-

Posts

1,723 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Misty

-

-

1 hour ago, Caldera said:

So the headline is nonsensical, as so often. Not the fact that they were mining bitcoin is illegal, but the fact that they were stealing electricity.

Maybe that's all it was - thievery. But cryptocurrency is a regulated activity in Thailand - were they licensed? Did they report their financials, pay tax, etc? Maybe they were stealing electricity in part to hide the operation.

-

23 hours ago, wordchild said:

and background to the case mentioned in todays ST https://www.aol.com/sec-fines-york-firm-devere-8-million-over-192142813--sector.html

https://international-adviser.com/criminal-complaint-filed-against-devere-partners-in-thailand/

-

11 hours ago, noobexpat said:

Not in the UK they can't. And not for the past +40 years.

You need to have FCA controlled function 30 authorisation.

Even has a wiki page...

https://en.m.wikipedia.org/wiki/FCA_Controlled_Functions

Same in Thailand: https://www.sec.or.th/EN Need to be licensed by Thai SEC

-

1

1

-

-

2 hours ago, MRtommyR said:

Mine was sorted as well. Same problem 🙂

They were very helpful in the branch and seemed to have had proper training about the transition. Total opposite of my experience with the Thanachart TMB merger a few years ago which was a shambles.

Mine was sorted as well. Also needed to update information, as well as remove off a phone block. The UOB staff were very professional at the branch office in the main building on Sukhumvit. They also had difficulty getting through to the back office people at first. Apparently they've been very busy since the final handover Sunday evening.

-

1

1

-

-

20 hours ago, Crossy said:

All sorted

The original issue was that my passport number had changed, I did try the old number but that didn't work either (probably because it had expired).

Anyway, the usual hassle (and multiple photocopies) of changing passport numbers ensued, very helpful young lady in the branch sorted that.

Then a different lady helped me set up the App. The process involves no less than 3 (three) one-time-passwords, your card number and PIN, setting up a username and password (which you will use once if you set up biometrics) and lots of "confirm" clicks. I probably would have lost it trying to get it going on my own.

The App looks pretty much like the Citi version and seems rather faster.

Glad to hear you got it sorted. Tried calling UOB again this morning, and unfortunately no progress. Looks like I'll need to go to my nearest branch today. Hope it's also a relatively easy fix.

-

1

1

-

-

5 hours ago, Lost Nomad said:

Questions for the group:

- If I choose to pay THB 50K at the BOI do I need to do this within 60 days of 4-24-24?

- Will they still accept cash? I don't have a Thai bank account yet.

- If I instead choose to pay for the e-visa in the US do I still need to arrive in Thailand within 60 days?

It's cheaper to pay in BKK, but the e-visa (USD 1600) might be worth the extra expense if it allows me to arrive later in 2023.

1. Yes, I think you're supposed to make an appointment at the BOI within 60 days of receiving the approval letter. You may be able to get this extended if you request it.

2. As of Dec 2023 they were still accepting cash for the LTR visa itself. If you get a digital work permit, however, it's a different cashier and they would only accept credit card or phone app bank transfer.

3. If you choose the e-visa in the US, you'll get a pdf of the visa and there's no 60 day limit for entry.

Just a note on e-visas: if you later want to switch to another type of visa these can be problematic. The LTR e-visa is good for 10 years (rather than the standard 90 days for most visa types). So you'd have to get the e-visa cancelled by the Thai embassy or consulate that issued it. It can be done, but the process is complicated and long. I had an LTR e-visa initially, but when I became eligible for an LTR visa with a lower income tax rate, it was financially worthwhile to switch. Eventually I was able to do so, but had I not gone the LTR e-visa route initially and instead gotten my LTR visa issues in Bangkok, the LTR unit in Bangkok could have handled cancelling the old visa, and the switch would have been much easier.

-

1

1

-

1

1

-

On 4/23/2024 at 9:50 AM, Crossy said:

I don't even get an OTP, just an "error try later".

It may just be flooded.

If not sorted by tomorrow I'm going to our "local" (20km drive) UOB branch with my "angry farang" head on!

EDIT They evidently have my phone number as I get notifications of transactions on my card.

Hope the local UOB branch can help. Phone calls (when I can get through) just result in being told that someone will call me back in 15 min. So far no one has called, and I conclude they are overwhelmed. No time to go to a branch today, but will do so tomorrow if this remains unresolved.

It's good you're getting notifications of transactions, so at least you can see if there's card misuse. I'm not getting those types of messages, although one UOB person was able to to confirm my phone number.

Hopefully the risks are low, but if data was compromised this period would be ideal for fraudsters.

