-

Posts

1,722 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Misty

-

-

1 hour ago, Guderian said:

It might have been asked and answered here already, but there's too many pages to search through. Does anyone know if other SEA countries, like Cambodia and the Philippines, are doing the same thing as Thailand?

-

2

2

-

-

12 hours ago, K2938 said:

Moreover, if you are paying yourself a fictitious salary via a UAE company while permanently living in Thailand, then this fictitious salary will most likely be considered to be Thai income anyway, regardless of where it is paid. People got away with this in the past due to lack of reporting. But these times are probably over. So this is unlikely to work for many reasons.

Agreed. And if you establish it was a "real" salary for work you are doing - if you were physically in Thailand doing the work, then it is Thai source income, not foreign source income. In that case, all of your salary is taxable in Thailand - whether or not you ever remit it.

-

1

1

-

-

1 hour ago, SportRider said:

Here's an idea...

The UAE has a DTA with Thailand. If you are economically active you could use a UAE company to pay yourself income. Taxed - at 0% in UAE.

Then legit bring funds to Thailand as tax-paid.

I hope you are right. It isn't clear how this will work in practice. For example, if you bring the income to Thailand and then need to file a Thai tax return to claim the foreign (UAE) tax credit against any Thai tax due, you might find you only get a foreign tax credit of 0%. So you'd still owe Thai tax.

This is how it already works for US taxes, just in reverse. There's a US-Thai DTA. US taxpayers are taxed globally, so have to file US tax returns no matter where they are tax resident. US citizens who are Thai tax residents can claim a foreign tax credit against any US tax due. If they pay 0% in Thai taxes on the income, they get 0% tax credit and still owe US taxes.

-

1

1

-

-

10 hours ago, ThailandRyan said:

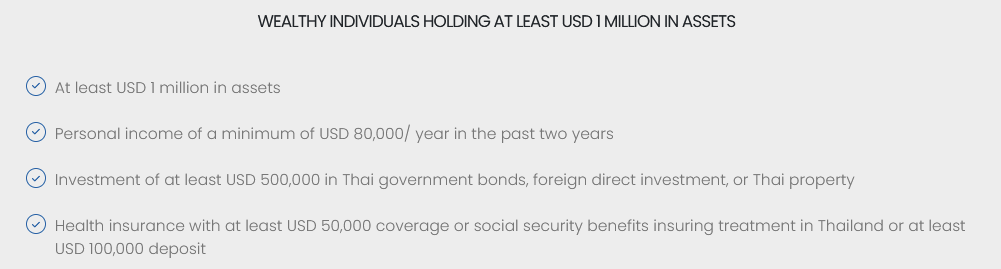

If they have that kind of assets then they can apply for the LTR-WGC visa, but then the assets, a certain amount must be in Thailand.

Yes, although for LTR-WGC they'd still need to show income of at least $80k/year for two years and invest $500k in Thai government bonds, foreign direct investment, or Thai property. https://ltr.boi.go.th/#what

If they can wait until they're over 50 years old and can show between $40-$80k in income, they could then apply for the LTR-WP and only invest $250k in Thai government bonds, foreign direct investment, or Thai property.

-

1

1

-

-

- Popular Post

- Popular Post

3 minutes ago, Smokey and the Bandit said:Agreed. They still have foreign/farang tourist police, go to walking street and you can see them, but they are more like liaison and have very limited powers.

Not sure these folks will feel they have limited powers. They seem to operate outside the law elsewhere.

"In October, the US unsealed criminal charges against seven Chinese nationals accused of spying on and harassing a US resident and his family as part of efforts by the Chinese government to return one of them to China. Last month, one of the Chinese "police stations" in the centre of the Irish capital Dublin was ordered to close by the government as a result of Safeguard Defenders' work.

And Canadian intelligence officials recently said they were investigating accusations that China had opened unofficial "police" stations on Canadian soil."

