-

Posts

1,667 -

Joined

-

Last visited

Content Type

Profiles

Forums

Downloads

Posts posted by Misty

-

-

16 minutes ago, Ben Zioner said:

Becoming hilarious, can imagine someone investing USD 500.000 in Thailand to qualify for a visa, and having to pay USD 150.000 as income tax because he didn't count to 180 before moving to his new, so welcoming, "home".

Agreed that that would be a nonstarter. It'll be interesting to see if this ruling holds whether there may be exemptions.

Still, if I understand correctly, the tax if only for tax residents who haven't already paid tax on the income to a country where there's a DTA. So if you aren't a tax resident yet (for example, you don't yet have an LTR), then no tax. Or if you have tax reporting records showing your $500k has already been taxed, then no tax.

-

4 hours ago, redwood1 said:

If a Thai retired to America.....Did not work, no investments in the USA, did not own a house and only lived off savings.....They would not pay 1 penny in taxes in the USA besides sales tax...

If a Thai retired to America, they almost certainly would be a US tax resident, and also a tax resident in an individual state. They may owe US and especially state income tax on income generated by their global assets.

Unless they only have cash stuffed in a mattress they will be receiving interest, dividends, capital gains - all taxable. In some cases they may also have to pay income tax to an individual city.

And if they purchase a property (as many do) they will also owe property tax.

-

1

1

-

1

1

-

-

36 minutes ago, ukrules said:

At what rate do Americans pay tax on for the first $120k ?

It's zero isn't it......

It depends. If the income is wages Americans can chose to exclude up to $120k in 2023 from their tax calculation. However, they'll still owe tax on other types of income, such as capital gains, interest, dividends. Or if it makes more sense, they choose not to exclude $120k, but instead take a foreign tax credit against any US tax owed. The latter can work out better in cases where Americans earn and pay foreign tax on substantially more than $120k in non-US wages.

-

1

1

-

1

1

-

-

2 hours ago, stat said:

I am glad you realized that regardless of a royal degree etc everyone COULD be in danger of having to pay taxes on every penny they ever earned before the LTR visa and maybe even after.

Rhetorical questions

-

2 minutes ago, MistyBlue said:

I don't think they have said that at all. It is the assessable income brought in. (Interest generated from the savings whilst a tax resident. Not the capital value.)

MistyBlue, there is some disinformation circulating that is confusing savings with return on assets. I've been sent it a couple of times now.

Like your name btw.

-

1

1

-

-

41 minutes ago, K2938 said:

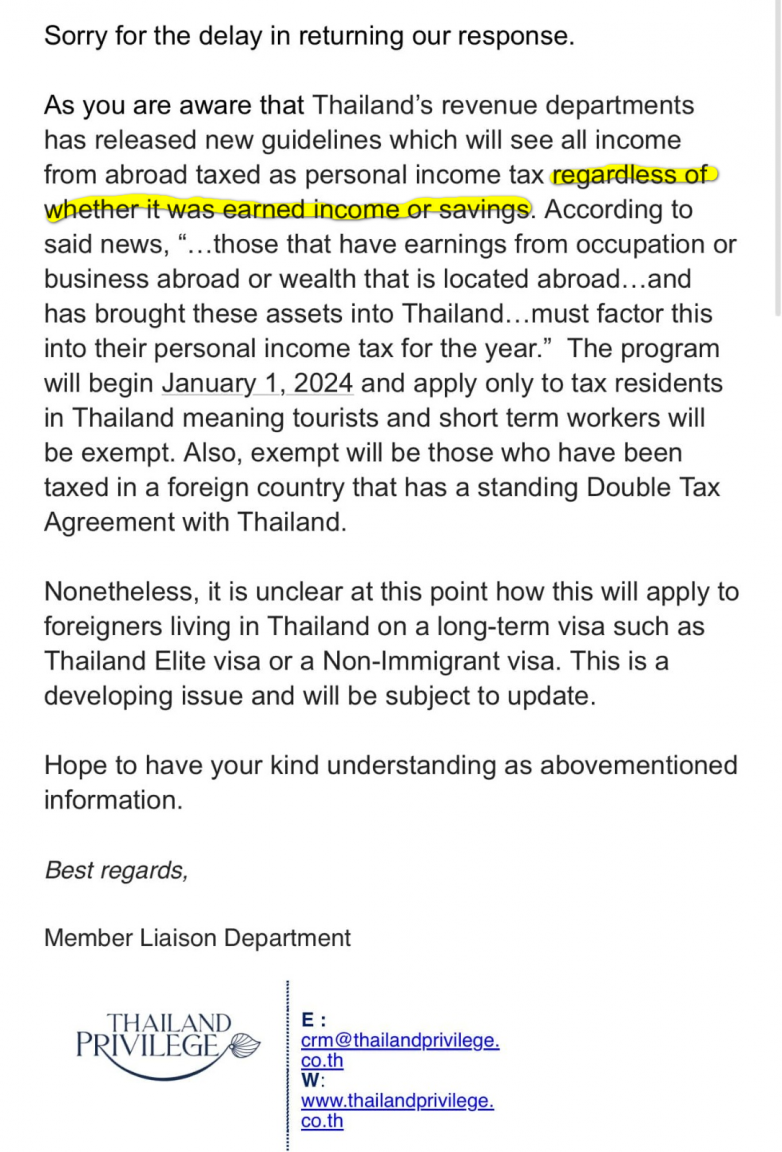

Interesting. I was forwarded an email with nearly identical wording from a completely separate, non Thai government, entity. So I wonder who really originated this verbage - was it Thailand Privilege, the sender of the email I received, or someone else? Especially the bit that is highlighted which seems pretty much nonsensical.

-

1

1

-

-

4 hours ago, Dogmatix said:

So the LTR visa will not allow someone to come and transfer their nest egg here to buy property and car etc, unless they earn all that after getting the LTR visa, which is unlikely to retirees.

What if they earn all that before they became a Thai tax resident.

Or as in my case if they earned all that and paid Thai tax on it already as a tax resident, but before getting an LTR visa.

-

1

1

-

-

- Popular Post

- Popular Post

7 hours ago, K2938 said:Thank you for posting this very useful email from the BOI. May I ask if you received this email before or after the announcement of the new taxation of foreign remittances from Jan 1, 2024 onwards? If it was after, then it seems rather weird that the BOI continues to claim that "normally, your overseas income will be subject to Thai personal income tax only when you... have brought such overseas income into Thailand in the same tax year that you... have received such overseas income" which obviously will not be the case any longer from Jan 1, 2024 onwards.

Hi K2938 I emailed and received that response yesterday, 26 Sep. Cheers.

-

1

1

-

1

1

-

1

1

-

2 hours ago, wwest5829 said:

Thanks but I am not in Bangkok.

It's online.

-

6 hours ago, wwest5829 said:

Representatives from American International Tax Advisors. They said they will return next month to update the Chiang Mai Expat Club members. The Club meets on the last Saturday of the month at Meliá Hotel in Chiang Mai.

AMCHAM Thailand's excellent Tax committee has a seminar on this subject on 4 October.

-

- Popular Post

- Popular Post

1 hour ago, Dogmatix said:You raise a good point. The English version of Royal Decree 743 translates it as "in the previous tax year", presumably to match the translation of Section 41 of the Revenue Code. The Thai is ในปีภาษีที่ล่วงมาแล้ว which is indeed exactly the same wording as the Thai version of Section 41. Literally it means "in tax year that passed already" which is a bit vague but, since Thai has no definite articles and the drafters would have been more specific, had they really meant "in any past tax years" it is obvious that parliament intended "in the previous tax year", as per the translated versions.

I don't know if the RD has to issue another order saying its reinterpretation of ในปีภาษีที่ล่วงมาแล้ว also applies to Royal Decree 743 or whether that will be left to LTRs' and RD inspectors' imaginations. But I think I now have to walk back my interpretation that the Royal Decree doesn't exempt past years, even though that was clearly the intent of the drafter who had no idea the RD would start taxing past years anyway. It would be hard even for the RD to apply two opposing interpretations to the same phrase in two related pieces of legislation just to collect more tax, although mental gymnastics of that type are not out of the question for Thai bureaucrats.

Text from an email from the BOI LTR Unit:

"Please be informed that normally, your overseas income will be subject to Thai personal income tax only when you are a tax resident (staying in Thailand 180 days or more in a tax year) and have brought such overseas income into Thailand in the same tax year that you are a tax resident and have received such overseas income. Please refer to Section 41 of the Revenue Code. If the aforementioned conditions aren’t all met, your overseas income won’t be subject to Thai personal income tax and you won’t need personal income tax exemption under Royal Decree No. 743.

If those conditions are all met and you have been granted a Long-Term Resident Visa for Wealthy Global Citizens, Wealthy Pensioners, or Work-from-Thailand Professionals, you will receive personal income tax exemption on your overseas income under such Royal Decree even if you have brought overseas income into Thailand in the same tax year.

