K2938

Advanced Member-

Posts

565 -

Joined

-

Last visited

Content Type

Events

Forums

Downloads

Quizzes

Gallery

Blogs

Everything posted by K2938

-

Expats angry at huge concessions in latest Thai visa announcements

K2938 replied to webfact's topic in Thailand News

Where is that, please? The announcement in the gazette only has three pages: https://ratchakitcha.soc.go.th/documents/37565.pdf -

Well, what they do would be consistent with them potentially knowing something bad they do not want to say (yet) and therefore hedging themselves. One would think that for them as a government entity it should be so easy to talk to the revenue service to get and publish the terms. But for some reason they do not do this...

-

You can buy reputable foreign olive oil brands in Thailand like for example Bertolli. And they do not put worse oil into their bottles for Thailand. So this is normal trustworthy olive oil.

-

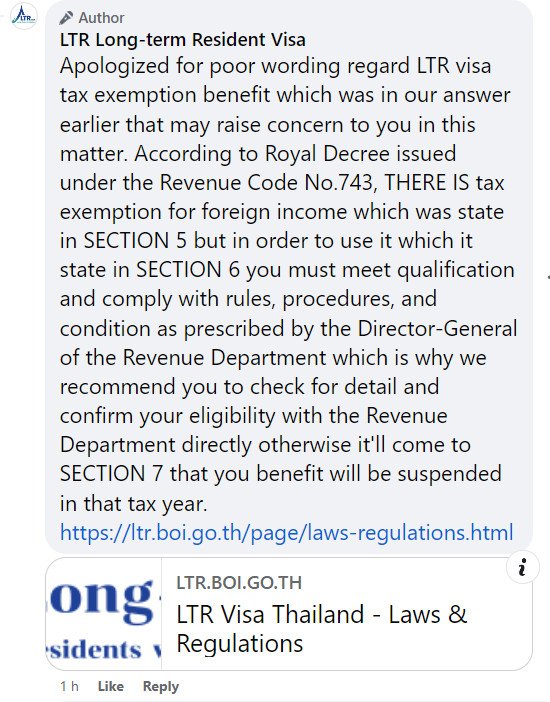

The BOI is continuing its cryptic stance on tax exemption. That is what they just posted in response to questions on the facebook page mentioned by @statabove: "LTR Long-term Resident Visa Apologized for poor wording regard LTR visa tax exemption benefit which was in our answer earlier that may raise concern to you in this matter. According to Royal Decree issued under the Revenue Code No.743, THERE IS tax exemption for foreign income which was state in SECTION 5 but in order to use it which it state in SECTION 6 you must meet qualification and comply with rules, procedures, and condition as prescribed by the Director-General of the Revenue Department which is why we recommend you to check for detail and confirm your eligibility with the Revenue Department directly otherwise it'll come to SECTION 7 that you benefit will be suspended in that tax year. https://ltr.boi.go.th/page/laws-regulations.html" And since they now refer to Section 6 of the Royal Decree where it states: "Section 6 A foreigner who is entitled to benefits under Section 3, Section 4, and Section 5 must meet qualifications and comply with rules, procedures, and conditions as prescribed by the Director-General of the Revenue Department." this means that to change whatever tax benefits there are, the Royal Decree does not even need to be amended/revoked, but the Revenue Department can just change the qualifications and rules in whatever way it desires.

-

Thank you for posting this. While you are unlikely to be able to sue the BOI for damages in Thailand based on what a low level employee is telling you anyway, the answer you quoted should make you even more careful. Contact the revenue department for a formal answer meeting all legal requirements, but do not really expect to get it...