-

3

3

-

1

1

-

8 hours ago, Thailand J said:

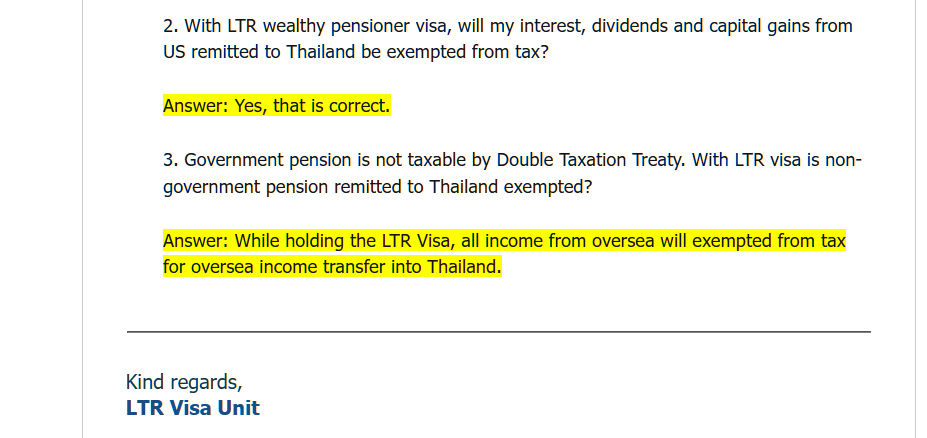

Thanks J, it is good to know. The answers I've received from BoI are also consistent with what you are reporting.

I'm about to switch my LTR visa to the LTR HSP version to save on current year Thai income tax. LTR HSP doesn't offer this exemption, but I don't need it now. At some point in the future, though, it'll make sense to go back to one of the other LTR versions that exempt foreign source income remitted to Thailand.

-

3 hours ago, hondoelsinore said:

Viewers please note: AMCHAM Thailand has an excellent tax committee. Years ago this guy gave a couple of presentations for AMCHAM. Not only is he no longer an AMCHAM member, but he is also not asked to speak there.

-

1

1

-

1

1

-

-

42 minutes ago, Mike Teavee said:

To align that to Thailand, that would that be like Thailand taxing all Citizens & Permanent Resident Holders on their World wide income.

And if I've understood you correctly, somebody who went to work in the US for 1 year on a H1B Visa would be taxed on their world wide income during that year, but presumably once they left the Job/US & were no longer Tax Resident, the US wouldn't tax any income not arising in the US.

The rules on who is a US tax resident are a bit complicated. But I think that it would be correct to say once someone is no longer a tax resident, the US wouldn't tax income not arising in the US. It may tax some types of investment income in the US as well as distributions from deferred income accounts such as traditional 401(k)s, IRAs, and Social Security.

Here's a link to definitions for US tax residency: https://www.irs.gov/individuals/international-taxpayers/residency-starting-and-ending-dates

The Thai definition is so much simpler.

-

1

1

-

-

1 hour ago, Mike Teavee said:

Perhaps somebody could explain how US Tax works for non-US Citizens living/Tax Resident in the US i.e. does the US Tax them on all of their world wide income or only Income earned in/remitted to the US?

I can see Thailand introducing a US Style Worldwide Income Tax on Thai Citizens (though they lack the "Clout" of the US when it comes to getting other countries/banks to report information to them) but I can't see them introducing this for Non-Thai Citizens even if they are Tax Resident.

Yes, the US does tax any tax resident on their world wide income - citizens, green card holders (permanent residents) and holders of other types of visas. Green card holders outside of the US are also taxed on world wide income.

-

2

2

-

-

7 hours ago, Thailand J said:

On the tax form in the section pertaining to rental income, ทรัพย์สิน has to mean real estate.

I still believe on RD 743 it includes all investments. We'll see.

It's strange that RD 743 Section 5 mentioned only 3 out of 4 types of LTR visa holders.

https://www.apthai.com/th/blog/know-how/knowhow-what-is-asset

Yes, it's important to note that the LTR Highly Skilled Professional visa is not included in the RD 743 exemption. LTR HSP visa holders must be employed by a Thai company, and receive a different tax break: a flat 17% tax on their Thai salaries. That alone can be a very significant tax break at higher income levels. At those higher income levels, LTR HSP should have less reason to bring foreign sourced income into Thailand. So perhaps it was reasoned that this is tax break enough for LTR HSP.