Royal Decree No.427 Link (Thai): https://www.rd.go.th/fileadmin/user_upload/kormor/newlaw/dg427KA.pdf

Royal Decree No.743 Link (Thai):https://www.rd.go.th/fileadmin/user_upload/kormor/newlaw/dc743.pdf"

-

1

1

-

3

3

-

- Popular Post

- Popular Post

5 hours ago, MartinBangkok said:I feel relieved.

After reading every single post, 48 pages now, I feel so relaxed and happy.

I have been working, and living in Thailand, the last 18 years on a Work Permit (WP).

The last 4-5 years have been increasingly difficult regarding renewal of the WP. Without any forwarning at all, I have been asked for new documents and new requirements.

Not to mention the nightmare is is dealing with the officers of immigration, labour and revenue (none of whom speak understandable English.. - maybe 1 in a 100).

And also their very condescending attitude and behaviour towards me (white, older farang).

This, in addition to all the ways we get ripped off and discriminated in this country, I have decided that enough is enough, no more if this.

This is my final year full time in Thailand, I will stay maximum 180 days a year.

I am already looking forward to a new adventure. Really, really, looking forward to it :-).

I guess I am lucky, being single and working online and not having established any binding commitments to this country (to be honest, that has been a smart choice ever since my first week in Thailand at the beginning of the century, when my then Thai girlfriend, sided with the motor cycle taxi guy even if he tried to rip me (us) off triple the going rate)

Cheers

(side note: I will probably qualify for the LTR-Visa, but considering my experience with this country (and as stated in numerous posts), you cannot be sure of anything, any other that they will try screw the farang in any way possible)

Martin my experience with Immigration and the increasing difficultly and requirements of renewing a NonB visa was similar to yours. One difference was that I own a Thai company, and therefore had a binding commitment of sorts. I switched to the LTR visa and have been very happy with the BoI. They are a pleasure to deal with, and the LTR visa itself is a real breath of fresh air.

It's interesting to me now that the Royal Decree granting LTR tax privileges seemed to be specifically intended to thwart any change in interpretation of the Thai Revenue Department's Resolution No 2/2528. It's almost as if the change in interpretation we see now was known, and expected, when the LTR visa system was set up.

-

2

2

-

1

1

-

3

3

-

2 hours ago, stat said:

I read 14 sites of tax advidors all agreed that this could change everything even for LTR visas. I already asked the BoI explicitly on income remitted, no answer yet.

Pls post a source of some tax advisors staating LTR is definitly tax exempt in the future, I bet you will not come up with a single one! Already posted the exact wording of LTR and it is clearly stated income from another year is exempted. That was exempted under any visa in the past.

My tax professor always said: Do not rely on planing taxes to detailled as the laws will change.

Do not get me wrong I hope LTR is exempt.

I have asked the BoI explicity on income remitted, and they have answered me. Why they answer me and not you I do not understand. Do you have an LTR visa?

Please post links to your 14 advisors who all agree that this could change everything for LTR visa holders.

-

1

1

-

1

1

-

-

1 hour ago, stat said:

and again the new directive could impact even a royal degree. That is what I am saying along with EVERY tax advisor. The situation is unclear. Let's hope you are in the right and LTR visa holders are exempt.

No, every tax advisor is definitely not saying that. And neither is the BoI. Before you post again here, perhaps you can write and ask them as so many of us LTR visa holders already have?

-

1

1

-

-

3 hours ago, stat said:

You are correct that it is not a law but a directive, my apologies!

But as mentioned in the directive, all older directives are void as is also stated by a very reputable law firm.

According to the New Order, if Thai tax resident individuals derive offshore-sourced income and bring offshore-sourced income into Thailand, they will have to pay Thai personal income tax, regardless of whether such income is brought into Thailand in the calendar year of receipt or in subsequent calendar years. The New Order will apply to any taxable income that is brought into Thailand from 1 January 2024 onward. Any regulation, instruction, revenue ruling or practice which is contrary to or inconsistent with this New Order shall be repealed.

It is noteworthy that if the offshore-sourced income is not a taxable income (e.g., proceeds from the sale of offshore securities or assets with no gain) or income that is exempted from Thai personal income tax under the Revenue Code, such as income from insurance, Thai tax residents will not have to pay Thai personal income tax when they bring that income into Thailand.

Also here:

Article 2: In line with the issuance of this order, all existing rules, regulations, orders, responses to inquiries, or any practices that contradict or oppose the provisions laid out in Order No. 16/2023 shall be void.

https://franklegaltax.com/thailands-new-tax-rules-reporting-foreign-income-for-residents/?lang=de

Can a directive override a Royal Decree?

