-

Posts

3,846 -

Joined

-

Last visited

-

Days Won

2

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by Airalee

-

I fired a date for voting for Trump

Airalee replied to Prubangboy's topic in ASEAN NOW Community Pub

-

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

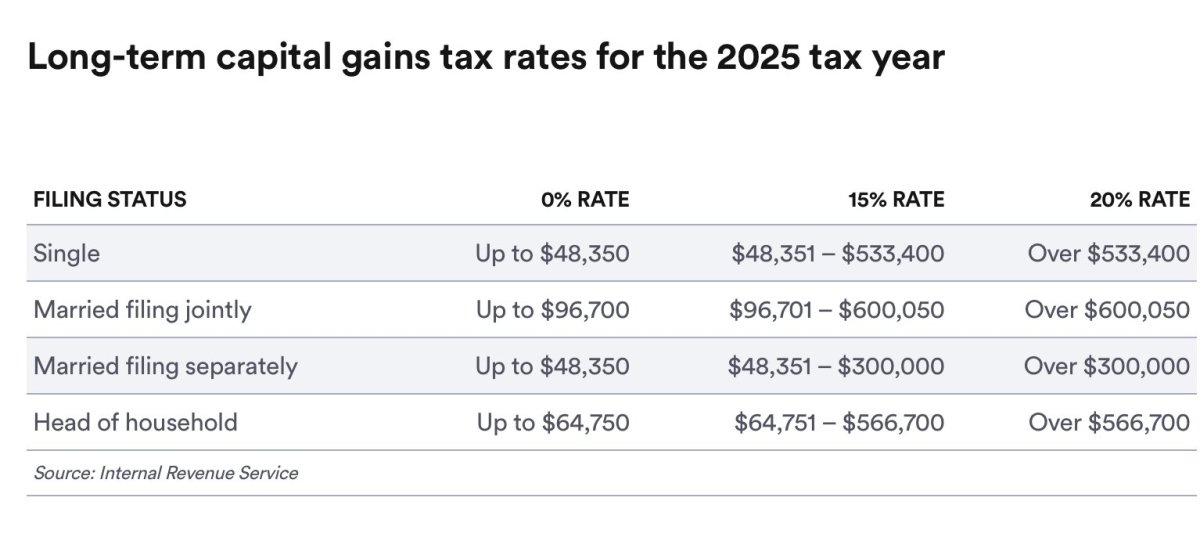

Now run those figures on double the amount (1.6 million) for not married, under 65 with half the income being from long term capital gains. I thought about transferring $100k USD to use as an emergency fund for healthcare. I would sell off a small amount of stocks to get part of that $100k so most of my income for that year would be long term capital gains back in the US (Nevada). Here is the chart showing the federal capital gains tax brackets for 2025 Tell me that it’s not worth bouncing out of Thailand for 6 months when those amounts are involved. But there are a lot of people who seem to be angry about that and want to give me some kind of lecture about choosing to limit my time in Thailand. Why should they care what I do? Why should they even address what choices I make? Jealousy perhaps? -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

Only a leftist would post pablum such as this… “So you have never used or benefited from the Thai transportation infrastructure? You know, the airports, roads, BTS, SRT and domestic airlines? You may have not had to use the services of the Thai healthcare, fire or police services but they are all there and will benefit you if you need them. The people who service your demands at the retailers, government offices, restuarants, hotels et al all have to be educated and assisted like any other nation does. The cost to deliver the electricity and water you receive and use are not covered by the user fees. It's the government that pays for the dams and electricity and water delivery network.” When I take a taxi, I am paying for the service of a private company. The same goes for the BTS as it is mostly privately owned and operated by BTS group holdings. When I need healthcare here in Thailand, I pay for it. The few times I have used it at a government hospital, I still had to pay for it….and more than a Thai person would have to pay. The “special after hours clinic” at Chulalongkorn Hospital is actually more expensive than the private hospital I usually go to. When I go to a public park, I have to pay for it. Ten times as much as a Thai. When I take a trip on a plane, I pay airport taxes. Sometimes, the taxes are higher than the fare. When I go to a restaurant or a hotel, I pay for it. The fact that people who work there were educated somehow in the past does not mean that I should be paying extra taxes for the privilege of buying something from a private company. All of Patongs assertions are indeed extremely leftist and dishonest. If I am expected to have a certain amount of money here (800k) to live in order to show that I can take care of myself and not be a burden on the government. That is fine. But to expect me to pay more taxes, and stating that it is my responsibility to pay these as part of the social construct, then I do not think it is unreasonable to expect the same benefits that Thais would receive from paying these taxes. The Thai government can’t expect us to pay taxes while still benefitting from different Thai/foreign prices. That is crap. -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

no. Telling me that taxes are covering my healthcare is disingenuous. Telling me that I should pay taxes to pay for potholed roads that never get fixed, dangerous sidewalks that never get fixed, schools that can’t even provide decent educations, even bringing the “street food seller” into the argument is disingenuous. It’s leftist nonsense. If Thailand wants us to pay the same taxes as other Thais, then we should get the same benefits as other Thais. Period. -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

Lost credibility? LOL. Leftists are disingenuous people. Own it. -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

Yes, it is. I’m not sure why it bothers people so much that some of us are deciding to pull up roots until the government makes things crystal clear. -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

