lannarebirth

-

Posts

18,698 -

Joined

-

Last visited

-

Days Won

2

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by lannarebirth

-

-

Livermore 101:

IMPORTANCE OF VOLUME

From the beginning of his trading career, Livermore was keenly aware of the importance of volume. Volume is a key factor in recognizing true Piv-otal Points and other recurring patterns. It was obvious to Livermore that as the volume drastically changed in a stock, it was a clear aberration or deviation from the normal behavior of the stock. But was the volume accumulation or was it distribution? Livermore was an expert at detecting

distribution. He had formed a strong opinion on that subject, because he knew how stocks were distributed by the pool runners of his day. The pool runners, experts like Livermore, were often charged with distributing the stock of the insiders who had formed a pool with their own stock for the purpose of controled distribution.

How did the pool runners do it? The same way as they do it today.Stocks were never distributed on the way up . . . they were distributed on the way down. The reasoning was simple—people will not take their losses when they should. The public will hold on to their stock as it drops and wait until it rallies back to the price where they bought it, so they cansell it. This is why so many stocks falter as they rally back to the old high.

The people who bought at the high are now selling to get their money back—because they got a serious fright—and are now happy to recoup their losses.

To the astute trader, a change in volume is an alert signal. It almost always

means that there is something afoot, a change, a difference, a possible

aberration. A serious change in volume always caught Livermore’s attention. He would ask himself—was it the volume leading to the blow off, setting the stage for a decline, or was it a real interest in the stock,was it being accumulated getting ready to be driven higher?

Reminiscences of a Stock Operator, Edward LeFevre

-

I've now invested 100% of my allotted stock market investment funds into equities/ETF's across the globe. 2 weeks ago I owned zero stocks! Really hard to call the markets short term direction but the only thing that matters is that it is worth more when I sell it. I read the last few pages of this topic and it's odd the abuse posters take for calling the market wrong. If I was right 80% of the time on my short term market predictions I would be extremely rich. As it is, I'm right slightly more than I'm wrong in the short term but almost always rewarded in the long term.

For what it is worth, I'm betting the market rebounds sometime in the next 2 weeks and the Dow will be above 10300. I'm extremely confident my portfolio(down 3%) will be heavy in the money before year end.

You're willing to go in 100% in the hopes of making 3%? How great of a stop loss would one put on that? Just curious.

-

My point was something along the lines that gold is acting as something of a 'low beta, risk asset.' So say yesterday's fall is seen as a 'delveraging of risky investments.' Now of course you could call a 'low beta, risk asset' a good proxy for forex or a good proxy for a higher beta risk asset like the stockmarket. In reality it shouldnt be much of either.

The point being that its price correlation relative to risk has changed. It used to be that gold acted as insurance - the price would be inversely correlated with risk. During black monday in 1987 when stocks fell 20%, gold actually rose 3%. It just doesnt seem to have that 'insurance' factor built in anymore.

P.S. In 1980 you could get 1500 loaves of bread for an ounce of gold. (The dollar in 1980 adjusted for interest would basically get you a little more than loaf of bread in any year - not much more, not much less.)

I don't think there are any more low beta assets anymore. At least when measured over the course of a single business cycle. A recent scanning of even this non trading related board would indicate that just about everyone is willing to take a flyer on whatever might provide greater than average movement or beta. Everybody's in or wants to be and see trading the magic beans as more profitable than other economic endeavours. Looks like food might be the place to put money.

-

A good example of what author Pira Sudham calls the "crippled mind" that is the main product of the Thai education system.

-

^ How can you view something you pay an 8%-10% premium on every time you exchange it for another "currency", as forex? It is fungible but the limitations are many and the penalties of ownership are steep. By contrast the slippage on a $USD forex exchange could be as low 1/100th of a penny.

-

Flying, i am missing your often used expression "interesting". isn't it interesting that global markets are weak but Gold falls 4% although USD strengthened an average of only 1%? i think this is food for thoughts.

Dollar up, Yen up = deleverage speculative investments.

interesting!