-

1

1

-

-

13 hours ago, MicroB said:

The most recent data is to 2022:

If you consider Britons traveling to APAC as a market (ie. the choice isn't between Thailand and Benidorm this year), then before the pandemic, about 8-9% of Britons going on holiday/visiting Asia were picking Thailand. In 2021, that dipped to 3%, and it looks like India benefited from that (though India travel will be a mix of holidays, a lot of family visits and business reconnections) and in 2022, it went back up to 8%. If I strip out India and Pakistan, then in 2022, Thailand attracted 18% of British visitors to APAC, compared to 13-15% prepandemic. Non-HK China has collapsed; 16% before pandemic and 3% in 2022; 14% in 2021. Other Asia (Cambodia, Indonesia, Vietnam etc) went from 34% to 48-51%, and that seems to be at the expense of China, and, to a lesser degree, Japan and Hong Kong.

Countries in this selection are

Hong Kong (China) Other China India Japan Pakistan Sri Lanka Thailand Other Asia Australia New Zealand But if I consider a wider range of destinations, then a slight different story. Comparing % share in 2022 to 2019, only the following countries have increased their share. The dominating feature, except for Brazil, is the Package Holiday. Destinations more associated with more independant travel, which is basically Asia, have lost out. I suspect there is a combination of cost; the destinations closer to the UK will be cheaper, but also, post COVID, security, ie having the support of a Tui, Virgin etc to not strand you at an airport etc.. Its more complex that that, because you also have to get into spend, nights stayed etc, which is all in that data source.

One take away is that Thailand has to work hard to get the Tour Operators to fill up flights, charters. Something that might be distorting is hotel vacancies; has Thailand become a place where there are more people living out of a Hotel room?

The biggest losers, in terms of the holiday share, are USA, Cyprus, France, Ireland, China, Japan, and Other Asia (Cambodia, Vietnam, Indonesia etc) Thailand is down 0.2%, but Sri Lanka, which has more package tours, is down 0.1%. Interestingly, USA is down 0.8%, Canada is down 0.12%. I put that down to Florida (Disney) being too expensive. The £:$ during that period wasn't too bad.

Greece Portugal Spain Turkey Egypt Morocco Barbados Jamaica Other Caribbean Brazil Mexico Fly/cruise (stay onboard)

Interesting to see the differences between the 2022 data of actual travel, and a 2024 poll that @BurmaBill posted in this thread previously. Florida could be too expensive, but at least in the poll NYC made it into the top 10 travel planned destinations: https://business.yougov.com/content/48404-what-are-britons-top-travel-destinations-for-2024

-

19 hours ago, Burma Bill said:

2023 -2024. Interestingly, the UK itself is the most popular (domestic tourism) Thailand does not get a mention😄

Top destinations for UK travellers

"Of the destinations considered, which are you most likely to visit?" (UK adults)

Table with 3 columns and 10 rows. Rank Destination Score 1 UK 17%2 Spain 15%15%3 Greece 8%8%4 Italy 8%8%5 France 7%7%6 Portugal 7%7%7 USA 6%6%8 Ireland 5%5%9 Germany 4%4%10 New York(USA) 3%3%December 11, 2023-January 9, 2024Thanks for the interesting link. I would have guessed at Spain and Portugal, and from UK friends also domestic UK. If you add New York + USA the two together are 9% so just above Greece.

-

1

1

-

-

4 hours ago, MRtommyR said:

Any Citi credit card holders able to successfully register for the UOB app since the migration yesterday? I complete my passport number and date of birth and successfully receive an OTP, but the next screen asks to confirm my credit card number and then rejects it. Same issue when trying to connect with them on LINE

You're a step ahead of me. I had a CC credit card and have tried to register for a UOB online account a couple of times since last night. Not receiving the OTP. The system appears to have my correct information and phone number,

Separately, now also not receiving OTPs from payment systems that used to be run by Citi and now say UOB. Have called UOB, and they are looking into the issues. Long phone wait times, they may be a bit overwhelmed.

-

23 hours ago, ChipButty said:

Not telling you

So you have no idea

-

1 hour ago, webfact said:

Whether this decline represents a temporary dip or a long-term change in British travel preferences remains to be seen.

So where are British going instead?

-

-

14 hours ago, Ben Zioner said:

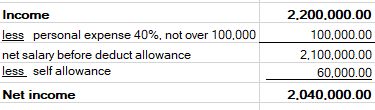

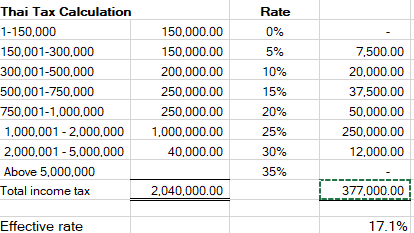

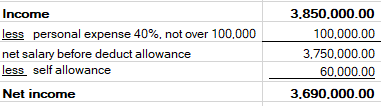

I like that 17% figure, without any "schadenfreude". IMHO a fair income tax system would be one where where tax would kick in, at a lower rate of 3% to 5% of total income and no one would pay more than 15% to 20%. I think I'd be ok I think if they taxed my foreign income at 17%.

