

UK Public Trust in Law and Order Undermined by Two Tier Policing

jcmj replied to Social Media's topic in World News

Lordy Lordy, this is going to be an even bigger problem as time goes on and the locals become the minority. Sad.