alanrchase

Advanced Member-

Posts

3,543 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by alanrchase

-

Can Foreign Tourists in Pattaya Expect Fair Legal Treatment?

alanrchase replied to webfact's topic in Pattaya News

Not really true is it? I was stopped one day for licence check. Handed my licence over and the cop waved it at the queue of Thais waiting to be issued tickets saying, "the foreigner can get one so why can't you lot". -

Some tax filing issues

alanrchase replied to Barney13's topic in Jobs, Economy, Banking, Business, Investments

Just ask for an FST for each transfer, they are free and are all the TRD want to see. -

Not saying you are arguing, saying I don't want an argument with the TRD. The money is interest. Yes, I could just tell myself the money transferred was pre 2024 but as I was paid interest from the account in 2024 how would I prove to the TRD that I transferred pre 2024 capital and not the interest earned? Maybe they would never ask but for this year I am happy to keep it simple. If there is more clarification about what they will and will not accept during the year I will adapt to any confirmed information.

-

I am not getting into arguments about whether interest earned was left in the account and savings from 2023 were transferred with the RD over 3,774 baht. I inherited some money from my grandmother years ago, I suppose I could argue that I have not spent any of that yet and am just starting to use it in Thailand. That would be tax free as well.

-

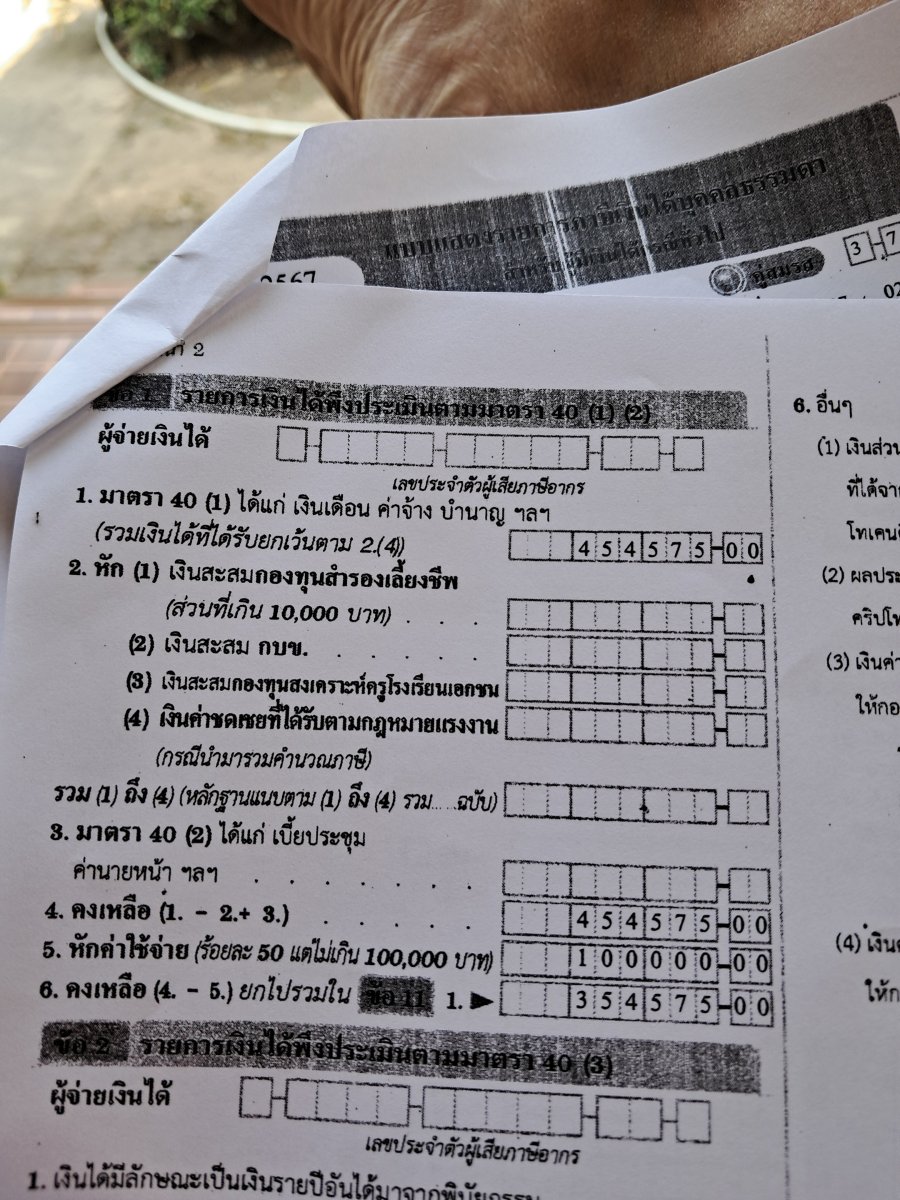

The calculations were as follows Declared 454,575 Deductible expenses 100,000 Total 354,575 Thai bank interest 4,542 Total 359,117 Then 2×60,000 deductible for personal allowance for wife and I. Total 239,117 First 150,000 tax exempt Total 89,117 Tax bracket 5%. 5% of 89,117 = 4,455 to be paid Subtract 681 for withholding tax paid Total 3,774 tax to be paid.