-

And that is what a 2024 study concluded: "The reprocedure rate of UroLift at 4 yr is double the rate of TURP and PVP. In appropriately selected patients, UroLift might be a suitable option for those who desire symptomatic relief from BPH with minimal erectile and ejaculatory side effects. However, the risk of secondary surgical intervention should be considered when considering BPH treatments." (https://www.sciencedirect.com/science/article/pii/S2666168323025296)

-

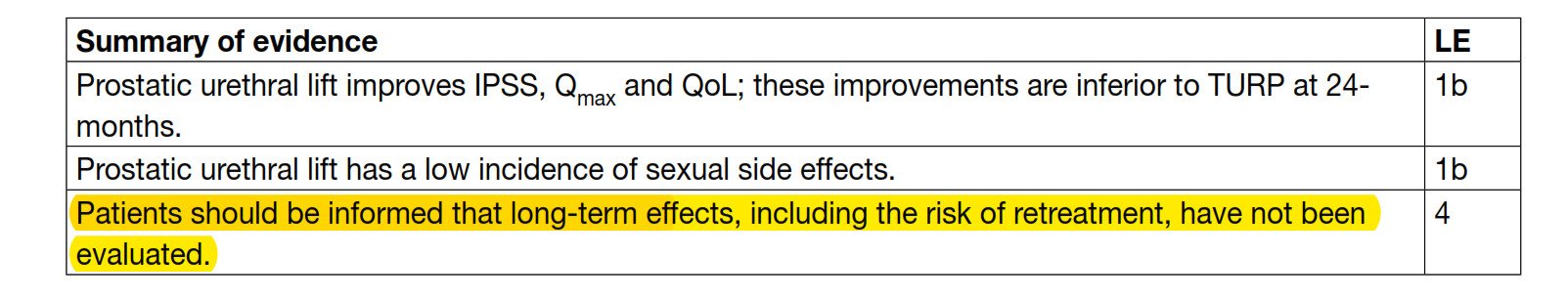

Thank you for this, Sheryl. I was advised that the key 5 year underlying evidence is from a manufacturer affiliated study putting a question mark over its reliability. Moroeover, even this is just a single study and only 5 years. So I was advised that if one views this over a longer period, like 10+ years, one will most likely need a conventional operation on top of this as the prostate just continutes to grow over the Urolift implants with a later operation at older age being much more dangerous. The "EAU Guidelines on Non-Neurogenic Male Lower Urinary Tract Symptoms (LUTS)" in their current, i.e. 2024, edition concluded as follows in view of the totality of the evidence currently available:

-

Urolift does not last very long. So unless your life expectancy is only a few years, this is unlikely to be a long-term solution

-

The vast majority of LTR retirement visa holders on this forum and outside are pension rich, not asset/capital gains rich. So their situation is entirely different from yours. And the people who drew up the rules for the LTR visa also really largely only focused on pensioners and are evidently struggling to even really understand other people. Otherwise you would not have the most bizarre rules like the $100k for the insurance waiver cannot be in a brokerage account, capital gains are disliked etc. etc.

-

If you fail in Bkk, try HK

-

Nobody knows, but since this would be such a fundamental change with the actual tax law required to be modified one might be inclined to expect that this would also kill the LTR remittance tax exemption. And then of course would be highly useful for the tax authorities that LTR visa holders have already disclosed all their income in their LTR application and probably disclosed so with a focus on maximising and not minising their income. We will see.

-

1) The problem with relying on capital gains is also that at least once every few years markets fall. And so your gains might not really exist in a year of relevance. 2) The dividend yield on Western equities is generally in the area of 1.5%-2%, in the U.S. currently even lower. So for 80k USD income without capital gains you would need an equity portfolio value of at least 4-6 MM USD. Not sure if disclosing such big amounts necessarily increases your safety in Thailand. 3) Maybe think of the Thai Elite/Privilege visa instead if you feel uncomfortable with the disclosure requirements and have the money.

-

1) So your chance to write an accompanying note explaining everything in a very easy to understand way. 2) Do however not get your hopes up too high about capital gains. If they are significant, the BOI does not very much like them regardless of what is written on their website. But you can try and see what happens.