For foreign remittances to be taxed at an effective rate above 17%, based on the current progressive tax schedule and using standard deductions and without an LTR visa, I figure you'd need to bring in about Bt8.5m each year (c.$236k) - without any foreign tax credits to offset it. Of course, a moot point if you have one of the LTR visas (except LTR HSP).

-

16 hours ago, Yumthai said:

I mean discriminatory in term of tax.

You have to show enough money to qualify and pay no tax. To me, it's a huge benefit and significantly unfair.

But good for anyone who qualifies and wants to live legally tax-free in Thailand. The LTR visa route is the go-to as all perks exceed all the other kind of visa at less average cost.

You may misunderstand the LTR visa's tax benefits. I currently have the LTR HSP visa but am not "legally tax-free." I will pay a substantial amount of Thai income tax on my salary, albeit at a flat rate of 17%. Previously on a different LTR visa at progressive rates I paid up to the top 35% marginal rate, or effectively a total of c30% including RMF deductions.

-

- Popular Post

- Popular Post

13 hours ago, Yumthai said:Not sure about that. Even without the tax exemption, the other perks alone exceed the other visas requirements.

Furthermore, tax issue should not be something to consider (and remittances are manageable anyway) for big spenders willing to settle in Thailand, or is it?

The tax issue is definitely something big spenders (wealthy/rich) expats consider when looking to move to a new country. If they don't, frankly they are hugely remiss.

Prior to last September's changes to how the tax code would be interpreted, these types of expats liked the fact that Thailand did not tax them on passive income earned outside of Thailand. And now that Thailand has changed the tax code interpretation, big spenders will certainly consider the LTR visa over other visas that don't address this tax issue.

-

3

3

-

1

1

-

- Popular Post

- Popular Post

11 hours ago, Pib said:No annual renewals, unlimited multi exit/reentry, no 90 day address reporting, tax exemption, work permit if wanted even on a LTR Pensioner visa, etc. If you have the pension/income then why not apply for a LTR....and the LTR Bt50K fee works out to Bt5K/year over the 10 year visa. A 1 year Non-O with multi-entry permit would cost Bt1.9K+Bt3.8K=Bt5.7K/year.

Other than being able to apply for a work permit for some 1 year visas, got any of above mentioned LTR benefits with a 1 year visa? Yes, yes, for many a 1 year renewal of a Non-O goes smoothly but for many it don't which keeps the AseanNow forums constantly abuzz....and the "every year" worry/concern of the renewal...what will possibly change for the upcoming renewal that arrives all too soon year after year.

Having had to annually extend a NonB/work permit every year for decades, with the mounds of annual paperwork and ever growing requirements, the LTR visa + digital work permit is a huge improvement. To start with, the LTR unit is professional, courteous and even friendly. Such a breath of fresh air! Given the amount of Thai income tax I've paid over the decades, the LTR unit's attitude is so welcome and in stark contrast to the attitude of the offices overseeing NonB visa/work permit extensions. Not to mention there's no annual renewals with the mountains of required paperwork and wasted time, no 90 day reporting, no requirement for re-entry permit, no Thai employee requirement, no minimum salary, no need to be in country every year (like with PR), no harassment of annual syphilis blood tests. There are some nice tax benefits. And using the fast track at the airport is further icing on the cake. At the very least, I can only guess @Gottfrid has never had a NonB / work permit or at least not recently, and has no idea what a corrupted mess that process has become.

-

1

1

-

1

1

-

2

2

-

2

2

-

- Popular Post

- Popular Post

2 hours ago, Gottfrid said:If we say like this:

If you want to work, you need work permit. With such permit you can get business visa/extension.

For retirees, there is already a better option with only 800k or 65k per month.

For people with Thai children or married to a Thai there is 400k or 40k per month option.

Besides that, visas for education, rather long stay tourist visas and smart visas.For those who qualify, an LTR visa is generally much better than the other options you mention.

-

7

7

-

10 hours ago, Ben Zioner said:

BOI/LTR could be good for you

Definitely suggest checking out the WP LTR visa. It's a 10 year visa and there are many advantages if you qualify, including up to 4 related visas for spouse and children.

-

1

1

-

-

13 hours ago, Pib said:

And even when that someone "did" have a tax return to submit but it showed less than the required income requirement because some of his income is "non-reportable/non-taxable" then that is when the other income documents come into play....actually become the primary documents to prove the required income and the tax return is just a secondary document. An example would be for a U.S. military veteran drawing a "Veteran's Administration (VA)" pension/benefit which could be tens of thousands of dollars per year---not one penny of that is taxable/reportable on a tax return per U.S. tax law....and the VA does not even provide an annual tax document because by law the benefit is not taxable/reportable.

