- Popular Post

Mike Teavee

-

Posts

4,306 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Posts posted by Mike Teavee

-

-

Just now, stat said:

I beg to differ you can reclaim some witholding taxes at least a part of it. Example: If you get a German dividend you pay 26.375% withholding tax on in. You can get it reduced to 15% afterwards if you know how to do it by filing a kind of tax declaration to the German IRS.

As we ended up in the discussion, the "WithHeld" tax is for the company not the individual & even as the owner of a company my accountant was very clear that I could not reclaim that tax.

-

27 minutes ago, dinga said:

Just a word of caution - Under the Civil & Commercial Code, I understand property bought during a marriage carries joint ownership (ie. 50:50 regardless of (a) the Chanote registration being in the name of only the Thai citizen; and (b) the Land Office required statement that the land is bought solely from funds 'owned' by the Thai national.

Don't think the TRD position on the eligibility of such a 'gift' has been determined at this stage - so it would be prudent to get professional advice before proceeding.

Under Thai Law Gifts given to an individual are normally considered Sin Suan Tua (Personal Property) unless explicitly stated as joint (Sin Somros)...

https://thailand.acclime.com/guides/marital-property-assets/

The "Rub" comes in if a guy gives his partner a "Gift" & gets a benefit from it (E.g. Let's say I send my GF the years rent to pay then obviously I'm benefitting from it & it's not really a gift).

Edit: I do wonder, I send my GF 210K (I asked her to give up her job working in a Central mall so we could live together so 30K over what she was earning) & know that's ok but a mate of mine sends 10K pm to his wife's 2 kids back home & I'm thinking he could send her grandmother (who he sends the money to) 120K pa without it being taxable for anybody

-

1

1

-

-

- Popular Post

- Popular Post

-

7 minutes ago, JBChiangRai said:

I agree with you there.Until we hear otherwise from Government sources, do nothing different than last year.

I’ve taken the approach of only remitting up to my (& my GF’s) TEDA (total of 445K between us) & spending down savings I already have here to make up the rest of the money I need.

Should be able to do this for another 3 years by which time I’m hoping things like tax on Capital Gains & UK Private Pensions (mine kick in Feb 2026) will be a lot clearer.

-

1

1

-

-

Just now, dinga said:

You are delusional (since when have I wanted to discuss remitted Australian Income?)

Enough for me - no point in further arguing the bleeding obvious and adding to non-relevant content when I sought to achieve the opposite.

Ok, so you're gripe is that we shouldn't discuss UK remitted income on here... Understood....

I'm off for a game of chess with a pigeon...

-

1

1

-

-

3 minutes ago, dinga said:

PS. This thread was started by a Brit so maybe you Dingos should go start your own thread...

Typical - Poms always the "moral winners".

Pragmatism & reality is not a feature - this thread is already 47 pages long, and has been hijacked with longwinded non-relevant commentary. Why expect folks to page through so much irrelevancy on the basis that you think it of universal interest?

Simple solution - create a new UK thread [and other countries of individual interest] and let us decide whether to follow or not

How is it non-relevant if we're discussing Tax on remitted income? What part of the thread title said "Australian Tax Discussions Only"?

If you want to start a thread discussing "Tax on remitted Australian Income" fill your boots, but why do you want to hijack a generic thread?

-

1

1

-

1

1

-

-

Just now, dinga said:

Take off the blinkers and re-read the last page of threads (pretty well 100% UK tax discussions). Start your own topic for those of you interested

Sorry too late with my edit, this thread was started by a Brit but thus far has been open to all for discussions, lets not let one page of discussions about a single country spoil it for all of us (Yes I am a Brit but I'm also interested in how US SS is treated & especially dividends in Australia).... Just scroll on if the post is not of interest to you.

It's inevitable that people will go into details about their own circumstances but I think we can all learn something from each other so would be a shame to have this kind of discussion in a country specific thread

-

1

1

-

-

10 minutes ago, dinga said:

REMINDER: this thread is about Thai gov. to tax (remitted) income from abroad for tax residents starting 2024 - Part II

For goodness sake, most of us have ZERO interest in matters UK. You Poms should start your own thread and not (further) destroy this one for the rest of us.

WTF... We were discussing tax on remitted income (granted, from the UK but we have the same questions as you Aussies) so absolutely on point for this thread.

LMFAO, Australia is one of the few countries that does have a Withheld Tax (Franking) on Dividends so that discussion should have been of interest to you.... Assuming you have any.

PS. This thread was started by a Brit so maybe you Dingos should go start your own thread...