-

1

1

-

1

1

-

-

2 hours ago, stat said:

Abother update from the LTR thread:

..OK another update from the visa guy who talked with the BOI today the Pension visa is only exempt for overseas income taht does not come into Thailand..

For now - who knows what will happen next year...!

I did not write this, you are mistaken

-

- Popular Post

- Popular Post

10 hours ago, Dogmatix said:This was a rather pointless video. Just saying that paying Thai tax on only $100,000 out of your income of $1 million is a good deal because it is only an effective tax rate of 2% is not helpful to most people here, who actually live in Thailand and don't have $1 million a year. I wasted over 10 minutes watching this garbage to see, if he had anything useful to say to but he didn't.

Thank you for the review - saves me from watching it. Nomad Capitalist's business model appears to be repackaging online information and selling it as top dollar "advice".

-

2

2

-

1

1

-

1

1

-

3 hours ago, Skipalongcassidy said:

This situation begs the question as to why Thailand insists on inventing the wheel all over again... is it pride or ignorance that blinds them to other tried and true systems that are up and running with all the bugs already dealt with. Asking for a friend.

It looks like the original Thai tax code in fact may have been based on an existing system. For example, the UK taxes inward remittances for non-domiciled tax residents ("non-doms"). https://www.gov.uk/tax-foreign-income/non-domiciled-residents

The difference is that UK non-doms I know avoid this tax by living on their income and remitting as little foreign income as possible. To make this work, they have to scrupulously keep their foreign accounts separate : those that remit income, and those that never do. High level executive non-doms usually get very expensive tax advice before they accept positions in the UK. They prepare for this tax in advance by opening and maintaining "clean" (nonmixed) accounts.

So Thailand may not be trying to invent the wheel. Thailand (and arguably Malaysia) are potentially using similar tax code, but the situation in country is very different. Unlike highly paid UK non-doms, many foreign tax residents in Thailand remit foreign income regularly and have not segregated their accounts. Thailand switching horses mid-stream could be messy.

-

1

1

-

1

1

-

-

On 11/1/2023 at 11:15 AM, Flyguy330 said:

Yes Misty, the way I'd do it is to spend 179 days in Thailand (if that's the preferred main base) then do 90 days (or as much extra as desired) in Malaysia, that gives you Malaysian Tax residencey.

Then you can use the other 90 (or less) days to travel the region, or visit home. Or just stay put in Malaysia the remainder of the tax year.

Rinse and repeat.

Maybe not everyones cup of tea, but if the tax savings are significant I'd be doing it.

It's good to have options.

By the way - these 'days in country' don't have to be consecutive, or in blocks. So you could just hop back and forth every couple of months if preferred. Just need to keep close tabs on the dates. You can then remit all you like to TH tax free. Bring up to 10K USD cash into Malaysia every trip, tax free.

Okay, I understand what you mean and why you'd need to have a tax residency somewhere to not be subject to your home country's tax. As a US citizen, I wouldn't get a benefit from gaining a tax residency in Malaysia and so didn't initially understand.

-

14 hours ago, Mike Teavee said:

I must admit that I didn't know about the updated Q&A Statement https://thelegal.co.th/2023/10/18/qa-statement-issued-by-revenue-department-clarifying-taxation-applied-on-foreign-sourced-income/

This added very little information except for the point about income earned in a year when the person was Non-Tax Resident would not be liable for tax whenever it was brought into the country. This is really good news for me as I plan on selling my house next year & taking the 25% Tax Free lump sum from my Pension in 2026, so as long as I stay no more than 180 days in Thailand during those years, I'm free to bring the proceeds in tax free at any point in the future.

Thanks for posting the link above. At the bottom of the text it says the new criteria "will become enforced on 1 July 2024." Is that a change or a typo? I thought the effective date was 1 Jan 2024.

