Digitalbanana

Advanced Member-

Posts

14,769 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Digitalbanana

-

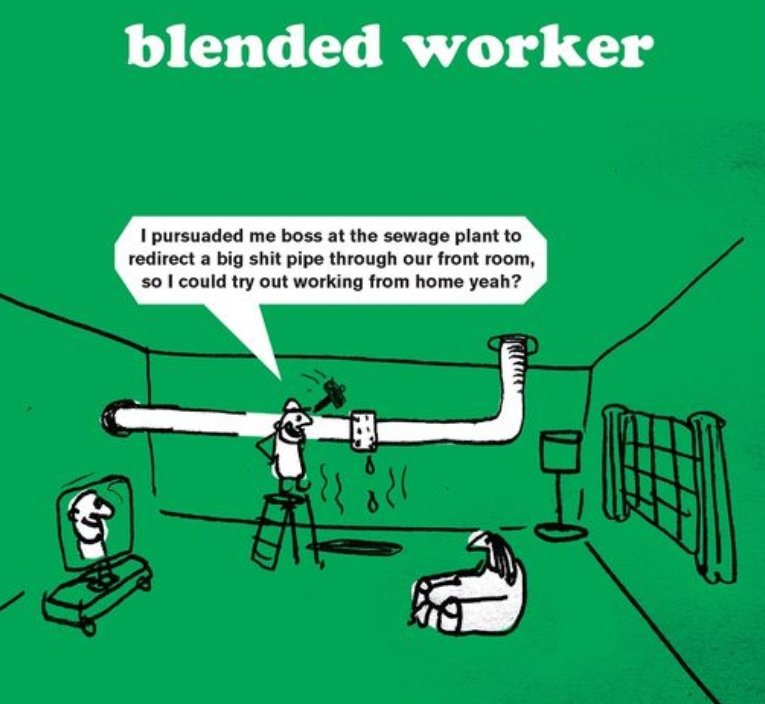

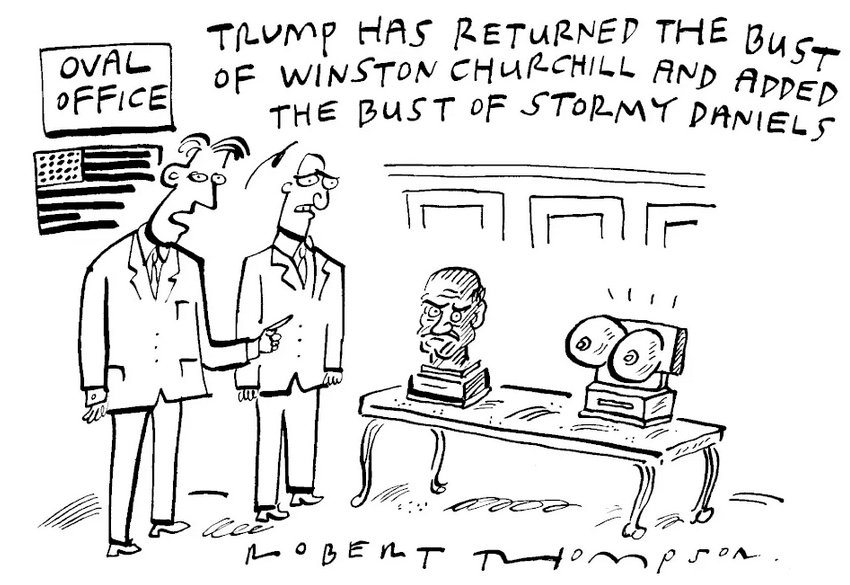

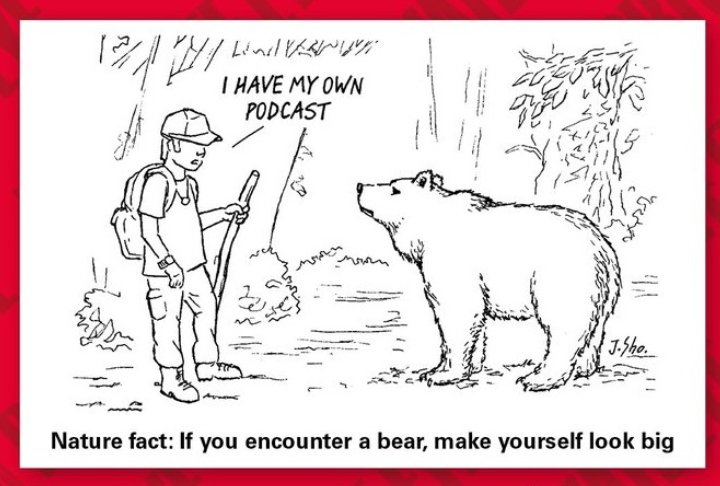

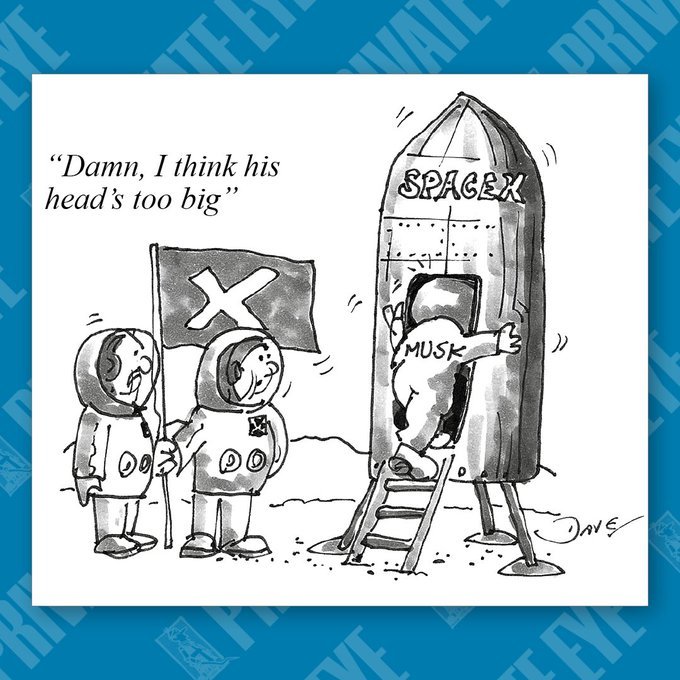

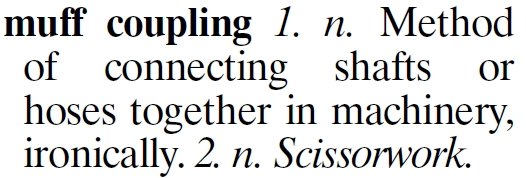

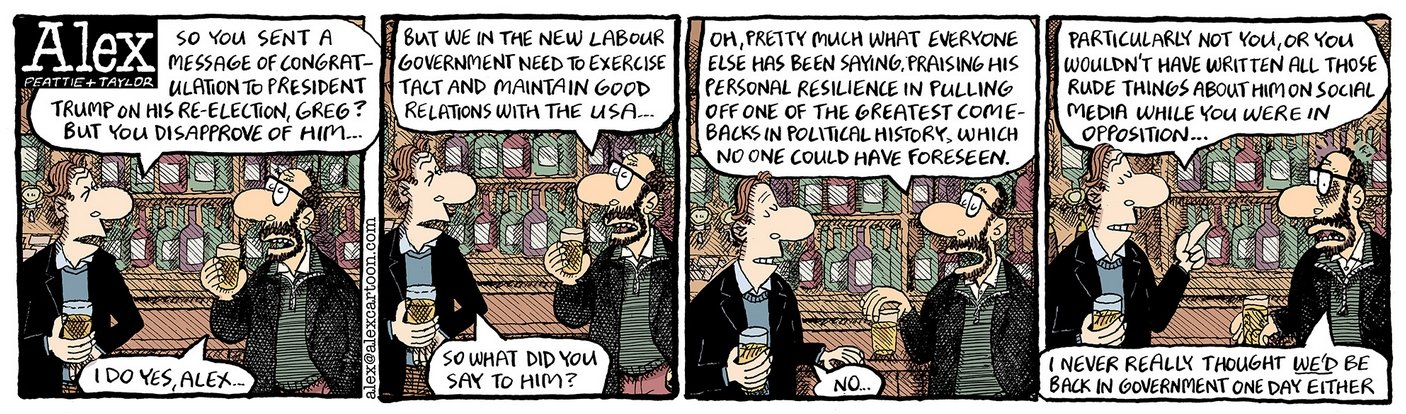

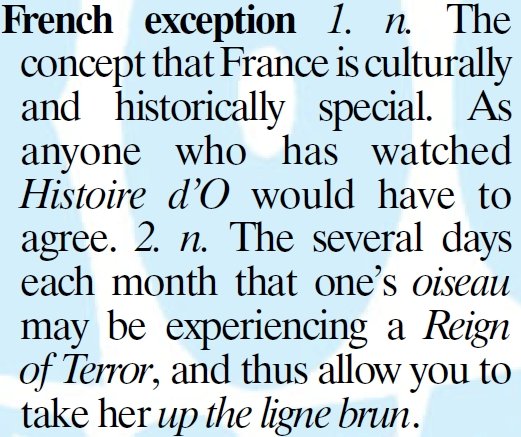

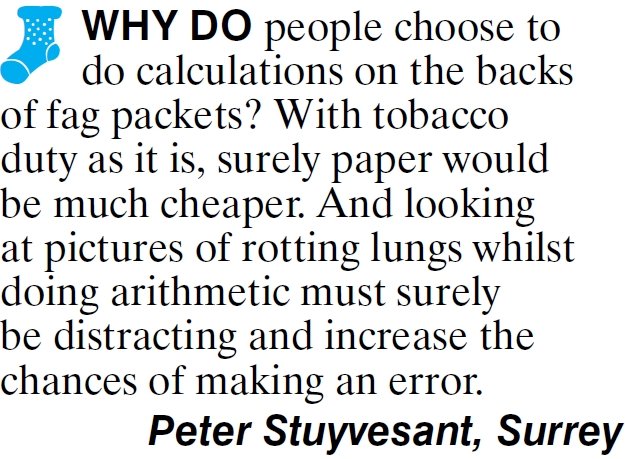

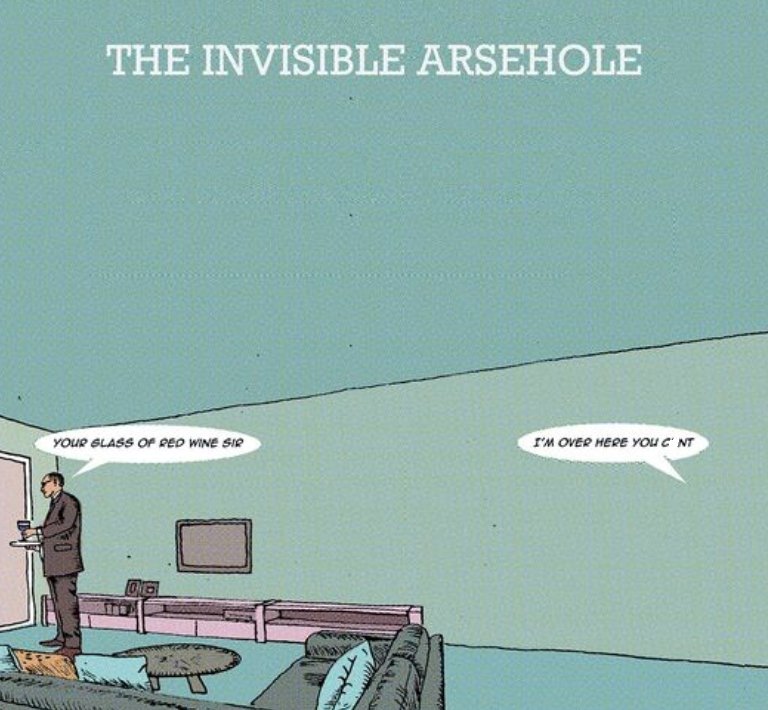

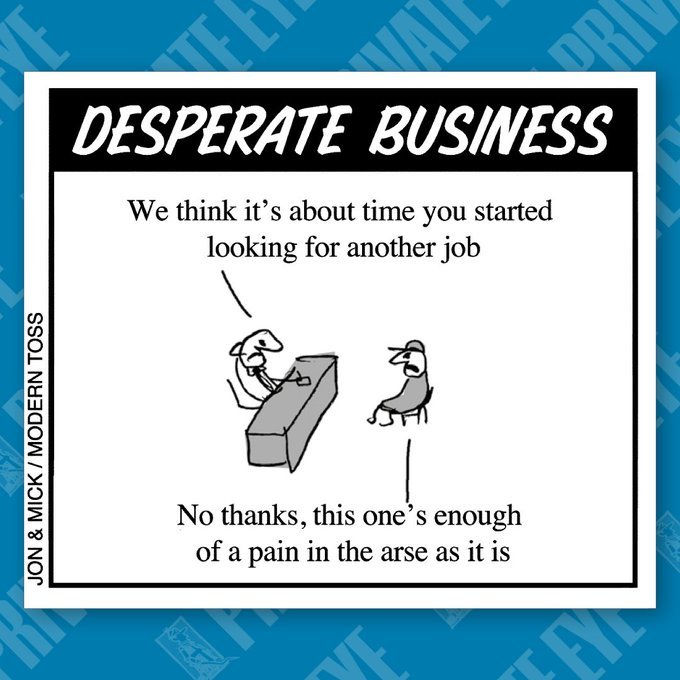

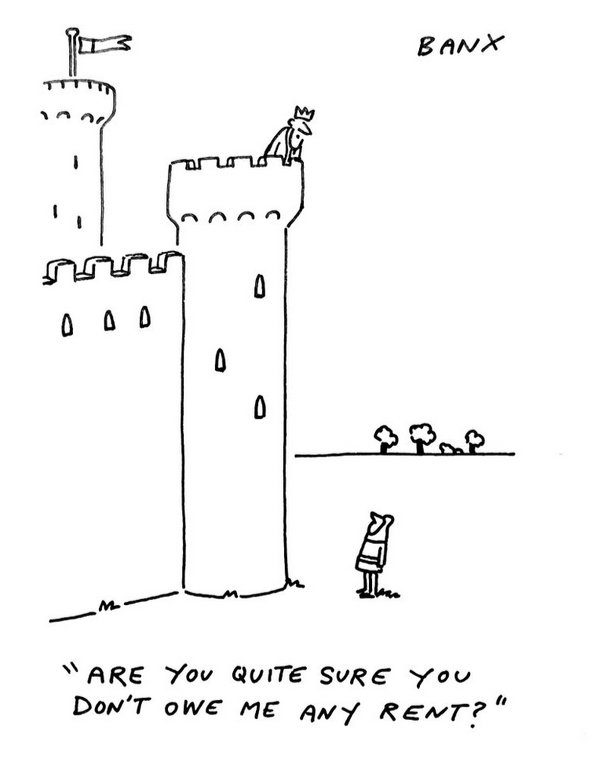

Worst Joke Ever 2025

Digitalbanana replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

Digitalbanana replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

Digitalbanana replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

Digitalbanana replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

Digitalbanana replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Global P/E Ratios.

Digitalbanana replied to swissie's topic in Jobs, Economy, Banking, Business, Investments