Another example is a US taxpayer with rental income that isn't taxable because of deductible expenses such as depreciation, etc. The rental income isn't included in taxable income on a US 1040 tax filing, but can be included as income for an LTR visa application.

-

2

2

-

-

8 hours ago, HerewardtheWake said:

Background: I had an O-A visa for which I had the required health insurance. I used the same policy for meeting the LTR visa requirement in 2023 April. The Pacific Cross insurance expensive (at over 100,000 Baht premium) and is useless because it has a 300,000 Baht deductible. I would like to use the self-insurance route of having a US$100,000 bank deposit. I have been trying in vain to contact LTR visa service in Bangkok. A written message to them gave me a an irrelevant canned answer without addressing my question. Phone calls get me a response to contact by email.

How does one go about getting LTR approval of the self-insurance? I got an account Balance Letter from my Charles Schwab bank and attached it as a file to my profile on the LTR website, but got no acknowledgment from LTR.

Would it be better to make a visit to the LTR office in Bangkok? Does one need an appointment? Would a Balance Letter be sufficient to meet the LTR requirement?

If anybody has had any experience with this, please comment.

I've found going to the LTR office in Bangkok to be the best way to get answers to questions when I couldn't get answers by phone or email.

From others posting in this thread - make sure the bank account balance is with Charles Schwab Bank, and not Charles Schwab Brokerage. Apparently the LTR unit no longer accepts brokerage accounts for the self insurance requirement.

If you do find you need to purchase an insurance policy, check out LMG Insurance - you may find their long stay visa plus policy with a high deductible to be better priced than the one you have: https://www.lmginsurance.co.th/en/long-stay-visa-plus-premium-plan-100000-usd

-

1

1

-

-

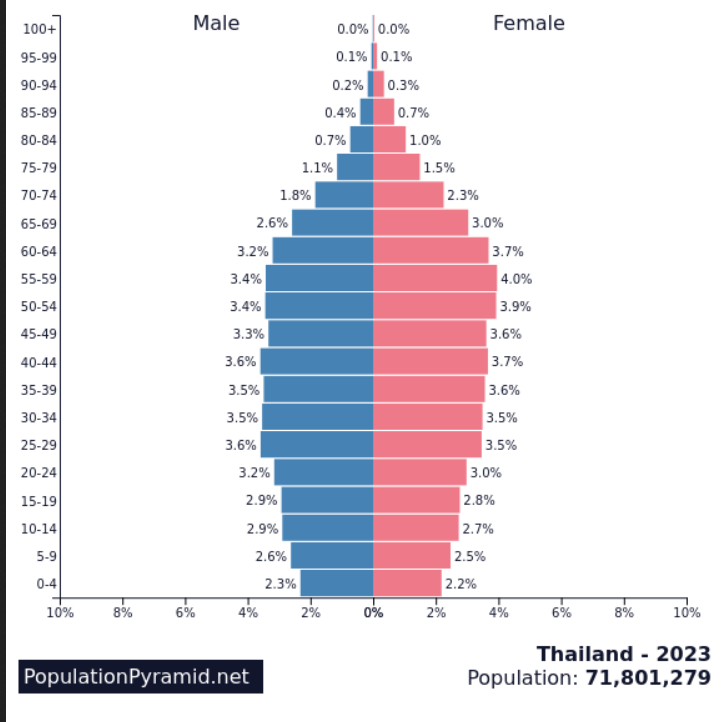

Demographics are not favorable for residential property demand.

-

1

1

-

-

20 hours ago, Cocon said:

Hi Misty,

No minimum salary amount is required, I have LTR WP and I work now for my old company as a consultant for 1-2 days a week, I asked them before and they said I could choose the salary by myself and there is no minimum.

Thanks Cocon, it's good to know. In the near term we're planning to hire a new employee. Longer term I could see a similar situation as you describe, working part-time.

-

I had a lot of pain in my neck and right arm during covid. Finally had it checked out, hospital ran some x-rays and said there were signs of degeneration. they thought related to aging.

Ended up working with a physical trainer and added a series of daily stretches to my normal workouts. These helped, but only some.

What really helped (and now have no pain) was starting to do pushups regularly again. Hadn't really done these since army days. Good form with neck straight is obviously important.

I wonder how much of what medicine calls "normal aging degeneration" can be helped in this way.

Expat Investment Advisors

in Jobs, Economy, Banking, Business, Investments

Posted

Agree. If you're in Thailand, you'd also want to ask how they are regulated and how you would be protected if things go south. A UK regulator is unlikely to help someone in Thailand. The Thai regulator is limited in what they can do if the adviser isn't regulated, and the process of filing a complaint is very long and drawn out.