norbra

Advanced Member-

Posts

1,437 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by norbra

-

Taxation of foreighners in S/E Asia?

norbra replied to swissie's topic in Jobs, Economy, Banking, Business, Investments

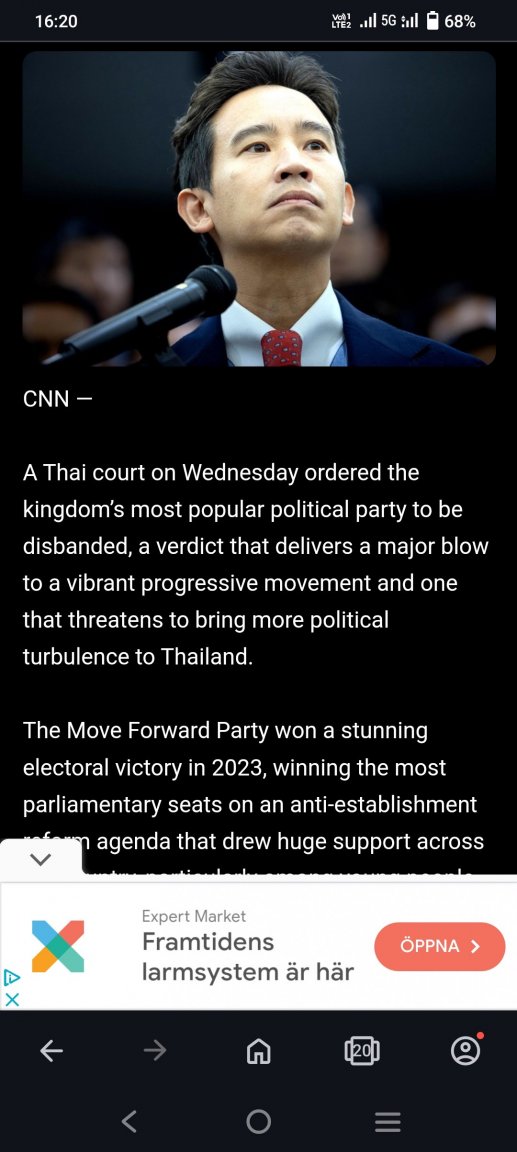

IMO For openers; The Thai Finance dept was well aware of those using the deferred remits of international income as they had tax id numbers of all concerned. Secondly, the Sept 2023 modification to the tax code only closed that "loophole" which did not require any vast changes to tax collection procedures. So expats were never their target and is the reason behind the TRD refusing to issue Tax Identifier Numbers. Just my take on this issue. -

Just read an item about cost of living in Australia. Your looking at AUD 12 for one of these refreshers

-

My forgettable shopping fail at 7/11many long years ago. While browsing with friend she suggested we can buy hot coffee,I agreed and made the first cup ,it was burning hot so I plucked a second cup from the dispenser to give better insulation against the extremely hot first cup . On seeing how hot it was my friend declined ,so off to the cashier, young lady said "cannot" after seeing the confusion on my face she added " Boss counts cups everyday" I can't recall leaving with a coffee

-

Technician crushed to death while repairing lift at Bangkok airport

norbra replied to snoop1130's topic in Bangkok News

Counterweight AKA "whispering death" as you never hear them coming. In some instances they can close on you at speeds in the region of 2000 feet per minute. -

Tax Return 2025

norbra replied to John Phuket's topic in Jobs, Economy, Banking, Business, Investments

60000 baht assessable income @5%,if it happens,still makes for a cheap party -

Technician crushed to death while repairing lift at Bangkok airport

norbra replied to snoop1130's topic in Bangkok News

The safety procedures to follow when working on a lift are the same procedures one should employ when using a Zebra crossing in Thailand -

Tax Return 2025

norbra replied to John Phuket's topic in Jobs, Economy, Banking, Business, Investments

