nigelforbes

Advanced Member-

Posts

3,583 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by nigelforbes

-

Sorry, that's not Thailand, it's a western enclave in Thailand.

-

In my next life I might chose Phitsanulok, I went there for the first time this year and I was wowed. The town has everything, an outstanding university, great scenery nearby, equi distance between North and South hence convenient access to other parts of Thailand. It took me 25 years to find the place, goodness only knows what other places exist that I haven't seen yet. I almost certainly would not chose the places you mention because they are all so commercialized and westernized in so many ways, they were great 10/15 years ago but not today.

-

A good point. A house to a farang in Thailand is like owning a puppy, it's for life! Trying to sell may literally be impossible, at least within any timescales that the farang think are reasonable. New build costs have been broadly flat for the last decade or more plus the price of land hasn't changed much at all (near me). OK so steel will have increased because of the pandemic/supply chain issues and some other prices also, but the market is very very different from what most will have known in the West.

-

Is this a test or a quiz! Your suggestion to rent in CM June/December and Krabi for the rest of the time is very sensible, I also would strongly recommend that. Most young guys who come here head for the tourist destinations because that's where they can find the things they think they want and where they can get by without learning Thai. Then they meet Ms. Right, probably only after meeting a few Ms Wrongs first and she introduces them to her Thailand, which he discovers is not a bit like Pattaya and some of the pieces start to fall into places, isn't it cheap he he will say. The guys who have been here a few years will know the rest.

-

26 years, why?

-

Ah yes, tourist eyes versus residents eyes, trust me, you will change your mind later as you learn more. But your math is faultless, I was wowed. :))

-

You have things back to front. Firstly, visit the various locations that you think you might want to live in and stay in each one for 6 months, do not make a decision to live anywhere until you have done that for at least 6 months each. After you decide on a location, decide if you want to buy a house or a condo, there are pluses and minus for both, not just cost. Thirdly, decide where you want that house or condo to be. You come across as somebody who has some money he wants to spend on property somewhere in Thailand and then hope he likes what he's bought and its location. Please show this to your mum and tell her not to give you the money until you've done these things.

-

Yesterday you were asking about transferring funds from your mum to buy a condo, what happened, changed your mind along with the location? May I respectfully suggest that before you decide what you want to buy that you actually visit the place first and spend at least 6 months, that way you will be able to decide first hand for yourself.

-

Pros and Cons of getting legally married.

nigelforbes replied to JayBird's topic in Marriage and Divorce

Upside It makes Power of Attorney and Living Will administration simpler. Improves her standing with relatives and in the community, yours too. Makes overseas visa applications very slightly less complicated, along with staying in hotels not only here in Thailand (at times) but also in neighboring countries such as Laos. Downside You share liability if she does something crazy, 50% of all assets acquired during marriage. -

Is Health Insurance from Pacific Prime Good?

nigelforbes replied to siftasam's topic in Insurance in Thailand

There's CIGNA Thailand and CIGNA Global, there seems to be a difference. I am with CIGNA Global currently but I wont remain with them. At age 72 my premium is 130k baht and it insures only half of my body. The worst part is the deductible is 340k, on top of that is a co-pay for the next 160k. There are no good options for anyone over 70, -

The purpose of that previous post was to explain what I wrote earlier about the controversy surrounding the founder of The Conversation. I don't have personal view on left versus right that I publicly promote or even share and I'm not suggesting you do either.

-

How are you preparing for the coming cold spell ?

nigelforbes replied to worgeordie's topic in ASEAN NOW Community Pub

I did the same thing but with a snow blower. -

How are you preparing for the coming cold spell ?

nigelforbes replied to worgeordie's topic in ASEAN NOW Community Pub

Any Global House store -

Firstly, my apologies that I referred to Prof. Costas as a female, it is the editor who is female. Andrew Jaspan founded the Conversation, he was forced to resign after ALL his journalists at the Conversation signed a petition demanding he do so. Why? Because he yet again attempted to introduce bias, influence journo's and what was written, "It’s not the first high-profile stoush for Jaspan. The British editor was sacked as editor of the Age in 2008 as part of a plan to cut 550 jobs and after 235 journalists voted unanimously to pass a motion accusing him of undermining their ability to report without fear or favor. He launched the Conversation in Australia in 2011". https://www.theguardian.com/media/2016/dec/21/the-conversations-chairman-resigns-amid-standoff-over-future-of-andrew-jaspan