No. And it’s not an “article” like the slop we have been fed by independent tax advisors here on AseanNow. I trust KPMG a little more than what I read here. And when the government clears things up so that there are no questions, I will reassess where I want to spend the majority of my time. I’m quite enjoying Danang this year however 😁 -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

I never said they disappeared. I just wanted to replenish them and pay capital gains tax at 15% and not have to pay the extra 15%. Be thankful you are in a lower tax bracket. How much do you keep in cash? -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

How long has the non-o visa program been running so far? I expect it will continue. I’m quite happy with it. With regards to the taxes, I’m fine being out of Thailand for half the year for the time being. -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

I pay for my healthcare at a private hospital. It is not subsidized by the government. The infrastructure is crap. The roads are crap. I barely drive and instead use taxis. What you wrote was nonsense. But to be expected from a leftist such as yourself. I’m quite content to have Thailand as a temporary residence from now on. It’s not worth hundreds of thousands of baht annually in taxes to live there full time. Thanks, but no thanks. -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

https://assets.kpmg.com/content/dam/kpmgsites/xx/pdf/2023/01/TIES-Thailand.pdf.coredownload.inline.pdf Section 2.10 -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

Nope. Not interested. -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

You should educate yourself on how the tax treaties work. -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

Up until now, I was remitting only savings. -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

Nonsense -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

Non-O retirement extension. It can be extended indefinitely. I’m not willing to take the risk that they will want a lot more money stuck in the bank here in order to get a new non-o based on retirement when history has shown that people at lower levels (they used to require 400k before it went up to 800k) are grandfathered in. -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

I’m referring to long term capital gains. Short term (for a trader) are taxed at income tax levels in the US. Higher than the 15% I will pay for the long term In Thailand, those gains will be taxed at 25-30% for me so I would be responsible for the difference between what I pay in the US and what Thailand wants. Tax treaties don’t mean that you pay 0% taxes here on income taxed already in the US if the tax rates are different. You are responsible for the difference. I don’t know why you are having such a difficult time understanding that. -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

I won’t consider the LTR visa because it is only 10 years. -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

Tell us specifically what the government spends for our benefit. Submarines and fighter jets? We certainly aren’t getting low cost healthcare. And the infrastructure isn’t worth paying hundreds of thousands of baht for. Your tax situation might be different. -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

No. It depends upon the brackets and if Thailand has a higher tax at a certain level of income than in the US….which is applicable in my personal situation, we are required to pay the difference above what we already paid in the US. For example. If something is taxed at 15% in the US and 30% in Thailand, I would pay the 15% in the US and then the difference of 15% would be paid in Thailand. -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

It’s not about being “taxed twice” Capital gains tax in the US is 0-15% for my tax bracket. Here, at the bracket I am in it would be up to 30% Legally, I would have to pay the difference which is quite significant. It’s not about “might happen”….it’s just the way it is. Thai capital gains taxes (on US based investments) are taxed differently. Your tax situation might be different. I’m not losing sleep over it. -

I am leaving Thailand - yes taxes!!!

Airalee replied to Celsius's topic in Jobs, Economy, Banking, Business, Investments

Not everybody is a tax dodger. I pay taxes in the US even though I don’t necessarily like what they are spent on (never ending wars and illegal aliens instead of the homeless). But being that Thailand taxes capital gains at income levels I am just fine spending more time back in the US and Vietnam and less in Thailand. If we actually got something for the taxes we pay….such as healthcare, I would feel differently. I’m not interested in paying for submarines and fighter jets. -

Wikipedia - Interesting immunology-tidbit on immunosenescence

Airalee replied to Red Phoenix's topic in COVID-19 Coronavirus

-

"Climate Change" is causing the LA fires...or is it?

Airalee replied to connda's topic in Off the beaten track

Some people just got lucky I guess. Here’s an article about it. https://apnews.com/article/california-wildfires-last-remaining-untouched-homes-photo-gallery-5adfbac6e9d52ffaed5126b7d7469733 -

"Climate Change" is causing the LA fires...or is it?

Airalee replied to connda's topic in Off the beaten track

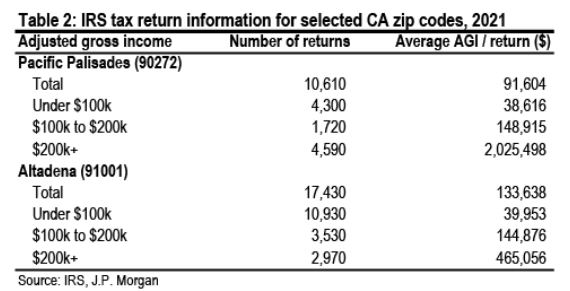

The majority of the people who lost their homes in both Pacific Palisades and Altadena are too poor to replace their homes. The fires supposedly have caused over $250 Billion in damage and there is only an estimated $20-30 billion in insured losses. Most have no insurance either through cancellation of their policies or they just couldn’t afford it in the first place. The California FAIR program only has about $750 million with an additional $2 or 3 billion in reinsurance. Most people are conditioned to think people in those areas are super-rich…but they aren’t. Even though the average house in PP was $3.5 million and $1.2 million in Altadena, most of them are/were house rich (millionaires on paper only), and many of the homes were either bought a long time ago or inherited by children who also inherited the prop 13 tax basis (1/10th of what the people who bought recently) so could afford to hold onto the homes….barely. Here’s some info on the incomes of the people who lived there….most will be lucky to afford a decent 1br condo when all is said and done.