NoDisplayName

Advanced Member-

Posts

4,877 -

Joined

-

Last visited

-

Days Won

1

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by NoDisplayName

-

Why did Axios get the leaked Biden/ Hur footage…?

NoDisplayName replied to riclag's topic in Political Soapbox

Bigly difference! The dry text does not include the stutters and stammers and slurring and 'ums' and 'uhs.' It's a cleaned-up version to disguise a senile, and now we know very sick, old man. Listen to the tape, follow the transcript from page 82. It's like night and broccoli. -

Yes, you can! You can also file late for additional refunds. We were trapped in China during the covids, returned August 2022. 2021 = 0 days, 2022 = 150 days. Last year, I filed 2023 late (200 baht fee), also filed 2021 and 2022 late (no late fees). Dividend and bank interest withholding all refunded.

-

Were you claiming a foreign tax credit? That would be....problematic....as the tax forms don't appear to have provisions for that, and local office staff are not familiar with the procedures, if there are any. If refunds for Thai withholding tax on interest and dividends, TRD rarely puts up a fight.

-

Note this: Of course, if these new provisions come into effect, foreign residents who remit money as it is earned abroad will not incur any tax liability. Keep good records, apply current earnings to remittances, saving pre-2024 income/savings for when the economy improves and Thailand can return to Plan A.

-

Report Thai Court to Rule on Yingluck's Rice Scheme Case 22 May

NoDisplayName replied to webfact's topic in Thailand News

That's ricist, yo. -

This is my understanding of the PROPOSED rule change: Old rule: Foreign income (not exempt by DTA) earned in prior years is not assessable. Foreign income (not exempt by DTA) remitted in same year is assessable. New rule: Foreign income (not exempt by DTA) earned prior to 2024 is not assessable. Foreign income (not exempt by DTA) earned after 2023 remitted in any year is assessable. Proposed rule: Foreign income (not exempt by DTA) earned prior to 2024 remains not assessable. Foreign income (not exempt by DTA) earned after 2024 remitted in the same or following year is not assessable. Foreign income (not exempt by DTA) earned after 2024 remitted in subsequent years is assessable. For Thailand tax residents: A source from the Finance Ministry who requested anonymity said the taxation of foreign income follows the residency-based principle, whereby Thailand taxes the income of individuals who reside in the country. This rule applies to persons who stay in Thailand for 180 days or more and have foreign income. Doesn't appear to be a one-off approach. The "for example" was added by the writer of the article. Under the new guidelines, Thais with foreign income will not be taxed if they remit that income in the year it was earned or the following year. For example, if income is earned in 2025 and brought into Thailand in 2025 or 2026, it is not subject to tax. Looks like Thailand wants money remitted into Thailand now to support the economy, as well as in the future, so tax residents are given a tax-free window on a rolling basis to remit.

-

Why would they keep their millions of baht in bank accounts paying 0.25% interest? They've likely invested all their money in designer watches and down-payments on propulsion-free submarines. For those incapable of making these strategic decisions, the government has assumed the responsibility in their best interest.

-

Tourism Pattaya Welcomes Chinese Delegation to Reinforce Tourism Ties

NoDisplayName replied to snoop1130's topic in Pattaya News

Today is "Hub Monday" Tomorrow will be "Hub Tuesday" The next day.......... -

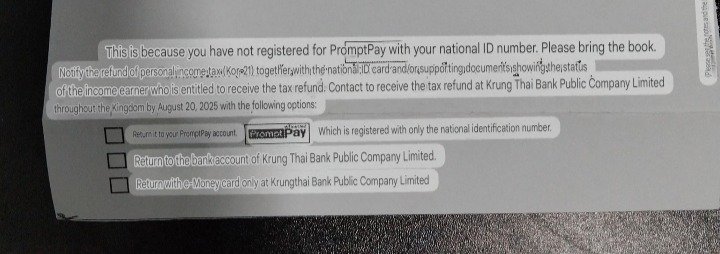

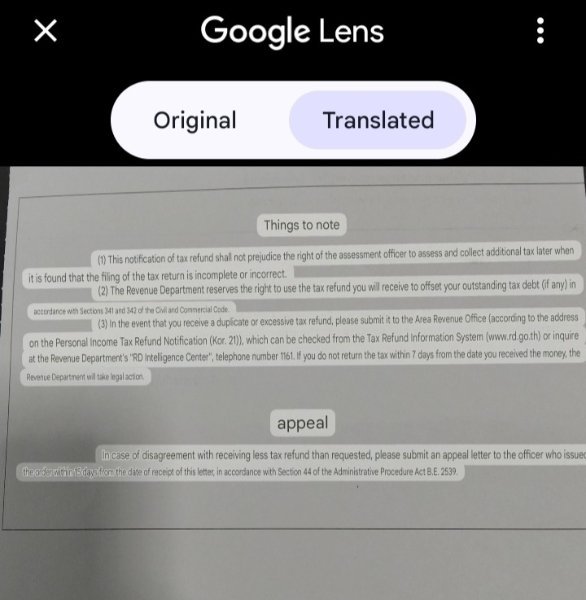

Where did you deposit/cash the refund check letter? I filed online Jan 06, uploaded additional documents Jan 18, and had a refund letter issued Feb 20 with only Krung Thai being authorized to accept the refund. Any bank can accept PromptPay, but only if account is linked to a pink ID. My local BKK Bank can not or will not add my pink ID to existing accounts, and can not or will not open a new account with my pink ID.