lannarebirth

-

Posts

18,698 -

Joined

-

Last visited

-

Days Won

2

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by lannarebirth

-

-

opinion from one of my "savings&loan" banks:

The chart-technical picture suggests the gold price consolidation is

coming to an end.

We expect prices to test 2010 highs in the coming months and with

room for more. We believe gold is attractive at present levels.

From a structural point of view, we think the market underestimates

a lack of central bank supply, long-term inflation risks and USD

weakness.

Price consolidation completed

From a chart-technical perspective, the consolidation formation in gold

prices since early December 2009 has come to an end. Despite a nontrending

market environment, the changed technical backdrop should

push prices higher. Additional support comes from a new all-time high

of gold in EUR terms. Investors are realizing that gold is not just a

function of EURUSD alone. We target a price move toward the old

highs at USD 1,220/oz in the coming months. Prices should find some

resistance at around USD 1,125/oz and in the range of USD 1,142/oz

to USD 1,161/oz.

Structural issues have not vanished

A strengthening USD in recent weeks does not mean the structural

problems behind the greenback are off the table. The US still requires

foreign financing via the fixed-income market. With inflation risks

prevailing in the long run, we question if investors will get adequately

compensated for holding the USD. A soaring US debt to GDP ratio

should command a USD risk premium. If not satisfied by an attractive

real interest rate, a weaker USD will do the trick in attracting inflows,

we believe.

In addition, central banks could turn out to be net buyers in the

market. After years of being strong suppliers, this radically changes the

supply and demand picture. The gold market runs the risk of being

undersupplied in the coming two years. Hence, gold is not in bubble

territory and has room to reach USD 1,300/oz in 2010.

Charts are self explanatory. There is something odd about a call based on a "chart technical picture" that doesn't include a chart but does have several paragraphs devoted to non technical rationalizations. Anyhow, they could be right that it moves up from here. If it does, and to new highs it will be a blowoff top to the LT cycle IMO.

What's your credit union have to say on the matter?

-

<modified quote removed>

Here's where you made your mistake. Should have given her the money, and then when she didn't pay it back all future tendering of funds are voided. Anyway, from the sounds of it, the girlfriend is stretching the truth a bit with regards to what funding is appropriate here. Also she has failed to protect you from the schemes of others, which to me should be a fundamental obligation of hers. Do what you like, but I think I'd move on.

-

Stupid? It's brilliant!

Well maybe the stupid customer is actually Germany.

Exactly! The thing people need to understand about these "mai bpen rai", "no worries mate" cultures, is that it's not that they don't recognize a problem; they're just not going to make their own problem.

To be honest the Greeks have been very upfront about their abuse of the euro. They would argue that any accusation of bad faith was made on an assumption of good faith.

I just want to know how many countries Germany is going to bailout before they realize that if you cant see the sucker you are the sucker. Whether their political commitment or financial discipline goes first.

Some people argue that Greece should be bailed out because it could bring down the Euro. I hope they realize that if that is the case then it simply isnt worth preserving in the first place. To be honest I feel bad for Germany they are about the only honest major economy and they are about to realize how futile that has been.

I don't think they are going to bail out any countries to any great degree. I think the Euro is falling, not because of the PIGS, but because the core major governments are only months away from having their own problems. Hey, look what the Fed did!

-

Stupid? It's brilliant!

Well maybe the stupid customer is actually Germany.

Exactly! The thing people need to understand about these "mai bpen rai", "no worries mate" cultures, is that it's not that they don't recognize a problem; they're just not going to make their own problem.

-

why do we tolerate these double standards?

There is clear evidence Goldman Sachs deliberately conspired to hide the true extent of an EU government's debt. That's abetting fraud, plain and simple. Jeffrey Skilling, former CEO of Enron, is sitting in jail today for that very offence. By contrast, Gary Cohn's boss, Lloyd Blankfein, just received a $9m bonus.

God forbid that Congress should antagonize one of its main funding sources.

http://www.creditwritedowns.com/2010/02/wi...all-street.html

That is a tough subject. Why was Greece so stupid to go into that much debt ? Can you really blame Lord Blankfein for finding a stupid customer ?

Stupid? It's brilliant!

-

That's interesting.

By the lack of reponse, I take it not many TV readers are married to Thainese girls.

My wife is 100% Chinese, but raised since a young child in Thailand. She pays zero attention to Chinese New Year or Quan Yin or ancestor worship.

-

Looks like some strong fundament (als).

-

Just imagine how Greece could deal with its problems if its gold were valued at $55,000 usd per ounce. In terms of current exchange rates that would raise Greece's liquid assets to 50% of its public debt. In other words, instead of being a "sub-prime" borrower, Greece would instantly become a PRIME borrower.

True and much the same argument could be made about Greece if Kalamata Olives are valued at USD$5,000 per ounce. If both happen at the same time, there is even the very small possibility that Greece wont need to borrow at all.

Even if they did need to borrow, the could always borrow of Italy which has suddenly become a net creditor nation.

what about this ugly "feta"-thing which the Greeks call "cheese"? wouldn't it benefit Greece if it was valued @ 25,000 dollars/ounce?

