-

TM30 Frustrations

It's not a problem as long as you have a copy of the landlord's Thai ID and Tabian Baan.

-

Do TV Soundbars Help Hard of Hearing?

My Samsung soundbar has a voice enhancer which you can turn on/off using the soundbar remote. It works very well, especially watching movies with muffled dialogue.

-

Buying Guitar Strings Online in Thailand

You can buy strings etc on Lazada or Shopee.

-

GF of 2 years suddenly blocked me

Sounds like you temporarily lost your place in the queue. She'll be back, just don't be there for her. Move on and put it down to experience and a lesson learned.

-

TV - Top Boxes

Probably better to state why you want one. What do you want to watch? The more knowledgable on here will give you the best options and advice.

-

What Movies or TV shows are you watching (2026)

Steal - TV Series - 6 episodes. A group of master thieves break into Lochmill Capital and hold Zara (Sophie Turner) and her colleagues at gunpoint, attempting the heist of the century. Two episodes in, and impressed. Sorry, didn't see all the recommendations for this on previous page! 🤭

-

Post (letter) not arriving from UK

I usually blame it on the postmen who whizz around on their motorcycles coupled with their inability to read English. Sometimes, not only English, but Thai! Eg: Thanks to the Thai man who lives three soi's away and had the good heart to deliver my wrongly mailed internet bill! 🙄

-

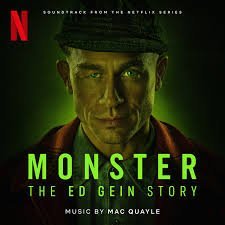

What Movies or TV shows are you watching (2025)

Watching this gruesome series (8 episodes) at the moment. Proper monster was Ed! Not for the faint hearted! 😲

-

Thai Visa Centre, Bangna. (Grace)

Mmmm..but I think that this has been mentioned a couple of thousand times before on here!

-

Thai Visa Centre, Bangna. (Grace)

Absolutely. When I am forced to keep 800,000k in my bank account here, then I'll just have to. Until then, I am more than happy to use their excellent service.

-

Monomax Full Replay audio Thai only

You could always try this: https://timesoccertv.com/

-

Amount of foreign teachers without work permits

By foreign teachers, you probably mean Native English speakers. I know the school I used to work at has gone from 90% Native English to 90% Filipinos, not only because of the qualifications but they can get away with paying them less too.

-

Amount of foreign teachers without work permits

I doubt very much that it's a 'vast majority', and with the clamping down on visa runs, there will be even less.

-

Naproxen Sodium or Ibuprofen 200 Caplets Where In Thailand ?

-

Naproxen Sodium or Ibuprofen 200 Caplets Where In Thailand ?

I bought my Naproxen Sodium on E-bay. Not available in Thailand or UK.

.thumb.jpg.b2b04c85be01168bf6f7f7cca13fe0bf.jpg)