-

1

1

-

-

- Popular Post

- Popular Post

-

5 hours ago, stat said:

Thanks for all the feedback regarding the UK tax situation! I think you "only" pay this 8.xx % as long as you are a UK tax resident. UK and Ireland +SG do not levy any withholding tax on dividends. Ireland is kind of strange cause it happens sometimes there but UK should be safe IMHO. Withholding tax is only for foreigners regarding the country of origin of the company. So a UK guy along with any other guy should not have to pay any withholding tax on a UK dividend if he is not a tax resident in the UK (for that year).

Yeah, I think I've confused the Withheld Tax that a Company reports to HMRC (Pre IR35 us UK IT Freelance guys would set up a limited company & pay ourselves in Dividends to reduce Tax/National Insurance & part of the dividend would include Withheld Tax) & "Disregarded Income" that a Non UK Tax resident can claim...

As mentioned, when I used to receive Dividends (from FTSE 100 companies) in the form of a Cheque they would come as a Dividend "Warrant" that showed how much "Tax had been Paid" but I now believe this to be by the Company & not the Individual so not relevant to Thai Tax discussions...

https://www.oxfordreference.com/display/10.1093/oi/authority.20110803095723779#

Thanks to all for the discussion, I think remitting Dividend Income is off the table for me now unless I'm Non (Thai) Tax Resident or manage to get an LTR visa 😞

-

1

1

-

-

5 hours ago, stat said:

Since when is there a 8.75% witholding tax on UK dividends? I always received my UK dividends tax free. Thanks!

2 hours ago, Mike Teavee said:The Tax is taken out before you get your Dividend and the rate/yield of the dividend is always quoted as the after Tax amount but Withheld tax has been considered as taken already.