Not my most insightful post, I agree.

-

Again you seem to be impugning the judges in Thailand.

and again I said that no courts are "perfect" but you cannot have ANY democracy without them. Maybe you just don't want a democracy at all?

such innnocence...*sigh* ... do your parents know you are on this board?

So ...

Are you suggesting that there can be Democracy without courts?

Are you openly stating that Thailand is similar to Zimbabwe? If so, how?

Are you openly impugning the Senior Judges in Thailand?

(Will you answer these questions? I think not. I think you will just duck them again.)

As I'm sure you are aware, it is a serious breach of the law to impugn court decisions and judges here in Thailand. Why are you trying to get this guy "on the record" doing that? That's not very nice.

-

Flying, i am missing your often used expression "interesting". isn't it interesting that global markets are weak but Gold falls 4% although USD strengthened an average of only 1%? i think this is food for thoughts.

Dollar up, Yen up = deleverage speculative investments.

-

Interesting and informative, thanks. for anone interested here is the link to the rest of the discussion:

http://asiapacific.anu.edu.au/newmandala/2...s-event-part-i/

-

Interesting panel discussion/presentation on what has led to Thailand's political crisis and what might end it:

http://asiapacific.anu.edu.au/newmandala/2...s-event-part-i/

http://asiapacific.anu.edu.au/newmandala/2...-event-part-ii/

-

... snip ... So any more positive suggestions, from our illustrious and brainy farang community, on how Thailand can resolve these difficult issues? ... Again, no stating of past wrongs, just things that will move the process forward. Towards peace, and reconciliation.

Sawasdee Khrup, Khun McGriffith,

late Edit : Well, speaking of being continually surprised : we just had time to read this breaking news on ThaiVisa about General Chaovalit being appointed "Supreme Commander of People's Army of Thailand" by Khun Thaksin : General Chaovalit escalated by Who ? to What ?

The most positive thing we can think of is to recognize the difference between "chaotic thought" in the minds of Farangs, and "chaotic perceptions" by Farangs (including our human component as a "Farang," of course) and ... events of a political nature in Thailand as they are experienced and evaluated by Thai people of different groups.

To recognize the limits of our understanding of what you might refer to as the "underground aquifers" of national identity, religious identity, ethnic identity, cultural identity, that underly the "modern" Thai state which we evaluate in terms of our own "western rear-view mirror" in which the modern "myth of democracry" has been constructed, embellished, and so frequently white-washed to remove the blood-stains.

What for the "brainy Farang" you invoke may appear as "cognitive dissonance" (to trot out Festinger's old pony), for the Thai culturally modal perceptual structure may have no incongruity whatsoever. Or, perhaps, better to suggest that the "incongruity" they experience, and the way they experience it may be quite beyond our (Farang) comprehension. And, why not one more hypothesis : the diversity of Thai experiences of this hypothetical "incongruity" might encompass a "range" vastly more complex than the "range" of Farang experience of chaos and cognitive dissonance (which, in our opinion, is often sheerly reactive and is based on complete lack of knowledge of Thai history ancient to modern).

If you can give temporary "credence" to this concept of "underground aquifers," perhaps you can also "try on for size" the idea that in times of crisis, in the "inflection points" of rapid social transitions, or in the "singularities" that "punctuate evolutionary equilibrium" (Gould), what is underground, sub-limnal, rises to the surface, and is enacted in "national psychodramas" whose "protagonists" can be individuals (as a certain out-spoken military officer recently arrested for a whole lot of reasons, or a certain ex-PM now swimming with Cambodia), or groups (as in the lost lives of the machine-gunned students of the 1970's during the Chamlong / Suchinda showdown who now, collectively, signify a national turning point and disaster).

That these "topsy-turvy" or "helter-skelter" times reflect very long historical themes seems a most reasonable hypothesis. And, obviously, we can't discuss here some of the most obvious long-term historical themes in Thai national identity.