And another international consulting firm is born.

Love the "outside the box" thinking.

Love the "outside the box" thinking.Actually it sounds a little bit like some of the mark to fantasy accouting rules coming out of FASB.

-

How many other countries in Europe have been helped by Goldman & Co ?

Wall Street helped dig Europe's debt

"Wall Street tactics like the ones that fostered subprime mortgages in the U.S. have worsened the financial crisis shaking Greece by enabling European governments to hide their mounting debts.

As worries over Greece rattle world markets, records and interviews show that with Wall Street's help, the nation engaged in a decadelong effort to skirt European debt limits. One deal created by Goldman Sachs helped obscure billions in debt from the European Union budget overseers in Brussels.

Even as the crisis was nearing the flashpoint, banks were searching for ways to help Greece forestall the day of reckoning.

In early November – three months before Athens became the epicenter of global financial anxiety – a team from Goldman Sachs arrived in the city with a proposition for a government struggling to pay its bills, say two people who were briefed on the meeting.

The bankers, led by Goldman's president, Gary Cohn, held out a financing instrument that would have pushed debt from Greece's health care system far into the future, much as when strapped homeowners take out second mortgages to pay off their credit cards."

http://www.dallasnews.com/sharedcontent/dw...n2.4c5ae02.html

goldman faces special audit and possible ban in Europe

http://jessescrossroadscafe.blogspot.com/2...es-special.html

This doesn't look like a scandal to me. It's what investment banks do in their regular activities. THAT od course is scandalous, but how else will next months pension check be funded?

-

It's no more consequential than watching X-Factor.

It really is hard to believe there is anything more important than X-Factor although Brad and Angelina's relationship is obviously a cause for concern.

Mulder and Scully, no?

-

The fed and treasury don't trade Comex gold AFAIK, although they may be friendly with guys big enough to move the markets.

The metals markets are too large for any one trading entity to suppress a strong uptrend for any sustained period of time, but there are trading entities who are certainly big enough to knock the price down for a day or two.

Why would the biggest players in the market keep knocking the price down?

Who benefits besides the government?

While they do not trade it...I would think it is not a stretch to think they control it.

The metals market is not as large as you think. In fact Silver being so small makes it very volatile. Also why the Hunt brothers were at one time able to control it.

As for the biggest players controlling & the govt benefiting.. You have answered your own question.

Of course they control it, but not in the way you think. They control those agencies that can quell speculation or let it run. They can freeze trading in it if they like. They could set a set price if they want. Mostly, I think they're happy to see a bunch of money go somewhere that is unproductive, unless it gets so high that it challenges the idea of what is the nature of currency.

-

The fed and treasury don't trade Comex gold AFAIK, although they may be friendly with guys big enough to move the markets.

The metals markets are too large for any one trading entity to suppress a strong uptrend for any sustained period of time, but there are trading entities who are certainly big enough to knock the price down for a day or two.

Why would the biggest players in the market keep knocking the price down?

Who benefits besides the government?

Of course they do. If you need any evidence look to see what happened to the price of gold on the Day AIG got their bailout. They're daytrading the US Treasury to rebuild balance sheets. If it weren't true it would make for great fiction.

-

Just another in the myriad of companies that want to charge you a percentage of your money for touching your money. If somehow that money should become more money they'll be wanting to charge you a greater percentage. If somehow you should lose your money, well, that's just the way it goes. There are presently no laws on the books that allow you to shoot them if they lose all your money. That's an unsatisfactory situation as far as I'm concerned.

Lanna,

I'm guessing that your tongue's embedded firmly in your cheek. I hope so!

Not even a little bit.

-

If you should ever travel to the north, every Hmong village has a local blacksmith.

-

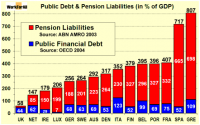

That is an extremely interesting chart Abrak, but 2003-2004 is like forever ago. Got anything more recent?

This is from a couple days back

Handy sovereign risk table

the risks implied are based on CDS values which the "market" dictates. markets are dumb! if markets were not dumb, clever investors would only make a fraction of the dough which they have made and are still making. let's hope markets will remain dumb for a long time to come. the chances are excellent

I agree,markets are dumb and the CDS imformation is less useful than absolute debt to income levels. Still, though dated, those were some pretty extreme debt/income percentages Abrak posted, if accurate.

-

Just another in the myriad of companies that want to charge you a percentage of your money for touching your money. If somehow that money should become more money they'll be wanting to charge you a greater percentage. If somehow you should lose your money, well, that's just the way it goes. There are presently no laws on the books that allow you to shoot them if they lose all your money. That's an unsatisfactory situation as far as I'm concerned.

-

-

In the past, a warmer planet has been associated with progress for humanity; cold periods with a contraction of activity.

For example, during the Medieval Warm Period (which AGW "scientists" tried to airbrush out of the record, despite contemporary written evidence) the Vikings colonized Greenland, there was a great economic flourishing in Europe (all those Gothic cathedrals were built) and supposedly vineyards were planted in the north of England.

