Jumbo1968

-

Posts

2,874 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Jumbo1968

-

-

2 minutes ago, chiang mai said:

That sounds right, the question is whether filing a tax return as not UK resident automatically informs DWP. My experience is the two entities are separate. I've filed returns as not resident and also received my pension as a resident, for three years during COVID-19.

You can be non resident for tax but you would I believe have to inform the DWP you no longer lived in the U.K.

-

1

1

-

-

46 minutes ago, Letseng said:

On my state pension letter it states that no tax has been deducted.

You would only pay tax on you State Pension if it was above the £12670 threshold, if you have a private pension the 2 are combined and tax is deducted from your private pension.

-

2

2

-

-

2 hours ago, BobBKK said:

I understand your view but believe you are wrong - here's why:

The pension is frozen - next year should be another good rise - probably 6 to 7%

The pension is increased by 1% every nine weeks

I will delay for one year only—that is a rise of 12%, which I think is worth taking. Also, I am waiting for the decision on whether we will all be taxed here. It will take 5 to 6 years to break even.I think your calculations are a little bit out,

If you reached state pension age after 6 April 2016, the 'pay back' period is 17 years at today's state pension rates or 15 years with the state pension increasing by 2.5% each year.

Take your health into consideration - if you're fit and healthy, you could end up with much more money as you get older

-

12 hours ago, Mike Teavee said:

Agree 100% & I'm giving serious thought to selling my UK House that same year which would raise Capital Gains that would certainly be assessable (Even after the CGT I would need to pay on it in the UK) but I also believe that, currently, the Tax "Experts" have no more information than us laymen so (personally I) wouldn't consult one until the situation is much clearer (I don't need to make a decision until 2026 so happy to sit back & see what happens).

As an aside Thailand's visas have changed so much in the past 6 months It would be silly of me to decide exactly what I'm going to do in 18 months, the LTR could (I'm not for 1 minute suggesting it would) lose it's "Tax Free" remittances or the Non-IMM O could morph into a 5 year Visa/Extension With tax free remittance of pensions (Which to me makes absolute sense for guys from a country that Thailand has a DTA with).

But the plan at the moment, is to do an Hotblack Desiato in 2026 🙂

Out of interest why would you pay CGT on your U.K. property after selling it ?

-

If they are serious about making it one way they should introduce delivery times for businesses for trucks albeit would anyone take any notice ?

-

- Popular Post

- Popular Post

15 minutes ago, Scott Tracy said:It is taxed.... Or at least taxable should it reach or exceed the current personal allowance, which mine does.

15 minutes ago, Scott Tracy said:It is taxed.... Or at least taxable should it reach or exceed the current personal allowance, which mine does.

Yep your State Pension is classed as taxable income, most of my tax allowance is taken up by my State Pension and therefore I pay tax on my private pension.

-

2

2

-

1

1

-

On 7/31/2024 at 3:43 PM, BobBKK said:

I'm almost in the same boat with an NHS pension and a State Pension due this year. I have deferred the State Pension until we get clarity.No benefit of delaying your date pension nowadays after they changed the rules in2016 meaning it takes years to get back the years you defer.

-

Will there be access for the elderly and the disabled at every station ?

-

1

1

-

1

1

-

-

1 hour ago, Sheryl said:

Could try https://www.staysure.co.uk/senior-citizen-travel-insurance/

But if living permanently in Thailand with no home country address why a travel policy? Or is it for trips elsewhere out of Thailand?

You have to have lived in the U.K. for the last 6 months out of 12 months and be registered with a U.K. GP and a Doctor where you live.

-

1

1

-

-

Looking at the application form there are conditions re employent, do you have to have employment or does the criteria of having a child resident in Thailand qualify you for a DTV.

I am currently on a Retirement Visa and the benefit of a DTV is I can hold the 500000 baht or equivalent in a U.K. bank account ?

-

I did a 14 day cruise in the Med on a similar vessel it was like working on the oil rigs only you didn’t get paid, food was pub grub style, if you wanted better quality you paid extra. I paid a Service Charge upfront then paid another on any services onboard. After enquiring why, the upfront charge was for the behind the scenes staff. Whilst the vessel was huge it was very claustrophobic inside, entertainment was second rate, the swimming pools area couldn’t accommodate all the passengers obviously. Ok we had daily various ports of call but you were continually clock watching and didn’t want to venture far from the port in case you got lost and missed the boat, they didn’t hang about. The most boring part was the 2 days at sea returning to the home port, nothing to do and all day to do it.