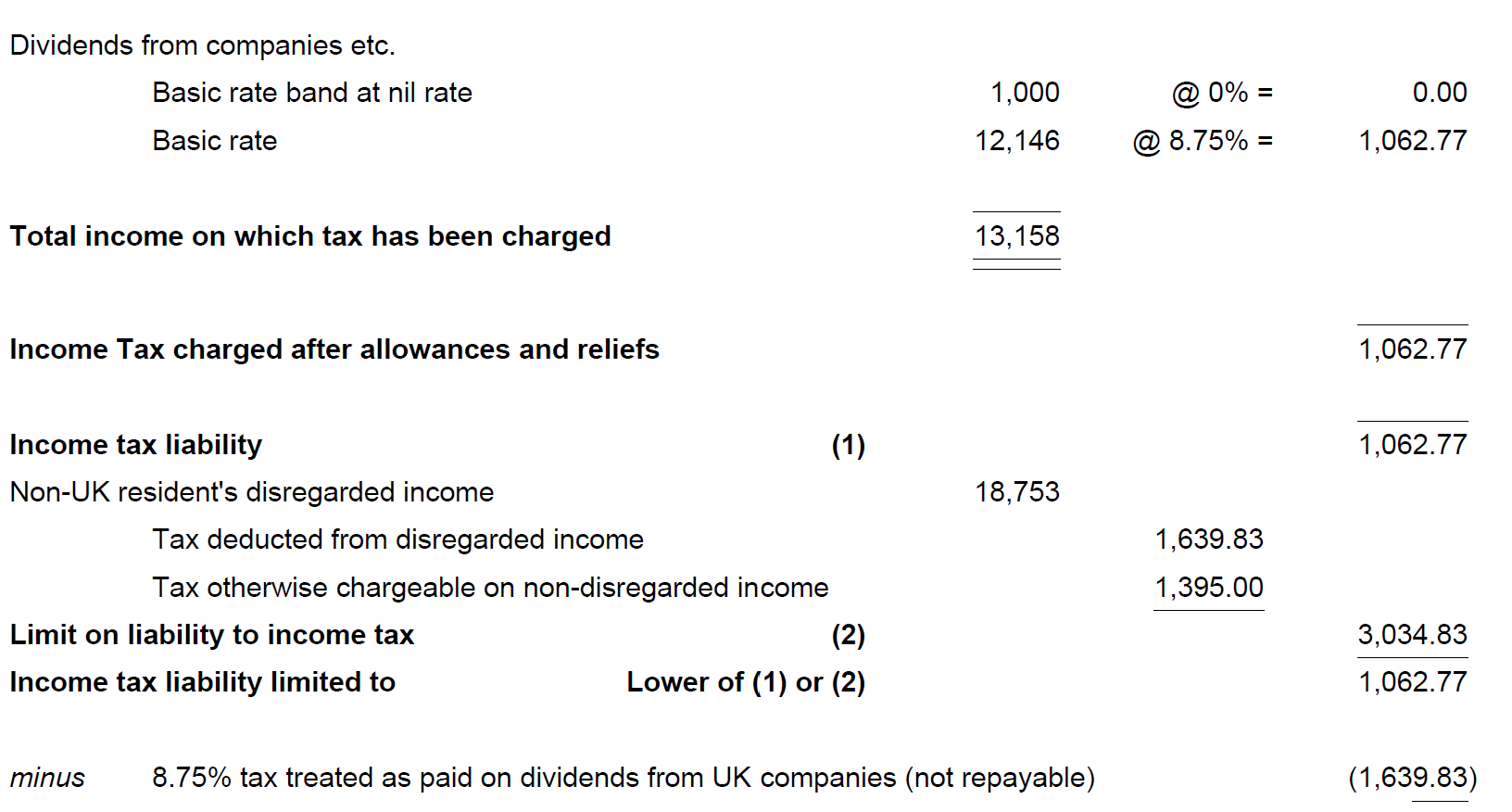

This is taken from my 2023/24 UK Tax return prepared by my accountant... NB the final line "8.75% tax treated as paid on dividends from UK companies (Not Repayable)".

The more I think about this, the more I'm thinking the "8.75% tax treated as paid" is more to do with the disregarded income rules and not the tax that is withheld on dividends by the Company so if that is the case then I have the answer to my question & do not have any UK tax that I could offset against Thai Tax on remitted dividend income.

-

1

1

-

-

11 minutes ago, LivinLOS said:

I dont believe you should pay any UK taxation other than arising from a fixed domestic asset (rental returns, forestry income, that kind of thing). I would need to check dividends, its not on my radar, possibly from a REIT I could imagine it being domestic source.. .. But people frequently think you need to pay uk tax on pensions etc and thats 100% incorrect.

It's not like you have 10,000 shares & they declare a 10p dividend so you get £1,000 & then they take 8.75% off you, the total dividend that the company declares to HMRC is approx. 10.96p & 8.75% is withheld so you get your 10p per share.

Years back when I had dividends sent to me as cheques they would come with a Tax Credit attached to them, but this tax is never reclaimable.

-

2 minutes ago, LivinLOS said:

Have you filed a P85 and obtained an NT tax code ??No, I have filed an NRL (Non Resident Landlord) but when I 1st became Non-Tax Resident I still owned my own company in the UK & planned to return after a couple of years Plus My accountant always seems to make it so I don't pay any tax so never seriously looked into it.

Will be a different story when my Pensions kick in so should probably start to look into it, any pointers/links for where to get more information.

NB doesn't affect withheld tax on dividends anyway as this is never reclaimable irrespective of your Tax code.

-

Just now, LivinLOS said:

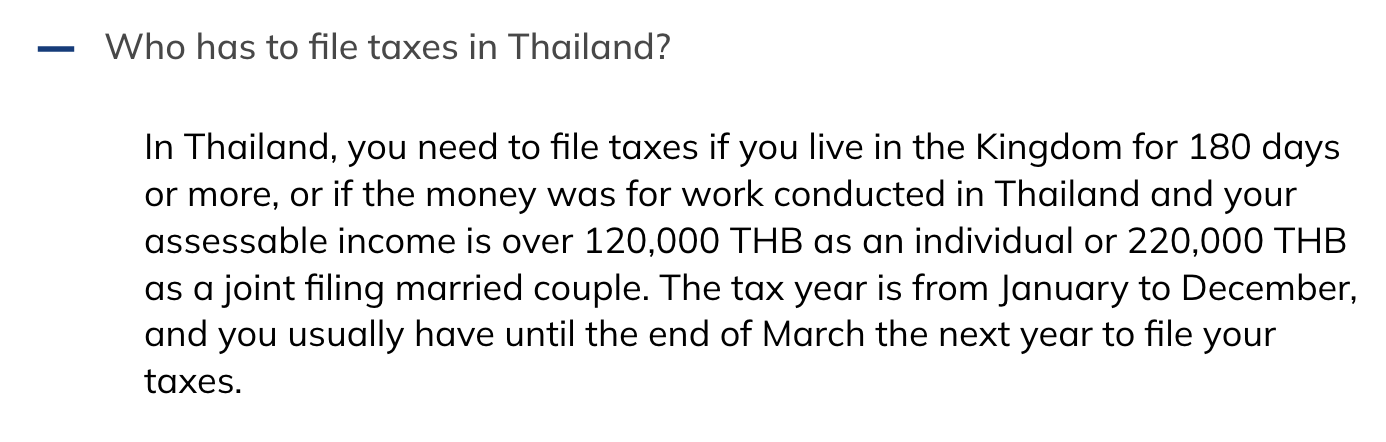

I think this is an easy determination.. 'Assessable' income is the amount sent in if you are tax resident, thats different from 'liability' to pay..

