nigelforbes

Advanced Member-

Posts

3,583 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by nigelforbes

-

If you're talking about Thailand hotel prices you should look again perhaps, most of the prices here are still heavily discounted. I flew last week from Chiang Mai to Bangkok return and the cost was lower than it was five years ago. Ditto hotel costs in Bangkok Pattaya and Hua hin, there's some seriously good deals to be had.

-

How are you preparing for the coming cold spell ?

nigelforbes replied to worgeordie's topic in ASEAN NOW Community Pub

Almost every large appliance store in Thailand that sells air con units, sells units that provide heat also, go and asks one. -

I have no idea what you want me to read but it's not that relevant anyway. Look, I'm really sorry to have to do this but I've been putting it off all week. Your continued chasing of my posts without having anything useful to say is distracting from my enjoyment of this site. So I'm sorry to say I'm putting you on ignore and wont see your future posts. Take care

-

The article was written on Thursday 29 September, US time, nothing has changed.

-

Here's a news link to confirm the rate at which BOE will buy Gilts, 5 bill per month over 12 months: https://www.reuters.com/markets/europe/bank-england-buy-long-dated-bonds-suspends-gilt-sales-2022-09-28/

-

I'm very happy to hear counter arguments or rebuttals but not from nonsense rags like The Conversation. Please, if you don't want use your own arguments, please use a source that is credible and reliable.

-

What utter tosh, I'm sorry but it really is! Good Lord man, wherever do you dream this stuff up! The correction is here, it's happening now, it's not an instant bang or a flash it's a slow repricing of assets which is well under way. The S&P is down 24%, the floor is estimated to be around 3,200 (it's around 3,600 today).

-

Not exactly. The BOE is going to buy Gilts at the rate of 5 billion a week, they haven't started yet and may never need to do so since the news that they might, seems to have quelled markets. BTW Gilts and guilts, oh never mind. ???? Secondly, they are going to use the Foreign Currency Reserves to buy the Gilts, later they will sell them again so there's no negative hit taken anywhere.

-

How are you preparing for the coming cold spell ?

nigelforbes replied to worgeordie's topic in ASEAN NOW Community Pub

I'm from Watford, I know what North is....:)) -

How are you preparing for the coming cold spell ?

nigelforbes replied to worgeordie's topic in ASEAN NOW Community Pub

It's oop norf, if you don't mind. -

The role of BOT during these times is to smooth the rise or fall of the Baht, much in the same way as the oil fund smooths the price increases of motors fuel. BOT is not trying to permanently move the value of the currency. That said, THB is a small currency and it doesn't take much to move its value one way or the other.

-

The Foreign Reserves are held in 24 currencies which represent the currencies of major trading partners. Included in those reserves is Gold, SDR (Special Drawing Rights) and crucially, THB. Once any currency becomes a part of the Reserves it remains there, despite it being traded for a different currency, for whatever reason. In theory though highly unlikely in practice, the Foreign Currency Reserves could be all held in THB. The USD comes from export bill settlements, 60% of which are settled in USD, that's the currency of import/export. That practice is being supplemented increasingly with currency swaps, especially between China and Thailand, this eliminates USD from the process. Sooo, Thai exporter sells product overseas and invoices the customer in USD (at least more likely, the EXIM Bank does so on his behalf). Customer pays EXIM Bank in USD, which is then passed onto the exporter who used to have 365 days to sell the USD to BOT. That period ha snow been extended by BOT and exporters are allowed to invest the USD offshore. But in practice, Thai exporters live in Thailand and they spend THB, they therefore sell their USD to BOT and get THB in return. Lastly, back to THB and the Reserves: BOT holding THB means they can intervene in the FOREX markets and sell THB when the Baht is too strong, it's not just a one way street. You asked how the BOT can sspend USD and increase its reserves. That's because there is a constant inflow and outflow taking place. Inflows from inward foreign direct investment, inward from export bill settlement etc etc and outward from government debt payment settlement and outwards from BOT activities....bond sales and purchases are yet another dimension on all of this.