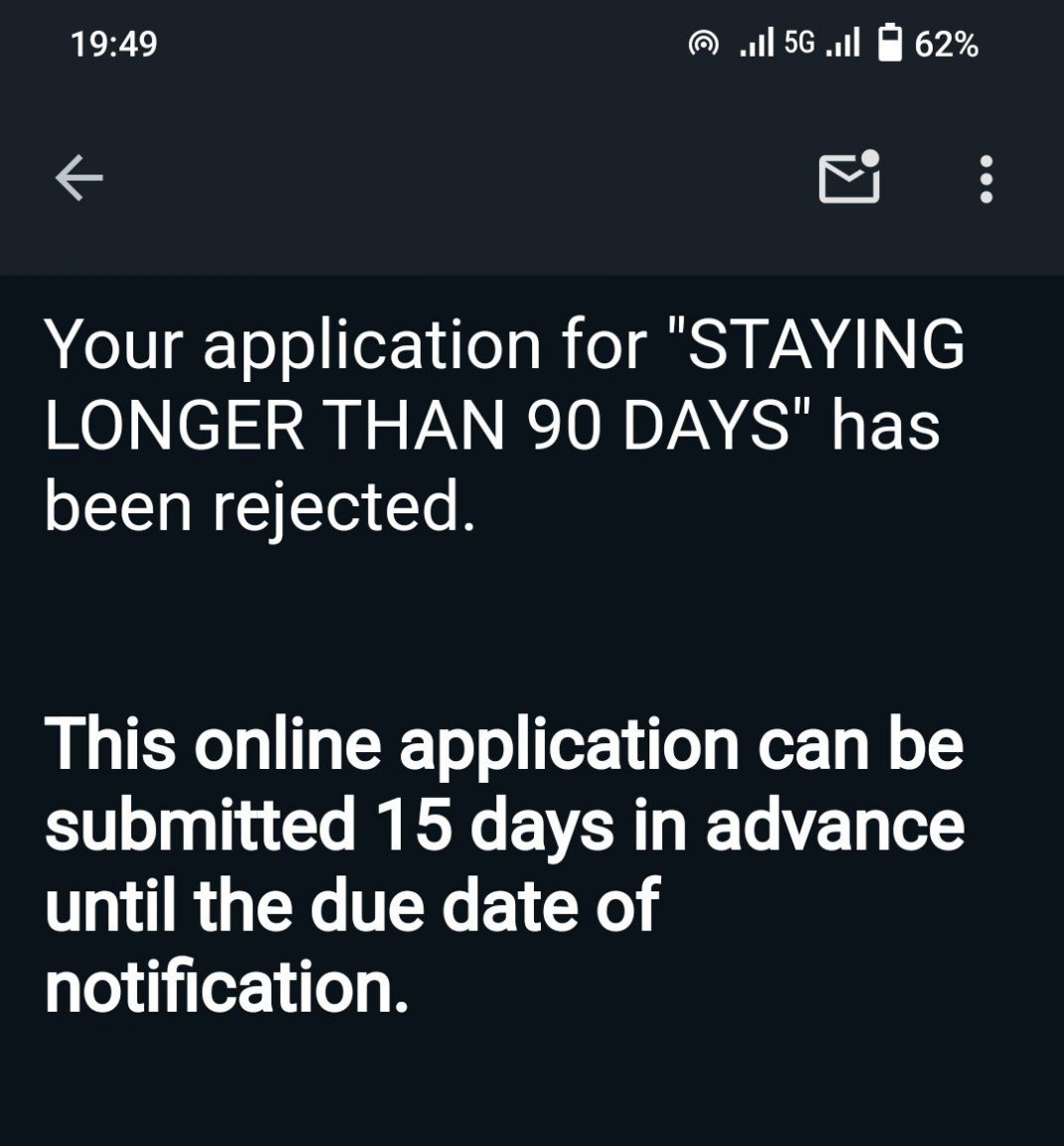

As my application for a TIN from TRD was rejected I will continue to party. -

Tax Return 2025

norbra replied to John Phuket's topic in Jobs, Economy, Banking, Business, Investments

Agreed, the easy money KH refers to has been available to the RD for decades. -

Tax Return 2025

norbra replied to John Phuket's topic in Jobs, Economy, Banking, Business, Investments

From my visit to TRD office it's already shoved -

Tax Return 2025

norbra replied to John Phuket's topic in Jobs, Economy, Banking, Business, Investments

Similar yes,but in my case I was not required to show any documents as the officer advised that I do not need a TIN. The officer explained that as my income/assets were in my home country currency it would not be taxed only income derived from employment in Thailand would be assessable. -

Tax Return 2025

norbra replied to John Phuket's topic in Jobs, Economy, Banking, Business, Investments

Procedure No1 should be acquire a Tax Identifier Number from a Revenue Department office,as without it you cannot submit a return. -

I found Airpaz showed not only AA flights but AAX as well best for Suvarnabhumi departures/arrivals

-

I just completed this quiz. My Score 40/100 My Time 194 seconds

-

I received the code via email

-

I just completed this quiz. My Score 10/100 My Time 159 seconds

-

-

There's a lot of information on the forums re reducing your tax liability. When the news first broke about the closing of the loophole regarding remits,I ran my numbers against TH taxable income and I was looking at 60,000baht tax pa. But keeping up with the many posts I was able to determine that as a single,aged pensioner I can claim 500,000 thb as allowable deductions so with out trying to find further loopholes my liabilty is now 3,000 thb pa. With 5 months remaining in this tax year I could reduce my remits to a level where i am tax free. Remember all earnings prior to 2024 you may have saved and remitted are not assessable. Last month The Thai revenue department refused my application for a Tax Identifier Number because my income was in my home country currency and I had no income from employment in Thailand. So I cannot file a tax return because I don't have a tax id number. Go see your revenue office and get current information about your circumstsances

- 562 replies

-

- 24

-

-

-

-

-

-

I just completed this quiz. My Score 80/100 My Time 97 seconds