All in all a waste of money yet some people swear by them, no idea why.

-

I used my U.K. Licence to get insurance, I wasn’t asked for Thai Licence or an International one albeit the broker did say if I got stopped by the Police they might ask questions.

-

2

2

-

-

Vlogers keep saying use a VPN from a less well off country when booking hotels and flights and you receive a better deal never works for me.

-

1

1

-

-

- Popular Post

- Popular Post

My wife worked various jobs, Fish Market in Bangkok, clothing factory, whilst would like her to have a part time job not a bar, hotel, restaurant etc,she said there isn’t any part time jobs 3/4 hours a day.

I mentioned shop work but she said they only want younger staff she is 46 years old, I can’t complain as she cooks, cleans looks after the house and our son. She gets up at 6 o’clock during the week never complains. Her worst habit is if we are going away anywhere she wants to be setting of hours before we actually need to.

-

1

1

-

2

2

-

The school my son attends not a government one teaches English and Chinese, none of my son’s teachers can converse in English not sure about Chinese. I have no idea how the teachers teach English when they can’t speak it themselves, he only speaks English because of me.

-

1

1

-

1

1

-

-

After reading all the posts I think the only way to ensure what you are actually covered for is to have a medical check up first, buying a policy over the telephone is definitely not an option when you become older.. A friend of a friend was receiving daily radiotherapy for Prostate Cancer, no overnight stay, the insurance company would not pay out because they classed it as out patient treatment which wasn’t included in his policy.

-

1

1

-

-

20 minutes ago, Pattaya57 said:

Rental agreement should include all documents required for a TM30 (copies of owner Thai ID or foreigner passport + Condo/House Chanote)

In a perfect world but you forget this is Thailand, nothing in the law to say that and even if it was it would be ignored.

-

Immigration are not going to chase an owner up for not doing a TM30 the next best option is the easy route chase the tenant up who needs a TM30 for whatever he requires it for.

-

2 hours ago, IvorBiggun2 said:

Good enough for me. I don't see why a company would want to tell lies. They gain nothing.

Good enough for you, next time you are immigration show it to them if they are going to fine you even you think you are correct, i can imagine what their reaction will be.

-

26 minutes ago, IvorBiggun2 said:Below shows that it's the property owners responsibility to register farangs staying at their property. If the property owner cannot do it themselves then a signed proxy from the owner can be submitted by the farang.

That’s not an official immigration website.

-

1

1

-

-

39 minutes ago, IvorBiggun2 said:

The IO knows darn well that trying to get a Thai to pay a fine, or come into an IO to pay the fine, is nigh on impossible. Hence why they started collecting the fine from farangs about 5 years ago. In all IO they have their rule book. Ask to see the part where it says 'farangs responsibility to pay'.

The TM30 notification and its underlying laws are about the obligation of a landlord (housemaster, possessor, or manager) to report the stay of a foreigner (non-Thai national) in his/her property.

-

6 hours ago, Sheryl said:

Actually both heart attacks and strokes can be the natural result of aging.

And neither ius considered a slef-inflicted injury. That e=termionology has a very narrow and specific meaning.

Heart attacks and strokes can also occur due to cardiovascular disease, for which dyslipedemias and hypertension are risk factors. Not immediate direct causes, but risk factors.

Unless you failed to declare a known pre-existing condition, a health insurer under a full underwriting policy is obligated to cover it. And indeed, these things are usually paid for. Ditto cancers and many other things that, by their nature, take years to develop.

I have age-related spinal problems. These will have been brewing for a long time, probably decades, but the first I knew of it was when it became painful, about 1-2 years after taking out my s=current health insurance. One does not, after all, have spinal MRIs , or even spinal Xrays, without a reasion and until then I'd had no reason. But for sure, the problem that then showed, took many, many years to develop.

A non-issue insurance wise. I'd not been previously diagnosed with it so not a pre-existing condition. Insuance paid in full.