-

Hmmmm! It doesn't matter who buys the currency the effect will be the same, the more it is bought, the stronger it becomes. What's confusing however is that in your previous post you suggest "they" manage to keep it lower, which is at odds with it being bought which makes it stronger. Just to be clear: when a central bank such as BOT buys Baht it uses USD to make the purchase, that makes THB stronger against USD. It also means that the THB they just bought, now becomes part of their foreign currency reserves, later, when the BOT wants to weaken the Baht they will take that same THB and sell it against USD. It therefore follows that the intervention by central banks such as BOT, in the OFREX market, doesn't generate a permanent loss.

-

Bank transfer to SCB bank from EU

nigelforbes replied to parafareno's topic in Jobs, Economy, Banking, Business, Investments

In practice, the blue "tax paid" receipt issued by the Land Office at the time of sale, is sufficient to allow the funds to be exported once again, but only up to the limit of the value of the receipt. -

Bank transfer to SCB bank from EU

nigelforbes replied to parafareno's topic in Jobs, Economy, Banking, Business, Investments

I assume you are not tax resident in Thailand so you would not be taxed on the income here. Whether or not your mother would be taxed in her home country is a matter for others to decide. I doubt that anyone here will interested in proving that your mum is actually your mum but you could bring a selection of nice photographs just in case. You know, you and mum, when you were 6, you and mum at the beach, you and mum at graduation, that kind of thing. If nothing else the pictures will be good talking points and will endear you to bank staff and any girls you meet I imagine. I will leave it to others to impart further wisdom. Byee. -

Bank transfer to SCB bank from EU

nigelforbes replied to parafareno's topic in Jobs, Economy, Banking, Business, Investments

That's a different picture from what you portrayed initially....I suggest you sort it out when you get here! I can see no reason why there would be tax on funds sent to your account in Thailand by your mother, why would there!! There are not many new rules, just old money laundering rules that are now being enforced to bring them in line with the West, they present no great hardship to anyone, unless they are doing dodgy things. -

Bank transfer to SCB bank from EU

nigelforbes replied to parafareno's topic in Jobs, Economy, Banking, Business, Investments

When you initiate the transfer in Europe you are required to state the purpose of the transfer, everyone does. I will be very surprised if SCB gets heavy handed and causes a problem, as soon as they see the funds are intended to buy a condo that should be sufficient although this may be a gamble. Worst case is they ask for more documentation, is there anything you can supply to satisfy that need? Is this a new condo or a private purchase? Perhaps the seller can supply something? -

Bank transfer to SCB bank from EU

nigelforbes replied to parafareno's topic in Jobs, Economy, Banking, Business, Investments

The problem seems to be SCB rules, there are no restrictions on FOREX inflows to Thailand. When you say SCB, I presume you mean Siam Commercial Bank and not Standard Chartered Bank, that being the case the situation is even more strange. When you say you talked to them, who did you talk to, Head Office or Branch, I see you say Customer Service but where? It's not unusual to get different stories from different people so maybe you should ask again, somebody else this time, perhaps try speaking with Treasury Department. I suspect the bank is quoting AMLO rules rather than BOT rules and these are being strengthened currently. See Guidance for Customer Due Diligence for Banks below The other thing that occurs to me is your location currently, that may be part of the problem. If you don't have a track record of living and banking here, they just be over zealous. https://www.bot.or.th/English/FinancialMarkets/ForeignExchangeRegulations/FXRegulation/Pages/default.aspx https://www.amlo.go.th/index.php/en/ -

Foreign Currency Reserves ebb and flow for various reasons, the major one is because they are used for trade, the purpose for which they are intended. The second major reason for their change in value is because whilst they are held in over 24 currencies they are valued and accounted for in USD, as the THB/USD exchange rate changes, so does the value of the reserves. In fact they have fallen by over USD19 bill. over the past year, just because of revaluation alone. Thirdly, they change because BOT does intervene in the FOREX to stabilize the Baht, that's their job and under IMF rules they are required to do so. The comparison between now and 1997 is inappropriate, there is nothing remotely similar about the two periods, foreign debt is under 40% of GDP, a very very low level. https://thediplomat.com/2020/12/thailands-debt-dilemma/.