-

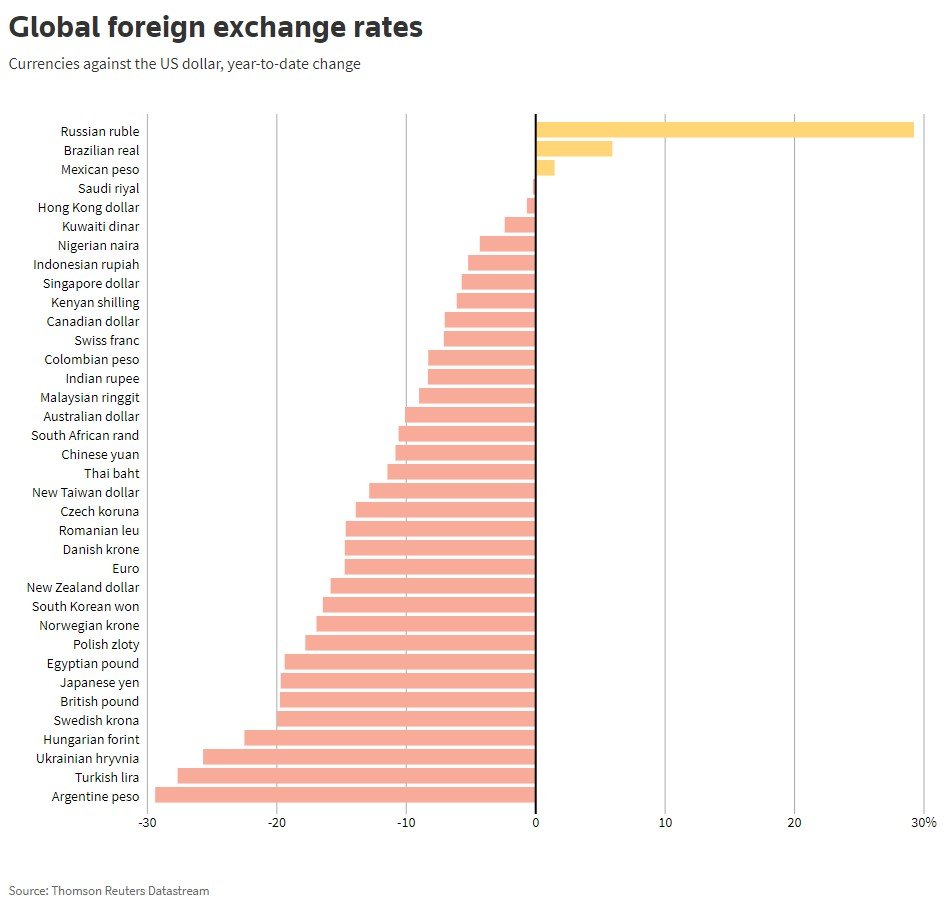

"why? Because of the policies and horrible spending habits of those trying to run things in the US government. Their intentional destruction of the global economy is not a good thing, no matter how anyone try’s to justify it". USD strengthening is not a bad thing done by bad people, it's a natural response to events and is entirely predictable. USD is the pre-eminent global reserve currency, in times of turmoil and economic uncertainty, people buy it for security. Inflation is a function of the post covid effect and a bi-product of the war in Ukraine, the US Fed is absolutely right to keep that genie in the bottle and raising interest rates is one way to do that. Unfortunately, that makes USD even more appealing. This is about cause and effect, not about what bad or misguided people are doing, stop trying to find someone to blame, if you must do that, blame Putin and the people who unleashed the covid virus, everyone else is trying to help..

-

This is not a devaluation of THB, this is a unique strengthening of USD against all currencies, which benefits the status of Thailand as an export economy. Here, the following may help you comprehend things better. BTW, if you try and insult me again we stop talking and you go on my ignore list, it's up to you:

-

Sorry to do this to you again but that's not correct either. There was a plan to reduce the top rate of tax but it wasn't going to become effective until next year, these things are always done on a forward year basis. But then the move was panned and then cancelled, now the rate will not be scrapped after all.

-

I personally don't care about the DJI, I don't know any investors who do care because it's not a meaningful indicator. The S&P on the other hand is, that's down to 3,600 from a high of 4,600 or so, the estimated bottom is between 3,000 and 3,200, a fall of 25%/30%. I do note that lots of people like to try and compare events of today with the crash of 1929. Exactly why people think that the 1929 crash is anything of a useful indicator or reference for today bear market escapes me, everything about the circumstances, the volumes, the value etc etc, are all very different today than they were 100 years ago.

-

A couple of points: Thailand is an export driven economy, that includes tourism. USD at 38 is probably the most helpful thing that could possibly happen to the country. Personal debt or consumer loans is an issue. But that's an issue that's in the hands of the Thai banks, all of which are well capitalized and closely monitored. It's worth pointing out that as GDP has fallen because of covid, the ratio of consumer loans has increased. That doesn't mean that banks have been lending more, it just means that the formulae is distorted because of the low GDP. That said, no-performing loans remain below 3%, a very acceptable level. As for the rest of what you wrote, the PM, suicides etc, sorry, but so what! In economics terms and Thailands economies, those things are meaningless and will not have an impact.

-

The thing is, I did see this coming, just as many others did also. I got out of equities in September 2021 when the 10 year Treasury bond yield curve inverted, the fact that inflation was coming was a no brainer. I went heavily into PNL, CGT and RICA and I'm extremely glad I did. Many of my fellow investors have seen their portfolio's fall by up to 50%, I'm down 5.7% but that's on the basis of only 20% in equities and 60% in cash. The point here is that market falls, contagion, inflation and bond market gyration are in mid throes currently, this is not something that is going to suddenly hit in the future, it's here, now. But the idea that Bitcoin and Gold will do as you suggest and that the DJ will go to zero is the stuff of fantasies, that's saying that no US listed company will have any value whatsoever, not even asset value and that's absurd. Sorry, it doesn't even pass the long distance sniff test, even Dr Doom isn't that far fetched.

-

Indeed I did read the article but I stopped when the author started to use previous articles she had written as the basis for her current article and the justification to support her current view. There's nothing quite like using experts to support your opinion and hypothesis but when you are that expert...well! After that I started to look at the ownership of the site and its history, it's effectively university academics and researchers rather than industry or sector experts. There was yet a third aspect which had to do with the founder of the site which you will be well aware of given the controversy surrounding him. That was enough for me. So yes, I did do due diligence before I dismissed the link.

-

I don't agree with the gloomy economic assessment. The country is able to feed itself plus government borrowings are low by comparison. Yes, international tourism will not live up to expectations for another two years is my best guess. And exports will continue to be below past peak levels as recession hits our trading partners and supply chains become fully functional. None of these things mean that Thailand will be in serious economic difficulty, they simply mean that progress wont reach expected levels as hoped. By comparison to Western countries, Thailand is in pretty good shape.