Do you need to file if not liable ? Or do you need to file asessable income anyway.. To be determined.There's been at least 1 report of somebody going into their Tax Office and asking if they needed to File as all of their income was not taxable by Thailand under a DTA & they were told that they didn't have to.

I think a lot of people will be filing non-taxable reports if this guidance was wrong (Plus a lot of US guys who thought they didn't need to file are going to be very upset).

-

1

1

-

-

2 hours ago, stat said:

Since when is there a 8.75% witholding tax on UK dividends? I always received my UK dividends tax free. Thanks!

The Tax is taken out before you get your Dividend and the rate/yield of the dividend is always quoted as the after Tax amount but Withheld tax has been considered as taken already.

This is taken from my 2023/24 UK Tax return prepared by my accountant... NB the final line "8.75% tax treated as paid on dividends from UK companies (Not Repayable)".

-

1

1

-

-

45 minutes ago, LivinLOS said:

Your mixing up assessable income and liability.. Someone who remits 1 mil thb funds has a 1 mil assessable income they 'might' have to justify.. Of course if it is social security, or pre jan 1 savings, or otherwise protected under a DTA then it may have no liability, but it IS still assessable to determine that.

If they choose to go this hard on it is anyones guess, this is all too new to know.I believe it's self assessment so it's up to the individual to judge whether it's assessable income or not & US SS is not so no need to report/file.

-

Just now, motdaeng said:

to be more precise...

if you are a married tax resident and transfer under 220,000k in the tax year into thailand,

you do not need to file a tax return ...

if you are a single tax resident and transfer under 120,000k in the tax year into thailand,

you do not need to file a tax return ...

Just to clarify it's 120K/220K of assessable income so somebody remitting 1Million THB pa of US Social Security "Income" would not have to file a return as they have no assessable income.

-

1

1

-

-

12 minutes ago, NoDisplayName said:

If you asking whether the total gains+losses is the figure used for determining tax on assessable remitted income, the answer is a definite NO. Only gains are considered, any losses are invisible to the system.

This is a big reason why worldwide taxation will be such a huge problem. Other countries allow losses to offset gains, tax loss harvesting, or selling to repurchase to reset cost basis, are methods to reduce taxes at home which will greatly increase the tax burden here.

Capital gains from sale of foreign stock are taxable.

Capital losses from sale of foreign stock are disregarded.

Losses do not offset gains.

If these are Thai stocks held in a Thai account, then irrelevant. Capital gains from SET stocks are not taxable.

I was thinking more a scenario where somebody:-

- Bought some shares several years ago for £10,000

- Sells them for £20,000 making a Capital Gain in the UK of £10,000 which (as an Expat) is not taxable.

- Instead of remitting the money, spends the £20,000 on new shares & sells them shortly after for £19,900 (£100 lost on Dealing fees + spread between buy/sell price).

- Remits £19,900 to Thailand

Have they remitted £10,000 of "Savings" + £9,900 of Capital gains OR zero capital gains as they made a small loss on the second purchase?

-

25 minutes ago, Yumthai said:

Tax residency law prevents TRD from asking you to file.

Different set of rules apply depending on whether you are tax resident or not. The main difference is non tax residents have to pay tax only on their Thai-sourced income.

As I mentioned, I don't see anything in the TRD regs that prevents them asking a Non-Tax Resident to file (or more likely a returning Tax Resident to file for the previous year when they were non Tax Resident if they see a large remittance) & if that income was "Earned" when you were a Tax Resident then they could argue a case that it is assessable income. But practically I can't see this happening, I'm just taking a "Belt & Braces" approach when it comes to a large remittance.

Would be great if somebody who's planning on speaking to a Tax Advisor could get a definitive answer to this & a couple of other points:-

- Are Capital Gains cumulative? E.g. If I made a gain on the sale of some shares, put all of the money into some other shares then sold those for a small Capital loss, would the Gains I got from the 1st sale count?

- Can the 8.75% withheld tax on UK Dividends be offset against Tax owed in Thailand (if yes then I'd guesstimate you could bring in approx. £22,500 dividends before any Thai tax would be due).