- 38 replies

-

- 10

-

-

-

How are you preparing for the coming cold spell ?

nigelforbes replied to worgeordie's topic in ASEAN NOW Community Pub

I live in the North, the temperature will drop to around 6 degrees C for a few days each year, for the rest of the winter season the low will hover around 12/14. BUT, in the mountains it will frequently drop below freezing overnight and people will build bonfires in the street for overnight warmth. Many will drink alcohol to stay warm, many of those people will die. Old people, young babies and the sick will die each year, the Red Cross will be out daily handing out blankets at this time. In a bad year over 100 will die from cold weather, that's very low compared to the 29,000 that will die from polluted air each year, burning season trumps cold weather every time. -

Thailand’s currency weakens to 38 baht per US dollar

nigelforbes replied to snoop1130's topic in Thailand News

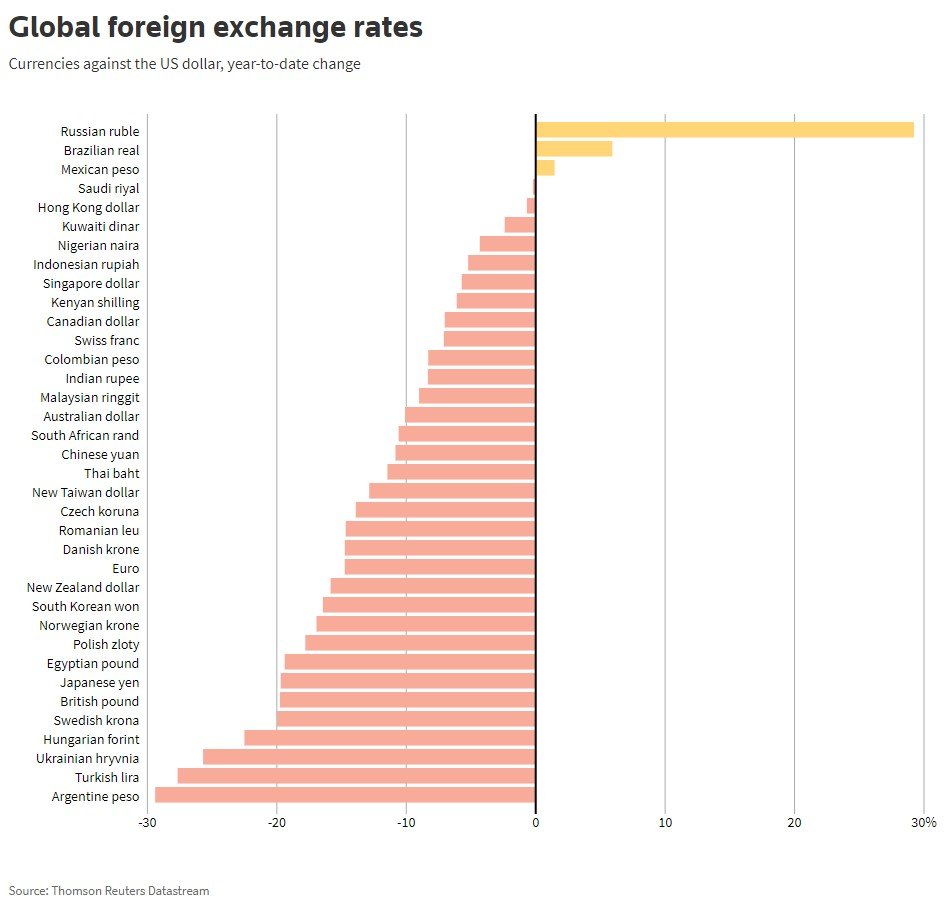

Not exactly. BOT operates a managed floating exchange rate under IMF rules, aka the cheaters float. This means the BOT is able to intervene in markets at will, in order to keep the currency within a desired range. And since Thailand is an export driven economy where over 60% of the export bills are settled in USD, it follows that the currency is managed against USD. The article is broadly correct, THB has weakened about 15% (from memory) against USD. https://www.reuters.com/markets/europe/global-markets-view-asia-graphic-2022-09-25/?fbclid=IwAR2S3ja8NLgK0XvB2ZN0jaOYMBgM8tVVfCUbGsAQ0QNpPDQYxkSIB-mC0d4 -

Ophthalmologists work only in hospitals and there's a nationwide shortage of optometrists. A couple of years ago there was only a handful of optometrists who didn't work in hospitals. The guys in the glasses shops know how to operate machines and sell glasses, nothing more.

-

You are a ripe age for cataracts, just like me, get thee to The Rutnin.