-

Posts

2,322 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by kwonitoy

-

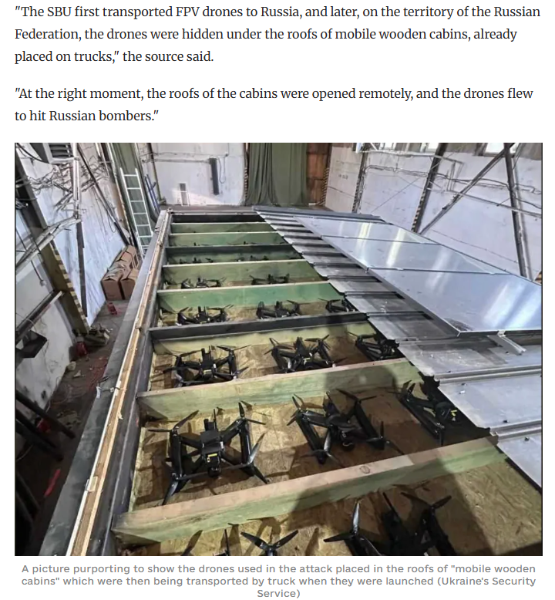

Fantastic news, drive trucks up to 4000 km inside russia to take out the bombers/missile launchers https://x.com/Osinttechnical/status/1929149970566836284

- 708 replies

-

- 14

-

-

-

-

-

-

He's fine, perfectly normal

-

It's been done many a year ago, In the mid 50's and early 60's At great expense at the time How much did the DEW Line cost to build? The DEW Line was an incredible undertaking of its time. It required more than a half-million tonnes of material, enough gravel to build a road from Vancouver to Halifax, and 25,000 construction workers. It cost $350 million – a large sum for the 1950s Replaced with North Warning System and with satellites The DEW Line, or Distant Early Warning Line, was a chain of radar stations built across Canada's Arctic during the Cold War to detect potential Soviet bomber and ICBM attacks. The DEW Line was a joint project between Canada and the United States, with the US largely funding and managing the project. The line stretched from Alaska to Iceland, with a significant portion located within Canadian territory.

-

Updates and events in the War in Ukraine 2025

kwonitoy replied to cdnvic's topic in The War in Ukraine

-

Updates and events in the War in Ukraine 2025

kwonitoy replied to cdnvic's topic in The War in Ukraine

-

Updates and events in the War in Ukraine 2025

kwonitoy replied to cdnvic's topic in The War in Ukraine

https://abcnews.go.com/International/hundreds-drones-attack-russia-impacts-disruption-reported-moscow/story?id=122256829 -

The "rudest" social security reform proposal yet

kwonitoy replied to Jingthing's topic in Political Soapbox

It's strictly income based in Canada, not net worth. They determine it by your CRA tax filing for the previous year. I sold a bunch of stock, had a high income so no government handouts. This year if I don't sell stock but still have seven figures in investments, then I will qualify for the government payments I'm eligible for Seems fair to me -

The "rudest" social security reform proposal yet

kwonitoy replied to Jingthing's topic in Political Soapbox

In Canada old age security OAS is income related, If your annual income is over 152,000 then any payments made the year before will be clawed back, along with any other benefits except for Canada Pension Plan, CPP. I know this directly, I had to pay back about 40G last year due to my income (got very fortunate on some stocks) I agree with the system, if you make 150+ Grand a year you don't need government help What is the maximum income to avoid OAS clawback? AI Overview In 2025, you can avoid the OAS clawback if your net income before adjustments (as shown on line 23400 of your tax return) is $93,454 or less. For every dollar you make above this threshold, your maximum OAS pension is reduced by 15 cents. If your income reaches $151,668 (for ages 65-74) or $157,490 (for ages 75 and older), your OAS benefits will be fully clawed back. -

Updates and events in the War in Ukraine 2025

kwonitoy replied to cdnvic's topic in The War in Ukraine

-

Updates and events in the War in Ukraine 2025

kwonitoy replied to cdnvic's topic in The War in Ukraine

-

At age 67, once. try for 8 to 9 hours in bed I put that down to drinking a lot of water daily.

-

Updates and events in the War in Ukraine 2025

kwonitoy replied to cdnvic's topic in The War in Ukraine

Bringing the war to the folks of moscow -

Updates and events in the War in Ukraine 2025

kwonitoy replied to cdnvic's topic in The War in Ukraine

-

Updates and events in the War in Ukraine 2025

kwonitoy replied to cdnvic's topic in The War in Ukraine

-

Anecdotal evidence My brother and his wife have a winter place in Yuma AZ. They sold it at a loss this last winter along with 14 other Canadian couples that sold their winter homes in that immediate area. Never to return.

-

bringing the ones with money in though. Only the best people

-

Updates and events in the War in Ukraine 2025

kwonitoy replied to cdnvic's topic in The War in Ukraine

-

Take her over to Bangkok Pattaya Hospital and talk with the admin there

-

Updates and events in the War in Ukraine 2025

kwonitoy replied to cdnvic's topic in The War in Ukraine

-

Updates and events in the War in Ukraine 2025

kwonitoy replied to cdnvic's topic in The War in Ukraine