So, speaking for one Farang, who co-habits with an Orang, we can only say that terms like "karma," "metta," "dharma," "chakravartin," "dhammaraja" are, we suspect, important signifiers ... whose depths may be forever "opaque" to the Farang mind ... but may be useful pointers to a long-term view of the dynamics of Thai history and its current perturbations which we (Farang) may perceive as "chaos."

Equally one might suggest that the "Farang" mind is so socialized to an ethos of "distributive social justice," "power as emerging from the people up into the political domain," etc., that it is hard for us to consider anything that does not conform to those categories of perception as anything but "depraved," "corrupted," or even "evil."

As to how Thailand might "resolve these difficult issues," or "move the process forward. Towards peace, and reconciliation." : in our humble opinion such things are going to be resolved in the Thai way by Thais themselves, not by suggestions from "brainy Farangs."

We think the best we can do with our "Farang brain" is to become as informed as possible about Thai history and culture, and continually remind ourselves of the bloody paradoxes of national development in our own homelands where our own "industrial revolutions" and modernization was built on the backs of conquest, genocide, looting, slavery, and colonial imperialism.

We prepare to be continually surprised. If the expectation of confusion reduces confusion slightly, that's a nice "bonus."

best, ~o:37;

Very thoughtful and insightful commentary Khun orang, thank you very much.

It's true our "farang brain" has not tools to measure what we perceive as the chaos that surrounds us. Todays news should probably not have come as a surprise to us, but I'm fearful that people who I once hoped might "inherit the earth" will instead "inherit the wind". This is not "normal" Thai chaos and it is reflected in the increased anxiety I see in my wife and others I come into contact with. I wish them all strength and wisdom.

It's true our "farang brain" has not tools to measure what we perceive as the chaos that surrounds us. Todays news should probably not have come as a surprise to us, but I'm fearful that people who I once hoped might "inherit the earth" will instead "inherit the wind". This is not "normal" Thai chaos and it is reflected in the increased anxiety I see in my wife and others I come into contact with. I wish them all strength and wisdom. -

I suppose you think this is the work of that evil monster, Thaksin again.

Not at all, but it does explain how he is able to garner such strong support in these same areas.

-

1984 is another good one, but my favorite is probably One Flew Over the Cookoo's Nest. It really illustrates the spirit of people in authority.

1984 is good and definitely worth reading. I don't think it accurately describes the changes in our society over time, whereby people voluntarily give up their freedoms and quality of life for the sake of "fun" and consumerism. The books I've mentioned are like a roadmap of these past 50 years and you can see where the next 50 are headed. One would would think it was silly if it weren't so uncannily accurate. I hope peoples new "libraries" continue to be "supported". That's doubtful however as there's always some new gadget they'll be wishing to sell you.

-

How many years, decades, centuries, will these "books" remain uncorrupted on the device's storage? My recommendation is let the first books you dowload be "Fahrenheit 451" and "Brave New World". You'll not find more prophetic books for this society.

-

So, you had an agreement and the other party has reneged on it. You're married already so the parents have let you off the hook from fulfilling your prior agreement. Take your wife and go home is my advice. If that causes a problem, better you learn it early on. Good Luck.

-

Any amount that would require a loan is an amount that is too high.

-

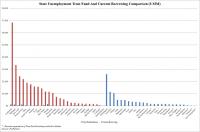

Unemployment in Europe is worrying and in the US it isn't much better:

A Majority Of States Are Now Insolvent: Quantifying The Disastrous Unemployment Situation

Zero Hedge recently highlighted the ever increasing Federal outlays on unemployment insurance, leading to questions on whether the true unemployment rate, as indicated by actual cash outlays, may be materially higher than indicated in increasingly dubious governmental reports.

One proposed alternative has been that the Federal government is directly subsidizing standalone states' depleted unemployment insurance trust funds.