Diversifying is how money is not lost. 100% isn't diversifying. -

Fire at Pattaya Condo Sparks Panic Among Tourists

Digitalbanana replied to Georgealbert's topic in Pattaya News

Just read Khaosod English if god forbid you actually needed to know the name of the condo. -

Worst Joke Ever 2025

Digitalbanana replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Works fine. Update your o/s and software.

-

Worst Joke Ever 2025

Digitalbanana replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

Digitalbanana replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

Digitalbanana replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Worst Joke Ever 2025

Digitalbanana replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Bangkok plans cycling lanes to ease congestion in key districts

Digitalbanana replied to webfact's topic in Bangkok News

No one is going to cycle anywhere to get to a place unless there is a secure place to keep the bicycle to avoid it being stolen, -

Worst Joke Ever 2025

Digitalbanana replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

BBC iplayer completely Blocked even with VPN's

Digitalbanana replied to liddelljohn's topic in IT and Computers

Works fine with Surfshark on Win11. -

Worst Joke Ever 2025

Digitalbanana replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!

-

Something like this works for me, less than 7K brand new with Win11 Pro. https://shopee.co.th/GMKtec-G3-Mini-PC-Intel-Alder-Lake-N100-Windows-11-Pro-Mini-PC-8-16GB-DDR4-256-512GB-PCIe-M.2-SSD-WiFi-6-BT5.2-Desktop-i.1342671968.28159109106?sp_atk=c673a365-ea19-4cc7-975b-924c3a44ce5a&xptdk=c673a365-ea19-4cc7-975b-924c3a44ce5a

-

Just another day crossing the road...

Digitalbanana replied to brewsterbudgen's topic in Thailand Motor Discussion

Judging by the confused and sad emoji reactions, there must be a lot of people who walk across roads without looking out for traffic. When I was a child I was taught to look left, right and look again before crossing a road, no matter what color the lights are if any. I notice my own children do the same as a natural instinct. -

Immigration - totally useless

Digitalbanana replied to Foxx's topic in Thai Visas, Residency, and Work Permits

It does not. Far from it. There are numerous posts on AseanNow regarding rejection of online report. Including the list of "conditions" you posted. I have 4 rejections from online (CW) despite successful online reporting in the past and as result have done in person. It's fine till online falls out of love with you. Previously you have castigated me for selectively quoting you on a reply yet you have done the same to me here. You have not addressed the points I made in my post. Was anything incorrect in my points 1,2 and 3 ? If so let me know. My experience is they have worked and I have been doing 90 day reports since 2008 including online since the service started. The only time my online application did not work in those years was when they closed the online web site service for a period to update the web site or when I did not follow those 3 points. -

Worst Joke Ever 2025

Digitalbanana replied to warfie's topic in Jokes - Puzzles and Riddles - Make My Day!