NoDisplayName

Advanced Member-

Posts

4,937 -

Joined

-

Last visited

-

Days Won

1

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by NoDisplayName

-

Not exactly. If you earned a salary/wage you directly paid 50% of FICA as shown on your pay stub, and you indirectly paid the other 50% by your employer reducing your potential salary/wage to cover the government mandate. Brought to you by the same folks that think $30/hour minimum wage won't result in fewer jobs for unskilled workers, or that China is gonna eat the tariffs, or that Mexico is gonna pay for a big, beeyootiful wall.

-

Mayhaps this will help: In general the DTA does not stipulate any specific item of income and tax rate. It provides whether the source or resident country is entitled to tax certain income. If the source country has taxing rights, the income will be subject to tax according to the domestic laws of that country. .... C. Elimination of double taxation The focus of a DTA is the elimination of double taxation. Each DTA may prescribe different methods of elimination of double taxation of a person by the resident country: (1) Exemption method The country of residence does not tax the income which according to the DTA is taxed in the source country. (2) Credit method The resident country retains the right to tax the income which was already taxed in the source country.... https://www.rd.go.th/english/21973.html DTA's can (as with US) specify certain income exempt from Thai tax. Exempt = non-assessable = not included in PIT calculation = not entered on tax return

-

No, this is the proposed rule which would (if passed) take effect in 2026, for the 2025 tax return..........so income earned after 2024. It would not be retroactive to income earned prior to 2024 or during 2024, which should be covered by 161/162. Assume there would then be rolling 2-year windows to allow tax-free remittance to follow, until the next change. Proposed rule: Foreign income (not exempt by DTA) earned prior to 2024 remains not assessable. Foreign income (not exempt by DTA) earned after 2024 remitted in the same or following year is not assessable. Foreign income (not exempt by DTA) earned after 2024 remitted in subsequent years is assessable.

-

Don't try to force everyone into the leftwing-rightwing binary utopia. Nothing I wrote was in support of Trump's incompetent lackey, but in response to quoting numbers out of context. Most seizures occur along the southern border, possibly because more assets are stationed there to, you know, make the seizures. I don't know what the actual numbers are, and I doubt Mr. Patel does either. He may not care to know if they diverge from the Trump narrative.

-

Why did Axios get the leaked Biden/ Hur footage…?

NoDisplayName replied to riclag's topic in Political Soapbox

Deflect! Deflect! Deflect! 'Tis relevant to his greatly diminished mental capacity, which is relevant to his alleged inability to stand trial. The stutters and sta-a-a-a-mmers and......long............preg.......i mean.....um...........pau, apau.........pauses, you know....the thing. -

Why did Axios get the leaked Biden/ Hur footage…?

NoDisplayName replied to riclag's topic in Political Soapbox

For patients covered by health insurance, out-of-pocket costs for a prostate cancer test typically consist of a doctor-visit copay and a laboratory copay of $0-$30 or more, depending on the plan. For routine wellness screenings, some insurance plans consider the tests medically necessary only after a certain age. For example, Aetna[1] covers screenings for men 40 and over, and men under 40 who are at a high risk, such as African-American men with a family history of prostate cancer. For patients not covered by health insurance, a prostate cancer test typically costs from less than $15-$250 for a digital rectal exam to detect any physical abnormalities in the prostate, depending on the provider and whether the exam is done on its own or as part of an office visit. And it can cost up to $6,000 or more for a prostate biopsy. For example, several cancer centers[2] in Michigan offer prostate exams for $15-$20. Talbert Medical[3] in California, charges about $60. And Robert Gluck, M.D[4] , a urologist in New York, charges $250 for an office visit that includes a digital prostate exam. Billions for genocide, but can't afford tree-fitty for the leader of the free world? -

To be fair....... There is a bigly difference between 1% of all imported, and 1% of what we managed to catch. That's why ICE publicizes the number of "contacts" with illegal border crossers, rather than the number that actually crossed. It's still quite easy to mosey across a southern border where hundreds of miles consist of a few strands of rusty barbed wire cattle fence. The US-Canada border runs 'bout 5500 miles, much of it isolated, forested, mountainous. Much of the border infrastructure consists of 20 meters or so of clear-cut...........or not. It's super easy, barely an inconvenience to walk across both borders unhindered. I've done it.

-

Why did Axios get the leaked Biden/ Hur footage…?

NoDisplayName replied to riclag's topic in Political Soapbox

Bigly difference! The dry text does not include the stutters and stammers and slurring and 'ums' and 'uhs.' It's a cleaned-up version to disguise a senile, and now we know very sick, old man. Listen to the tape, follow the transcript from page 82. It's like night and broccoli. -

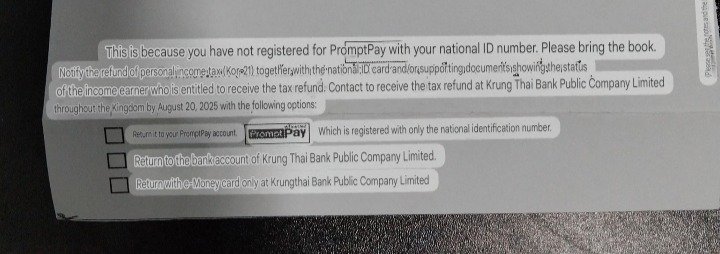

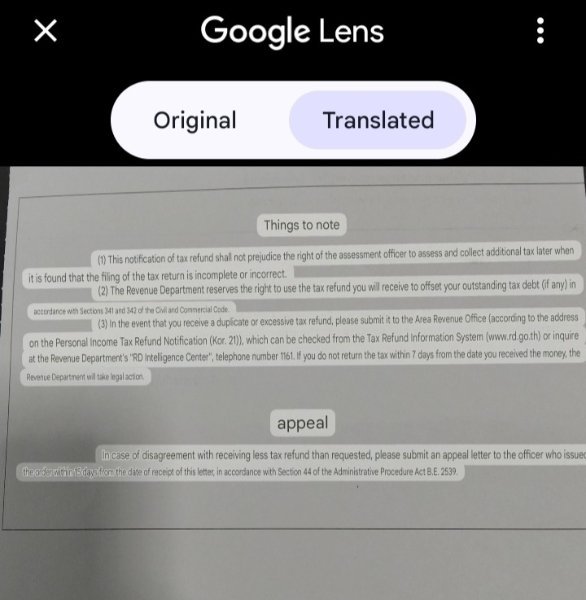

Yes, you can! You can also file late for additional refunds. We were trapped in China during the covids, returned August 2022. 2021 = 0 days, 2022 = 150 days. Last year, I filed 2023 late (200 baht fee), also filed 2021 and 2022 late (no late fees). Dividend and bank interest withholding all refunded.

-

Were you claiming a foreign tax credit? That would be....problematic....as the tax forms don't appear to have provisions for that, and local office staff are not familiar with the procedures, if there are any. If refunds for Thai withholding tax on interest and dividends, TRD rarely puts up a fight.

-

Note this: Of course, if these new provisions come into effect, foreign residents who remit money as it is earned abroad will not incur any tax liability. Keep good records, apply current earnings to remittances, saving pre-2024 income/savings for when the economy improves and Thailand can return to Plan A.