Later came the Little Ice Age, which cut European food production by 15-20% (shorter growing season) bringing poor nutrition, famine, social unrest, and deaths by the millions.

Generally, then, humanity does better when it's warmer (as do other animals and plants).

Locally, the effects vary. Thailand, being warm enough already, probably doesn't need any extra heat, so the important thing, as pointed out above, is rainfall patterns, and I don't believe any credible scientist would claim to be able to predict how they might change in future, whether the earth warms up or not.

Will there be more rain, or less? Will it arrive in the right quantities at the right times? These are questions that farmers have been battling with since the dawn of agriculture because, as we all know, the climate does naturally change.

EDIT: Anyone who is seriously interested in how all this came about, might like to read an article just published by Jerome Ravetz, in which he discusses "post-normal science", that is, science which is complex and diverse, and which cannot be repeated and verified in multiple laboratories. Thus he suggest ways that well-meaning and competent scientists gradually morphed a concern about human impact on the environment into a stance of unchallengeable AGW.

It's quite a long and serious article, so perhaps only for the genuinely interested.

In a similar vein, I recommend Lee Smolin's book "The Trouble With Physics", wherin he describes the pressures on scientists to accept theories that are popular and fundable rather than retain their objectivism and commitment to experimental confirmation.

-

You understand you still pay an exchange fee/ commission to withdraw your funds, right? Anyhow, if that's what you want, which I doubt anyone would recommend, you can find it in Chiang Mai. I had one at Kasikorn Thai bank, Nimmanhaemin Branch. Worst bank I've encountered on 4 continents.

No. I did not. But I am not surprised. So if I take 1000us from my FX account and deposit it (electronically) into my pass book account and have it exchanged at that time obviously, how much does the Gov. git. Say we are at bangkok bank or ball park me if u know.

Everyone has an FX account for different reasons I suppose, but for me the reason is I don't want the money converted to THB. You don't pay an exchange/commission on deposit, but you will pay approx 1% on withdrawl to THB. If you want to withdraw $USD you pat approx 2% because first they have to convert to THB and then back to $USD.

I jsut checked out Bangkok band FX account fee's. Upon reciept of usa fund they charge max 500 bht. Upon deposit (assume to my pass book accout) they get another max 500bht. So, armed with this information, my strategy is flawed as I am gettin double dipped. I should just go straight to pass book account. Thanks

I wasn't even referring to "fees". Those are extra and will vary bank to bank. I was referring to the fact that you MUST convert your foreign funds to THB at some point, even if you don't want to, and of course you're going to pay exchange rates for that.

-

You understand you still pay an exchange fee/ commission to withdraw your funds, right? Anyhow, if that's what you want, which I doubt anyone would recommend, you can find it in Chiang Mai. I had one at Kasikorn Thai bank, Nimmanhaemin Branch. Worst bank I've encountered on 4 continents.

No. I did not. But I am not surprised. So if I take 1000us from my FX account and deposit it (electronically) into my pass book account and have it exchanged at that time obviously, how much does the Gov. git. Say we are at bangkok bank or ball park me if u know.

Everyone has an FX account for different reasons I suppose, but for me the reason is I don't want the money converted to THB. You don't pay an exchange/commission on deposit, but you will pay approx 1% on withdrawl to THB. If you want to withdraw $USD you pay approx 2% because first they have to convert to THB and then back to $USD.

-

Why the FX account and not a straight THB account?

It is a substantial amount that i feel would be better off remaining in dollars for the time being, plus I am working two angles for the extension of stay requirement. 1. monthly income from state and 2. seasoned funds in thai bank.

You understand you still pay an exchange fee/ commission to withdraw your funds, right? Anyhow, if that's what you want, which I doubt anyone would recommend, you can find it in Chiang Mai. I had one at Kasikorn Thai bank, Nimmanhaemin Branch. Worst bank I've encountered on 4 continents.

-

Why the FX account and not a straight THB account?

-

Hi. I am a simpleton with no understanding of science. I suspended rational thought long ago. I take pride in participating in the destruction of the planet. I enjoy posting whatever nonsense Exxon-Mobile tells me to post to divert people from the fact that global warming and climate change are real. I think it is fun to totally ignore reality and engage in conspiracy theories. I guess I am a certified lunatic.

Don't be embarrassed, you're certainly not alone. Anyhow, the "Shock Doctrine" doesn't so much deny that disasters happen; they surely do. It is mainly a thesis that says that with every new ocurrence some group makes a huge profit from it and some other group of people loses some economic or other freedoms.

-

More and more people are now realising that climate change is another scam, similar to the Y2K scam. Gore and others have made millions from this.

After SARS, bird flu , AIDS (it was going to kill us all) I wonder what the next big scare will be, and who will make money from it ?

Financial Crisis

in Jobs, Economy, Banking, Business, Investments

Posted

One thing people always miss about the problems in the USA. In order for US to improve it's fiscal situation, it need only STOP doing many of the extravagant things it does that are wasteful. Other governments need to give MORE than they are presently to heal their problems. That hurts. US also has more taxing authority available (by present first world global standards) than do other major governments. We'll see.