-

3 hours ago, Flyguy330 said:

Just for info - in case anyone is considering a move to Malaysia in order to gain Tax Residency there to avoid tax residency in Thailand.

You only have to spend 180 days in Malaysia in your first year. After that you can maintain tax residency by only spending 90 days there in a year.

This might be of value to folks who want to lose their Thai tax residency, but need to have a 'Tax Residence' somewhere nearby, and don't really want to move full time to Malaysia.

Except that you can have more than one tax residency at the same time. Unfortunately gaining Malaysian tax residency doesn't mean you automatically lose Thai tax residency.

-

2

2

-

-

Article doesn't mention the Bt10k digital wallet initiative being part of the debt solution. I had thought that Bt10k was central bank digital currency (CBDC). But our staff seem to think that the digital wallet plan is not CBDC but rather courtesy of a private currency owned or controlled by the PM and/or Thaksin, sort of like the scrapped Libra/Meta plan. Anyone else hearing similar?

-

1

1

-

-

10 hours ago, Dogmatix said:

This picture is doing the rounds of Thai social media. I have no idea if it is genuine but it purports to be an ad to recruit people for a new DOPA swat team. DOPA raided a large pub in Patum Thani recently without any police, using armed Local Defense Volunteers instead. If genuine, the pic may represent a move to recruit a regular SWAT team that could enforce its powers over licensing to raid pubs, casinos, brothels and the like in the pursuit of the MoI's crackdown on influential figures and their criminal activities.

Since DOPA is the department of the MoI responsible among many other things for citizenship and PR, it may be interesting for some of you to know about this potential new string to its bow. As far as the citizenship process is concerned, it is as well to know that big changes are afoot at DOPA and the MoI under the new BJP minister and deputy minister which may or may extend to the citizenship process. Any inclination towards DOPA taking over responsibilities from the police would be consistent with the minister going ahead with the revised ministerial regulations on citizenship and getting DOPA to take over SB's role in initial processing of applications. However, reforms to the citizenship process may not be a priority to the minister right now, as he seems to have a lot on his plate.

If this ad is real, it's absolutely chilling. Whether or not Thai citizenship and PR applications are affected. What Thai social media is it circulating on?

-

9 hours ago, Tequila Sunrise said:

Thanks.

I will ask my HR whether they filed a tax return for me covering the 2022 tax year. They pay me net of taxes each month so it seems they somehow know how much tax I need to pay, this is odd as some of my salary is variable (e.g., annual bonus) so not sure how they know or whether they do adjustments.

Thanks for the advice on going to a big-4 firm. Another member also recommended a smaller firm that I assume he personally vouches for. Trust me, all recommendations are gratefully received and I will follow up on these. I do appreciate the help.

I have joined the gym, but find most people are walking around with their headphones on not being sociable. Anyway, this is something I can work on. What I meant by friends is someone who has been in Thailand years and has made all the newbie mistakes and can share what works and what doesn't work. It's difficult when working as my free time is extremely limited.

Yes, your HR department should be able to clear this up immediately. At your compensation level, it sounds like you're most likely working for a major employer. It doesn't sound like you're working for a small school or other institution that wouldn't automatically file income taxes for its foreign staff.

Most likely your employer filed online, in which case you wouldnn't sign anything. I know many expats of large employers where this is the case. Employers often do not automatically give tax filing documentation, unless it's requested. Many expat employees don't know about the Thai personal income tax filing process. Americans tend to be the exception, as they need Thai documentation to file their US taxes.

Congratulations on getting your LTR HSP, and thanks for the heads up at the time required at the BoI. I'm returning to Thailand soon and will be switching over my existing LTR to a new LTR HSP. Hopefully the process will go as smoothly! The BoI staff said I can keep my existing 5 year digital work permit, so hopefully I can skip the step of getting a new one.

-

1

1

-

1

1

-

-

19 hours ago, Tequila Sunrise said:

Thanks. Would you be able to give me a pointer in the right direction to any said "well connected" Thai accountant?