-

The income was processed under 1. 1. 40(1). That is for salary, wages, pension etc.. Theoretically it should be under interest I suppose but I am retired so it is like a pension to me. If anyone is interested I put it into the tax calculator below and the amount it gives agrees with what I paid if my Thai bank interest and withholding tax is not taken into account. The calculator has no way of entering that. https://www.uobam.co.th/en/tax-calculation I include a picture from the copy of my return for the skeptics.

-

Elon Musk: Elizabeth Warren’s 18F Tech Team Has Been ‘Deleted’

alanrchase replied to Social Media's topic in World News

Then why has the money spent on condoms for Hamas doubled under the Trump administration? Last week Trump said it was $50 million and yesterday he said it was $100 million. -

Just been and done mine. Situation, one year extension based on retirement, 63, married to a 62 year old Thai, one adult child who is working, wife does not work, 454,000 transfered from an offshore account, source of funds declared as interest, no dual taxation treaties apply. Started at Bangkok Bank, asked for a withholding tax statement for myself and my wife. A bit of confusion because of the word "statement", their term is withholding tax receipt. Got mine, wife never keeps enough in her account to require one. Then requested a FST for the single transfer I had made in April last year, no issues getting that. If you haven't requested those documents before they were done at the teller desks in my branch. I tried at the sit down desks first which wasted a bit of time. Went off to the local revenue office on my own, wife went shopping and home. Handed the nice lady behind the desk my withholding tax receipt, FST, tax ID and passport. Explained in my poor version of Thai why I was there. She seemed up to date on the requirement for me to file. She took my wife's details from a picture of the ID on my phone. I explained the money was all interest on a bank account and she asked me to sit and wait. I tried to point out a transaction for my motorcycle insurance that I made with a foreign debit card, she nodded but I am not sure she understood, the information was on a Thai insurance app and I had no hard copy of the transaction. Provided phone number and cleared up a few questions she had regarding passport. Shortly after that she printed the documents, pointed out I had 3,774 baht to pay and asked me to sign. Paid with QR code via bank app and was handed the receipt. Asked if I could have a copy of the paperwork which was a mistake. They will do it but it is an "official" copy which requires more copies of passport, more signatures, stamps on each copy and a fee of 42 baht. Started in the bank at 10am walked out of the Revenue office at 12:00. Would have been 20 minutes earlier if I hadn't asked for the copy.

-

A 1992 2.4 litre Nissan Pathfinder. Nothing fancy about it and a bit underpowered compared to Land Cruisers, Patrols, Range Rovers and Cherokees. Used it mainly for fishing trips to the Red Sea. It could go anywhere and never got stuck. Pulled numerous more powerful 4X4s out of the sand and mud with it. Abused it for ten years and it never let me down.

-

FAA’s Diversity Policies Under Fire After Deadly Air Collision

alanrchase replied to Social Media's topic in World News

Thank God this DEI stupidity never happened on Trump's watch? https://www.faa.gov/newsroom/faa-provides-aviation-careers-people-disabilities https://medium.com/faa/opening-doors-to-the-controller-workforce-d8d2ace46fa5 -

FAA’s Diversity Policies Under Fire After Deadly Air Collision

alanrchase replied to Social Media's topic in World News

There seem to be some major misconceptions on how DEI hiring for ATC positions work. All ot does is help people get an initial foot in the door. After that they are subject to the same rigorous training that non DEI hires would be. No one goes straight from passing the training to a position in the tower at Regan International. The video below has the ATC and aircraft communications overlayed in real time on the flight track data. It appears to show that ATC did their job but for some reason the helicopter climbed 200 feet a moment before the crash. -

FAA’s Diversity Policies Under Fire After Deadly Air Collision

alanrchase replied to Social Media's topic in World News

But there aren't any relevant facts in the article. -

I'm in such a good mood today.

alanrchase replied to Elvis Presley's topic in ASEAN NOW Community Pub

Seem to remember Bob having some magical medication to help with the negative effects of his drinking. For some strange reason he was unable to name that one either. -

Combined car+motorcycle Thai driver's license not possible?

alanrchase replied to farrol's topic in Thailand Motor Discussion

Haven't they changed the "watch a video" part to the requirement for an online test now? Thought you needed the QR code from that before they will continue to process the application?