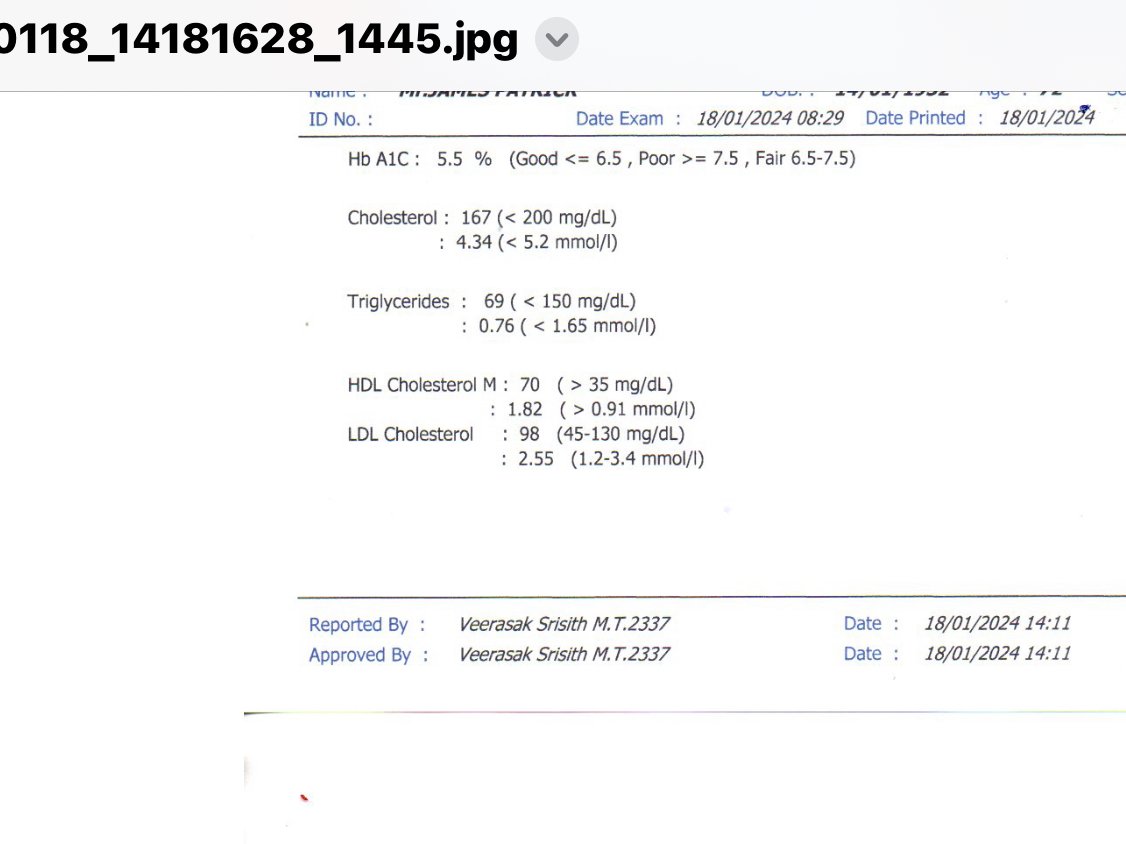

"Cholesterol" per se is not meaningful. What exactly do you refer to? Cholesterol ratio? LDL? or what?

My last blood test, I take 20mg statins 1 a day.

-

9 minutes ago, ujayujay said:

In 17 years I saved about 500k Baht by avoiding agents. It is so easy to handle visa and other matters yourself

If I had took the documents the owner gave me to Immigration I wouldn’t have got a TM30, the agent ‘smoothed’ it out for me well worth the 500 baht fee.

-

20 minutes ago, Sheryl said:

Pre existing means already known (or could reasonably been known) at the time the policy was issued.

Insurance companies usually do pay out for heart attacks and strokes, and when they don't it is usually because of a clearcut condition known present before policy took effect.

If you have high blood pressure or high cholesterol and you weren’t aware of it and it caused a heart attack would the insurance company pay out as it’s ‘self inflicted’ ? Heart attacks and strokes occur for a reason they are not a natural occurrence. I take statins not because my heart is unhealthy but can prevent me from a heart attack. My cholesterol with statins is 4.5 and 6 with out taking statins which isn’t unnaturally high. My doctor advised it was up to me to take statins as my cholesterol wasn’t dangerously high.

All these Asia YouTubers

in ASEAN NOW Community Pub

Posted

A lot of the YouTubers are basically beggars online where there are certain videos you can only watch if you pay a subscription.

One which is very popular non subscription although they have a members section is the bar on Soi 7 on a Sunday at 5pm where 6 vey skimpily dressed bar girls sit on what they call the casting couch bumming drinks of the viewers and they end up p*****, hardly entertaining.