-

2

2

-

-

14 hours ago, wwest5829 said:

According to the recent tax expert who spoke at the Chiang Mai Expat Club meeting, your statement is false. I think I will listen to those whose business is tax matters between Thailand and the countries having tax treaties.

Who was the tax expert?

-

14 minutes ago, stat said:

Thanks a lot of the link. Capital income falls under which chapter in the Thai law? I do not know It is mentioned previous tax year only. In addition as is mentioned in the new law all other laws are null and void if I remember correctly; IMHO this could imply that also a potential tax exemption in the LTR is void. However I hope you are in the right on this subject, but just can't read it out of the laws.

Confirmation today from LTR unit by email.

I haven't seen a new tax law only a Thai internal RD directive. Can you post a link to the new law?

-

1

1

-

-

- Popular Post

- Popular Post

38 minutes ago, stat said:Pls show me the exact wording where it is stipulated that income transferred is tax exempt. It is only stated that income generated from overseas is tax exempt, no mentioning of transfered income to Thailand IMHO. Thanks!

I received written confirmation from the LTR unit by email today. However, you can also check out this English translation of Royal Decree No. 743) B.E. 2565 (2022). See Section 5. https://ltr.boi.go.th/documents/Royal-Decree-743.pdf

Section 5 Income tax under Part 2 of Chapter 3 in Title 2 of the Revenue Code shall be exempted for a foreigner categorised as Wealthy Global Citizen, Wealthy Pensioner, or Work-from-Thailand Professional who is granted a Long-Term Resident Visa under immigration law for assessable income under section 40 of the Revenue Code derived in the previous tax year from an employment, or from business carried on abroad, or from a property situated abroad, and brought into Thailand.

-

2

2

-

1

1

-

- Popular Post

- Popular Post

1 hour ago, stat said:No LTR does not change anyting as it "only" exempts income earned abroad NOT income transfered into TH.

No, sorry but that is not correct. Three of the LTR visas DO exempt foreign income transferred into Thailand from Thai tax. Only one visa does not: LTR HSP.

-

1

1

-

4

4

-

- Popular Post

- Popular Post

3 hours ago, Negita43 said:Just for clarity does a non O visa extension mean I am a resident (I thought it meant just the opposite) - I think the concept of residency is (as in most countries) blurred and confusing.

Finally, there is an old saying "two things you can't escape - death and taxes" For me it's a matter of which comes first????!

There are different types of residency - for example "legal residency" (which in Thailand might be considered Permanent Residency (PR) status, or perhaps Long Term Residency (LTR) visa status).

Separately, there is "tax residency" which is not related and often is simply based on number of days spent in a tax jurisdiction.

So you could be a tax resident, but not a legal resident.

-

2

2

-

2

2

-

46 minutes ago, No Forwarding Address said:

Thank you all for the informative replies, I am not ready to travel yet, wonder if there is a time limit on using the completed eVisa - 3 months, 6 months?? Does it have a 'must enter Kingdom before (date)' on the eVisa.............Cheers

Yes, my LTR e-visa said the visa must be used 10 years from the issue date.

-

1

1

-

-

- Popular Post

- Popular Post

19 minutes ago, Aldo123 said:Are you sure that LTR 5 year+ retirement visa avoids Thai income tax? I thought it was a requirement, which kind of put me off, just like applying for PR for same reason.

It doesn't avoid Thai income tax on all income. LTR visa tax benefits include exclusion from Thai tax on foreign source income only. But you're still taxed on local source income, including work, local dividends & interest.

-

2

2

-

1

1

-

2 hours ago, No Forwarding Address said:

This is all good information, very clear and concise. One question, I am currently in USA for at least the next 6 months, do you know if I can apply for the LTR Visa here, or do I have to be in Thailand? Closest Consulate is in California, I am in Hawaii, I would have to mail my passport to them.........Thanx again for informative post. Cheers

Hi I applied for my initial LTR visa last year while I was outside of Thailand. The LTR BoI unit approved the application and issued an approval letter. I then had 60 days to either make an appointment in person in Thailand, or to use the approval letter to apply for an LTR e-visa from a US consulate. I chose to apply for the LTR e-visa from the NY consulate and received the pdf of the visa very quickly. I then had plenty of time to enter Thailand with the LTR e-visa print out.

-

2

2

-

-

26 minutes ago, mrmagyar said:

Could you link to the facebook thread please? Or tell us which page it's on?

This is from the LTR BOI website, privileges of the LTR visa: https://ltr.boi.go.th/#pri

-

1

1

-

Thai government to tax all income from abroad for tax residents starting 2024

in Jobs, Economy, Banking, Business, Investments

Posted

Interesting. Could you post a link to the new rules stating this please?