I am struggling in Thailand, been here 1 year and haven't made a single friend or connection. Been deceitfully scammed more than once and cannot speak the lingo so basically get ripped off every single day. The work here is much harder than I thought it would be, very long hours and I am the only foreigner in a team of 300 people. Most people in my company can speak great English but they choose not to and I'm starting to feel very alone and lost. My day is basically 8am-8pm work, grab some dinner and sleep. Repeat. Weekends I'm so tired I just stay around the condo and rest. I don't want to give up as I see many expats here have a great life.

I have been reading posts on this forum and people seem nice, informative and having a decent sense of humor. Hence I signed up for some friendly support.

My current annual income tax liability is millions of THB. I don't want to state the number as it's not polite but let's say more than 4 million and less than 6 million.

Congratulations on getting your LTR visa. I'm switching over to the LTR HSP visa and have talked to my company's accountant regarding the difference in Thai tax filing going forward. To date I've filed PND90/91 each year. My accountant has explained in the future I'll use PND95 for the 17% tax rate.

Does your company currently file your Thai taxes? The reason I ask is that the PND90/91 is a fairly simple form (at least as compared to my US taxes) and my Thai accountant fills it out and files it each year on my behalf. Going forward, PND95 should be similarly streamlined and easily handled by my accountant. I've also worked with KPMG for corporate tax issues and have no doubt they can handle filing PND95 as well.

-

3 hours ago, SHA 2 BKK said:

Agree. Don’t know where you’re based mate but get to the BOI One Stop Service Centre at Chamchuri Square. I had my Pensioner LTR in two weeks but my wife daughter got “frozen” somehow in the system. It was Christmas/New Year and we were overseas. When we got back I visited the Centre and things were done in 72 hours.

2. Yes I think your LTR is cancelled unless you find a new Employer who you qualify with - Misty will know.

3. No you can’t claim any privileges until you have your LTR. I’d get a Thai accountant to maximize allowances etc.

Seriously cobber I’d go to Chamchuri Square with all your paperwork.

I also understand that an LTR HSP is tied to your job. LTR HSP would be cancelled if you left the job. You'd need a new type of visa.

-

2 hours ago, ajs73 said:

Putin won't accept the invite. He's on a "most wanted list", and for that matter it would be a security nightmare for the GRU.. Foreign policy wise it's like lighting a stick of dynamite and seeing how long one can hold it before it blows up in your face. imo this is a dangerous move on Thailand's part.

Presumably Putin remembers what happened with Victor Bout.

-

1 hour ago, redwood1 said:

All very good points......The Srettha road show has been non-stop since he took office.......At this rate he will be running out of new countries to have photo-ops with........lol...........I not quite sure how this smiling lackey got to rich in the first place?

The Srettha road show comes to AMCHAM's AGM meeting on 25 Oct. I hope there will be plenty of time for member Q&A to include the AMCHAM Tax committee. Unfortunately I'm travelling and won't be able to go.

-

On 10/7/2023 at 10:52 PM, SHA 2 BKK said:

Misty you know more than all than all of us combined! Changing LTR midstream - champion in my books. Yes 17% on Thai sourced income. But for we “poor” pensioners no tax reduction for income made in Thailand but zero tax on income remitted from the previous year?

I reckon I close to the mark Krap????

hi Sha2Bkk - sorry for slow response. Am travelling and just saw your post. Yes, there's a tradeoff between the LTR HSP visa and the other LTR visas in that with the HSP you get a break on taxes for local income, but unlike the other LTRs you don't get any breaks for foreign source income.

The HSP suits my current situation well. But at some point in the future if I no longer have local source income I'd consider reapplying for one of the other LTR visas. Will have to see how this new interpretation of the RD directive plays out. I've had no shortage of locally sourced/ Thai taxed income from decades of working here. Will be interested to see how the new interpretation would apply, should I decide to repatriate some of it.

LTR Visa is Now available for Long Term Residency

in Thai Visas, Residency, and Work Permits

Posted

KBANK's bond desk (specialized department inside KBANK) has also sold LTR visa holders gov't bonds.