Using data provided by ProPublica we have been able to confirm that indeed standalone states are for the most part now bankrupt and have no reserves left in their coffers when it comes to funding ever increasing insurance benefits. As ProPublica indicates, there are now 26 states which have depleted their trust funds, among these are the usual suspects including California, Michigan, New York, Pennsylvania and Ohio, which now rely exclusively on borrowings from the Federal government to prevent the cessation of insurance payments to recently unemployed workers. Currently all states collectively posses $10.7 billion in trust fund assets(with the bulk held by less impacted states such as Washington ($2.6 billion), Louisiana ($1.1 billion) and Oregon ($1.1 billion). On the other hand, 26 states currently rely exclusively on the Federal Government, and have borrowed a combined $30 billion through December to fund payments. ProPublica estimates that another 8 states will be insolvent within 6 months, as their trust funds also approach 0.

The chart below demonstrates the amount of borrowing per state, as well as trust fund holdings.

Another way of visualizing the damage can be seen on the following chart which highlights:

The most bankrupt states are California, with $6.8 billion in borrowings, Michigan ($3.4 billion), New York ($2.4 billion), Pennsylvania ($2.2 billion) and Ohio ($1.9 billion).

Third chart, (California) see in article, link below

So what is happening on the Federal side of the ledger?

Recall that in December the government spent $14.65 billion in Unemployment Insurance Benefits, which was a 24% jump from the $11.8 billion in November.

How is January shaping up? Through January 28th, the Federal Government had spent a total of $13.85 billion for this outlay. Once we get the Friday additional data, we will update our previous chart" we expect the final number to be about $14.1 billion, roughly in line with the December total.

DAILY TREASURY STATEMENT - Cash and Debt operations of The United States Treasury -January 28, 2010

DAILY TREASURY STATEMENT - Cash and Debt operations of The United States Treasury -January 28, 2010From:

http://www.zerohedge.com/article/majority-...yment-situation

LaoPo

The fiscal condition of the individual states and counties within them is pretty distressing. I think there is a growing realization that a large amount of the TARP funds which were to have been used as "stimulus" will become diverted to prop up these government bodies. That and the need to reduce deficit expansion are really starting to put a damper on the idea of a "V" shaped recovery. Talk of increased and new forms of taxation should be coming next. May be good for the $ but wouldn't think markets will like it very much.

-

The paying of key money is a tax avoidance sheme by the landlord. If you operate a business and have to account for all expenses when paying your own taxes you should either demand a receipt for the key money or ask for an apportioned raise in rent that reflects the key money demanded.

-

Som-o

in Chiang Rai

Mission accomplished, there were three stalls selling it at the flower market.At 60B/80B each I'll be restricting my intake though.

Next time you visit Chiang Mai you can stock up at those roadside vendors at the checkpoint 10 clicks south of Chiang Dao.

-

True in many ways......

So the question is....

Are we in a crisis? Are we headed further into a crisis?

Are we coming out of a crisis? Are we already out of a crisis?

Put 10 of the world's best economists in a room to debate this issue and it will likely result in a fist fight. I wouldn't expect to find the answer on this forum

Another valid question is: if there is more crisis ahead of us, will it cause the same end-of-the-world sentiment as when this mess started?

My guess:

End of the world -> Gold

Recession is a little worse than we thought -> USD

One of which is highly liquid.

-

It's time for bondholders to eat it. They've been blessed this past year with public largesse, or more exactly plundering of the public wealth. Take the risk, eat the paper.

-

The kind of person who can't bear not getting 1000 bt per head?

Disgusting indeed.

Yeah. This kind of thing happens all the time, usually when wages are due. Poor helpless souls.

-

but Khun Thaksin was replaced in a coup right? is that legal?

That's a fact, Jack, and coups are not legal - even in Thailand.

Break from politics

Thaksin announced on 4 April 2006 that he would not accept the post of Prime Minister after Parliament reconvened, but would continue as Caretaker Prime Minister until then.

He then delegated his functions to Caretaker Deputy Prime Minister Chidchai Wannasathit, moved out of Government House, and went on vacation.

-

Peaceblondie

in Chiang Mai

Posted

Heartfelt wishes for a complete and speedy recovery Frank. You're a true gentleman, and that's a rare thing here.