-

1

1

-

- Popular Post

- Popular Post

Just now, NoDisplayName said:I don't see it. The law is clear, at least on this point.

Going forward, tax residents are liable for tax on income earned from January 2024 when remitted while under tax residency. Non tax residents are not liable for tax on remittances regardless of when income was earned.

Practically and technically, taxing non tax residents on remittances requires a major change in the law.

You're probably right & I'm over thinking it but any income you earn during the time you are Tax Resident in Thailand is potentially liable for Tax when you remit it & I don't see anything in the TRD rules/laws that prevents them from asking you to file a return even if you're not Tax Resident should they see a large remittance or more likely, asking you to file one for the previous year when you become Tax Resident again....

All feels like too much of a gaping loophole to me so even if they don't move to a Worldwide Income taxation model (which would be a game changer) then I think they'll close it quickly.

Anyways I figure it's not worth taking the risk of having to pay >6.5Million THB in tax when I remit my PCLS/Capital Gains from the sale of my house so I'll be Non-Tax Resident in the year the income is earned & remitted.

-

3

3

-

2

2

-

- Popular Post

- Popular Post

Just now, NoDisplayName said:How did you come to that realization?

In a year in which you are tax resident, you MAY be liable for tax on assessable income remitted to Thailand.

In a year in which you are NOT tax resident, you are NOT liable for tax on any funds remitted to Thailand.

Does this imply that NON tax residents may be required to file tax returns and pay tax on remittances?

I'd need a citation if your claim were true, as if one exists it would be a real game-changer.

I think @ballpointsummed it up nicely above... As usual the TRD rules around this are "Open to Interpretation" & we had a discussion on this point in one of the main Tax threads (possibly even earlier in this one) which I came away from with the knowledge that I am potentially liable for Tax on any remitted Income earned whilst being a Thai Tax Resident & the view that Technically I could have to pay it even if I remitted it in a year when I wasn't Tax Resident but Practically I wouldn't be filing a Tax return so don't see how they could Tax me.

Now TRD could argue that even though I'm not Tax Resident I am remitting taxable income so I should be filing a return but again, practically I can't see this happening.

In any case for large remittances (E.g. the sale of my house) I will be making sure to be non-tax resident in the year the gain is realised & the year it's remitted... I feel much more confident that realising the Gain in a year I'm not tax resident is not taxable but again, wouldn't want to take the chance with a large sum of money.

-

3

3

-

On 7/25/2024 at 11:37 AM, Lorry said:

I think it's valid for 5 years.

Never heard of a "use by" date, like an activation date.

I could be wrong.

Some Visas (e.g. Tourist / Non-IMM O) have an "Enter Before" date which means you need to enter on the Visa (or Use by) this date...

From pics posted of the DTV eVisa, there is no such limitation so presumably you could make your 1st entry just before the 5 years was up.

-

17 minutes ago, Ricardo said:

So has it now been absolutely confirmed (Sorry but I haven't been paying-attention) that a tax-resident (which I undoubtedly am) is now taxable on worldwide-income, interest/dividends/pensions/unrealised-capital-gains, not just on money actually transferred into Thailand during a tax-resident year ?

I had thought worldwide-income was still up-in-the-air ?

Currently I'm still aiming to reduce my visible-transfers, and hoping to stay below-the-radar, by bringing-in less than B500k so not filing because I don't owe anything. Does that definitely not work now ?

No, I was talking just about remitted income so when you remit the £250,000 4 years of that were earned when you were Tax Resident so technically it's assessable income just as if you'd remitted it each year it was earned - In fact it's worse as you would have lost the opportunity to use your annual TEDAs.

-

1

1

-

-

- Popular Post

- Popular Post

8 minutes ago, sikishrory said:I read a report on here yesterday morning. It was either in this thread or the other thread. I can't be bothered looking for it. The guy mentioned just having 1 medical appointment and receiving the visa.

If they ever did want to see proof of a “Medical Appointment” on each visit (and I don’t think they will) 180 days could tie in nicely with 6 month dental check-ups.

-

4

4

Thai gov. to tax (remitted) income from abroad for tax residents starting 2024 - Part II

in Jobs, Economy, Banking, Business, Investments

Posted

Trust me as an ex-owner of a UK LTD company that paid dividends, the Tax I misunderstood was actually the company offsetting profits against corporate tax not me as an individual..

I really got things wrong on this one (Hold my hand up).

Anyways, I'm done on this thread, apparently discussing UK Tax related issues is frowned upon on here so I'm bowing out (as I've noticed Mike L has already done).

Good luck to all....